Author | Wang Lingfang

Editor | Qiu Kaijun

Of all the power batteries in the world, 60% of them are made in China and the remaining 30% are made elsewhere.

Chinese power battery enterprises have completed a rapid development from weak to strong in less than 10 years.

According to SNE data, in 2015, Chinese enterprises only accounted for 16% of the global power battery market share. As of November 2022, that share has reached 64.5%.

China has taken over from Japan and South Korea, becoming the third country to dominate the lithium-ion battery market.

The influence of Chinese power batteries has expanded from regional to global, and any company intending to rapidly manufacture smart electric vehicles cannot avoid Chinese battery suppliers.

Furthermore, Chinese power batteries are also extensively deployed overseas, supplying local car manufacturers.

According to incomplete statistics, the combined overseas capacity of Chinese power battery enterprises that have been built, under construction, or planned has exceeded 300GWh, surpassing the total installed capacity of global power batteries in 2021. Leading players in overseas investment include CATL with 114GWh, EVE energy with 20GWh, Farasis Energy with 157GWh, Gotion High-tech with 20GWh, and SVOLT Energy with 24GWh.

In addition, Chinese battery enterprises also export to foreign companies, with a cumulative export of 68.1GWh by 2022.

However, 20 years ago, China wasn’t a major player in the overseas lithium-ion battery market; it was Japan and Korea who dominated the market.

Let’s review how China’s power battery industry has risen and “gone global” in the past decade.

Struggling to support itself in a small corner

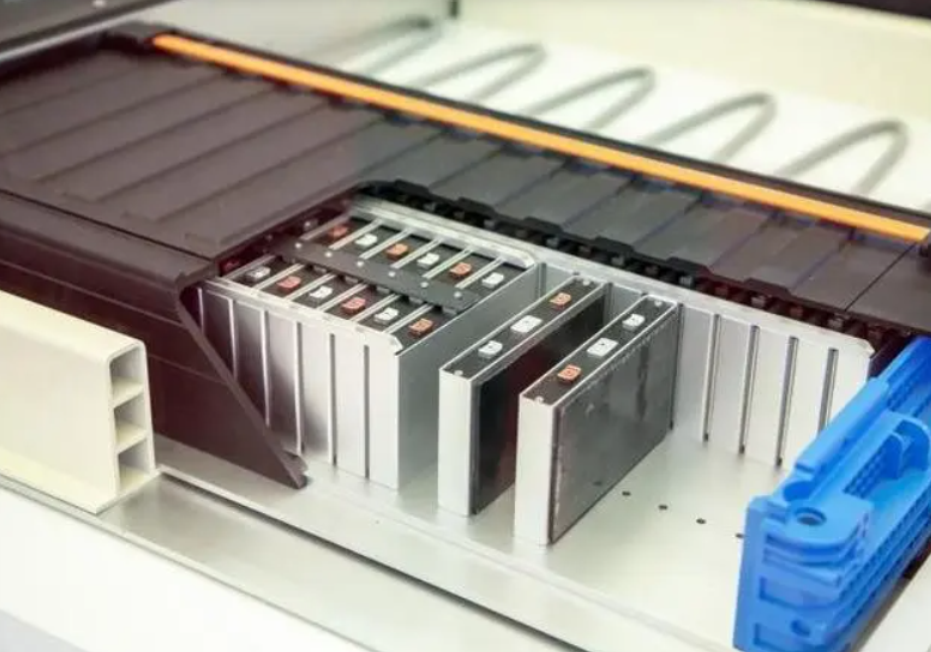

Power batteries are an important branch of lithium-ion batteries. Prior to the rise of new energy vehicles, 3C products were the largest application space for lithium-ion batteries. Therefore, to understand the development of power batteries, we must begin with the commercialization of lithium-ion batteries.

(1) Early domination by Japanese and Korean enterprises

Lithium-ion batteries, now widely used in cars, were first commercialized in Japan.

In 1991, Sony Corporation developed lithium-ion batteries for use in portable electronic products. Over the next 20 years, Japanese and Korean companies led the world in technology and cost.

