Q: The overall performance of the market was not good in January, except for Ideal which delivered 15,000 vehicles. Is the company satisfied with this growth, and what are the reasons for its counter-trend growth?

Li Xiang: The first quarter was indeed difficult, mainly due to two factors.

The first factor is that December overdrew this year’s sales volume. At the end of last year, due to the “new energy subsidy reduction” and the “cancellation of 50% purchase tax exemption for fuel vehicles”, many sales were overdrafted this year, and faced with the situation that Shanghai will not issue license plates for extended range vehicles, resulting in many sales in the first quarter being consumed in the fourth quarter. For example, more than 20,000 cars were sold in December last year, including more than 1,000 units that were purchased in advance by users in Shanghai.

On the other hand, it was due to price reductions. Price reductions do not necessarily help increase sales, but they can impact other companies, as after the price reductions, everyone will be watching their opponents and their companies will certainly have to cut prices.

Our product competitiveness is still relatively strong at this price point. With Tesla’s proactive price reduction, our intersection has become smaller. Tesla has raised the price of its main model to 250-260,000, which makes people think that Model Y is a car in the 200,000 price range, which has created more space for us and brought in more new users.

_20230303153332.jpg)

Q: In reference to the Q4 financial report, Ideal maintained a healthy gross profit margin of 20.4%, which was also a milestone as the first new power vehicle company with a profitable single quarter. Can you tell us the reason for this, and whether the profit will be short-lived?

Li Tie: Regarding profit, let me share something. In fact, the past three years have been our verification period from zero to one. Before that, we spent five years on research and development. We did not have the opportunity to face consumers. In the past three years, we have verified our products, our many hypotheses, and our business models.

Our operating profit is relatively simple. We subtract research and development, sales, and management expenses from gross profit. Our operating profit and long-term operating profit are actually the options we give to employees. This thing is actually an uncontrollable quantity, such as the day we issue options, the stock price is how much, that is how much it is, and then it will go in. So, we focus on what we can fully control, which is to increase the long-term operating profit by 5 points.We are still in the early stages and need to strike a balance between R&D investment and financial indicators.

_20230303153557.jpg)

Q: The current penetration rate of new energy vehicles has reached about 25%. Some market voices believe that the industry’s growth rate is likely to be in a downward trend in the future. The pressure on car companies to rely on sales to generate revenue will become greater and greater. Is the ideal pressure high?

Li Xiang: The pressure is definitely high. The biggest pressure in this industry is that the top two companies can both engage in price wars. This is not seen in the phone and other industries, and there is an easily overlooked problem, which is to diagnose the problems of various companies. We found that consumers still have some basic knowledge and awareness.

Q: Under the situation of high costs and intensified competition, how do you view the survival status or competitive pattern of new-upstart automakers in the future?

Li Xiang: After we looked at the adjusted price of Tesla and BYD, we found that they placed themselves in a reasonable space in terms of price, not too cheap, but within the reasonable range that users know.

When we were at Autohome, we observed the psychological state of users. If they bought a medium-large SUV and it was a decent brand, the price couldn’t be over 200,000 RMB. Why? Because everyone will think there is a problem with your car if it is sold for more than 200,000 RMB. You might definitely have cut corners. This is a cognitive bias. Another type of bias is that users think that if you spend so much money, and then buy such a big car, you must be poor. You must have economic problems. These are common biases. So many times, the cheapest car is not the best one to sell, and the most expensive car is not the best one either.

You can draw a curve for each level, and the curve drawn by BYD is the most accurate, from 100,000 RMB to 250,000 RMB. Tesla’s curve after adjustment is also very accurate. In fact, once it exceeds 250,000 RMB and reaches 300,000 RMB, our curve is exact. It cannot go any higher or lower. Therefore, we strictly build the entire product system according to this price curve.When we make pure electric cars, we will not sell them at a higher price on this price curve, even if it is 800 volts or silicon carbide. So, in fact, this is a basic problem that many companies face. If we sell mid-size cars for over 300,000 CNY, we cannot sell them; if we sell mid-to-large SUVs for over 200,000 CNY, we cannot sell them either.

Q: You were profitable in the fourth quarter of last year. Will you be profitable in the first quarter of this year? Will this year be the first profitable year?

Li Tie: Tesla Investor Day mentioned that we would try to explore some long-term value. We hope that this year will be a continuous and stable start of profitability, it is an internal goal that we strive for, and we also think it is what a company with a market cap of 100 billion CNY should do. We talked about operating profit, and there are actually many constraints below.

Q: Just now you talked about the issue of price reduction. If you can maintain a gross profit of more than 20%, including a 5-point increase in operating profit margin, is it possible to share the additional profit with customers? Is it possible to also reduce prices?

