Author: Zhu Yulong

This year, Shanghai’s license plate data was different from usual due to the impact of the epidemic.

- In August 2022, the overall number of license plates in Shanghai was 70,000, and the number of new energy vehicle license plates was 32,200, with a penetration rate of 45.65%.

- From January to August of this year, the number of license plates in Shanghai was 335,000, and the number of new energy vehicle license plates was 146,500, with a really high penetration rate.

The average penetration rate of new cars in 2020 was 22.25%, and in 2021 it was 38.93%. In 2022, the average penetration rate increased to 46.12%. Currently, with the support of subsidies in Shanghai and Jiading district, the new energy vehicle penetration rate in Shanghai has gained support. The withdrawal of plug-in hybrid electric vehicles from the new energy license plates in Shanghai in 2023 may cause some fluctuations in the market, but the high penetration rate in China’s first-tier cities has become an established fact that is hard to shake.

Market segmentation by vehicle model

Looking at the number of license plates by vehicle model (Figure 3), we can see that new energy vehicles have already surpassed traditional vehicles in the intermediate and popular categories, and have a lead in the SUV field as well. Due to the price of Shanghai license plates, traditional vehicles can still maintain a lead over new energy vehicles in the two categories of imported and luxury cars (there are not many good new energy imported cars either).

Looking at the data from the history of the entire Shanghai license plate auction, as new energy vehicles develop, the number of people participating in the auction has dropped from 250,000 at the end of 2020 to 80,000. The habits of Shanghai auto consumers have indeed changed, and with the gradual satisfaction of the demands of this group of auction participants, market habits will further evolve.

Similarly affected by the epidemic, the demand for private cars in Shanghai will continue to rise. Various restrictions on public transportation will make those who have the intention to buy a car more determined.

Analysis of Shanghai’s Car Market Demand from January to August

In the first eight months of 2022, 122,000 traffic insurance policies were issued. Predicted from the market share of car models, the expiration of free Shanghai license plates for PHEVs will not have a significant impact on Shanghai’s overall new energy vehicle market development:

- BEVs at 84,000, accounting for 68.8%

- PHEVs at 38,000, accounting for 31.14%

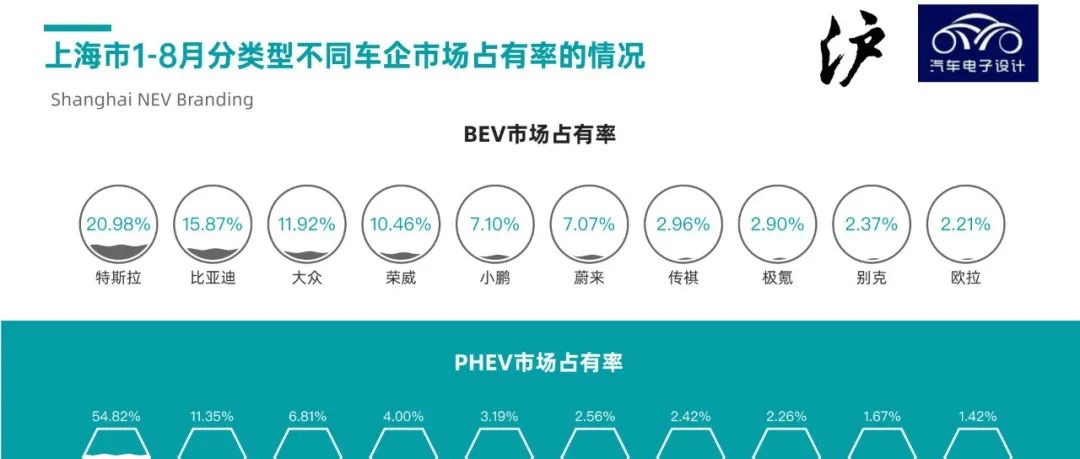

From the perspective of brands in the market:

- Pure electric vehicles: Tesla, BYD, Volkswagen, Roewe, XPeng, and NIO are preferred by Shanghai consumers, with Tesla accounting for one-fifth of the pure electric market.

- Plug-in hybrids: BYD dominates the market, accounting for 54.8%; Roewe performed relatively poorly, with only 10% of the market.

I made a decomposition of the PHEV market (Figure 7), which shows that a range of 100-150 km that satisfies Shanghai commuters’ needs is indeed the most popular among Shanghai consumers, accounting for 54.8%; the second most popular range is 50-80 km.

For the pure electric vehicles preferred by Shanghai consumers, those with a range of 500-600 km account for 54%; followed by those with a range of 400-500 km. As for models with a range of over 600 km, Shanghai people are rational consumers—they feel no need for such a large range as the public charging network gradually improves.

Overall, BYD is the most popular brand among Shanghai residents (oops, last year’s first-ranked Tesla needs to “recharge”).

In addition, the major operating vehicles in Shanghai are Roewe and Buick, although the range of company vehicles is relatively wide.

Summary: A brief overview of the Shanghai market during the holiday season. Due to the impact of the pandemic, tracking of Shanghai data was interrupted for two months. The market will continue to be monitored after the recovery. A comparison with Shenzhen and Beijing can be made in the future— I plan to produce a video about it, if you are interested, you can make an appointment on the Little Broken Station.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.