Tesla’s Price Reduction in 2023: A Major Turning Point in the New Energy Vehicle Market

Author: Tao Yanyan

After subsidy decline in 2023, the new energy vehicle market has experienced a major shift, reflecting the complex situation in the Chinese automotive market. On January 6th, due to poor sales, Tesla fired the first shot in the new energy vehicle market by announcing a significant price reduction for its domestic models, with the starting prices of Model 3 and Model Y reduced to 229,900 yuan and 259,900 yuan, respectively. By reducing prices, Tesla won orders in the sluggish automotive market, but the sales volume didn’t show excellent performance in the domestic market.

At this point, Tesla’s price reduction reflects the short-term difficulties in the automotive consumption market this year. For the entire new energy vehicle market, Tesla’s price reduction wave is like a heavy bomb, prompting us to think more deeply about this matter.

What is the purpose of price reduction?

Firstly, we need to consider a question: Why does Tesla need to reduce prices so urgently?

Tesla reduced its prices to increase its sales volume and market share in the fiercely competitive new energy car market, attracting more consumers to buy its products. Tesla knows the sensitivity of automotive consumers to prices and can increase its brand and market competitiveness by reducing prices to win many orders.

To understand the core motivation behind Tesla’s price reduction, it revolves around the utilization rate of production capacity to grab orders during the off-season. For Tesla, without an order pool, the entire production will stagnate, and the entire cost will be very high. According to Troy’s order pool data, price reduction is a must-do thing. For a direct selling enterprise like Tesla, there is no buffer pool of dealers and it must strive for orders with all its might.

With Tesla’s price reduction, automotive companies have followed suit. Indeed, price reductions can ensure that they can get through this period. This does reflect the panic of new energy car companies, but is price reduction the only answer?

The Path to Problem Solving: Focused on the Consumer

In the development of pure electric vehicles, I believe that the goal should be to make electric vehicles more user-friendly for consumers, which can be achieved through two main paths:

-

Automatic driving assistance to make driving easier: This path is what Tesla is working on with its FSD system. By improving the perception system and upgrading the onboard computer with high computing power, the automatic driving assistance system can be improved. The Waymo approach, which focuses on L4 level autonomous driving, is not feasible. It is recognized that the progressive approach, transitioning from L2++ level “human-machine co-driving” to L4, is more realistic. With the advent of ChatGPT, AI will play a significant role in the future. The fundamental concept of smart cars is embedded in this approach. If low cost is the only priority, it can be easy to miss the essence of smart cars in the future.

-

Charging and battery replacement facilities to ensure peace of mind for travel: This is what we have seen before. For pure electric vehicles to advance, it must have comprehensive infrastructure.

Looking at the new energy market at home and abroad, charging facilities are crucial for promoting electric vehicles, and public charging piles are the bottleneck for the development of China’s electric vehicles market. Through the construction of charging facilities, we can understand the current status of the new energy market. In January 2023, China had only 785,000 public DC charging piles. According to the total data, there are currently 13.1 million new energy vehicles in China, of which 3.57 million are equipped with private charging piles. The installation rate estimated based on this data is 27.2%, but actual data may fluctuate.

