Author: Zheng Senhong

If there is one word to summarize Ideal Auto’s situation in 2022, it would probably be “mixed feelings.”

On the one hand, despite shortages in parts supplies and surging battery materials costs, Ideal achieved a turnaround in the fourth quarter of 2022, putting an end to the trend of losses that had persisted for the previous three quarters.

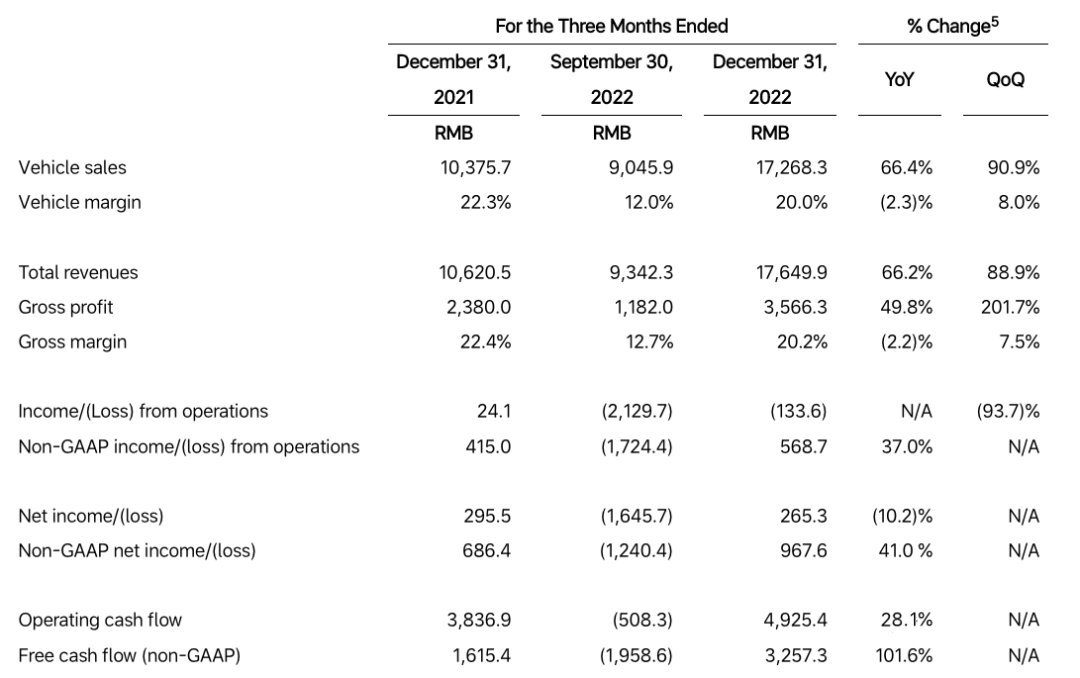

Looking solely at financial reports, Ideal realized revenue of 17.65 billion yuan and a net profit of 265 million yuan in the fourth quarter of 2022, an increase of 66.2% year-on-year.

On the other hand, starting in 2023, the policy of not providing license plates for extended-range vehicles in Shanghai will be implemented. Previously, Shanghai accounted for about 5% of Ideal’s insurance volume.

According to data from an automotive industry platform, in December 2022, Ideal delivered 2726 vehicles in the Shanghai area, while in January 2023, it delivered only 65 vehicles, a decrease of 97.6% year-on-year.

In addition, expanding the layout and investing in research and development, balancing short-term profits and losses, and realizing long-term goals is also a self-doubt that Ideal needs to face.

According to financial data:

In the fourth quarter of 2022, Ideal’s R&D expenses were 2.07 billion yuan, accounting for 11.7% of expenses.

In 2022, the full-year R&D expenses were 6.78 billion yuan, accounting for 15.0% of total expenditures, a doubling of research and development investment costs compared to 2021, and an increase of 106.3%.

Achieving profitability and positive cash flow is an important sign for a company’s business model to be validated. From the perspective of the high gross profit margin of 20%, efficient direct sales system, and extremely low sales and management expense ratio, Ideal has turned in an impressive performance in 2022.

