Special Contributors | Wang Tie, Wu Songquan, Zhu Yifang, etc.

Editor | Wang Lingfang

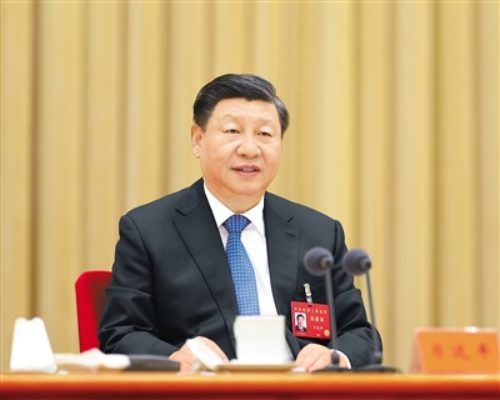

The first Central Economic Work Conference after the 20th National Congress of the Communist Party of China was held in Beijing from December 15th to 16th, 2022. General Secretary Xi Jinping delivered an important speech at the meeting, comprehensively analyzing the current domestic and international economic situation, systematically deploying the 2023 economic work, pointing out the direction for next year’s economic work, and providing orientation for the comprehensive construction of a socialist modern country.

The automobile industry has wide coverage, a long industrial chain, and a large market size. As a strategic and pillar industry of the national economy, automobile consumption is of great significance to boosting domestic demand, stabilizing industry and economic development. With the continuous development of electric, connected, and intelligent automobiles, the automobile manufacturing industry is accelerating its integration with energy, transportation, information and communication, and other industries or sectors, and the interaction between the automobile industry and the national economy has a wider scope and deeper level.

Looking back on 2022, in the face of the turbulent international environment and the arduous and heavy domestic reform, development and stability tasks, the entire Party, the entire country, and all ethnic groups have risen to the challenge, steadily improving the quality of development and maintaining overall stability in the economy and society.

China’s automobile industry is generally stable and heading in a positive direction, with a small increase in annual production and sales expected, and the production and sales scale continuing to rank first in the world; domestic auto brands are steadily improving, and the market share of Chinese brand passenger cars continues to increase; major companies are entering the international market one after another, and the export of new energy vehicles has grown significantly, helping China become the world’s second-largest automobile exporter.

Looking ahead to 2023, the Central Economic Work Conference proposed to “adhere to the principle of seeking progress while maintaining stability,” “focus on the transformation and upgrading of traditional industries and the cultivation and development of strategic emerging industries, make efforts to strengthen weak links in the industrial chain, and forge new industrial competitive advantages in the process of implementing the tasks of carbon peak and carbon neutrality,” “enhance the endogenous power and reliability of the domestic large cycle, and improve the quality and level of the international cycle,” “support consumption such as housing improvement, new energy vehicles, and elderly care services,” and “accelerate the research and development and application of cutting-edge technologies such as new energy, artificial intelligence, bio-manufacturing, green and low-carbon, and quantum computing,” and “actively promote the high-standard economic and trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the Digital Economy Partnership Agreement.” On the one hand, the Central Economic Conference has pointed out the direction and created favorable conditions for the development of China’s automobile industry; on the other hand, developing new energy vehicles, expanding automobile consumption, and other measures have become important levers to ensure stable operation of the national economy.

The China Automotive Strategy and Policy Research Center carefully studied the spirit of the Central Economic Work Conference and analyzed and interpreted it based on the actual situation and objective rules of the development of China’s automotive industry, focusing on consumer promotion, new energy vehicles, intelligent connected vehicles, low-carbon development, circulation and after-market, circular economy, and internationalization.

I. Stable car consumption is an important cornerstone of stable growth, stable employment, etc.

(I) The Conference releases positive signals and is good for car consumption

The Central Economic Work Conference requires continuing to implement active fiscal policies and prudent monetary policies in 2023, better coordinating supply-side structural reforms and expanding domestic demand. It puts increased domestic demand in the “five major aspects” of key work and emphasizes the need to stimulate market vitality and tap the potential of the domestic market more fully in the “six areas of focus.” The Conference also clearly stated that increasing consumption in priority and various channels should be pursued and that support should be given to housing improvements, new energy vehicles, and other consumption.

Cars are an important consumer item in expanding domestic demand and have significant implications for China’s economic and social development. The automotive-related tax revenue as a percentage of the national tax revenue, the number of practitioners as a percent of the total urban employment, and the automotive sales revenue as a percentage of the national commodity retail sales have all exceeded 10% continuously for years. Employment in the national automotive-related industry has surpassed 1/6 of total employment in society. According to the China Automotive Strategy and Policy Research Center’s estimation, the proportion of the entire automobile industry chain’s added value to GDP is around 5% in 2021.