Two data points illustrate the duopoly of Japanese and Korean enterprises at that time: In 2000, Japanese lithium-ion battery companies accounted for 93% of the total global sales. Subsequently, Korean battery company market shares rose from 15% in 2005 to 39% in 2010, and the gap between market share of Japanese and Korean firms narrowed significantly, forming a duopoly.“`

In 2000, China’s domestically produced lithium-ion batteries began commercial production. With low labor costs and a huge demand for electronic products, China quickly became the largest producer of lithium-ion batteries. However, during this period, about 40% of these batteries were produced by foreign companies such as those in Japan and South Korea.

The embarrassment for Chinese domestic companies was that they had production but no core technology.

In 2007, the National Development and Reform Commission issued “Rules for the Administration of Production Access of New Energy Vehicles,” which clearly stipulated that China would begin supporting the development of the new energy vehicle industry through subsidies.

In January 2009, the “Ten Cities, One Thousand Vehicles” demonstration and promotion plan for new energy vehicles was released. With the support of the Ministry of Science and Technology, the Ministry of Finance, the National Development and Reform Commission, and the Ministry of Industry and Information Technology, the plan aimed to develop 10 cities each year for three years, with each city launching 1,000 new energy vehicles for demonstration purposes.

Thus, China’s promotion policy for new energy vehicles began to be implemented.

With the rise of new energy vehicles, the proportion of lithium-ion batteries as the power source in automobiles has become increasingly larger.

At this time, there was no battery developed specifically for electric vehicles. Across the ocean, Tesla began to use 18650 cylindrical computer batteries to power their vehicles. This signaled the beginning of the application of electronic product batteries in the field of electric vehicles. The only company in the world specifically producing batteries for electric vehicles was AESC, a joint venture between Nissan and NEC, while the rest were consumer battery companies that transformed themselves.

At that time, Panasonic, LG Chemical, Samsung SDI, and AESC held the main market share in the international power battery market, with Panasonic as Tesla’s main power battery supplier. After acquiring Sanyo, Panasonic remained the market leader by relying on Tesla’s development, with a stable market share of over 30%.

LG Chemical and Samsung SDI quickly opened the market with advanced technology and low-price strategies, and grew at a rapid pace. AESC gained a major market share by virtue of the success of Nissan’s pure electric car, the Leaf.

“`(2)Relentless Pressure from Korean Companies and Distorted Expansion of Local Enterprises

In 2009, when China launched the “Ten Cities, Thousand Vehicles” new energy vehicle plan, it was the era when Japanese and Korean lithium-ion batteries dominated the world in the field of electronic products batteries.

The advantage of Japan and Korea in the field of electronic product batteries was extended to that of vehicle power batteries.

By 2012, China’s new energy vehicles had officially entered a phase of rapid growth, and Chinese battery companies saw development opportunities.

The rapid development of China’s new energy automobiles caught the attention of Japanese and Korean battery companies.

In 2015, Korean companies such as LG and Samsung seized the opportunity and entered the Chinese market with their mature ternary battery technology, accelerating the production of power battery production lines.

On October 22, 2015, the Samsung SDI Xi’an plant was completed. The factory has the most advanced production line for producing high-performance vehicle power battery (pure electric EV standard) with an annual output of 40,000 units. The production line covers the full process flow of producing automotive power battery cells and modules.

An industry insider told “EV Observer” magazine that the visitors to the Xi’an factory were endless, so much so that Samsung later struggled and considered contacting tour groups to help alleviate the company’s personnel burden. In November of the same year, Samsung SDI began supplying cylindrical batteries for electric vehicles to Jianghuai Automobile.

Shortly thereafter, on October 27, the LG Chem Nanjing plant was completed. The first phase of the LG Chem new energy battery project, which was built this time, has a production scale of more than 100,000 new energy vehicle batteries per year and has squeezed into the forefront of domestic power battery manufacturers.

The Korean companies, whose production capacity was ready, hoped to thoroughly defeat Chinese battery companies through a price war and continue their brilliant record in the field of electronic products. Around 2015, when the factory price of domestic ternary lithium batteries was around ¥ 2.5-3 per watt-hour, Japanese and Korean companies intercepted a large number of orders, including those from Chery, Geely, and Changan, at a loss-making price of ¥1 per watt-hour.

The fruits of the development of new energy vehicles were intercepted by Japanese and Korean companies.

As an example, from the initial stage of Xi’an production line, Samsung had customers such as Zhengzhou Yutong and Beiqi Foton, and then increased to more than ten automakers.

