Special Contributor | Gratifying and Comfortable

Editor | Qiu Kaijun

In 2022, BYD has created many new records for independent brands:

- A single independent brand achieved the highest sales volume of 1.8 million vehicles in a year

- The first OEM to cease production of gasoline-powered vehicles among independent brands

- The first annual sales champion among independent brands in China’s passenger car history

- The first new energy brand in the world to achieve monthly sales of 200,000+

- The best-selling new energy brand in the world…

These are actually well-known facts. Today, let’s talk about something different from the perspective of new energy increment — BYD in 2022.

First, let’s take a look at a set of data from the China Association of Automobile Manufacturers: in 2022, the sales volume of new energy passenger vehicles in the Chinese market was 5.6743 million, a year-on-year increase of 93%. The absolute increment in 2022 was 2.6853 million. Among them, BYD’s absolute increment was 1.2215 million, accounting for 45.49% of the total increment in the market.

In 2022, BYD was like a “black hole,” absorbing most of the growth in the new energy market.

Increment of the New Energy Market in the Past Three Years

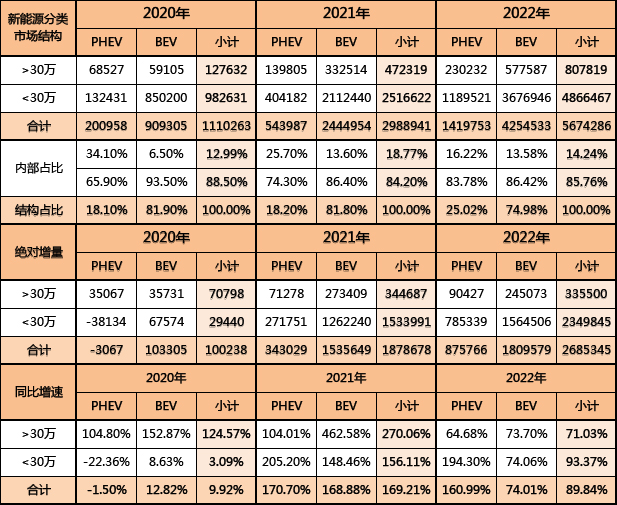

Let’s first take a look at the increment structure of the overall market:

In 2020, with the successive launch of the first-generation products of new forces, the hotspots (increment) of the market were all concentrated on pure electric models. Among them, pure electric models priced above 300,000 achieved a year-on-year growth rate of 124.57%, while the overall plug-in hybrid models experienced a year-on-year decline.

In 2021, it was a year of explosive growth in new energy vehicle sales. During this year, pure electric models exceeded 2.4 million in sales volume, a year-on-year growth rate of 169%; plug-in hybrid models, despite their low base, achieved a sales volume of just over 540,000 for the whole year, with a year-on-year growth rate of 171%.

In terms of price segmentation, pure electric models priced above 300,000 benefited from the rapid growth of Tesla’s sales, achieving a year-on-year growth rate of 463%. At the same time, with the introduction of BYD’s all-new DM-i super hybrid models, plug-in hybrid models priced below 300,000 also achieved a year-on-year growth rate of 205%.

Markdown Text in English

By 2022, the penetration rate had quickly exceeded 25% and the overall market had entered a “rapid adoption of new energy” situation. Firstly, the growth rate of plug-in hybrid models was much higher than that of pure electric models, with plug-in hybrids growing by 161% compared to only 74% for pure electric models. Secondly, the growth rate of models below 300,000 RMB was also significantly higher than that of models above 300,000 RMB, with growth rates of 93% for models below 300,000 RMB and 71% for models above 300,000 RMB.

Looking at the sub-markets, plug-in hybrids for models below 300,000 RMB had a year-on-year sales growth of 194%, becoming the main driving force behind the growth of the new energy market in 2022.

Over the past three years, we can see the overall market change from the increase in pure electric models above 300,000 RMB to the rapid shift towards plug-in hybrid models below 300,000 RMB. When combined with the different price ranges for new energy penetration rates, passenger car sales in the 80,000-150,000 RMB price range accounted for over 40% (approximately 8.2 million vehicles), but with a penetration rate of only 14% (far below the overall 27% new energy penetration rate), this low penetration rate represents a significant potential for growth.

