Author: Zhu Yulong

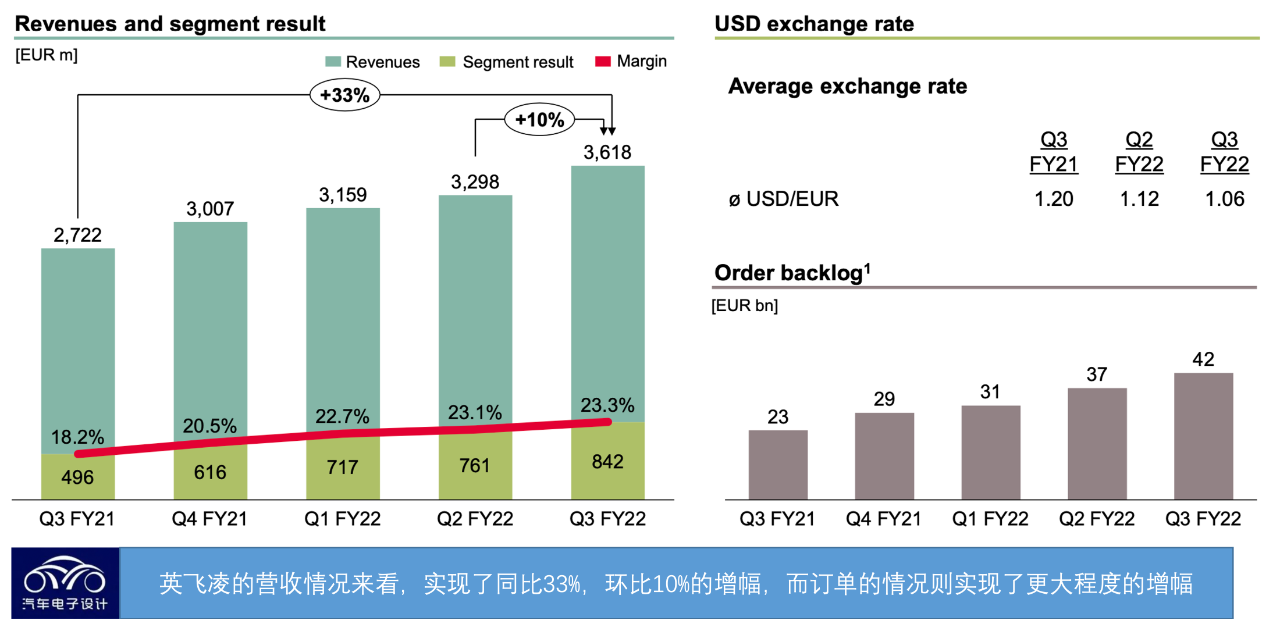

Recently, the semiconductor manufacturer Infineon announced its Q3 fiscal year 2022 financial report, with a revenue of €3.618 billion, a year-on-year growth of 33%, and a profit of €842 million, achieving a profit margin of 23.3%. In terms of business segments, the revenue of Automotive Electronics (ATV) and Power & Sensor Systems (PSS) showed significant growth, while the revenue of Industrial Power Control (IPC) and Connected Secure Systems (CSS) slightly increased.

