Author: Zhu Yulong

Zero Run Auto will be listed on the Hong Kong Stock Exchange on the same day it launches on the C01, making it the fourth new energy automobile company to list in Hong Kong after XPeng Auto, NIO, and Li Auto.

Zero Run Auto was founded in Hangzhou, Zhejiang Province, in December 2015. It is a rising star in the new force of automobiles. It has a digital intelligent factory in Jinhua, Zhejiang Province, where it produces intelligent electric vehicles and their core systems and electronic components. Compared with traditional automobile factories, Zero Run Auto’s Jinhua intelligent factory has specialized “three-electricity” workshops – battery assembly workshop, electric drive assembly workshop, and electronics assembly workshop – capable of producing self-developed products such as battery PACKs, motor assemblies, controllers, cameras, and headlights.

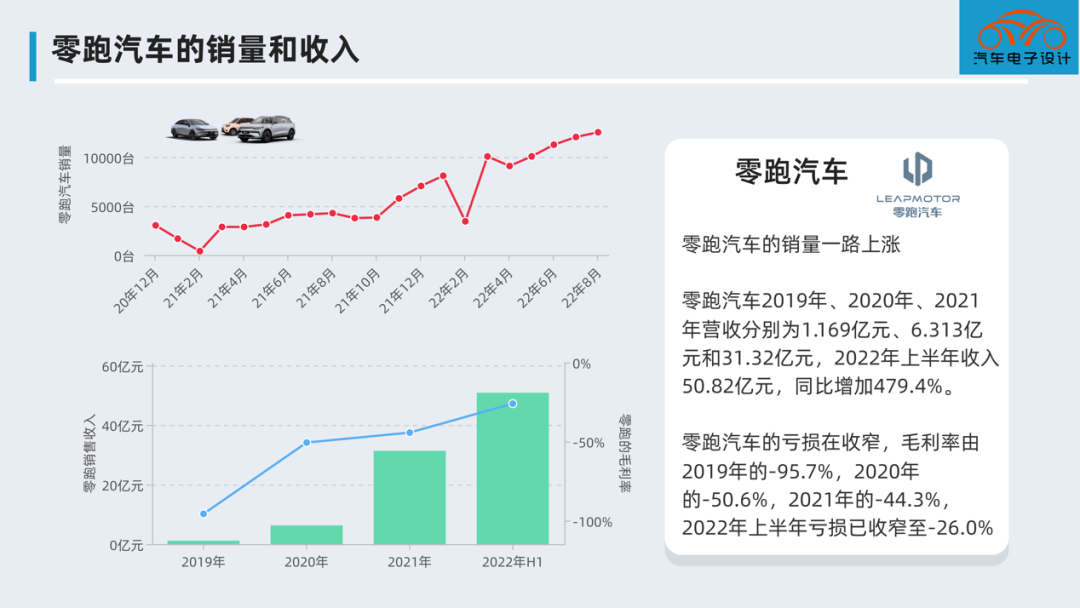

Zero Run Auto delivered a total of 43,748 electric vehicles in 2021, a growth of 443.5% from 2020. The sales are also steadily increasing in 2022. Its revenue in 2019, 2020, and 2021 was CNY 116.9 million, CNY 63.13 billion, and CNY 3.132 billion, respectively. Its revenue in the first half of 2022 was CNY 5.082 billion, an increase of 479.4% year-on-year.

As the entire price system changes from T03 to C11, Zero Run Auto’s loss is narrowing. Its gross profit margin was -95.7%, -50.6%, and -44.3% in 2019, 2020, and 2021, respectively, and had narrowed to -26.0% in the first half of 2022. To establish a foothold, new forces need to expand their scale and continue to control costs, as well as improve operational efficiency. As vehicle prices rise, the company’s gross profit margin will continue to improve. With further improvement in the proportion of C01 models, Zero Run Auto’s gross profit as a whole is expected to return to positive.

Looking at the price positioning, we see that there have been some changes in the product line:

- T03: Starting from A00 level, first run batches of models.

- C11: Starting with SUVs needed by individual consumers, creating high-cost-effective models.

- C01: Creating best-selling models around mid-to-large sedans.# Zero Run C01 Electric Vehicle Officially Launches on September 28th

According to the official announcement of Zero Run, C01 reservation has already exceeded 100,000 vehicles thanks to the “zero deposit” strategy adopted. The conversion rate from pre-orders to actual purchases will depend on the exact price and configuration of the vehicle upon launch. Additionally, taking cues from the successful launch of the C11, which correctly positioned its entire price range, this bodes well for the C01.

Positioned as an intelligent luxury electric car, the C01 features technology imported from CTC, including a 3.66-second 0-100 km/h acceleration performance, a body length of over five meters, and CLTC’s range of 717 kilometers. The vehicle also sports an independently designed through-type large module that supports a variety of lighting modes and OTA upgrades.

Zero Run plans to launch one to three new models annually and aims to release seven new models before the end of 2025, including full-electric and hybrid versions that cover compact, midsize cars, SUVs, and MPVs. In terms of volume, Zero Run produced its 100,000th vehicle in June 2022, marking a significant milestone.

