Author: Zhu Yulong

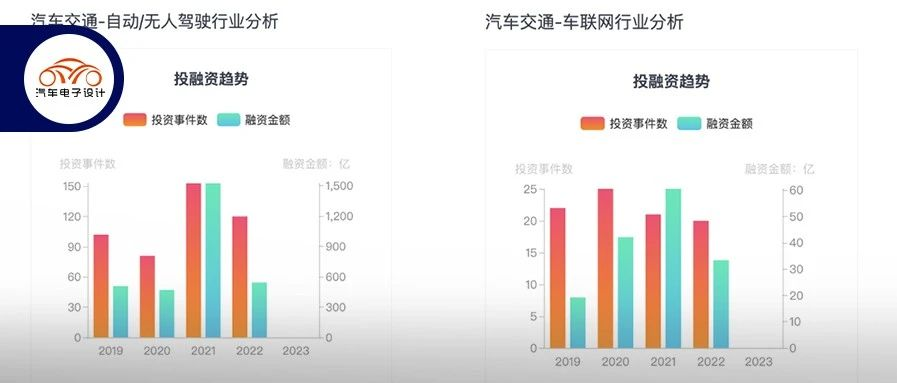

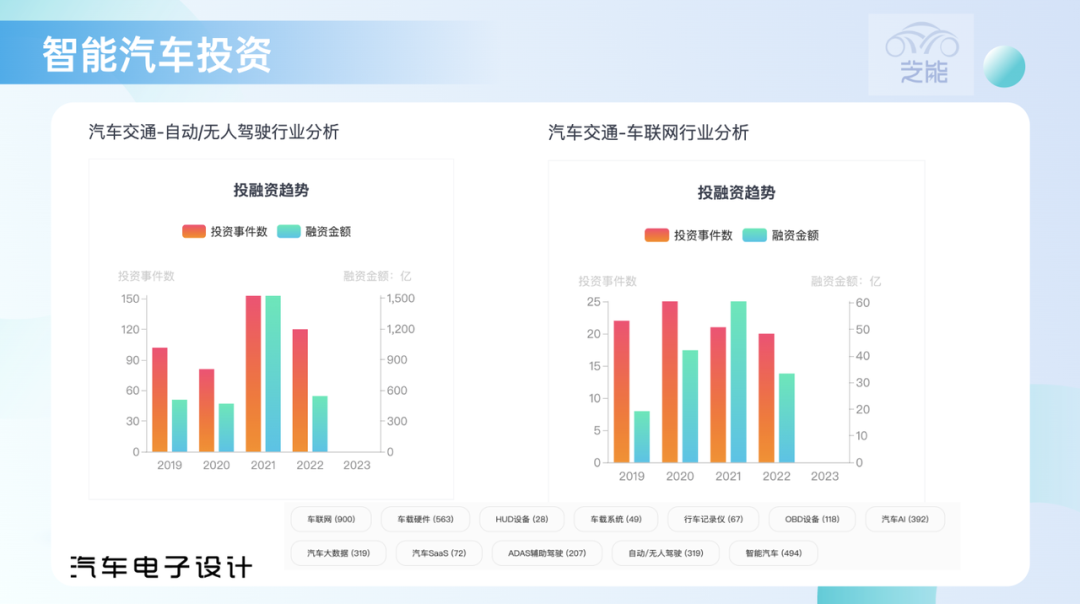

As previously discussed, investing in the intelligent automotive industry requires careful consideration. When it comes to the composition of intelligent vehicles, the addition of hardware mainly consists of several key components, such as sensors and domain controllers for intelligent driving, intelligent cabins, and intelligent network architecture. In terms of investment practices and funding amounts, investment in intelligent driving has dropped the fastest from 2021 to 2022. Data from IT Juzi indicates that the autonomous driving industry includes a broad range of companies (including 207 ADAS assisted driving companies and 319 fully autonomous/self-driving companies) worldwide, with investments dropping from more than ¥152.5 billion in 2021 to just over ¥50 billion in 2022. Compared to the automotive networking field, which has only 900 companies with a funding amount of ¥3 billion.