The recent “Strategic Plan for Expanding Domestic Demand (2022-2035)” issued by the CPC Central Committee and the State Council has raised the level of expanding domestic demand and unblocking economic cycle bottlenecks to the national strategic level. The automotive industry is still mentioned as an important area, indicating that the central government hopes that automobiles can continue to play a leading and driving role in durable consumption.

In the face of industry transformation trends, a relatively stable and healthy consumer market is an essential guarantee for industrial transformation and upgrading and achieving high-quality development. Driven by the new round of technological revolution, the automobile has become the most important carrier of cross-industry integration and integrated innovation. At present, the development focus of China’s automotive industry is shifting from speed and scale to quality and structure. Its development model is shifting from following and learning to surpassing and innovating. It is at a crucial point in implementing the carbon peak and carbon neutrality strategy and transitioning from an automobile power to an automobile power nation. This also represents a significant historical opportunity. We should maintain strategic determination and place the stabilisation and promotion of car consumption in a prominent position, using mass car consumption to drive the domestic consumption market, effectively promoting employment and stable economic operations. This will also help to promote cross-industry integration and innovation through the transformation and upgrading of the automotive industry and play a role in the construction of a manufacturing power, quality country, and transport power.## 2. Opportunities and Challenges in the 2023 Automotive Consumer Market

In 2023, the Chinese automotive consumer market will continue to have various favorable factors. On the one hand, the macro level has laid the foundation for the recovery of automotive consumption. The optimization of epidemic prevention and control policies and the stabilization mechanism will help stabilize the market. On December 7, the Joint Defense and Control Mechanism of the State Council issued ten measures to further optimize the implementation of the prevention and control of COVID-19, further optimizing control measures, laying the foundation for the normalization of social economic activities in 2023. The Central Economic Work Conference also prioritizes the recovery and expansion of consumption and clearly supports the consumption of new energy vehicles. At the same time, the “Strategic Plan to Expand Domestic Demand (2022-2035)” issued by the Central Committee and the State Council has also pointed out the direction for the future development of the domestic automotive market. On the other hand, new energy vehicles, medium- to high-end passenger cars, automobile exports, and other subdivisions are expected to become driving forces for the overall market growth.

However, there are still considerable downward pressures on China’s automotive consumer market in 2023. First, geopolitical conflicts continue, and the risks of global economic recession are increasing. Second, China’s macro economy is under continuous pressure, financial revenue is declining, residents’ savings propensity is increasing, and the lack of driving force in domestic demand and infrastructure investment is not conducive to the overall growth of the automotive market. Third, the overdraw of some consumption due to the halving of vehicle purchase tax in 2022 and the expiration of subsidies for new energy vehicles may affect the market growth in 2023. Fourth, the pressure of the unstable global supply chain continues. The China Automotive Strategy and Policy Research Center analysis believes that the possibility of a significant decline in the domestic automotive market in 2023 is very high.

3. Policy Recommendations for Stable Automotive Consumption

Further implement the decision-making arrangements of the Party Central Committee and the State Council, comprehensively promote policies to unleash consumption potential, adhere to problem-oriented and precise policies, stabilize automotive consumption, and support “stable growth, stable employment, and stable prices”.

It is recommended to continue to tap and release the potential of automotive consumption in 2023, strive for positive growth, and support the stable operation of the economy. Firstly, continue to implement the policy of reducing vehicle purchase tax. In the first half of 2023, the policy of halving vehicle purchase tax for passenger cars will continue to be implemented, and then gradually returned to normal in the second half of the year; light commercial vehicles will also be included in the policy benefits. Secondly, increase the purchase index for cities with purchase restrictions in 2023 and comprehensively cancel the purchase restriction in a timely manner. Thirdly, support the scrapping and renewal of old cars and give appropriate financial subsidies. Fourthly, provide subsidies for consumers to buy eligible intelligent new energy vehicles. Fifthly, continue to provide local charging facilities construction and operation subsidies for local governments, and support local governments in providing policy support and preferential treatments for charging and replacement, passage, and parking. Sixthly, comprehensively implement the policy of facilitating the circulation of used cars, regulate the invoicing and related services of the second-hand car trading market, and improve the content and price transparency of invoicing and testing related services.## 2. Strengthening the foundation, making up for shortcomings, and promoting the high-quality development of the new energy vehicle industry