Vehicle model upgrades qualify as the first profitable new force in China

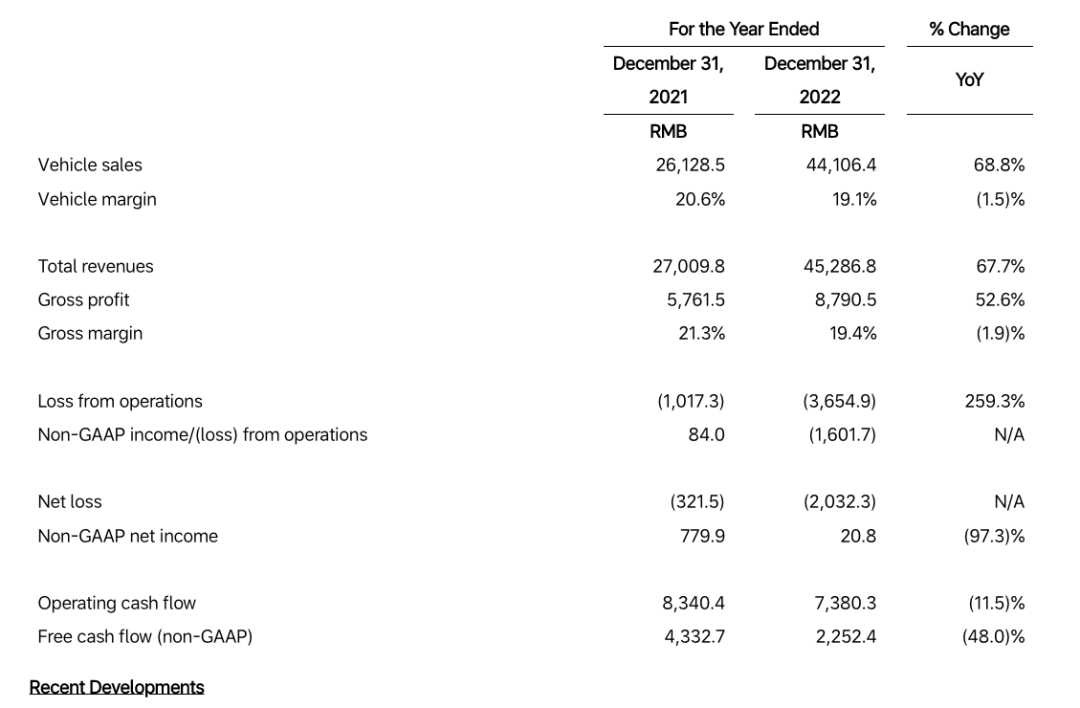

Looking at the entire year, Ideal’s vehicle sales revenue was 44.1 billion yuan, with approximately 133,000 deliveries, an increase of 47.2% year-on-year, and an average selling price of 330,000 yuan for the year.

This is Ideal’s highest revenue record to date, primarily due to the significant increase in deliveries in the fourth quarter of 2022, with the total deliveries for Ideal in the fourth quarter reaching 46,319 vehicles, a year-on-year increase of 31.5%.

Thanks to the hot delivery of the L series and the acceleration of scale effect, the ideal is expected to turn losses into profits in Q4 of 2022, ending the previous trend of continuous losses in the past three quarters.

According to financial report data, the ideal achieved a revenue of RMB 17.65 billion in Q4 last year, a year-on-year growth of 66.2%, and a net profit of RMB 265 million, compared with RMB 296 million in the same period last year.

In less than a year, the ideal has successively launched three models of L9, L8, and L7, of which the latter two models provide Air, Pro, and Max versions, providing diverse choices in the 300,000-500,000 RMB five-seat SUV market segment.

Based on the above product matrix, the ideal has given a high sales guidance for Q1 2023:

It is expected to achieve a delivery volume of 52,000-55,000 vehicles, a year-on-year growth of 64.0%-73.4%, and a total revenue of RMB 17.45-18.45 billion, a year-on-year growth of 82.5%-93.0%.

Taking the minimum value of 52,000 vehicles as an example, the ideal delivered a total of 31,700 vehicles in January and February, which means that the ideal needs to deliver no less than 20,000 new vehicles in March.

