Author | Shiyun Zhu

Editor | Shiyun Zhu

On the previous day, the Aion Y Plus from Aiways, the ARIYA from Nissan, and the R7 from Flyby all went on sale simultaneously. On the following day, the Li Auto’s HKEX IPO’s first-day closing price plummeted by more than 30%. Porsche became the largest IPO in Germany in 25 years at a price of 84 euros.

After nearly a decade of being conquered by “barbarians,” traditional automakers seem to have launched a massive counterattack overnight.

On September 27, Flyby, the second pure electric brand under SAIC, launched its first independent product, the mid-size SUV Flyby R7, with four models priced from RMB 289,900 after subsidy, or RMB 205,900 in the vehicle-electricity separation mode, and an official retail price of RMB 302,500 or more.

Flyby describes the R7 as the “Screen King of the Intelligent Cabin and the Navigation King of the Intelligent Driving.” It is equipped with a 43-inch ultra-wide three-screen display and the Huawei AR-HUD front view display system, a “full-fusion smart driving system” based on 4D imaging radar, and a battery swap system as standard on all models to realize a vehicle-electricity separation business model.

From the R brand to “Fei Fan,” and now the product positioning of “reigning supreme,” traditional automakers, including SAIC, have bid farewell to their humble and cautious communications of the past and directly come out with “ambitious” aspirations to showcase to the world.

The question is, in the Chinese market, which has been “educated” by Tesla and NIO, can calling it “Fei Fan” make it the King of the Road?

“We have made data technology solid through our system with ingenuity,” said Liu Chen, general manager of Flyby’s user development center, in an interview after the launch.

Despite being positioned as the “Navigation King of the Intelligent Driving,” the Flyby R7 has not yet landed the most advanced city navigation function. Its “RISING PILOT Full Fusion Advanced Smart Driving System” still has a maximum function of “highway navigation driving assistance,” which has been deployed by XPeng Motors two years ago.

Liu Chen said, “King of the Road” does not mean “cutting-edge,” it does not have to be extremely advanced, but it should ensure safety and redundancy. This is because one of the major issues that the industry needs to address now is the confidence of users in intelligent driving.

“At this stage, what is more suitable for consumers to use are functions like LCC, TGA, and AEB that can be used frequently and with confidence. In this regard, the Flyby R7 has done a lot of solid accumulation, research, testing, and verification.”The opening conditions of the R7 intelligent driving system will be more relaxed, and it can be activated even in situations like fuzzy lane lines;

In terms of high-speed navigation, R7 has strengthened its capabilities in scenarios such as ramp entry, overtaking, and obstacle avoidance, hoping to become the “ramp king” and have linear cornering capabilities;

In terms of decision-making logic, R7 takes safety as its core orientation. For example, when exiting a ramp, R7 will prioritize safe passage options (such as early merging to the right and waiting for the ramp entrance) over options with higher speeds (such as merging to the left and then to the right).

“I think there are still many problems to be solved in urban navigation at present, and the development of high-speed navigation functions is in the best period of dividends due to the usage demands of Chinese consumers,” said Liu Chen. Next, R7 will also push for urban navigation functions.

CHJ automotive driving solution

Before 2016, Tesla dared to do low-level highway driving with only one Mobileye camera and chip.But even until 2022, highway driving has not become a widely used function like ACC. The huge gap between the ability to implement autonomous driving and the ability to implement autonomous driving reliably is evident.

From a hardware perspective, the CHJ R7 driving system is only on par with the industry-leading level.

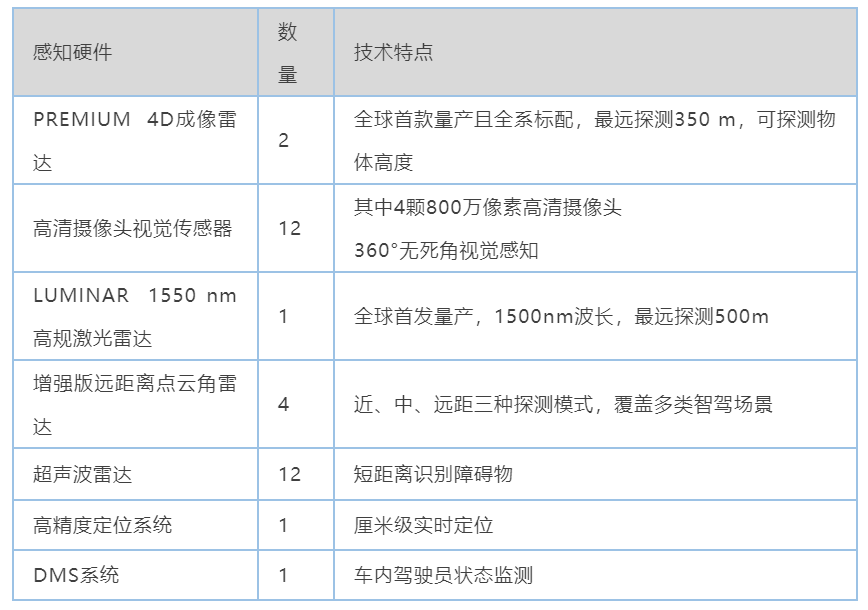

The R7 is equipped with 33 sensors in total, with Continental’s PREMIUM 4D imaging radar, Luminar’s 1550 nm high-definition lidar, and four 8 million-pixel cameras serving as the core perception hardware. The computing platform is equipped with two NVIDIA Orin chips at 254 TOPS.

The real magic lies in the algorithm behind it.

Currently, similar hardware configurations in the industry that use laser radar + cameras mainly rely on camera vision perception, combined with laser radar to form the driving space or perform fusion to mutually verify perception results.