In 2015, China’s commercial vehicles were quickly launched, the battery supply was in short supply, and the market was unusually hot, which made many companies that did not involve power batteries begin to try the field. GBII data shows that in 2015, there were about 84 lithium-ion battery companies for power in China. Other sources showed that in 2017, the number of power battery companies had exceeded 200.The Chinese power battery industry, which has been growing larger, does not seem to have become stronger.

(3)The Chinese Power Battery Enterprises Stuck in One Corner

Except for a few companies such as CATL having overseas customers, few Chinese companies are recognized by foreign car manufacturers.

In general, Japanese and Korean batteries are the preferred choice for European and American car manufacturers. For example, Tesla, the fastest-growing enterprise, is exclusively supplied by Panasonic; General Motors and Ford choose LG as their primary supplier. Japan and Korea have become the main export countries for batteries, while Europe and the United States are the corresponding import countries. China mainly produces and sells its own batteries.

At this point, Chinese power battery enterprises with relatively complete industrial chains have not gone abroad.

Under the stimulus of new energy vehicle subsidies, the Chinese power battery industry, like strawberries and apples injected with a lot of growth hormones, has grown larger, but the quality of their products is not satisfactory.

Previously, the North China Research Institute of Vehicle Technology once organized a comparison test of domestic and foreign vehicle-use batteries. Japan’s ability to control the consistency of its products had reached 100% qualification rate. Upon seeing the results, testing experts acknowledged that “China should increase its investment in battery research, design, and production, carefully analyze the technical reasons for the gap and research methods to solve the differences and possess independent intellectual property rights.”

At this time, Chinese battery enterprises not only faced the unreasonable price pressure from Japanese and Korean companies but also dealt with the chaotic competition within their local companies. There were very few enterprises that put a lot of effort into improving technique since there were no scaled battery enterprises, and they faced enormous survival pressure.

At the same time, most domestic automakers’ purchases were used to exchange subsidies and did not care about the use effect. Even some automakers had fraudulent subsidy behavior. This only worsened the attitude of some battery companies towards production and the lack of attention to technology.

Reflecting on the development of this stage, the Chinese power battery industry mainly solved the problem of creating something out of nothing, but their products have neither gone abroad nor have they formed brand recognition.

China Promotes to the Largest Market: Local Enterprises Welcome Home Field Advantage

For the lithium-ion battery industry, 2015 was an extraordinary year, as the main products, dominant enterprises, and primary countries all underwent earth-shattering changes.## Global Smartphone Shipment Growth Rate Decreased to 10% in 2015, while China’s New Energy Vehicles Booming Driven by Huge Subsidies

Due to the huge subsidies, the installed capacity of power batteries for new energy vehicles in China has grown rapidly, surpassing lithium batteries for smartphones and becoming the largest market in the lithium-ion battery industry.

It is also in this year that China surpassed Japan to become the world’s largest power battery producer. The following year, China overtook the United States to become the country with the largest fleet of new energy vehicles, accounting for 40%.

The turning point of the Chinese power battery industry comes from the government’s support.

In March 2015, the Ministry of Industry and Information Technology released the “Regulations on the Automotive Power Storage Battery Industry” (hereinafter referred to as the “Regulations”) and the “Administrative Provisions on Access to New Energy Automotive Production Enterprises and Products” (hereinafter referred to as the “New Energy Automotive Access Rules”), which left the development opportunity of power batteries to local enterprises.

According to the “New Energy Automotive Access Rules”, from July 1, 2017, electric vehicle batteries must enter the directory of the “Regulations”, otherwise, new energy vehicles using this battery will not be able to enter the promotion directory, and will also be unable to obtain subsidies.

Since November 2015, the Ministry of Industry and Information Technology has successively announced four batches of company lists that meet the “White List”. A total of 57 battery companies have been selected, mainly including domestic power lithium battery companies such as CATL, BYD, Guoxuan High-tech, and Tianjin Lishen. However, Japanese and Korean power battery companies such as Samsung SDI, Panasonic, LG Chemical, and SKI are still unable to enter the directory. Their further development plans in China have been forced to be shelved.

This has gained valuable time for local lithium battery companies.

CATL and BYD are typical companies that have seized the opportunity. In the 2015 new energy vehicle directory announced by the Ministry of Industry and Information Technology, 500 of the 3,200 models used CATL’s batteries, while BYD occupied the global lithium battery market leader position based on its own electric vehicle sales.