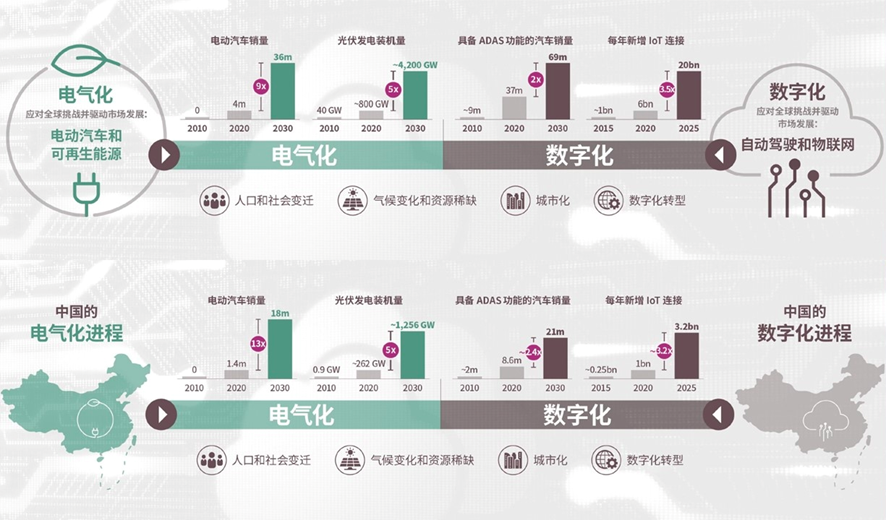

Despite the difficult macroeconomic environment, Infineon relied on a differentiated product portfolio to continue its strong momentum. Currently, structural driving factors such as decarbonization and digitization continue to increase chip demand, and the global trend of electrification in the transportation sector is accelerating. Many regions around the world are seeking to ensure independent energy supply, which will further accelerate the expansion of renewable energy.

Infineon’s green, intelligent, and personalized concept for future mobility also fits this trend.

From the above data, it can be seen that Infineon’s financial report highlights that the company’s business has achieved good development.

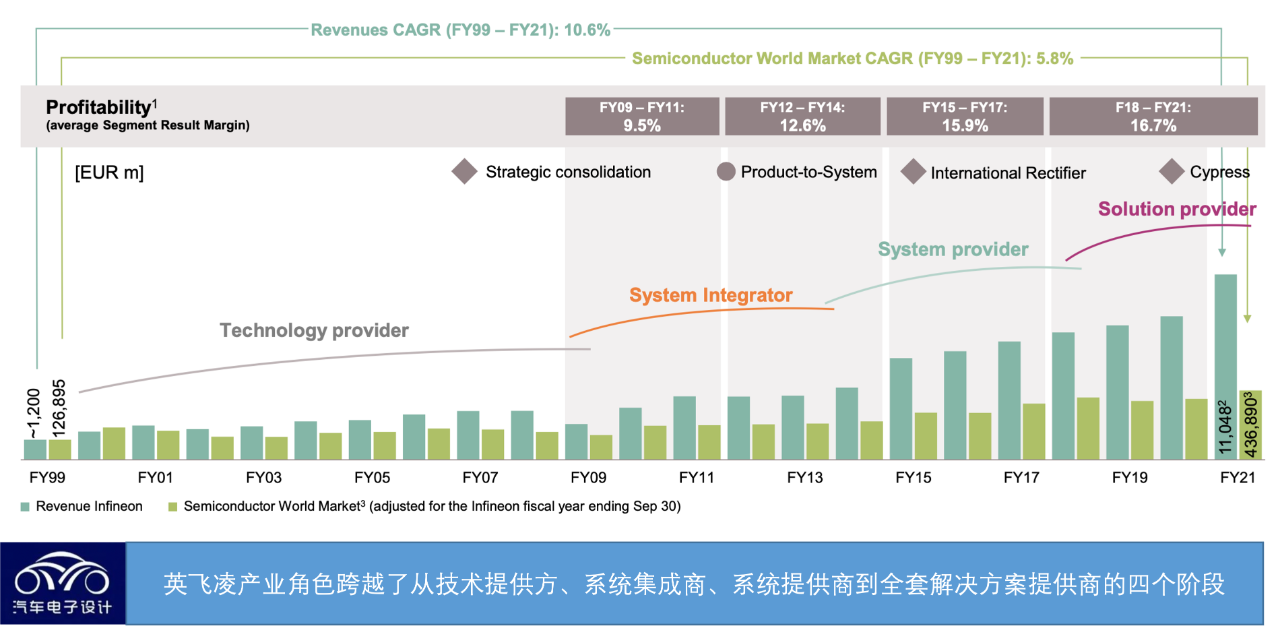

Looking at Infineon’s phased summary, its development has spanned different stages. These four stages are: from a product and technology provider to a system integrator, then becoming a system provider, and finally, a provider of a complete solution. This has brought us many insights, especially for analyzing the development of the automotive field.