From ADAS to L4 Autonomous Driving

I understand that the focus of this round of investment in ADAS and L4 autonomous driving is different for various companies.

L4 Autonomous Driving

This wave of autonomous driving companies essentially does not need to be based around existing automobile manufacturers. Waymo pioneered a system that did not rely on automobile manufacturers but instead only needed to add the appropriate sensing and processing system to the current vehicle models. This could be understood as purchasing a car and constructing an entire set of sensing and processing systems, as well as a system backend, which acts as an independent system that requires vast amounts of capital investment.

The bottleneck is on the operating end. After removing the driver, how to calculate the input and output balance became a major question. By integrating the cost of drivers into the investment, these companies then calculate their scenarios on various operational ends.

Based on this, there has been a large amount of investment in China these past few years, which is not entirely represented in this article. That is to say, as Waymo, Cruise and many US-based Silicon Valley companies have had trouble scaling quickly in high-cost labor markets, such as the US, these Chinese companies have been investing enormous amounts of capital and will start the process of becoming a high-tech supplier.To achieve a balance between investment and income in specific situations, it seems difficult to pursue the path of L4 under the current employment background.

Investment in ADAS

If taking the path of L4 mentioned above is one option, the companies that mainly focus on ADAS initially complete the approach around perception and domain controller. Collaborating with automakers is necessary in this path. Therefore, we can see that the companies that transform from L4 and establish a cooperative relationship with automakers still have certain advantages. The final contradiction lies in the fact that the final buyer, like Tesla’s FSD in the United States, needs to invest continuously at ¥285,000. In China, how to charge for the L2 + system that leads to L3 and how to do it is still under exploration of automakers.

Automakers are not willing to simply hand over the R&D of the “soul” of automotive technology, as they did before, to Tier1 to achieve software and hardware collaboration. It is not easy to achieve collaboration between Tier1 and automakers. Moreover, at the hardware level, the calculation SOC also slows down the iteration process.

Therefore, investments in ADAS and L4, and even Qualcomm chips that build a chip-based software architecture, are compressing the value-added of this market. The problem we see is that more and more people enter this field and can achieve a score of 70-80, but consumers are not yet fully paying for this.

Investment in Sensors and Chips

If we break down the details further and think about the model of intelligent driving perception + computing power, investments can still revolve around perception + chips.