The Central Economic Work Conference pointed out: “Efforts should be made to expand domestic demand, give priority to restoring and expanding consumption, increase the income of urban and rural residents through multiple channels, and support consumption of new energy vehicles”. Since 2022, facing the impact of factors such as the scattered outbreak of the epidemic and weakened consumer demand, China’s new energy vehicle industry has demonstrated strong resilience in development. From January to November 2022, China’s new energy vehicle production and sales reached 6.253 million and 6.067 million, respectively, representing a year-on-year increase of 100%, with a market share of 25%, and an expected annual volume of 6.8 million units. As a “new dynamic” for the development of the automotive industry, further support for the development of the new energy vehicle industry and the optimization of new energy vehicle consumption will play an irreplaceable strategic role in promoting sustained economic growth and seizing new heights in international industrial competition.

Looking to the future, China’s new energy vehicles will enter a stage of rapid, large-scale development, and the inherent driving force for the development of the industry has been basically formed. By 2023, there will be about 100 new energy vehicles in China’s domestic market, with a synchronous growth of about 40%, and new additions are expected to be seen in many sectors of the market. The abundant market supply corresponds to the diversified demands of customers, which will effectively promote the market to maintain a trend of benign development. It is estimated that China’s new energy vehicle sales in 2023 are expected to reach 9 million units.

However, profound changes are taking place in the internal and external environment of industrial development, and the deep-rooted problems that continue to hinder the sustained and rapid growth of China’s new energy vehicle industry still exist.

Firstly, international competition is becoming increasingly fierce. Countries such as Europe, America, and Japan are accelerating the layout of core technologies by increasing subsidies and R&D support, and setting up trade barriers, while supporting the local supply chain, attempting to seize the dominant position in future competition, which may pose serious challenges to China’s participation in global competition in the new energy vehicle industry.

Secondly, cost competitiveness is still not sufficient. In recent years, as the average driving range of electric vehicles continues to increase and the proportion of intelligent technology applications rapidly increases, the purchasing cost of new energy vehicles is still about 20% higher than that of fuel vehicles of the same level, and no alternative advantage has been formed yet. At the same time, affected by subsidy reduction, as well as the shortage and price increase of chip and battery raw materials, the difficulty of cost reduction for automakers has further increased, and the market may experience significant fluctuations next year.

Thirdly, breakthroughs are still needed in key core technologies. China’s intelligent network-connected key technology fields, such as vehicle-level chips, operating systems, new electronic and electrical architectures, and high-performance sensors, have not yet formed advantages. The industrial ecosystem is still incomplete, and there is still a significant gap in some areas compared with foreign leading levels, which presents a bottleneck.

Chip

One issue is the uneven development of charging facilities. The coverage of charging facilities in China’s large cities has reached 90.6%, but the layout in second- and third-tier cities, rural areas, and highways is seriously inadequate, and the structure is uncoordinated. The proportion of fast-charging and battery-swapping facilities is not high, and the application of new technologies is insufficient, which hinders the further expansion of China’s new energy vehicle market.

In the face of these problems and challenges, we suggest implementing the spirit of the Central Economic Work Conference, coordinating and cooperating among departments and fields, further strengthening overall planning and layout, and promoting high-quality development of the industry.

The first suggestion is to continue to support the consumption of new energy vehicles. The policy of exempting vehicle purchase tax for new energy vehicles will be extended until 2023, which is conducive to the consumption of new energy vehicles. At the same time, local governments will continue to carry out consumption promotion activities based on local conditions, which will greatly promote the vitality of new energy vehicle consumption across the country.

The second suggestion is to strengthen supply and resource security. Accelerate the development of domestic resources, improve the recycling system, enhance the supply capacity of key components, and ensure resource security.

The third suggestion is to accelerate electrification in public areas and launch city-wide electrification pilot programs for public vehicles. Focus on improving the electrification level of urban logistics, taxis, sanitation and other vehicles.

The fourth suggestion is to guide the application of advanced technologies and accelerate the research and development and industrialization of key technologies such as new battery systems, vehicle-grade chips, and vehicle operating systems.

The fifth suggestion is to optimize the construction of charging and swapping infrastructure. Increase support for the construction and operation of charging and swapping facilities in the central and western regions, highways, and rural areas, and focus on solving the problems of uneven and insufficient development of charging and swapping facilities in China. Increase support for new technologies and new models, encourage the application of battery swapping, V2G, and intelligent orderly charging technologies based on local conditions, and optimize the new energy vehicle energy supplement experience.