As automotive electronics continue to develop, more and more chip companies see opportunities in this field. While accelerating their layout, they are also challenging the leading companies in the original automotive semiconductor industry. How should Infineon do in the fields of electrification and intelligence?

Infineon’s financial interpretation

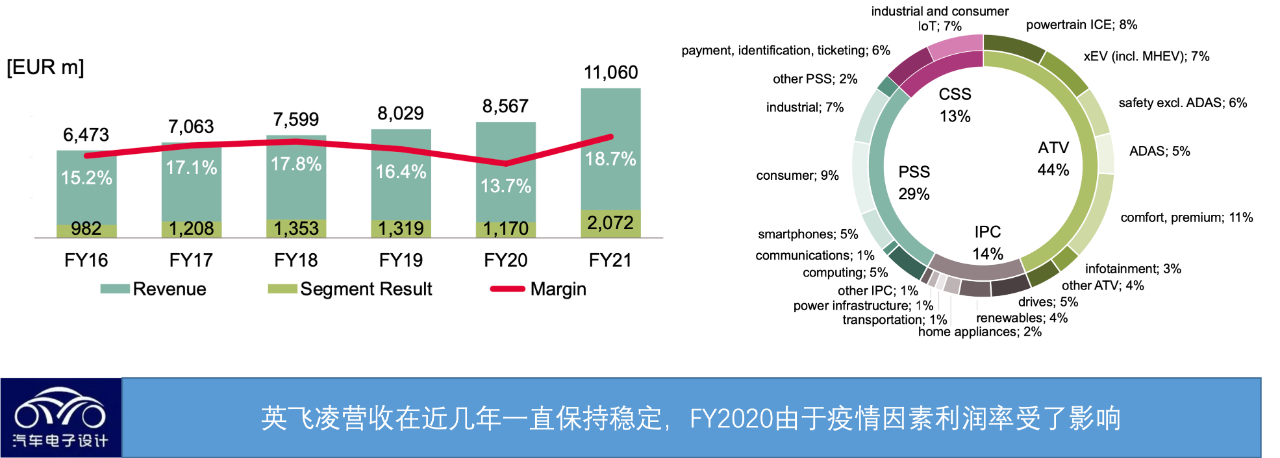

Since the 2016 fiscal year, Infineon’s revenue has been maintaining relatively high growth, and the profitability has also been in a good state, although the profit margin decreased in the 2020 fiscal year, it made a strong comeback in the 2021 fiscal year. Currently, Infineon’s automotive electronics business revenue accounts for approximately 44% of the total revenue. In the breakdown of Q2 FY2022, we can see that:

-

The revenue of the automotive electronics business has increased from 14.91 billion euros in the first three months to 17.01 billion euros, with a significant growth rate of 14% compared to the previous quarter, with automotive microcontrollers (MCUs) being a key source of revenue growth. On the other hand, the increase in manufacturing capacity has led to an increase in production, and in a situation of tight supply, products have regained pricing power, which is also one of the factors driving revenue growth.

-

The revenue of the IPC division increased to 436 million euros in the third quarter of the 2022 fiscal year, compared to 430 million euros in the previous quarter, with a relatively stable growth rate. Specifically, revenue from industrial drives, renewable energy, energy infrastructure, and transportation has slightly increased.

