Author: Xu Jinkai

“Be the OEM factory for users, buy better products with less money.”

“Take down the overpriced brand premiums and provide users with the most sincere products.”

At the LI Auto new product launch event on March 1st, Li Xiang Automobile Chairman and founder Li Xiangming repeatedly emphasized the development concept of “Value for Money“.

In his opinion, LI still has the capital to seize the market at a low price. If LI fails to gain a certain market foundation in a short period of time, then the follow-up development will become increasingly difficult.

“The first thing you need to do is to ensure that you have a market share, which is our first goal.” Xiangming, who comes from a technical background, believes that only by taking more market share on the basis of independent research and development can we share costs and achieve economies of scale.

It is precisely based on this development concept that LI has launched a combination of across the board price cuts.

Push Excessive Competition to the Limit

Price reduction is the theme of this LI new product launch event. Among them:

LI T03 mini car, 2023 official guide price ranges from RMB 59,900 to RMB 899,000, a decrease of up to RMB 20,000 compared to the previous price range of RMB 82,500 to RMB 99,500.

LI C01 mid-to-large-sized sedan, 2023 official guide price ranges from RMB 149,800 to RMB 228,800, a decrease of up to RMB 60,000 compared to the previous price range of RMB 193,800 to RMB 286,800.

LI C11 medium-sized SUV, 2023 electric version sales price ranges from RMB 155,800 to RMB 219,800, down RMB 20,000 to RMB 30,000 compared to the previous price range of RMB 185,800 to RMB 239,800.

C11 extended range version’s official guide price is between RMB 149,800 and RMB 185,800, a decrease of RMB 10,000 compared to the previous pre-sale price.

Relative to competitive models in the same category, LI’s prices are in an absolutely low position.

Using the example of the Leapmotor C01, its length, width and height are 5050×1902×1509mm respectively, and its wheelbase has even reached 2930mm. This spatial performance far exceeds that of traditional mid-size sedans such as the Accord and Camry. In the new energy vehicle market, the dimensions of the Leapmotor C01 fall between the NIO ET7 and ET5.

Combining these features with the new car’s ultra-low pre-sale price, the Leapmotor C01 has already formed the “low-price, large-space” advantage in both the fuel vehicle market and the new energy field, and the car’s cost-effectiveness immediately becomes apparent.

In addition to its spatial performance, Leapmotor also excels in smart technology.