III. Optimizing policy and regulatory environment, accelerating the commercial development of intelligent connected vehicles

The Central Economic Work Conference pointed out: “Industry policies should be developed and security should be sought at the same time. Optimize the implementation of industrial policies, focus on transforming and upgrading traditional industries and cultivating strategic emerging industries, and strive to strengthen weak links in the industrial chain.” At present, the transformation of China’s automobile industry is shifting from the first half of “electrification” to the second half of “intelligence.” Intelligent connected vehicles, as a fusion of the automobile industry with strategic emerging fields such as artificial intelligence, the Internet, and satellite communication, are gradually becoming the core area of transformation in the automobile industry. How to better leverage the foundation of the traditional automobile industry and utilize the strategic emerging field will become an important topic for us to seize the commanding heights of the industry.The global autonomous driving industry is currently in a critical period of transition towards commercialization. Firstly, there is rapid iteration and breakthrough of autonomous driving technology. The electronic and electrical architecture of autonomous driving vehicles is accelerating from distributed to centralized, with exponential growth in demand for software, data, computing power, and other related components. Secondly, the scale of demonstration and commercial applications is continuously expanding. Since 2021, companies such as Waymo and General Motors Cruise have launched autonomous driving taxi services for commercial operation in San Francisco, Los Angeles, and Phoenix, among other cities in the United States. In August 2022, various Chinese cities such as Guangzhou, Chongqing, and Wuhan successively released policies supporting autonomous driving commercial demonstration pilots, with companies such as WeRide, Pony.ai, and Baidu obtaining qualifications for commercial demonstration operation. Among these, Baidu’s autonomous driving ride-hailing service platform “Apollo Go” has exceeded one million orders and has become the world’s largest autonomous driving ride-hailing service enterprise. Thirdly, the scale production of vehicles with driving assistance function is increasing. In most global major automakers or startup companies, such as Tesla, Toyota, General Motors, SAIC, Geely, and others, many mass-produced models are already equipped with L2-level autonomous driving functions, which enable users to carry out automatic parking, automatic navigation, and other related operations. In addition, Audi, Honda, Mercedes-Benz, and other automobile companies have launched L3 and higher-level autonomous driving vehicle products on the basis of driving assistance, accelerating the commercialization process of L3 autonomous driving vehicles.

According to feedback from testing demonstrations and commercial explorations in various regions, there are some issues in current policy regulations in China in terms of product access, on-road driving, high-precision maps, network security, and other related aspects which constrain the commercial development of the industry. For example, technological maturity is not fully achieved, and existing product standards and some traffic management laws and regulations are not applicable to intelligent connected vehicles; the mapping management system presents potential constraints on the development of autonomous driving technology; and the data security policy system is incomplete. While taking into account both industrial innovation and national security, the government is proactively promoting pilot programs and exploring ways to optimize the policy regulatory environment, seizing opportunities for commercial development.

Regarding product access and on-road driving, in July 2021, the Ministry of Industry and Information Technology issued the “Opinions on Strengthening the Management of Intelligent Connected Vehicle Production Enterprises and Product Access.” In November 2022, the Ministry of Industry and Information Technology, in conjunction with the Ministry of Public Security, issued a “Notice on Launching the Pilot Work of Autonomous Driving Vehicle Access and On-Road Driving” (draft for solicitation of opinions). It is expected that national pilots will commence in 2023, proposing pilot schemes at the national level for product access and on-road driving, exploring commercialization pathways and regulatory measures in “city + production + operation” joint entities, focusing on practical exploration to form breakthroughs in policy optimization and access solutions that support the commercialization of intelligent connected vehicles.In terms of geographic information, the country has successively issued or initiated multiple policy standards, such as “Promoting the Development and Maintenance of Surveying and Mapping Geographic Information Security for Intelligent Connected Vehicles” and “Technical Requirements for the Protection of Basic Map Data Security for Intelligent Vehicles”, clarifying the surveying and mapping behavior and restrictions of intelligent connected vehicles, and supporting the development of new technologies and business models for autonomous driving vehicles. With the development and improvement of relevant policy standards, behaviors such as geographic information surveying and crowdsourcing will be gradually clarified and regulated, which is conducive to the development of intelligent connected vehicles.

In terms of network and data security, the country attaches great importance to the security of automobile networks and data, and is actively promoting the pilot implementation of the “Management Regulations for Automobile Data Security (Trial)”, data classification and grading, cross-border transmission and other areas of data security protection exploration, regulating from the establishment of management systems to the formulation of industry technical standards, and ensuring the healthy and orderly development of the industry.