However, Li Xiang himself admitted at the financial report conference that this overly aggressive delivery plan has put enormous pressure on the supply chain.

In 2022, from selling a single model to selling multiple models, from planning, production, sales to delivery, the ideal has brought new challenges to employees and suppliers.

In addition to the pressure on the supply chain, the increase in delivery volume is directly reflected in the gross profit margin.

“`

“`

In the fourth quarter of 2022, the ideal gross profit margin reached 20.2\%, and the annual gross profit margin reached 19.4\%, which was lower than the gross profit margin of 21.3\% in 2021.

In comparison, Tesla’s single-car gross profit margin in 2022 was 28.5\%, NIO’s single-car gross profit margin in the third quarter of 2022 was 16.4\%, and XPeng’s single-car gross profit margin in the same period was 11.6\%.

Li Xiang has divided the gross profit margin standard line for different industries into three levels:

-

The gross profit margin of the manufacturing industry’s business model is about 10\%;

-

For consumer goods business models (such as the automotive industry), a gross profit margin of 10-20\% is considered a good level;

-

Technology companies need to achieve a gross profit margin of more than 20\% to support R&D investment.

Li Xiang believes that the latest quarterly gross profit margin of BYD (excluding dealers) is close to 16\%, and according to the financial model of the direct sales system (including dealers), BYD’s gross profit margin is expected to exceed 20\%. This is a healthy and conscientious gross profit margin for an enterprise with tens of billions of revenue.

“All products on the L-series platform have an overall gross profit margin set at 25\%. Considering this year’s battery prices and macroeconomic conditions, we have lowered the gross profit margin to 20\%,” said Li Tie, co-founder and CFO of the ideal car.

On the R&D level, the ideal car is changing its past image of being “stingy”:

-

In the fourth quarter of 2022, the ideal R&D expense was 2.07 billion yuan, accounting for 11.7\% of the expenses;

-

The annual R&D expense in 2022 was 6.78 billion yuan, accounting for 15.0\% of the annual expenses. This was double the R&D investment expense in 2021, and a year-on-year growth rate of 106.3\%.

According to the previous plan, Ideal’s R&D expense investment in 2023 is expected to be between 10 billion and 12 billion yuan.

Regarding the interpretation of the fourth-quarter financial report, Li Xiang personally highlighted that, when allocated to model expenses, marketing had the lowest proportion while R&D had the highest value.

This is not difficult to understand. The Ideal car currently has only three models, even if the L8/L7 has three different versions based on configuration and battery supplier changes.

Besides, in essence, the design and hardware of L9/L8/L7 can be regarded as "a model".

If the same research and development costs are shared among XPeng and NIO's product lines, the R&D content of their products may be different.

In summary, Idealsee is still the most financially healthy and cost-effective new car maker in China.

## Rooted in the 300,000-500,000 RMB SUV market, challenging 20% market share

Since the delivery of ONE in 2019, Idealsee's single product strategy has made it a leader in cost control among new car makers. With the competition in the market becoming hot, Idealsee has almost pulled the pace of car making to the maximum.