Currently, energy transformation is being deeply carried out globally, and the development of wind and photovoltaic new energy is gradually accelerating. Infineon believes that future transportation will be “green.” In the process of changing the way people travel, successful energy transformation and the expansion of related renewable energy will play a core role in achieving zero-emission green power production. With the increase in the proportion of renewable energy, the importance of maintaining the stability of the power supply system, ensuring the adjusting capability of the power system, and stabilizing efficient power transmission and distribution and energy storage systems will gradually become prominent.

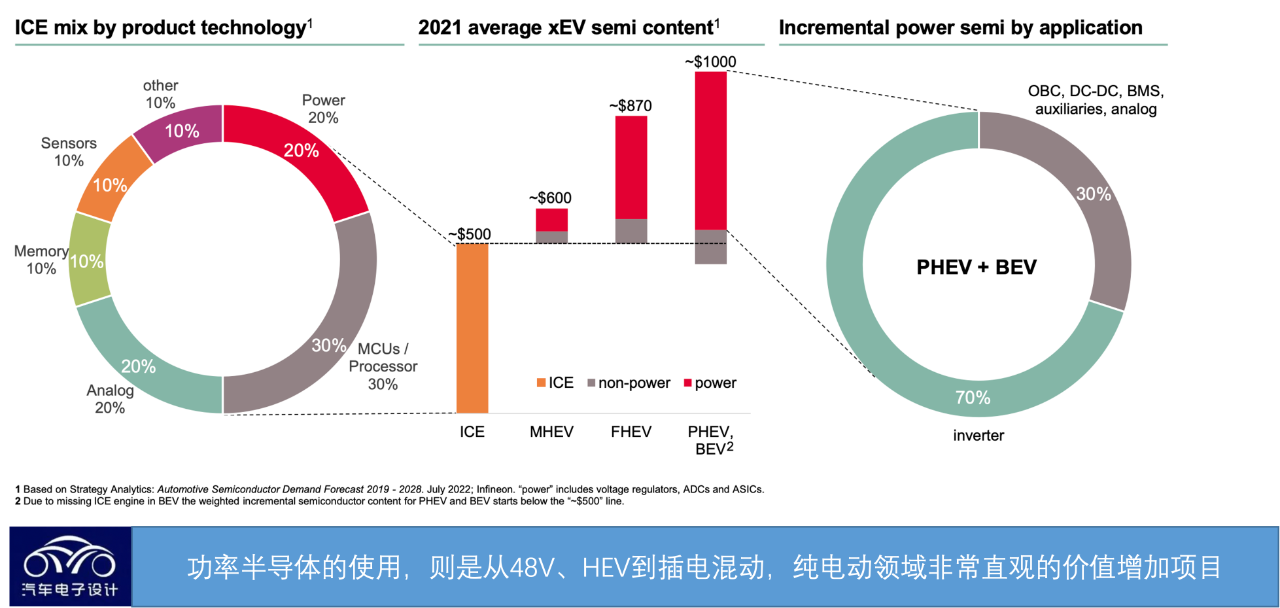

Therefore, the application of power semiconductors is a very important part of the current situation. From traditional frequency converters, industrial power supplies to new energy vehicles, DC charging piles, high-speed rail and other transportation fields, power semiconductors are everywhere. The average semiconductor content of a single new energy vehicle in 2021 is 600-950 US dollars, of which the hybrid and electric vehicle models have the highest powertrain semiconductor content, about 75% is from inverters, and 25% is from OBC, DC-DC, BMS, analog and other auxiliary devices. With the deepening of electrification, the power semiconductor content and economic value of new energy vehicles are constantly increasing.

As electrification deepens, the development of cars will move more towards software. The further development of intelligent, connected, and digitalized cars will require more semiconductor devices and intelligent systems for automotive application scenarios. For a new car, emerging applications include automatic assisted driving, intelligent cockpit, software over-the-air (OTA) upgrades, and more comfortable and luxurious functions of automotive electronics.