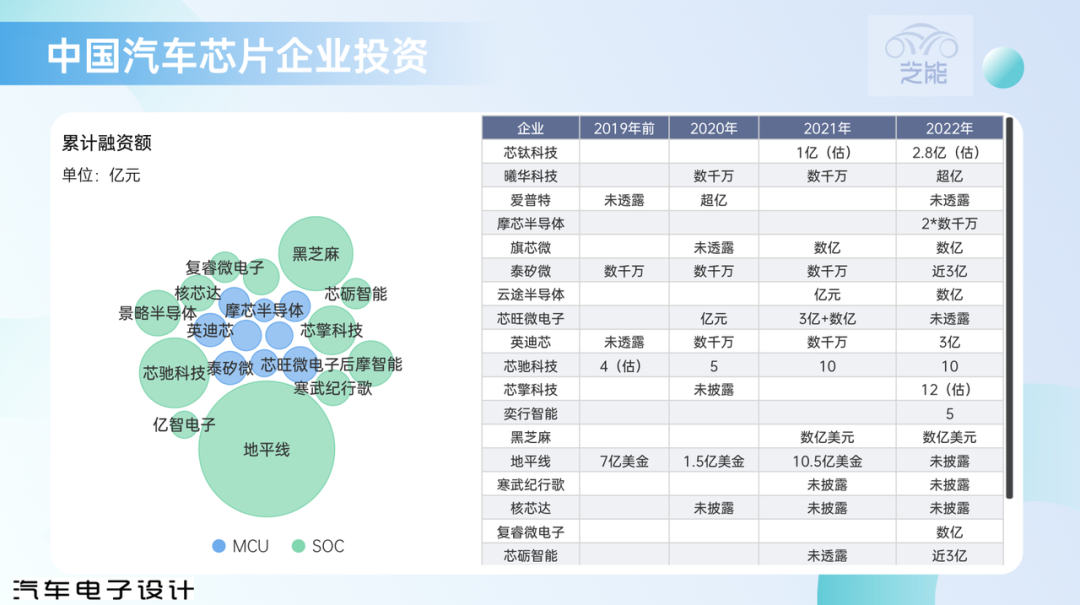

Chips

As the competition for the computing SOC chip used in the cockpit and intelligent driving is very fierce, NVIDIA and Qualcomm are in the lead. After that, enterprises such as ME, TI, and Renesas are following. Due to massive investment in this field, it has now reached the later stage. Establishing an ecosystem of automakers, Tier1, and software is heavily related to the companies that are engaged in intelligent driving.

Sensors

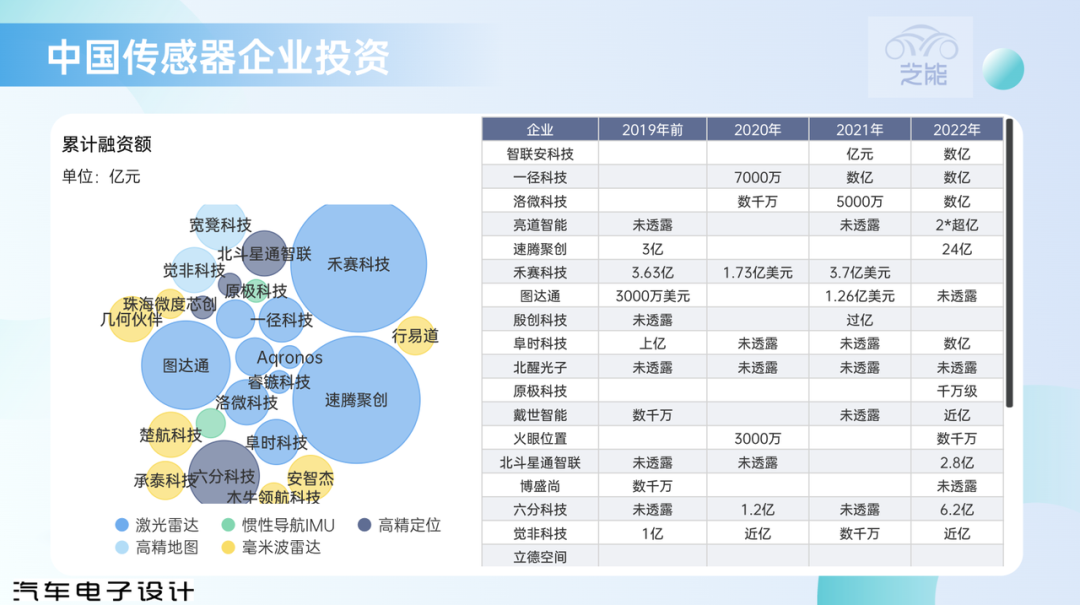

Currently, the major types of sensors revolve around three types: lidar, millimeter-wave radar, and camera. However, the greatest investment has been made in lidar and millimeter-wave radar over the past two years. The biggest challenge here is that the sensors themselves are headed towards hardware-based solutions, with software-based perception fusion through centralized processing. Once this logic is applied to single-product hardware, continual improvements to optics, radio frequency, and chip design will eventually drive down the price of these sensors.

As for chips, because automotive chips have yet to form a strong resonance with other industries and the competition is extremely fierce, the hardware trend in sensors, with thousands of unit prices, still restricts the speed of popularization.

Conclusion: I believe that the overall investment in the intelligent automobile industry has suffered a major slump due to the downward trend in the U.S. stock market in 2022. Since this is a technology-intensive field that requires long-term confirmation, the investment period will be particularly long. Under the pendulum-like valuation fluctuations, determining the competitive landscape of so many companies will be the key factor in shaping the future direction.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.