Li Tie: Regarding gross profit margin, it is more about competition. As long as we can obtain the volume we want and drive our production capacity, Tesla’s maximum price reduction in China aims for maximizing the utilization of production capacity. I think this is a comprehensive decision, which is not just about benefiting customers but also about achieving a win-win situation for the company and customers.

Q: We learned from the terminal that Ideal currently has some cars in stock, why is that? Are there any problems with the orders?

Li Xiang: Regarding inventory, we have been doing it since last year, which is different from before when we sold Ideal ONE, as it was an incremental market that we created. We found that when users buy BBA, almost 100% of the cars in this price range are available in stock. A considerable part of the user group comes for cars that are immediately available. Therefore, since last year, we have ensured that about 10-15% of the volume is available in stock. These users are not so concerned about what color or configuration they want, but they pay more attention to having the car available right away.We don’t stock our cars in the stores, instead we put them in each district and allocate a certain proportion of cars based on customer demand. We need to grab our share from the stock market of BBA, especially in L7. If we increase our market share in L7, cars like Audi Q5 will definitely decline and can’t avoid the competition. Because this market itself is not growing, it is actually a zero-sum game. If we have more, others will have less.

Li Tie: Investors have the same problem. As Li Xiang just mentioned, we used to have centralized management with a national strategy, achieving 9% of market share. To achieve 20%, we need to shift the focus of management and operation, to decide where the budget should be spent.

The more we go to first-tier cities, the more we will find store managers complaining that they lose a lot of customers every day. They come in and ask if there are any cars in stock, and if there are not, they leave. You can’t challenge everyone’s common sense. Even if you tell them that Tesla is the same, some people still leave, so we give them the right to know.

Q: What is your view on the Chinese market for assisted driving and Ideal Auto’s position in it? Regarding software 2.0, we start with assisted driving business, what are the specific progress so far?

Li Xiang: I think under these large models, doing city NOA, including large model high-speed NOA, the solution for high-speed will be available after city NOA is achieved. The key is the proportion of user’s navigation-assisted driving time, which is the real key. This is similar to the DAU of the Internet, including the use time of video websites, and it is crucial.

Q: Just mentioned a proportion of 30%, we may have established joint ventures, such as the range extender, silicon carbide, and electric drive to strengthen the supply chain security. But regarding self-research, continuously taking over core components in a self-research way, what specific strategies will we have in the future?

Ma Donghui: First of all, it needs to be clarified that self-research and self-made are two different dimensions. In terms of platform technology development, we have range-extended electric vehicle, high-voltage pure electric vehicle, smart space, intelligent driving, and EEA electrical architecture. Both the range extender and the five-in-one motor are the core technologies of our range-extended platform. There will be some self-research technologies in the future on the pure electric platform, such as silicon carbide functional modules and three-in-one motor. But supply and self-research are different. The entire supply chain will be divided into several dimensions according to the properties and categories of the materials, such as leverage materials, strategic materials, routine materials, and bottleneck materials. The supply strategies for different materials are completely different. The main purpose of our self-research, self-made or self-research and joint venture companies is to ensure that our core technology can be landed and that our supply is secure.We will control the proportion of self-developed components within a reasonable range, around 25%-30%, to ensure that the technology can be implemented and to maintain competitive power in the market. Furthermore, the direction of our core technology research and development is related to our platform technology.