According to a report released by market research firm Canalys, global EV sales only reached 6.5 million in 2021, while the sales in the first half of 2022 have exceeded 4 million. It is expected that the global EV sales will increase nine-fold to 36 million by 2030, with the Chinese market accounting for 50% and reaching 18 million. China is leading the world in this aspect.

Infineon’s Product Strategy

In the field of electric vehicles, Infineon is providing automotive semiconductors and system solutions to support a climate-friendly and carbon-free future:

-

Power electronics mainly use Si, SiC, and GaN, among which the voltage range suitable for Si is from 25V low voltage to 1.7kV medium voltage. Its mainstream technology has been developed for decades, and its applications in power to low watts, mobile power, charging piles, photovoltaics, and other fields are very mature, making it one of the most widely used basic materials in the industry.

-

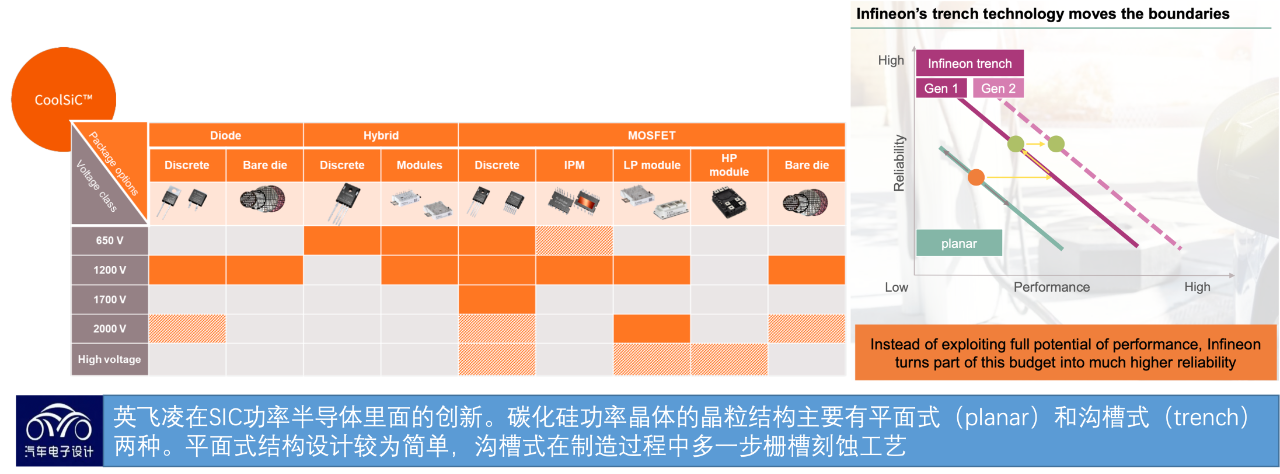

Silicon carbide (SiC) is suitable for high-voltage applications from 650V to 3.3kV, making it suitable for high-power applications with switch power from medium to high. Its applications are wider than Si, including wind power, power supply for large data centers, and more.

-

Gallium nitride (GaN) has a lower voltage range, from 80V to 650V. Due to its fast switching frequency, GaN has a switching frequency of MHz level, which can reduce the size of magnetic components and the final design.

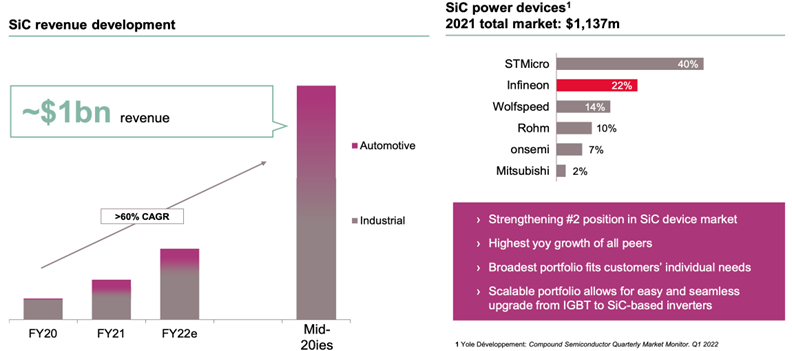

We interpret Infineon’s product layout from two aspects of power and calculation, and start with power electronics. Infineon is the global market leader in the entire power device market and the largest automotive and IGBT supplier (with a market share of over 50%), with stable revenue. BYD is also a customer of Infineon, and if wafer cutting and packaging are considered, Infineon has a market share of over 60% in the Chinese market.