In terms of local trials, Shenzhen, Shanghai, Beijing and other places are also actively carrying out local trials. By issuing the “Regulations on the Management of Local Autonomous Driving Vehicles” and establishing “Policy Leading Zones”, they are exploring the construction of local autonomous driving vehicle policy and regulatory system, breaking through existing policy and regulatory restrictions, accelerating the local commercialization process, and seizing development opportunities. Among them, Shenzhen relies on the legislative authorization of the National People’s Congress for the special zone to issue the “Regulations on the Management of Autonomous Driving Vehicles in Shenzhen Special Economic Zone”, promoting the construction of autonomous driving vehicle policy and technical support system covering product access, traffic management, insurance claims, network and data security, high-precision maps and other aspects, and taking the lead in carrying out local commercialization trials.

In summary, intelligent connected vehicles are still in the stage of commercial incubation, and further optimization of the policy and regulatory system is needed in terms of product access, on-road driving, high-precision maps, network security and other aspects to cope with all new changes and challenges caused by commercialization.

Fourth, taking the implementation of “dual carbon” as an opportunity to accelerate the forging of low-carbon competitive advantages in the industry.

The Central Economic Work Conference pointed out: “Optimize the implementation of industrial policies, focus on transforming and upgrading traditional industries and nurturing and strengthening strategic emerging industries, and work hard to strengthen weak links in the industrial chain, forge new industrial competitive advantages in the process of implementing the dual carbon peak and carbon neutrality targets.” The automobile industry is a pillar industry of the national economy, with a long industrial chain and wide coverage, deeply affecting the economy and having a strong driving effect. Accelerating the green and low-carbon transformation of the automobile industry is not only an important support for implementing the country’s “dual carbon” strategy, but also an inherent requirement for the high-quality development of the industry.However, overall, China’s green, low-carbon transformation in the automobile industry still faces dual constraints from both domestic and international aspects. Domestically, China’s policy and standard system for promoting the green and low-carbon development of the automobile industry is not yet perfect, and the foundation supporting the industry’s green and low-carbon development is relatively weak. The carbon emissions of China’s automobile industry account for about 9% of the country’s total carbon emissions, and the industry’s low-carbon development is crucial to China’s smooth achievement of the “dual-carbon” goal.

As of now, China has not yet issued any guiding, landmark document to promote low-carbon development in the automobile industry, nor has it established a support policy system or standard system linked to carbon emissions. In addition, there are still certain gaps between Chinese enterprises and international advanced levels in aspects such as low-carbon technology innovation, green development awareness, clean energy and green material use. Internationally, some countries are constructing new competitive barriers and trade barriers centered on carbon, and China urgently needs to strengthen coordination and mutual recognition with international standards and regulations.

The European Council and the European Parliament have reached a common view on the “EU Battery and Waste Battery Regulations,” and will conduct full-lifecycle monitoring of new energy vehicle batteries entering the EU market. The EU has also clearly stated that it will levy a carbon border adjustment tax in 2026, and there is a possibility of including automobile-related products in the collection scope in the future. Countries such as the United States, Canada, and Japan are also studying and formulating carbon-related tariff schemes. Currently, China’s automobile industry is still in the initial stage of carbon emissions accounting system construction, and it urgently needs to strengthen the relevant work of constructing a carbon emissions accounting system for the automobile industry in order to be better prepared to adapt, respond, and counteract.

Under the current situation, it is necessary for China to take the implementation of the “dual-carbon” goal as an opportunity to accelerate the forging of low-carbon industrial competitive advantages, and to propose the following four suggestions:

Firstly, issue a roadmap for the green and low-carbon development of the automobile industry. Strengthen the top-level design, further clarify the timetable, key tasks, implementation paths, and guarantee measures for the automobile industry to achieve the “dual-carbon” goal.

Secondly, establish and improve the carbon emissions standard system for automobiles. Accelerate research progress in vehicle fuel consumption limit standards, energy consumption labeling standards, and road vehicle greenhouse gas standards, revise and improve the traditional vehicle energy-saving standard system, strengthen the construction of localized carbon emission factor databases, and promote the coordinated mutual recognition of international standards and methods.

Thirdly, improve the promotion and application environment for low-carbon vehicles. Revise and improve the “Parallel Management Measures for Passenger Vehicle Corporate Average Fuel Consumption and New Energy Vehicle Credit”, study and formulate preferential policies for new energy vehicles purchase tax after 2023, continue to implement energy-saving and new energy vehicle taxes and fees preferential policies, study and implement preferential policies such as charging and replacement electricity pricing, passing and parking fee reduction, etc.

