Author: Zhu Yulong

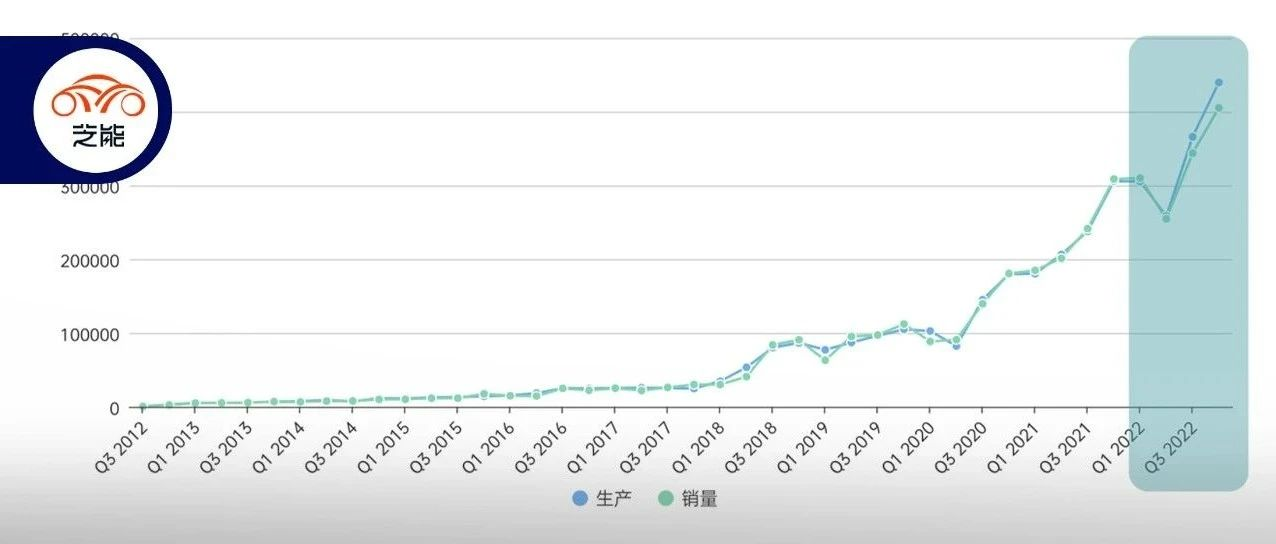

Tesla’s global delivery overview has been released, with a total of 405,278 vehicles delivered worldwide in Q4 2022, a 31% YoY increase compared to the 308,600 vehicles delivered in Q4 of last year, and an 18% YoY increase compared to the 343,830 vehicles delivered in the previous quarter.

Looking at specific models, the two popular models, Model 3 and Model Y, had a total production of 1,298,434 units and delivered 1,247,146 units in 2022.

In 2022, Tesla delivered a total of 1,313,851 vehicles worldwide, a 40.3% YoY increase compared to the 936,172 vehicles delivered in 2021. This is in alignment with Tesla’s target of 50% growth in production and deliveries for 2022 before the resignation. I would like to discuss this matter further.

Tesla’s Global Production Capacity

In November, Tesla China released data showing that the delivery volume of the Shanghai factory was 100,291 units, including exports and domestic sales. This means that the output capacity is 100,000 units per month. After the upgrade of the production line at the Shanghai Gigafactory, a yearly output of 1.2 million units can be achieved by 2023. The slowdown in production in December was unexpected.

At present, production capacity at the Texas Gigafactory and Berlin Gigafactory is ramping up at a slower pace.

◎The Berlin factory achieved a weekly output of 2,000 units (8,000 units per month, 96,000 units per year) in October, and in early December, it reached a weekly output of 3,000 units (12,000 units per month, 144,000 units per year).## Tesla’s production capacity and demand outlook in 2023

◎ Texas factory achieved a weekly production of 3,000 units in mid-December (12,000 units per month and an annualized rate of 144,000 units).

According to logical reasoning, the maximum expected production capacity of Tesla’s factories worldwide in 2023 is:

◎ Fremont factory: 550,000 units

◎ Shanghai Gigafactory: 1.2 million units

◎ Texas Gigafactory: 250,000 units

◎ Berlin Gigafactory: 250,000 units.