If the new energy penetration rate continues to increase in 2023, plug-in hybrids that replace petrol cars in the 80,000-150,000 RMB range will become the main growth direction of the new energy market.

BYD’s recent growth

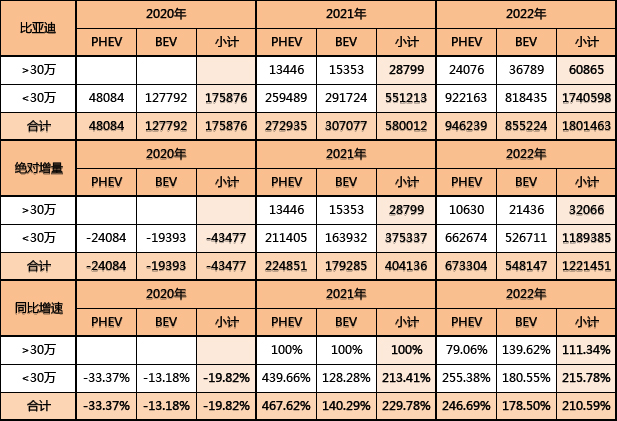

In 2021, BYD had explosive growth in new energy, with sales rocketing from 175,900 in 2020 to 580,000 in 2021, representing a 230% year-on-year growth. Pure-electric models increased by 140%, with plug-in hybrids increasing by a staggering 468%. One can say that BYD’s new DM-i super hybrid model has consolidated its future growth in new energy over the next 3-5 years.

Worth mentioning is that, with the successful sales of higher-end models such as the Han EV and Tang EV, BYD has also achieved the breakthrough of 300,000+ in vehicle sales for the first time.

In 2022, with the help of several new models in the “DM-i super hybrid + pure electric e-platform 3.0”, BYD achieved a year-on-year growth for the second consecutive year of more than 200%, resulting in a leap from 580,000 vehicles sold to 1.8 million vehicles sold, an increase of 210% year-on-year. Plug-in hybrid models had a year-on-year growth of 247%, while pure electric models grew by 179%. Plug-in hybrids, mainly driven by the BYD Qin Plus and Song Plus models, had a year-on-year sales growth of 255% for models below 300,000 RMB, becoming the cornerstone of BYD’s new energy sales.If we take a look at the entire market, we can see that BYD’s incremental growth in new energy vehicles accounted for 21.51% of the overall market in 2021. Among them, the incremental growth rate of plug-in hybrid models below 300,000 yuan reached 78%. Basically, BYD has single-handedly driven the explosive growth of the entire plug-in hybrid market.

In 2022, BYD seems to have entered a mode of “incremental black hole” – the incremental growth of new energy vehicles accounts for 45.49% of the overall market. Among them, incremental growth of plug-in hybrid models below 300,000 yuan exceeded 84%. BYD’s absolute strength in the plug-in hybrid field in 2022 attracted almost all of the incremental growth. At the same time, BYD also has a 30% share of incremental growth in the pure electric field, which is truly a typical example of “both plug-in hybrids and pure electric vehicles need to be strong.”

If BYD has taken away most of the incremental growth in the market, how have other major car companies performed in terms of incremental growth?

Let’s take a look at the performance of the 16 mainstream new energy vehicle brands in the market.