4. Establish a sound system for the recycling and reuse of automobile products. Improve policies for automobile production and recycling, accelerate the construction of a recycling system, promote the high-quality development of automobile component remanufacturing, and especially improve the recycling system for waste power batteries, optimize the recycling service network, and strengthen the standardized construction of recycling service outlets.

5. Break through the constraints and bottlenecks, and stimulate the potential of the automobile aftermarket

General Secretary Xi Jinping once pointed out that structural policies should focus on smoothing out the national economic cycle, deepening supply-side structural reform, focusing on smoothing out the domestic economic cycle, breaking through supply constraints and bottlenecks, and linking the production, distribution, circulation, and consumption links. As an important strategic and pillar industry of the national economy, the automotive industry has a long industrial chain and a high proportion of social and retail sales, making it an important area for expanding consumption and boosting domestic demand.

With China’s automobile ownership ranking first in the world, the potential for consumption in the automotive usage stage is further evident. In March 2021, the National People’s Congress issued the “14th Five-Year Plan for National Economic and Social Development and the Long-Range Objectives Through the Year 2035,” which proposed “promoting the transformation of consumption goods from purchase management to usage management,” and identified automotive usage management as an important direction for promoting automotive consumption. Currently, the development of various fields of the automotive usage stage in China is still not mature enough, and the proportion of the automotive aftermarket output value to the automotive industry still lags behind that of developed countries, and the management systems for various aspects such as used cars, after-sales services, finance, insurance, modification, and travel are still not perfect.

Optimizing related management measures, standardizing the automotive usage environment, can help create more application scenarios, promote growth in automotive and related usage stage consumption, and achieve the goal of promoting automotive consumption and improving usage efficiency.

Affected by domestic and international economic situations, the automotive aftermarket-related industries in China face risks and challenges in 2023, further stimulating the vitality of automotive usage stage consumption and enhancing the driving force of automotive consumption is crucial for fully unleashing the potential of automotive consumption. As an important link in the entire life cycle of an automobile, the circulation of used cars plays an increasingly important role in revitalizing automobile stocks, driving new car sales, and promoting automotive consumption. Meanwhile, parallel imports of automobiles, automotive culture, and automotive finance play an increasingly prominent role in meeting the personalized and diversified consumption needs of consumers. In 2023, it is proposed to further increase the scale and level of industry development and accelerate the development of related industries, based on the current policy direction.First, on the basis of further implementing the unreasonable restrictions on the sale and trade of used cars, we will further promote the standardized and large-scale development of the used car market. In September 2022, the Ministry of Commerce and the Ministry of Public Security jointly issued the “Notice on Improving the Filing of Used Car Market Subjects and Vehicle Transaction Registration Management”, which clearly stipulated that “from January 1, 2023, if a natural person sells three or more used cars with a holding period of less than one year in one natural year, automobile sales companies, used car trading markets, auction companies, etc. shall not issue uniform invoices for the sale of used cars and shall not handle transaction registration procedures for them.” This move provides a basis for the large-scale development of the used car market. Accelerating the standardized development of the used car market also plays a key role in reducing the difficulty for consumers to choose and purchase cars and releasing the vitality of the used car market.

Second, we will further improve the management of parallel import automobile industry. Since the implementation of the “National VI” emission standard, the source of parallel imported cars has been greatly affected due to the differences in domestic and foreign standards and the difficulty in obtaining core data. In the future, with the continuous improvement of related policies, the development of the parallel import automobile industry will also be further stabilized.

Third, automobile cultural consumption continues to strengthen. Automobile culture covers many fields, including automobile tourism and campsites, automobile races, traditional classic cars, and automobile modification. It is not only a reflection of the soft power of the development of the automobile industry, but also an important part of the strong automobile country. With the continuous improvement of the management policies of the traditional classic car and automobile modification industries, and the reduction of the impact of the COVID-19 pandemic, automobile cultural activities will also be strengthened.

Sixth, the construction of a standardized system for the reuse of automobiles and typical components.

The Central Economic Work Conference put forward: “Focus on expanding domestic demand”. On December 14, the CPC Central Committee and the State Council issued the “Outline of the Strategic Plan for Expanding Domestic Demand (2022-2035)” (hereinafter referred to as the “Outline”), proposing to “vigorously promote green and low-carbon consumption. Accelerate the construction of a waste recycling system, and standardize the development of automobile, power battery, home appliance, and electronic product recycling industries. ” Actively promote the transformation and upgrading of traditional industries and standardize the development of the remanufacturing industry.”