In terms of SiC, Infineon’s business is second only to ST, with customers including XPeng, Hyundai, Japanese and American brands, and others. The company’s goal for its SiC business is to increase the sales of SiC power semiconductors to $1 billion by the mid-2020s. In terms of investment, Infineon’s main focus is on third-generation power semiconductors. The company announced that it will invest more than €2 billion in building a third factory area in the Kulim plant in Malaysia in order to expand the production capacity of SiC and GaN semiconductors. The new factory area will begin construction in June 2022 and will be completed in the summer of 2024. The first batch of wafers will be produced in the second half of 2024.

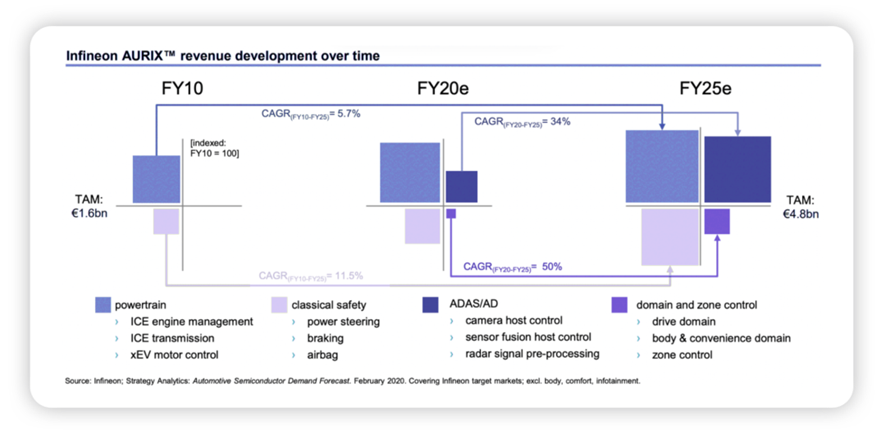

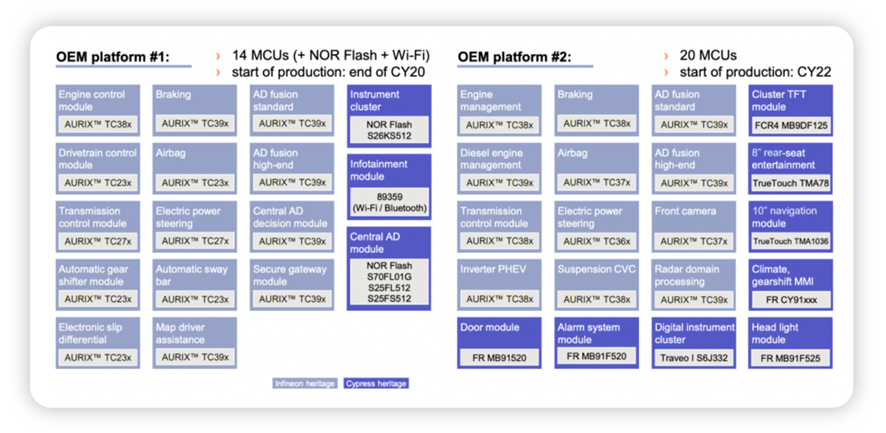

Next, let’s take a look at the situation of automotive MCUs: the market size of the entire automotive MCU was about $7 billion in 2020. The annual growth rate of MCU in the powertrain is about 5.7%, 11.5% in the chassis, 34% in ADAS, and 50% in the domain controller. Under the condition of centralized computing power, this prediction may be correct for Infineon. However, from the perspective of the entire MCU market, it is being replaced by SOC high-computing chips, and its functions are realized through the virtualization of ECUs.

