Author: Zhu Yulong

Today I want to talk about a few big issues, and I am also struggling with where the investment opportunities lie in the current time point of the automotive industry. If we focus on the changes in China’s new energy vehicles and the Chinese automotive industry, it seems difficult to find significant opportunities as growth appears to have slowed due to internal demand. So, what changes will occur globally from 2022 to 2023?

-

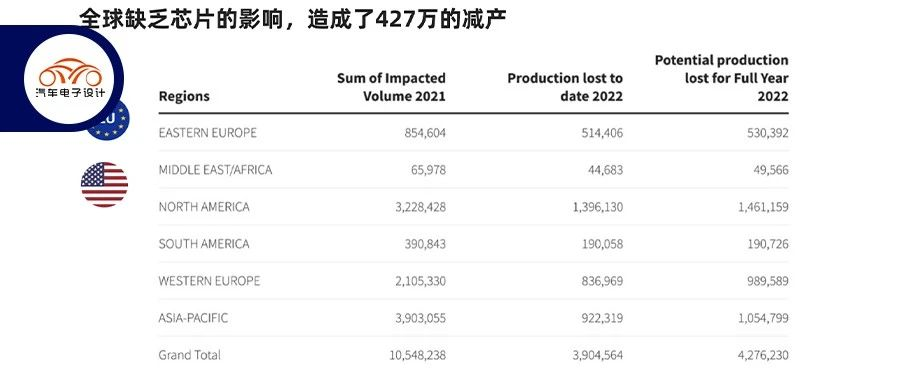

According to AFS data, the shortage of global automotive chips has resulted in a reduction of approximately 4.27 million in production, with 1.46 million in the United States, 1.05 million in other Asian regions, and 0.989 million in Europe. From the perspective of the automotive chip cycle, there will be a significant improvement in Q2 2023. We will analyze the Chinese automotive market in 2023 later, but globally, under the improvement of effective supply, car prices will decrease, and sales will see significant recovery.

-

As for the global penetration rate of new energy vehicles, with the convergence of policies, we find that the sales of major economies with larger sales bases are hovering around 30% (Germany, China, and the UK). In the short term, only Sweden and Norway are able to break through this barrier, mainly due to their small market size with complete supply from the global market. However, it is easy to cross the threshold from a global perspective, from 0% to 5% to 20% penetration rate. This is mainly because global consumers with avant-garde consciousness all believe that electric vehicles are fashionable and “new” products. Consulting and investment institutions, car companies, and governments all share this belief, and it has spread worldwide.

Therefore, from a big-picture perspective, provided that there are no uncertainties domestically, how to achieve a successful global market in 2023 is a major issue. Will it be similar to this year’s automotive industry, exporting products smoothly to peers in a global shortage of chips, or will it seek a long-term layout?

From January to October, North America’s automotive production was approximately 1.47 million fewer than the original plan, and it will reach 1.5366 million for the entire 2022. In Europe, production has been reduced by 1.3812 million in 2022 and will reach 1.5498 million by the end of 2022. In Asia (excluding China), automotive production decreased by 764,600, totaling 848,700 by the end of the year. In South America, automotive production decreased by about 216,200.## Global Automotive Sales Situation

According to LMC data in October 2022, passenger car sales were adjusted for seasonality to an annualized rate of 86 million units, unchanged from the previous month. The actual sales volume in October was 7.12 million units, a year-on-year increase of 10%, while the cumulative sales volume from January to October 2022 was down about 1% from the low base in 2021.

As I understand, LMC’s data is a broad measure, which has some differences from what we see at the retail end. Therefore, according to this data table, China has already reached 21.86 million (broad measure). The sales volume in the United States and Europe has a significant impact due to economic factors, as well as a complex and volatile supply chain environment, which has greatly affected the automotive industry. Currently, vehicle manufacturers can enjoy the “dividend” of a shortage of vehicles in the market, so terminal discounts can be reduced, and profits are still considerable. Therefore, in the overall context, 2022 is the weakest period for Tier 1 and Tier 2 suppliers in Europe and the United States. They face problems such as:

◎ Cost increases due to energy and material prices

◎ Shortage of supply chain chips and materials

◎ Reduced automobile production

◎ Unable to pass on rising pressure

These factors have indeed caused signs of bankruptcy and restructuring in the automotive parts and processing industry, which has led to layoffs and increased efficiency in Europe and the United States or even direct closures.

Penetration Rate of Major Countries Worldwide

I think China’s 30% penetration rate for new energy vehicles is already very impressive. From a global perspective, except for Norway, which has a bug, Sweden has also very little volume. Looking at the global penetration rate, China has already entered the top five in the world with such a large base. It is quite difficult to estimate the room for further improvement of China’s new energy vehicle penetration rate.In the worldwide scope, the improvement in penetration rate is global and it means starting from the easy part. Therefore, there won’t be a big drop in demand for batteries even if we maintain a flat situation. Given this situation, the United States and Southeast Asia have gradually started to try, so it is difficult for us to expect a particularly large decrease in costs (unlike from 2017 to 2019).

So, to my understanding, our opportunity may come after 2023 when the domestic growth is affected by the profitability of the car companies and the subsidy decline, and the situation outside China is relatively strong.

Conclusion: It is indeed a difficult situation at the end of this year, and many analysts are also confused. It is difficult to find opportunities by analyzing from a macro perspective or from a bottom-up approach. However, enterprises that go abroad are still worth considering repeatedly.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.