With the rapid growth of China’s new energy vehicle ownership, how to solve the problem of scrapping and recycling of new energy vehicles has gradually become one of the hot issues of concern to all walks of life. For traditional fuel vehicles, China has basically established a sound and adaptable policy system for recycling scrapped vehicles. Due to the differences in power systems between new energy vehicles and traditional fuel vehicles, and many unique parts, the current management system still needs to be further improved and perfected. Currently, all relevant departments are actively improving the system for scrapping and recycling of new energy vehicles. From the “Outline”, it can be seen that “standard development” is the main theme in the future.## Recycling Management for Scrapped Motor Vehicles

Since the promulgation of the “Scrapped Motor Vehicle Recycling Management Measures” (hereinafter referred to as “Order No. 715”), the scrapped motor vehicle recycling industry has entered a new stage of self-reform and transformation. Some new issues have emerged after the implementation of the new policies. Currently, the industry is in the stage of transformation and upgrading. It is expected that the industry’s regulatory authorities will study and formulate relevant policies to accelerate the industry’s quality improvement and upgrading in response to the new problems that have emerged in the new stage. More detailed industry technical standards will be issued for scrapped new energy vehicles.

Recycling and Utilization of Power Batteries

Currently, China has initially established a policy system framework for the recycling and utilization of new energy vehicle power batteries with the producer responsibility extension system as the basic principle, and has established a standard system for recycling and utilizing power batteries, which is gradually improving.

As of the end of August 2022, more than 10,000 recycling service outlets have been built in China, and 45 backbone enterprises for cascaded and recycled utilization have been cultivated, exploring a batch of new business models such as “leasing cascaded batteries instead of selling them” and “scrap for raw materials”. However, there are also problems of an irregular market for recycling of scrapped power batteries, where the illegitimate market outperforms the legitimate one, and there are issues such as unclear economic viability and safety hazards for cascade utilization.

The main reason for the above problems is that the relevant policies for the recycling and utilization of power batteries in China lack sufficient mandatory constraints. It is expected that special policies and regulations with mandatory constraints for power batteries will be issued as soon as possible in 2023.

Re-manufacturing of Automotive Parts

Since the State Development and Reform Commission launched the pilot work of the first batch of 14 automotive parts re-manufacturing enterprises in March 2008, the automotive parts re-manufacturing industry has become the mainstay of China’s re-manufacturing industry. Preliminary statistics show that in 2021, the output value of China’s automotive parts re-manufacturing industry reached 20 billion CNY, accounting for about one-third of the national re-manufacturing industry’s output value. At present, China’s automotive parts remanufactured products are gradually expanding to new energy vehicle-specific parts, including drive motors, motor controllers, air conditioning compressors, on-board chargers, etc.

Currently, new energy vehicles account for more than 30% of ride-hailing and taxi companies, and its components are prone to failure. Meanwhile, new energy vehicle models and major components are iterated rapidly. Remanufactured products can better guarantee users’ vehicle maintenance needs. It is suggested to carry out a pilot program for re-manufacturing new energy vehicle parts on the basis of further promoting the application of traditional automotive parts remanufactured products and encouraging exploration and research on power battery remanufacturing.## 7. Recognizing the New Situation, Seizing New Opportunities, and Promoting Internationalized High-Quality Development of the Automotive Industry

The Central Economic Working Conference proposed: “Enhancing the domestic circulation dynamic and reliability, improving the quality and level of international circulation,” and “actively promoting the accession to high-standard economic and trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Digital Economic Partnership Agreement.”

The meeting emphasized that there are many difficulties and challenges facing economic development next year. It is necessary to better coordinate domestic and international circulation, focus on building a new development pattern, enhance the domestic circulation dynamic and reliability, and improve the quality and level of international circulation.

It is necessary to promote the high-quality development of the Belt and Road Initiative and actively promote the accession to high-standard economic and trade agreements such as the CPTPP and the Digital Economic Partnership Agreement, proactively comparing relevant rules, regulations, management, and standards, and deepen reforms in related domestic areas.

In 2022, facing the continuous spread of the global epidemic and risks such as the unsmooth operation of the supply chain, China’s automobile industry has shown strong resilience and vitality. Automobile exports have continued to grow rapidly, and the annual export volume is expected to exceed 3 million units, contributing significantly to stabilizing the scale of foreign trade growth and the stable operation of the supply chain.