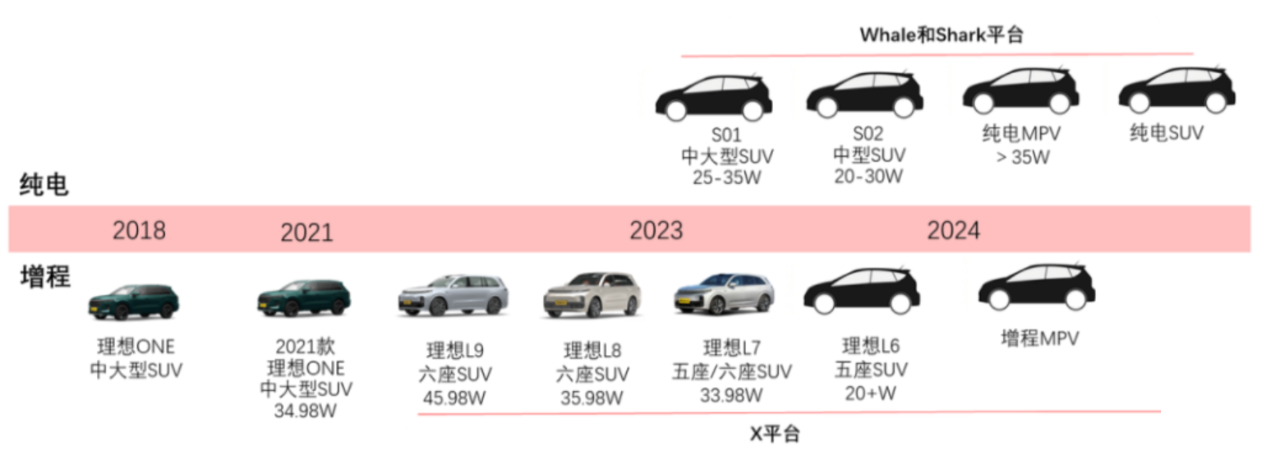

- In June 2022, L9 will be launched, and delivery will begin in August of the same year.

- At the end of September 2022, L8 will be launched, and delivery will begin in November of the same year.

- In February 2023, L7 will be launched, and will be displayed in stores the next day; delivery will begin in March.

This pace is extremely rare in the industry.

This also means that Idealsee has not experienced the problem of monthly delivery volume sliding due to production capacity climbing-not only has set a new record for monthly delivery volume, but also successfully avoided the sharp slide in the new energy vehicle market in January this year.

It was the smooth handover of the L series products that prompted Li Xiang to accelerate Idealsee's L series products entering the "harvesting mode".

In the earnings call, Li Xiang said:

"In 2022, Idealsee's SUV market share in the 300,000-500,000 RMB range is 9.5%. Our prediction for the market this year will be between 1.4 million and 1.5 million. Our requirement for ourselves is to double our market share, which means achieving 20%."

"The figure of 20% has been calculated. In 2023, the scale of the subdivision market is about 1.4 million. When the market share reaches 20%, we will be able to stably take the sales crown of the luxury SUV market", Li Xiang added.

According to calculations, Idealsee's target for annual delivery this year is 280,000-300,000 vehicles, and the monthly delivery volume is not less than **23,000** vehicles.

This is not the first time that Idealsee has revealed its ambition for the luxury car market, and it is not the first new car maker to covet the BBA market.

_20230301210237.png)

Li Xiang believes that in the second quarter, the monthly delivery volume of 25,000 - 30,000 vehicles can be achieved, thanks to the delivery of the Ideal L7 series.

When it comes to the problem of overlapping prices of the three models, Li Xiang believes that the cross-demand for Ideal L7 and L8 is not as high as imagined. The former tends to families of three or two, while the latter mainly caters to families with second children or three generations living together.

"Through the effective price coverage of L7, L8, and L9, we have constructed not only a product line but also a product network. Our core product strategy is to meet the needs of all SUV users between 300,000 and 500,000 RMB, and to make them hesitate between choosing L7 or L8 or L9, rather than choosing other brands after looking at the Ideal products."

From the perspective of Ideal itself, the three existing L series models do not yet have obvious cost advantages.

The revenue guidance for the first quarter of Ideal this year is RMB 17.45-18.45 billion, which exceeded the market's anticipated RMB 16.5 billion, but the only flaw is that the single-car price has fallen too much.

According to the calculation that miscellaneous income accounts for about 2\%, the average price of Ideal cars in the first quarter may be lower than RMB 330,000, which is a significant drop from RMB 370,000 per car in the fourth quarter. The reason behind this is undoubtedly that the delivery of Ideal L7 started in March, and the lowest-priced L7 model has undoubtedly lowered the average car price.

From Li Xiang's perspective, after L9/L8/L7 achieves a certain delivery scale and reduces vehicle costs, locking up a larger market share through lower-priced products will be possible.

Compared with XPeng, Ideal has more focused and clearly positioned products, and compared with NIO, under the single-car bestseller model, Ideal has stronger output stability.

Putting aside the aggressive sales targets, from the sales trend of the product lineup, Ideal is the most stable among China's new forces, but Ideal's more significant challenge is how to break the current single-product situation.