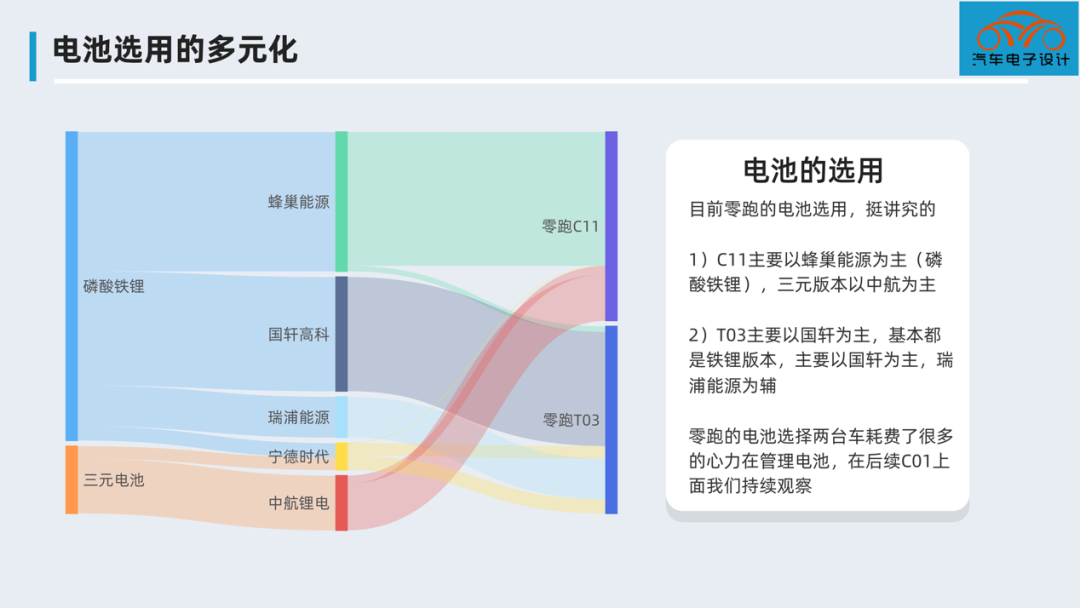

The C01 provides two versions of drive systems: a single motor version with a maximum power of 200kW and a maximum torque of 360 Nm, and a double motor version with a maximum power of 400kW and a maximum torque of 720 Nm. The vehicle offers four different ranges: 500km, 606km, 630km, and 717km. Diversified battery procurement is one of Zero Run’s strengths, which has enabled the implementation of multiple battery types.

Regarding battery selection, Zero Run is very particular. For the C11, the primary battery is honeycomb energy (lithium iron phosphate), while the ternary version primarily uses China Aerospace. For the T03, the primary battery is owned by Guoxuan, and it mainly uses iron phosphate versions. Zero Run has put much effort into managing its batteries and will likely make similar choices of the C11 for the C01, which falls under the same platform.

In terms of innovation, the battery design of LI is fast incorporated with CTC (Cell to Chassis) strategy that integrates modules and removes the cover of the battery pack, achieving a 20% reduction in the number of components, a 15% drop in structural component cost, and a 25% increase in overall vehicle rigidity. The battery and chassis are integrated into a unit, featuring a CTC dual skeleton circular beam structure that combines the battery skeleton structure with the chassis structure, making it both a body and a battery structure, and with a more efficient overall structure. The CTC technology uses the basic structure of the chassis and uses longitudinal and transverse beams in the vehicle body to create a complete sealing structure. The benefits are: improving the overall matching with the vehicle, and facilitating flexible mass production. Achieving high integration and modularity, it can adapt to future models of various levels and types across platforms, and is compatible with intelligent and integrated thermal management systems. It is also compatible with the 800V high-voltage platform and supports 400kW super-fast charging.

In terms of intelligence, the C01 follows the trend of consumer demand and has adopted the popular triple-screen design, with a 12.8-inch central control screen and 10.25-inch instrument and additional screens. The processor chip has been upgraded to a Qualcomm SA 8155P chip, providing a hardware basis for the smooth operation of the in-vehicle system.

In terms of intelligent driving, LI is relatively pragmatic, and has made some cutting steps during the process of making family cars and SUVs priced between 100,000 and 200,000 RMB.

LI’s Next Steps

In 2021, LI’s main focus was on raising capital. In January, LI announced the B round financing, which totaled CNY 4.3 billion, including investors such as Hefei Government, Guotou Chuangyi, Zhejiang University Jiuzhi, and Yonghua Capital. In August, LI announced the completion of a new round of financing, with a total financing amount of CNY 4.5 billion, led by CICC Capital and followed by Hangzhou State-owned Assets Investment, CITIC Construction Investment and CITIC Damka. LI raised a total of CNY 8.8 billion in 2021, which means that it has a solid foothold in the Hong Kong Stock Exchange and will have more means to realize further development.

Summary: The path of Leapmotor may be a bit tortuous, but fortunately the first step has been taken and the planning of product matrix is now more targeted. After listing, I believe there will be more resources to narrow the gap with the top three new carmakers. In such a fiercely competitive market in China, every automaker works hard and must keep improving. With the leading role of the C11 and C01 models priced at 200,000 yuan, the overall competitiveness has greatly improved.

Summary: The path of Leapmotor may be a bit tortuous, but fortunately the first step has been taken and the planning of product matrix is now more targeted. After listing, I believe there will be more resources to narrow the gap with the top three new carmakers. In such a fiercely competitive market in China, every automaker works hard and must keep improving. With the leading role of the C11 and C01 models priced at 200,000 yuan, the overall competitiveness has greatly improved.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.