Looking at the distribution spectrum of Infineon MCU, the TC39x series is mainly used for security backup, and this function is adopted by most automobile companies. Infineon’s advantage is that it has more footholds in powertrain and chassis security. The new AURIX™ TC4x series microcontrollers (MCUs) produced using the 28nm process technology further enhance the product lineup of its AURIX™ MCU family. AURIX™ TC4x series MCUs can be widely used in new generation electric vehicles, advanced driver assistance systems (ADAS), automotive electronics/electrical (E/E) architecture, and other fields.

Infineon’s Ecological Strategy

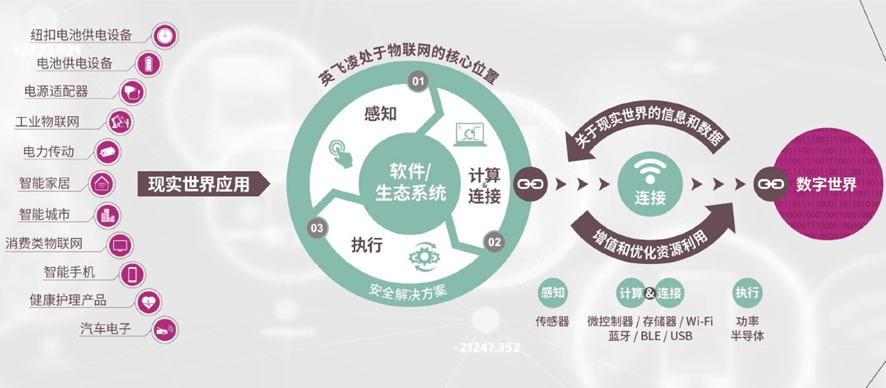

Overall, Infineon has established a “perception, calculation, execution, connection, and security” strategy covering the perspective of automotive semiconductor. This strategy is specifically applied to the future field of travel to build a complete Infineon automotive electronics ecosystem. With the arrival of automotive electrification, intelligence, and networking, as well as changes in the industrial pattern, Infineon’s automotive electronic solution system has become more enriched and perfected. It has received comprehensive attention and attention from industry ecological chain partners such as host factories, first-tier suppliers, and software developers, attracting many partners to participate actively in it.