## Fully Electric Products with 800V and 8295 chips will be released this year.```

## An Ideal Product Layout

A "range-extended" SUV targeted to home users remains the main product. Data shows that the compounded annual growth rate of "range-extended" electric vehicles from 2020 to 2025 is 64.7\%. In 2025, range-extended vehicles will only account for 7.3\% of the market, which means electric vehicles will ultimately represent the future.

Walking on two legs is unavoidable, and an ideal product layout also reflects this:

1. Along the range-extended technology route, L9 (CNY 459,800) is positioned as the flagship 6-seater SUV for families, L8 (CNY 300,000-400,000) is positioned as the upscale 6-seater SUV for families, L7 (CNY 300,000-400,000) is the 5-seater version, and the unreleased L6 (CNY 200,000-300,000) will become a lower version of L7.

2. Along the pure electric technology route, based on the Shark (W) and Whale (S) electric platforms, an MPV (CNY 500,000 or more) will be developed, as well as a second generation 6-seater (CNY 400,000-450,000) and a third generation 5-seater (CNY 300,000-350,000).

Both of these routes are top-down approaches, that is, from high-end to low-end, with the number of seats ranging from 6 to 5. This is consistent with Li Xiang's logic of differentiating products based on vehicle configuration and number of seats.

Filling in the gaps and strengthening the strengths may be the reason why the ideal L-series products are so popular, but can this business model, based on range-extended technology, be adapted to the pure electric market?

According to Li Xiang's plan, future pure electric products will have the same price range, from CNY 200,000 to 500,000, as the L-series, and at least two high-voltage pure electric car models will be launched every year.

However, the game rules between pure electric and range-extended vehicles are clearly different.

First of all, range-extended products have a natural advantage over pure electric products in terms of BOM structure, which is one of the reasons why Li Xiang chose to make range-extended vehicles in the first place.

“`

The development and design of pure electric products are evidently more difficult and expensive, especially when it comes to efficient power electronics, thermal management, aerodynamic design, and 800V voltage platform, which will consume limited costs.

Previously, it was reported that Ideal’s pure electric products will be equipped with 800V high-voltage pure electric platform components, including power chips, power modules, electrical control, motors, and transmission systems, all of which will be independently developed by Ideal.

Furthermore, the basic logic of the pure electric vehicle industry is not only to build sufficient consumer driving force in product and brand but also to construct a complete complementary energy network.

_20230301210451.png)

Ideal is following the route of fast charging, aiming to achieve a 400km range recharge in just 10 minutes. This requires the vehicle to have an 800V voltage platform and a 4C charging battery, and charging stations to have high-power charging ability of 480V.

In 2022, Ideal Car and CATL (Contemporary Amperex Technology Co. Limited) announced cooperation in the production of 4C batteries to be deployed in 2023. However, the construction of a charging network will undoubtedly require a large investment from Ideal.

In addition, Li Xiang revealed at the financial report meeting that the next Ideal model will come with the Snapdragon 8295 chip.

According to news that the 8295 chip will be available on the automotive digital cockpit platform as early as the end of 2023, Ideal’s W01 is highly likely to be released at the end of this year. Deliveries are due to begin in 2024.

The Snapdragon 8295 chip is the fourth-generation Snapdragon automotive digital cockpit platform developed by Qualcomm, based on a 5nm process. The 3D rendering performance of the GPU is three times better than that of the 8155 chip, and the AI computing power reaches 30TOPS.

In terms of product layout, from plug-in hybrid to pure electric models, the entire system of Ideal will also face a new test.

In short, Ideal’s product strategy for 2023 is close to being established – offering a pure electric model in the second half of the year, which is no less powerful than the existing L-series, including mainstream levels for range, charging, and intelligence.

As of the fourth quarter of 2022, Ideal’s cash reserves have reached CNY 58.45 billion. As a company with billions of cash and cash equivalents, can Ideal successfully expand its vehicle model matrix, quickly deploy pure electric models and related supporting facilities amidst severe competition?

“`

Looking forward to the report card for the second half of the year with high expectations.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.