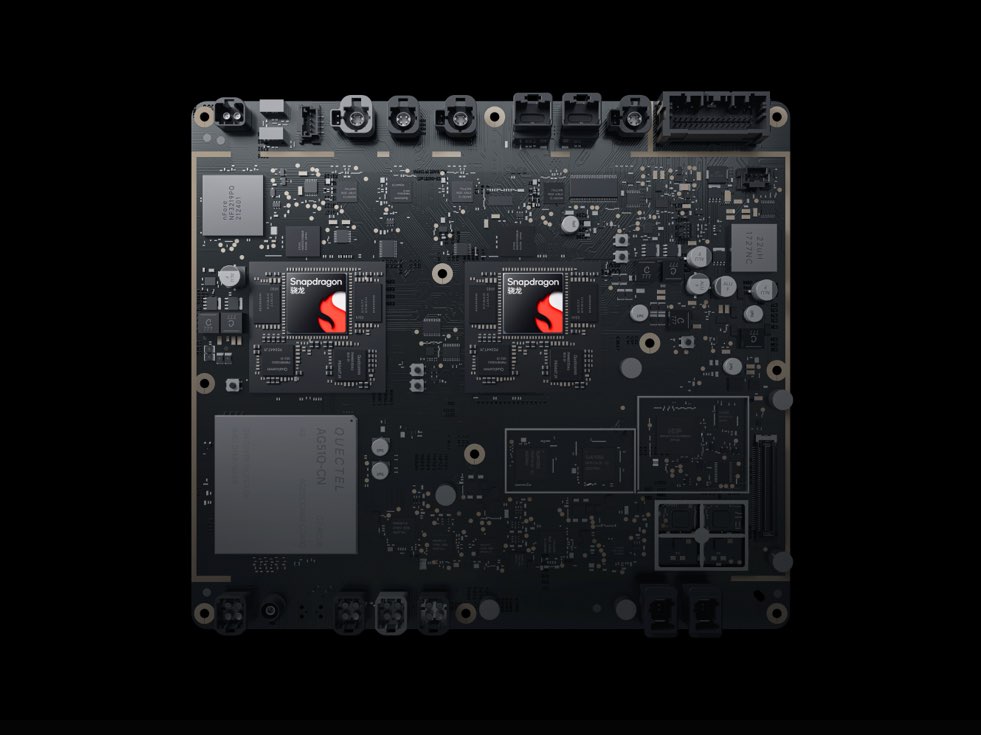

Q: Regarding autonomous driving, this generation’s Orin does not support Transformer well. How can we address the issue of deploying large-scale algorithm models in the future? Will we launch new hardware platforms? How will we resolve the issue of different capabilities between two generations of vehicles?

Xie Yan: Orin’s Transformer is not very efficient because it is based on a general GPU architecture, but its efficiency can still be improved significantly. We will work with NVIDIA to optimize it and increase its actual computing TOPS performance, similar to using more effort to compensate for a slightly weaker platform. This is the approach we plan to take.

Li Xiang: The next generation of NVIDIA chips is expected to be delivered by 2025, but the algorithms can be extended, and the basic sensors are widely available. Therefore, applications and model training for algorithms can be extended.

Q: Owners of models priced above 300,000 RMB have different decision-making processes compared to those of models priced below 300,000 RMB. As we expand on a larger scale, will the concept of domestic brands be diluted when we operate in the below-300,000 RMB market? How should we approach the logic of launching new products? Should we continue with the L7 to L9 logic or introduce new logic?

Li Xiang: Costs present a greater challenge for the 200,000 to 300,000 RMB price range. Our current scale of producing one to two thousand units per month cannot support high competitiveness in the 200,000 to 300,000 RMB price range. Therefore, we plan to enter this market in 2024 when we can produce 30,000 to 40,000 units per month, which will be more effective.However, when we enter this market, we will not compromise on the product power but only reduce the size. Our core technologies and platform advantages will continue to exist and will be almost identical. This will ultimately lead to higher long-term efficiency.

Q: Regarding the pure electric plan, when will Ideal start deploying an 800V high-power supercharging network? 800V is not actually scarce, what is scarce is the high power. Behind high power is actually the enclosure of the city range, including negotiation with high-speed service areas, your battery capacity, and the location of the car, which are all difficult.

Li Xiang: We believe that the most effective way is to use slow charging at home, fast charging in the city, 200 kW is enough for the city, and use supercharging on the highway. Building a lot of these supercharging stations in the city will have high requirements on the property and the surrounding environment. We think that building fast charging stations near gas stations is a better way in the city, such as building them on the ring road. Where there are gas stations, there should be supercharging stations, but if you want to build 480 kW supercharging stations in office buildings, I think the challenge is still very high for property management, and even firefighting requirements similar to gas stations may be proposed.

Although we can increase the power more and more, the capacity of the power grid is another factor to consider, including the city’s power grid and the high-speed power grid. I think the best way is to use slow charging at home, fast charging in the city – not the 60-70 kW fast charging of the past but 200 kW fast charging, and use supercharging when traveling long distances.

_20230303153004.jpg)

Q: Ideal has always emphasized the need to make profits early. For the pure electric series, the profit margin may be higher, but the absolute number is relatively small. Can the subsequent operation of this profit margin support the expansion speed of the entire supercharging network?Li Xiang: We are very confident about the coverage of long-distance. Because since last year, the whole country has encouraged companies to directly build superchargers, and our superchargers will be shared with other 800-volt vehicles to ensure that every other competitor’s vehicle can also run at a high efficiency. In the long run, as far as normal charging prices are concerned, the supercharging system will definitely not lose money once it runs smoothly. As for how much money can be earned, it still depends on one’s own operational ability, but at least breaking even is completely achievable.

Q: Li Xiang said that the early bird test of NOA in city will be opened in Q4 this year, and the nodes covering all cities will be available in 2024. Will NOA also be a standard feature like now? If it is a standard feature, will it lead to the imbalance between software development investment and return? Secondly, what is the biggest challenge in technology from the high-speed domain to the urban domain? Will it evolve into a fusion of high-speed and low-speed domains like FSD?

Li Xiang: Ideal’s technology route is no different from FSD, it is exactly the same. And because of the big model, the algorithm itself is not a problem. The key is how to build a high-quality and efficient training system, because it is entirely based on training, and human intervention is just auxiliary. Currently, in terms of performance, only AD Max can run the big model for city NOA, while AD Pro cannot because AD Pro’s performance design from the beginning can only meet high-speed NOA.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.