NIO Emphasizes Battery Swap Strategy for Long-Term View of the 2023 Tough Market

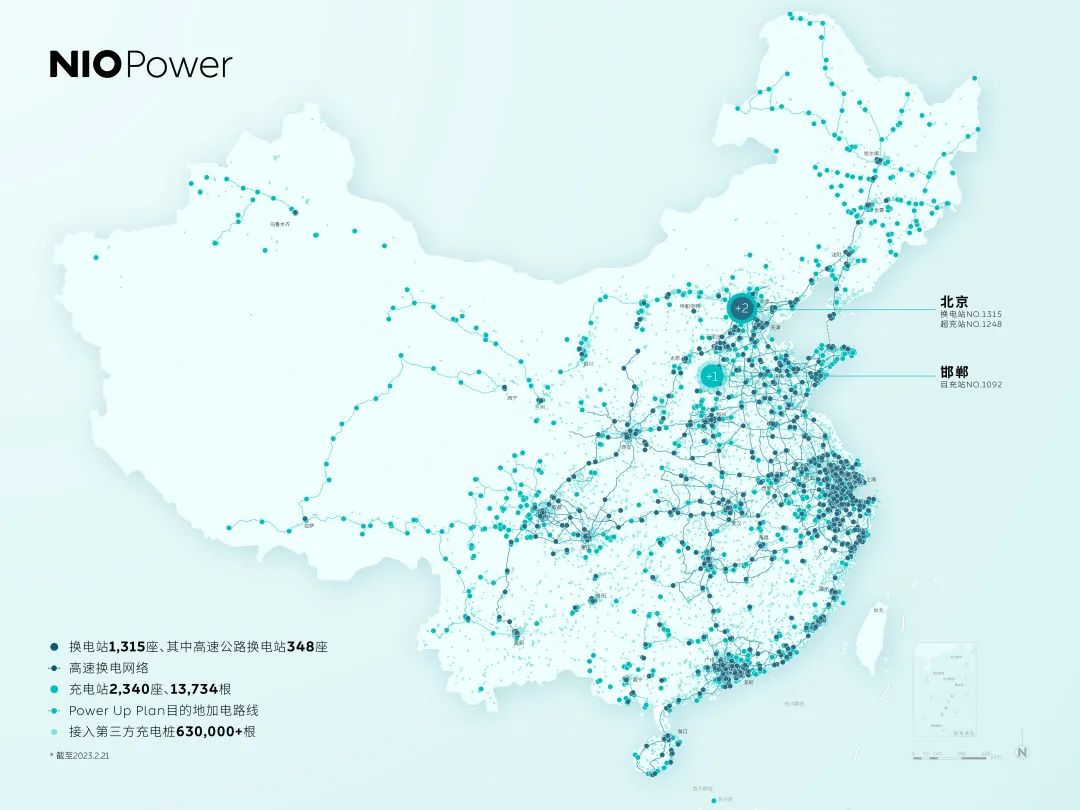

During NIO Day at the end of 2022, NIO announced its plan to add 400 battery swapping stations in 2023, with the goal of reaching a total of 1,700+ stations. Facing the current situation, NIO updated its goal for 2023:

◎ In 2023, to add 1,000 battery swap stations. Among them, 600 stations will be mainly located in third- and fourth-tier cities and districts, and 400 stations will be situated at locations such as high-speed service areas or near highway exits.◎ By the end of 2023, the accumulated number of battery swap stations built will exceed 2,300, with the number of high-speed swap stations rising from the current 300+ to 700+.

Faced with price cuts, NIO has chosen a differentiation strategy centered on solving problems in a better way.

Action: NIO announced the addition of 1,000 battery swap stations this year

Admittedly, this strategy is only suitable for NIO. For NIO, it is better to accelerate forward than to lower the car price. The increase of battery swap stations enhances the driving experience, and it can be said that the substantial increase in the target of building swap stations is for better vehicle sales. Specifically, under the layout of battery swap stations sinking to third- and fourth-tier cities, by deploying swap stations to third- and fourth-tier cities/counties with insufficient holdings, NIO aims to promote the penetration of battery swap technology and encourage those potential buyers in those areas with doubts about basic infrastructure to try NIO services.

Effect: Battery swap solves energy replacement anxiety, and the best experience of energy supplement drives word-of-mouth recommendations and sales growth

Currently, NIO’s sales are relatively concentrated, mainly due to insufficient energy replacement facilities, which limits the convenience of battery swap for potential buyers in third- and fourth-tier cities. Under pressure in 2023, NIO’s strategy is to expand the coverage of its swap stations. Battery swap is really more convenient than refueling. Without a widespread deployment of battery swap stations, the entire concept would remain completely impractical.

I think NIO is taking a long-term approach in this area, it chooses to pursue the permanent improvement of the energy supplement experience rather than a short-term price cut. Corporate choices reflect their values and beliefs.

In summary: During this period of industry consolidation, car companies must choose the right path based on their own strengths. Only those companies with their own barriers can develop better.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.