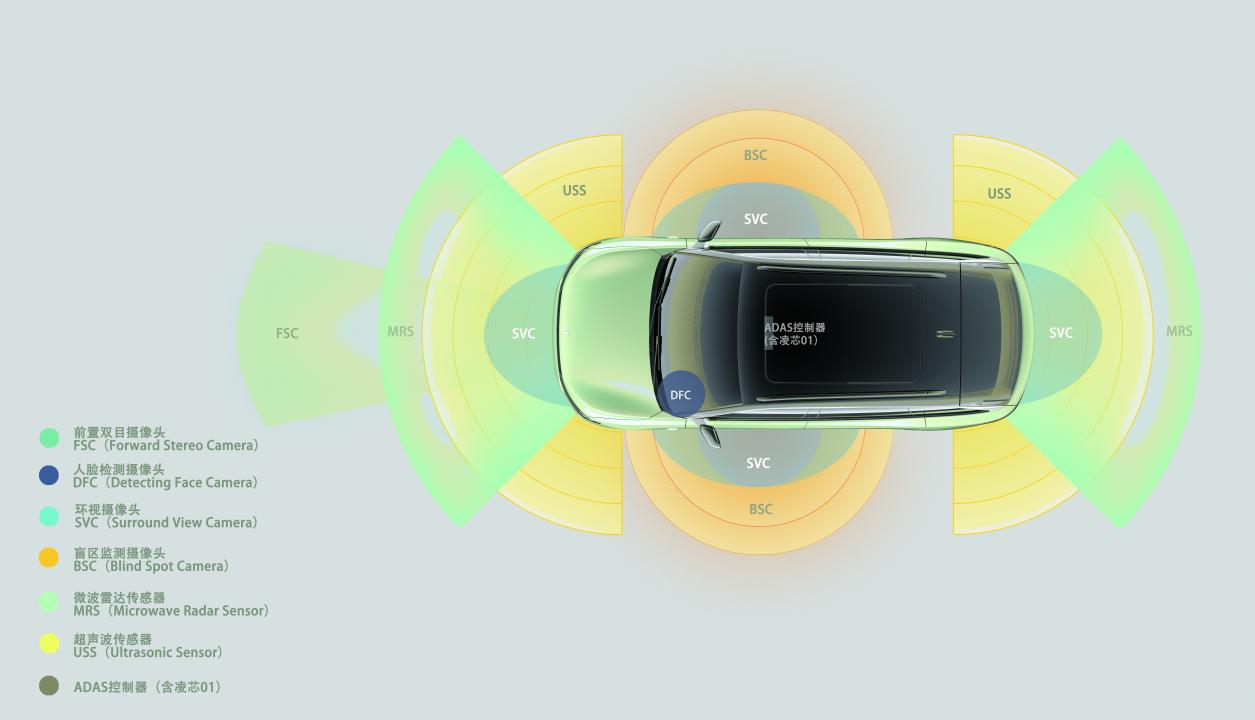

The Leapmotor C01 is equipped with an 8155 chip, which can achieve seamless linkage between the 10.25-inch LCD instrument panel, 12.8-inch intelligent vehicle system, and 10.25-inch entertainment screen. Coupled with the car’s Leapmotor Pilot intelligent driving assistance system, it can achieve multiple L2++ level intelligent driving assistance functions such as HWA high-speed assisted driving, ICA high-speed cruising assist, and TJA traffic congestion assist, providing consumers with a more relaxed driving experience.

Although Leapmotor’s smart technology advantage may not be particularly prominent compared to other new start-ups, its smart technology level is quite advanced compared to traditional fuel vehicles. Coupled with its ultra-low price, its advantage is self-evident.

The advantages of the Leapmotor C01, including its large space, outstanding smart technology, and low price, are also reflected in the C11 and T03.

Leapmotor’s extensive reduction in prices from mini-cars to mid-to-large-sized cars has further intensified competition within the industry and made the automotive market in 2023 even more explosive.

Independent Research and Development Support

“By redefining the value standard of 150,000 to 200,000 yuan vehicles using a configuration experience that was previously priced at 300,000 to 400,000 yuan”. While repeating the development advantages of Leapmotor’s “price-to-value ratio,” Zhu Jiangming emphasized the development foundation of independent research and development (R&D) support.

Leapmotor believes that for independent R&D to truly be effective, the continued expansion of enterprise scale is necessary. Zhu Jiangming said: “As our scale grows larger, the platform based on our independent R&D will bring about price reductions for the large-scale procurement of core components. We are confident.”“`

Global independent R&D refers to building the most important aspects of cars, such as power, intelligent driving, and cabin systems, from the ground up, achieving complete independent R&D of “software + hardware”.

For many new brands, the advantages of global independent R&D are mainly concentrated in the following areas:

Firstly, costs can be controlled by reducing joint development cycle costs, increasing platform reuse rate, and lowering costs, to provide users with high cost-effective products.

Secondly, the overall performance of the vehicle is stronger through independent calibration of software and hardware, connecting the underlying logic of each component, with higher conformity and consistency, fully tapping into the performance and effectively eliminating compatibility issues.

Thirdly, it can better resist risks through independent control of core technologies, obtaining stronger voice in the face of unstable market conditions.

The goal of achieving global independent research and development has been pursued by LI (LI One) through self-research in six major areas including overall vehicle architecture, electronic-electric architecture, intelligent interconnection, battery, electric drive, and intelligent driving, covering 70% of overall costs.