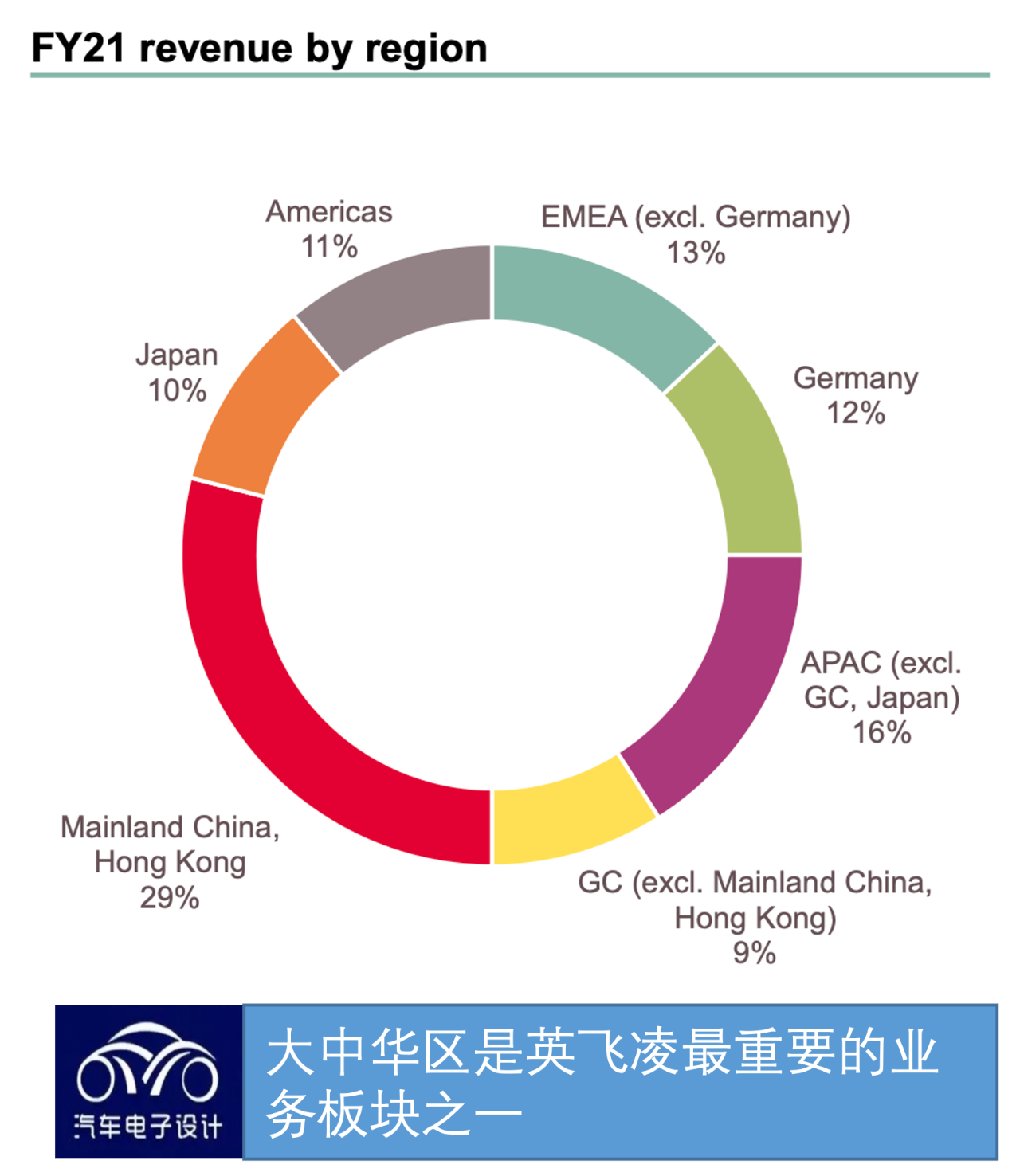

From the business structure point of view, the global electronics market has a huge market prospect, and the market size and growth rate in Greater China are far ahead, which is a key for any semiconductor company to layout its business. Here are two sets of data. In 2020, in Greater China where Infineon conducts operations, the scale of relevant markets has reached 128.7 billion euros, which is 16.3 billion euros more than the sum of other regions. Furthermore, it is predicted that from 2020 to 2025, the incremental growth of relevant markets in Greater China will reach 68 billion euros, which is far more than other major developed economies around the world. Secondly, the electronic industry innovation atmosphere in Greater China is strong, and many forward-looking plans and designs have been implemented, which are now in a leading position in multiple markets. Finally, Infineon has built a complete local industrial value chain and ecological system, transforming from a traditional “solution-based ecosystem” to today’s “value chain-based ecosystem.”

Infineon’s technology and semiconductor solutions are important components of future travel. For example, they can ensure that the battery’s electrical energy is effectively converted into kinetic energy and increase the driving range through effective energy conversion. In addition, Infineon’s solutions can promote technological breakthroughs in charging infrastructure and improve the charging speed of electric vehicles.

In summary, as China begins to build the automotive chip industry, and the two global important development trends of decarbonization and digitization continue to advance, the entire automotive chip ecosystem is changing. Here we will find that chip companies also need to reform, and Infineon has obviously prepared itself for this change.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.