On the one hand, Chinese battery companies have made rapid progress; on the other hand, Japanese battery companies have encountered major setbacks.

In 2015, among the top ten power battery companies in the world, there were four in Japan, three in Korea, and three in China, among which BYD was the leader in China.

In 2016, the Japanese power battery industry encountered major setbacks. Nissan significantly reduced its stake in AESC, and Sony sold its battery business. The top ten Japanese companies shrank to three, with significant market share reductions for Panasonic EV Energy, and LG and Samsung from Korea also had a noticeable decline. In their place, the number and proportion of Chinese enterprises have increased significantly.“`

Since 2017, CATL has been developing rapidly, surpassing BYD first, then surpassing Panasonic to become the world’s number one.

In 2018, CATL seized the critical window and launched rapid expansion: IPO listing, going to Europe, establishing factories in Germany, signing a 1 billion euro order with BMW, taking a 56GWh order from Honda, entering the supply chain of foreign automakers such as Daimler, Jaguar Land Rover, Volkswagen, Honda, Nissan, and establishing deep cooperation relations with domestic automakers such as SAIC, Changan, BAIC New Energy, JMC, Dongfeng, GAC, Geely, etc., forming a dominant position in the domestic power battery market.

The time of transformation for the power battery industry has come.

Soon, companies represented by CATL not only achieved product exports and overseas factories, but also exported technology to foreign companies. China has since moved from being a big power battery country to a strong one.

Technology output, product output, capacity output

Today, power batteries are one of the few strong fields in which China has a strong presence in the automotive industry, with not only product exports and overseas factories, but also technology exports.

In 2022, China’s lithium battery exports increased by 86.7% year-on-year, with much of it contributed by power batteries. Last year, China’s power battery companies exported a cumulative total of 68.1 GWh.

In 2018, CATL and other Chinese battery makers represented by it were no longer satisfied with the domestic market and successively moved to the international stage, with Europe becoming a new battleground.

In 2018, companies such as Farasis Energy, CATL, and Funeng Technology announced their plans to build factories in Europe, becoming the first batch of companies to plan overseas factories.

Subsequently, news of Chinese battery companies planning to build overseas factories emerged one after another.

In November 2020, SVOLT announced that it will establish a cell and PACK factory with an annual capacity of 24GWh and a total investment of 2 billion euros in Saarland, Germany.During the period from 2021 to 2022, many Chinese power battery companies, including EVE Energy, CATL and Gotion, are still adding overseas factory construction plans.

According to incomplete statistics by Battery Online, as of 2022, multiple domestic lithium battery companies, including CATL, EVE Energy, Heter Electronics, Contemporary Amperex Technology, Blue Energy, Funeng Technology and Zhonghuan Semiconductor, have announced plans to build factories overseas, with a total of 23 factories (including cell, module and PACK factories) and a planned production capacity of over 366.5 GWh in 18 factories.

In addition, CATL and Heter Electronics have begun to export their independently developed power battery technologies overseas. In October 2021, CATL signed a strategic agreement with Hyundai Mobis to authorize the latter to use its CTP technology to supply CTP-related battery products globally. In May 2022, CATL authorized ArunPlus, a wholly-owned subsidiary of the Thai National Oil Company (PTT), to use CTP technology and supply battery products to the Thai electric vehicle brand Horizon Plus.

Meanwhile, Heter Electronics has exported its IP intellectual property to a well-known company in India to help Indian companies upgrade their battery product technologies.

In December 2022, CATL’s first overseas factory located in Thuringia, Germany, successfully started mass production of lithium-ion battery cells, marking China’s battery companies’ formal entry into the overseas market.

This process cannot be achieved without the continuous efforts of each enterprise in the battery industry chain, the subsidies and policies have cultivated companies that can face global competition independently.

After ten years of development, subsidies have not only brought about the localization of the entire battery industry chain, but also enabled the industry to go global and become a leading player.

Undoubtedly, the current status of China in the field of liquid lithium-ion batteries is irreplaceable, but technological progress has no limits, and any disruptive progress can overturn the existing order. In the field of solid-state batteries, will China still be a strong player in the future? This requires the entire battery industry in China to answer.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.