“Firstly, we have reduced costs through more innovation, including our CTC, which is also a way to reduce costs. As I mentioned earlier, our cabin and electric drive, which we self-researched, give us a good foundation for reducing costs. At the same time, we use a platform-based architecture, and everything that follows is based on the same platform architecture, which can also bring many cost advantages,” said Zhu Jiangming, CEO of LI.

In Zhu Jiangming’s view, innovation and platform-based architecture can greatly reduce car production costs, and he gave an example about the 8155 chip.

“Everyone uses the 8155. Others may only have one function, such as the cabin, but what can ours do? It can do a 360-degree view with four cameras and handle acoustics from Akm. Now, the amplifier is also included in the 8155. We’ve saved over 1000 RMB compared to others in one go,” he said.

This approach of lowering costs through innovation also includes CTC architecture and intelligent driving.

“There are 70,000 RMB in components that we make ourselves out of a 100,000 RMB overall cost. If there’s a 10% markup for the price difference between outsourced products, we have 7,000 yuan of competitiveness compared to others. With increasing scale, the generated price difference will be even greater, and development costs can be spread more evenly,” Zhu Jiangming further explained.

From this state, it is easy to see that the highly self-developed status has given LI a discount to boost sales and reduce costs.

What is worth mentioning is that in terms of sales packaging, LI has set itself as an industry benchmark for value reference and declared the slogan “Choose a Car, Choose LI, and Have a Reference Value.” For many competing brands with poor cost performance, this is indeed a big threat.

LI wants to grab the pricing power of the new energy market?

“We price based on cost, not on brand, and we are a contract manufacturer for users,” LI is reconstructing the pricing logic of new energy vehicles.

In the past, most car pricing adopted “referential pricing”, that is, there was a leading model in each segmented market, and the selling price of other brand models is determined by referencing to it to determine the final selling price.

For example, in the area of sporty hatchbacks, there was only the Honda Civic in the past. With the increasing consumer demand, independent brands successively launched many sporty cars such as Lynk & Co 03, Xiaopan, and UNI-V. Although these models have strength that surpasses the Civic in terms of intelligence and power, their terminal prices are lower than those of the Civic.

- Firstly, in the field of fuel vehicles, joint venture brands have stronger pricing power;

- Secondly, because the early Civic has formed extremely strong market appeal, new models can only please consumers at a lower price.

Although the “referential pricing” of the fuel vehicle era and LI’s “cost-based pricing” are completely different, they have a common characteristic, that is, they must have sufficient market influence.

_20230308215447.png)

LI’s “cost-based pricing” method is based on the foundation of self-development and a huge market scale. Both are indispensable. Considering only these two dimensions, the vast majority of new brands do not have such strength. Thus, LI has taken the road that other brands cannot imitate.

“““

Of course, ZERO is also facing two challenges:

-

One is at what level of annual sales can it break even, and whether ZERO’s losses before this meet investors’ expectations;

-

Second, higher market performance also means greater operational investment and higher risk of failure. Can ZERO handle such problems properly?

According to ZERO’s financial report data released earlier, ZERO’s gross margin has always been negative, with gross margins of -95.73%, -50.63%, and -44.3% from 2019 to 2021, respectively.

In the first three quarters of 2022, ZERO lost 3.784 billion yuan.

In terms of R&D, ZERO’s R&D expenditures were 358 million yuan, 289 million yuan, and 740 million yuan from 2019 to 2021, respectively, and R&D expenses increased to 900 million yuan in the first three quarters of 2022.

Accumulated R&D expenses are 2.287 billion yuan, far from NIO’s R&D investment of 10.8 billion yuan last year.

Judging from such low investment, ZERO is not far from profitability, but whether such low investment can maintain its leading position in the overall self-development remains a big question mark.

In addition, higher sales not only mean that ZERO needs more sales channels, but also needs to deal with more product crises. For ZERO, low-priced sales are not difficult, but low-priced and strong products are the key to ZERO’s rapid increase in market share and gradually entering the fast development track.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.