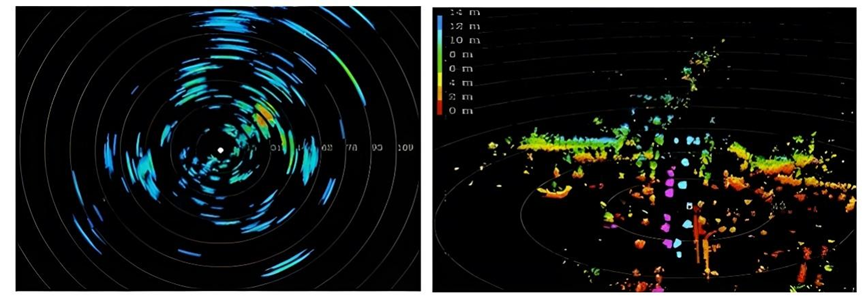

After the R7 was equipped with 4D imaging radar with the same “language system” as the lidar, this “play style” changed.

Jin Jieyu, chief scientist of RisingAuto autonomous driving, said that RisingAuto’s fully-grained algorithmic functional algorithm system is based on the PP-CEM (Pixel Point Cloud) point cloud pixel complex environment model algorithm.

Based on PP-CEM, an omnidirectional multi-task requirement neural network construction was realized. The results of this neural network are mixed with the results of the post-fusion to achieve a more accurate and detailed element reconstruction of the entire environment under various weather and environmental conditions (and ultimately form the driving space).

In other words, the neural network for omnidirectional task processing used previously by everyone was still focused on the field of machine vision perception, while RisingAuto’s AI introduced point cloud parameters, which were perceived together.

The reason why the neural network for automated driving perception represented by Tesla’s “Nine-Headed Snake” is mainly based on visual perception is that the Transformer model has developed rapidly in the field of machine vision. Its advantage is that the upper limit of visual perception is very high, but the disadvantage is that it requires a massive amount of training data.

We do not know what new breakthroughs and gains Feefine’s neural network has made so far.

However, logically speaking, AI models that can incorporate point cloud parameters have indeed shifted LiDAR from its previous “waiting” position to the main field, directly obtaining depth/distance information and allowing the algorithm to acquire landing capabilities with less learning cost.

In addition, the reason why Feefine’s system is called “full integration” is due to the fact that it not only integrates all elements before mixing but also performs post-fusion of the independent perception results of vision, millimeter-wave, and LiDAR, and further mixes them before outputting driving space. This approach imposes high requirements on computing power and signal transmission efficiency.

“As for the boundaries of our capabilities, I believe that among all models using the Orin chip, we are moving very, very fast. RISING PILOT can already deploy a multi-heat neural network for 360-degree imaging. As for the boundaries of our capabilities, I believe that among all models using the Orin chip, we are moving very, very fast,” said Jin Jieyu.

Conventional + Money

If Feefine’s convolutional method is only for scenario function and algorithm improvement, it is still a play for new car-making forces, but Feefine does not stop there.

In addition to the intelligent cabin and intelligent driving, another major selling point of the R7 is the standard battery switching architecture across all models. This makes Feefine another large-scale automobile brand to layout battery swapping, following NIO, BAIC, and Geely.

Feefine will work with Shanghai Jieneng Zhide to promote the transformation of more than 50,000 national gas stations of Sinopec and PetroChina into comprehensive energy service stations with both charging and battery swapping functions. According to the plan, nearly 40 comprehensive service energy stations will be built within 2022, 300 are expected to be built in 2023, and the scale will be nearly 3,000 in 2025.

On September 29, NIO officially stated that it had built a total of 1,145 battery swapping stations nationwide (including 312 battery swapping stations on expressways), connecting the Zhejiang expressway battery swapping network, and will continue to encrypt the battery swapping network in the Beijing-Tianjin-Hebei urban agglomeration in the future.Flyvolt officials have announced that the first 40 battery swapping stations will mainly be located in Shanghai, Beijing, Shenzhen, Guangzhou, Chengdu, Tianjin, Hangzhou, Suzhou, Nanjing, and Zhengzhou, with plans to continuously expand nationwide based on Flyvolt’s store location and car owner hotspots.

The battery swapping model enables consumers to achieve rapid power supplementation, healthy batteries, and also meets the configuration requirements for those who consider car ownership a light asset, thus reducing the threshold for purchasing cars.

However, for the original equipment manufacturers (OEMs), swapping batteries is a high capital and high technology barrier business.

As the actual entity of Flyvolt and SAIC battery swapping, Jebsen Intelligent Charging registered capital is RMB 4 billion, with SAIC (37.5%), China Petroleum & Chemical Corp. (25%), China National Petroleum Corp. (12.5%), and CATL (12.5%) as major shareholders.

“CTP battery technology is the first and foremost supportive function for vehicle-electricity separation, and secondly, an extremely reliable fast-swapping technology is required, which must satisfy these two aspects first, followed by sustainable development,” said Xu Lu, chief operating officer of Flyvolt Intelligent Charging.

Battery swapping is not the only area where Flyvolt leverages SAIC.

In March, Flyvolt announced strategic cooperation with SAIC Innovation Research and Development Institute through a co-creation mode, to carry out in-depth cooperation in design, intelligent driving, intelligent cabin, and the three electric aspects.

This is also where Flyvolt, as a light asset, gains confidence to be the “King of Coils” in heavy investment, technical areas.

“Nowadays, everyone is pursuing higher configurations. I think hardware configurations are one aspect, and whether the software can exert the efficiency and effectiveness of these configurations is another aspect. Therefore, today we also hope to build integrated software and hardware capabilities as our core competency,” said Flyvolt CEO Wu Bing. “We hope to open the market by demonstrating sincerity, value and offering a price strategy.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.