This means that Tesla’s total production capacity worldwide is 2.25 million units. Based on the production capacity in 2023, the US is expected to produce 800,000 units, Europe 250,000 units, and China may surpass these two regions.

Looking at Tesla’s deliveries this year, they have been moved from December to November to avoid expected sales promotion and delivery logistic resource constraints. However, this adjustment led to overestimation by experienced analysts, such as Troy Teslike, who miscalculated by 17,700 units. According to Troy’s estimation, Tesla’s inventory at the end of Q4 is 71,000 units (13 days’ supply). This situation marks the end of Tesla’s production outstripping demand. On December 15th, Tesla’s global order backlog was 144,000 units, lower than the 190,000 units on November 30th; this outcome was unexpected in the first half of 2022.

When evaluating an issue, linear thinking may not always be the best approach. If someone had said half a year ago that Tesla’s order backlog would reach 476,000 units, it would have been unimaginable that Tesla would have accumulated the highest inventory and that orders would be at a very low level.

How to view Tesla’s demand outlook for next year

With the increase in Tesla’s production capacity in 2023, it’s possible to supply 2 million units. Furthermore, if everything goes smoothly, Cybertruck’s production has already entered the equipment debugging stage, and it is expected to begin mass production at the end of 2023. Cybertruck’s order backlog has already surpassed 1.6 million units; it’s hard to tell how accurate this figure is.From the perspective of the United States, 800,000 production capacity can cope with the cancellation of the 200,000 limit by the American IRA Act. In 2023, there is hope for Tesla to receive a maximum subsidy of $7,500 for the purchase of Tesla in the United States, which may stimulate a new round of demand growth in the American market.

In 2023, the Model 3 will undergo some improvements before production at the Shanghai factory. However, in the Chinese market, it will be considered good enough if the sales volume of 2022 can be maintained without reducing prices. A new entry-level model in the Model series is under development and may be released in the second half of 2024. However, simply reducing costs may open up a broader mid-to-low-end market, but in China, it is a double-edged sword. Assuming a price of 150,000 to 200,000 yuan, it will completely destroy the value of the Tesla brand. In fact, it is better to hope for small upgrades to the Model 3 to improve product competitiveness than to expect Tesla to push down the unit profit (about 10,000 US dollars). After all, as the bottleneck of chip and upstream materials supply is alleviated, continuing to earn so much money will be detrimental to market share.

In my opinion, Tesla’s current goal of reaching 2 million in 2022 may still be achievable, but whether it can completely surpass Audi, follow Mercedes-Benz, and approach BMW’s goals is really hard to say. The probability of this is slightly lower than that of NIO surpassing Lexus in China.

To be honest, I heard very early on that in North America, the engineers who were once the backbone of Tesla felt exhausted during a wave of exhausting development. Under Elon Musk’s continued pressure, Tesla’s engineers are actually working hard, but after all, this kind of roll is from top to bottom and is transmitted by Elon Musk. When the leader’s interest shifts elsewhere and there are not so many surprises for everyone, it is hard to expect engineers in Silicon Valley and Texas to work as hard as we do. The Chinese market is often a matter of life and death. I think it is time to lower expectations for the development of Tesla and pure electric vehicles.

In summary: I think that the current development of pure electric vehicles has fallen into a state that has no template to copy. Especially when Tesla faces Chinese car companies without cost advantages, we find that Tesla doesn’t have so many cards to play. What other innovative means do we see from other Chinese players? None, it seems. When the entire pure electric siege hammer becomes dull, it is indeed necessary to rethink the sustained driving force of development.# 我的Markdown文本

这是一个Markdown文本,里面包含一些基本格式和HTML标签。

基本格式

- 加粗文本

- 斜体文本

- ~~删除线文本~~

HTML标签

这里有一个链接到谷歌的超链接。

下面是一张图片:

这是一个无序列表:

- 项目1

- 项目2

这是一个有序列表:

- 第一项

- 第二项

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.