At present, the international market environment is more complicated and severe, with ongoing geopolitical conflicts and the continuing impact of the epidemic. The global economic and trade recovery is weak, international economic and trade rules are undergoing rapid reconstruction, and the industrial chain and supply chain are undergoing deep adjustments. The complexity, severity and uncertainty faced by Chinese automobile companies in “going global” are increasing.

Firstly, global demand for the automotive market is still sluggish. Affected by factors such as the epidemic, the growth momentum of global economic and trade continues to weaken, and the demand for the automotive market in major countries such as Europe and the United States is sluggish. According to the IMF and WTO’s forecast in October this year, the global economic and trade growth rate will slow to 2.7% and 1.0% next year. According to the prediction of the FOURIN Institute, the global automotive market will not recover to the level of 90 million units until around 2025.

Secondly, geopolitical conflicts and trade protection are intensifying. The complexity and duration of the Ukraine-Russia conflict is increasing, European energy prices have fluctuated greatly, and global inflation remains high. The United States has successively launched the “Indo-Pacific Economic Framework (IPEF),” “Chip 4 Alliance,” “Chip and Science Act,” and “Inflation Reduction Act,” and tightened export controls on China, attempting to restrict the transformation and upgrading of China’s automobile industry and its upward development in economic, trade and technological fields.

Thirdly, new green trade barriers are forming. The European Union is introducing regulations such as “carbon footprint” and “carbon border adjustment mechanism.” A new type of trade barrier centered on “carbon” is forming, and there is a risk of carbon tariffs being levied on automobile exports. At the same time, major mining countries such as Indonesia and Chile have strengthened export controls and restrictions on cobalt, nickel, lithium and other key raw materials, and the prices of these materials remain high, leading to increased production and export costs for new energy vehicles.4. International service system needs to be improved. Compared with multinational car companies in developed countries such as Europe, the United States, and Japan, most Chinese brand car companies have not developed internationally for a long time, with small overseas investment scale and low localization degree. This has led to the need to strengthen and improve in areas such as overseas sales and after-sales service network layout, overseas financing and consumer credit system construction, international logistics transportation, and foreign exchange risk management.

Internationalization is the only way to accelerate the construction of a trading and automobile power. In the face of new situations and new challenges, China is focusing on constructing a new development pattern that takes the domestic and international dual circulation as the main body, and mutual promotion of domestic and international circulation. The automobile industry must firmly implement the spirit of the 19th National Congress of the Communist Party of China and the deployment of the Central Economic Work Conference, accelerate the promotion of high-level opening up, seize the major opportunities of jointly building the “Belt and Road” and free trade zone construction, accelerate the promotion of international development, and cultivate China’s brands with strong international competitiveness.

-

Under the background of low demand in the domestic market, excess production capacity, and fierce competition, backbone vehicle companies should pay more attention to export and international development strategies, increase key market layout and product planning, and China’s automobile exports are expected to further increase during the 14th Five-Year Plan period.

-

With the steady improvement of international competitiveness, China’s new energy vehicles are accelerating their entry into the markets of developed countries such as Europe. Enterprises need to actively respond to the carbon emission management requirements of key countries such as the European Union, and collaborate with battery suppliers to establish overseas maintenance networks and service systems.

-

The country is accelerating the high-quality development of the “Belt and Road”, maintaining a diversified and stable international economic and trade relationship, strengthening industrial docking and strategic cooperation, bringing new opportunities for Chinese car companies to expand their export scale and investment cooperation level in the field of automobiles.

4. With the implementation of RCEP and the accelerated CPTPP negotiations, tariff costs and technical barriers will be further reduced, enhancing the international competitiveness of export products. Actively participating in the revision of international rules and regulations, promoting mutual recognition of technical regulations and product certification with key countries, and striving for more countries to adopt or refer to China’s new energy vehicle and other characteristic standards.

5. Continuously improve the policy system that supports the internationalization of the automobile industry. It is recommended to optimize cross-border financial policy support, encourage China Development Bank and other Chinese-funded banks to actively provide overseas comprehensive financial product service systems. Expand export transportation channels, leverage methods such as roll-on/roll-off ships and China-Europe freight trains to support shipping companies’ innovative transportation methods. Support professional organizations to build automobile product export and international service platforms, providing enterprises with overseas market and policy consulting, testing, certification, research and development, training, and other services.The authors of this article are Wang Tie, Wu Songquan, Zhu Yifang, Yang Xianglu, Zhou Wei, Yao Zhanhui, Liu Kexin, Ge Peng, Liu Yu, Shi Hong, Zhu Yueyan, Song Rui, Cao Daqian, Li Zhenbiao, and Ma Sheng.

——END——

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.