Incremental Growth of Other Brands

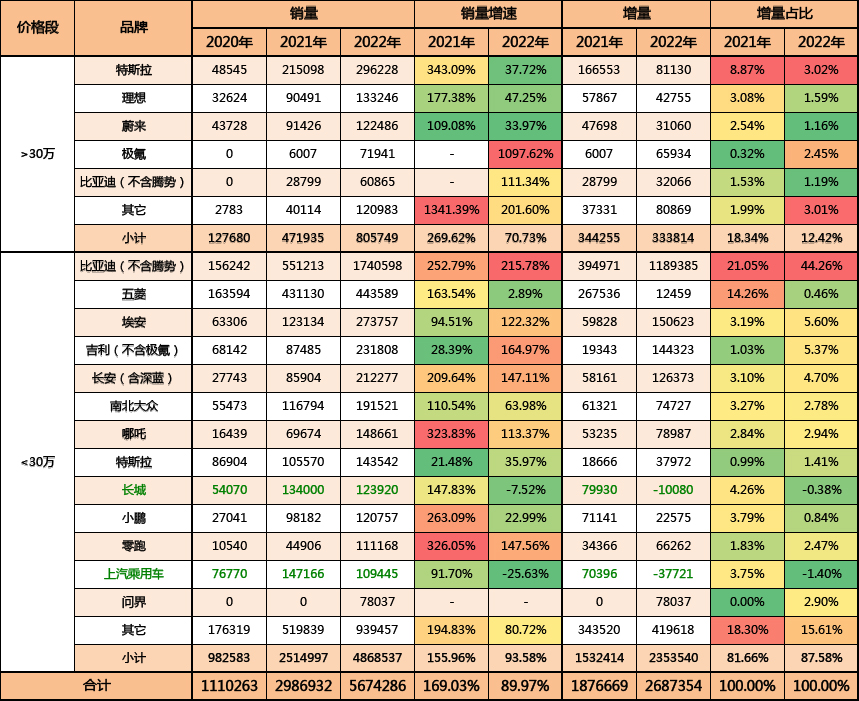

- Brands with a price tag over 300,000 yuan:

In 2021, the overall incremental growth rate for this price bracket was 18.34%. Among them, Tesla accounted for the highest share at 8.87%, followed by NIO at 3.08% and Xpeng at 2.54%. Together, the above three brands accounted for 14.49% of the share.

In 2022, the overall incremental growth rate for this price bracket dropped to 12.42%. Among them, Tesla accounted for the highest share at 3.02%, followed by Jinko at 2.45%, Xpeng at 1.59%, and NIO at 1.16%. Together, the above three brands accounted for 7.06% of the share.

Looking at their performance over the past two years, the growth rates of Tesla, NIO, and Xpeng are significantly lower than the overall growth rate of the new energy vehicle market.

- Brands with a price tag below 300,000 yuan:

In 2021, the overall incremental growth rate for this price bracket was 81.66%. Among them, BYD ranked first with 21.05%, followed by Wuling with 14.26%, Great Wall with 4.26%, XPeng with 3.79%, SAIC with 3.75%, and FAW-Volkswagen with 3.27%. Together, the above six brands accounted for 50.38% of the share.The overall increment proportion in this price range in 2022 is 87.58\%. Among them, BYD ranks first, accounting for 44.26\%; Guangqi Aion is second, accounting for 5.60\%; Geely (excluding Geometry) is third, accounting for 5.37\%; Changan (including Blue Whale) is fourth, accounting for 4.70\%; NIO is fifth, accounting for 2.94\%; and Weltmeister is sixth, accounting for 2.90\%. The market share of these six brands reached 65.77\%.

From the structure of increment, after the penetration rate exceeds 25\%, the increment of the market will shift more and more to the traditional brands with a selling price below 300,000 yuan. Especially, plug-in hybrid models at the price range of 100,000 to 300,000 yuan will become the main force driving the market growth in 2023. BYD also achieved a breakthrough in this price range to obtain such a high increment proportion.

However, the new energy vehicle brands focusing on the medium-to-high-end market only obtained 18.78\% market share amid the explosive growth of new energy vehicles in 2022.

The Most Comprehensive New Energy Vehicle Matrix

In 2022, BYD built a complete matrix of new energy best-selling models priced from 100,000 to 300,000 yuan, including Qin, Song, Tang, Han, Yuan, Dolphin, and Diving. This is a “unique” existence among all new energy vehicle companies in China, which also led to BYD’s occupancy of more than 45\% of the new energy market increment.

After entering 2023, BYD deployed DENZA-branded products priced from 300,000 to 600,000 yuan, and also launched new energy products priced above 800,000 yuan under the Yangluo brand. As a result, BYD became the first and only automaker in the world that built a complete matrix of new energy products or brands priced from 80,000 yuan to 2 million yuan.

In 2023, we hope to see more new energy automakers emerge and challenge traditional fuel vehicles together with BYD through sales.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.