Quarterly Performance of BYD in H1 2022

By | Pain-Free

Edited by | Qiu Kaijun

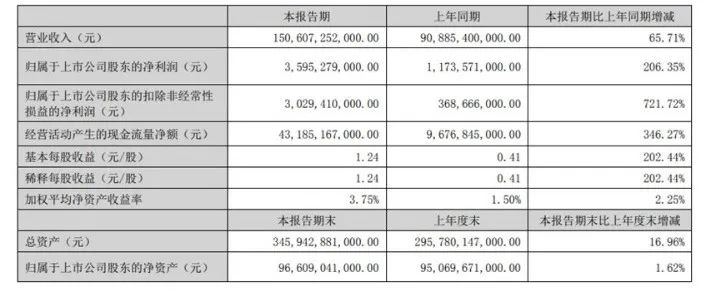

On the evening of August 29th, BYD released its half-yearly results for 2022, bringing in a significant profit growth.

H1 2022 —

Car sales reached 646,399 units, an increase of 162.03% YoY;

Revenue surged to CNY 150.6 billion, an increase of 65.71% YoY;

Net profit attributable to shareholders reached CNY 3.595 billion, an increase of 206.35% YoY;

Adjusted net profit was CNY 3.029 billion, an increase of 721.72% YoY.

Finally, BYD has been able to shed off the label of “revenue growth without profit” for many years. After shedding off this label, we also found that BYD’s half-yearly report can be summarized as “1, 2, 3, 4, 5.”

“1” The barrier of scale: Mount Dashan

Tesla was once stuck in production capacity and losses from 2018 to 2019. However, everything changed in 2020–because Tesla turned profitable this year.

In 2020, Tesla sold nearly 500,000 vehicles and achieved an annual profit for the first time. In 2021, Tesla’s sales volume rose to 930,000 vehicles, and the gross margin reached a historical high of 29%.

Entering into the H1 of 2022, BYD surpassed Tesla, becoming the global sales champion of new energy vehicles in H1, with 630,000 units sold.

Thus, when BYD climbed over the barrier of sales scale, it also ushered in its own turning point of profitability.

When the scale effect of products gradually ferments, many fixed costs in the entire vehicle manufacturing process, such as depreciation of fixed assets and amortization of intangible assets, can be spread out by larger sales volume (directly reducing the cost per vehicle) – this is also the greatest embodiment of the scale effect in the automotive industry.

In H1 2022, BYD’s average sales price per vehicle exceeded CNY 170,000, with a profit of CNY 4,500 per vehicle. Among them, in Q1 of 2022, BYD’s average sales price per vehicle was about CNY 160,000, with a profit of about CNY 2,300 per vehicle. By Q2, the average sales price per vehicle approached CNY 180,000, with a profit of about CNY 7,300 per vehicle.

500,000 units are basically the turning point for most new energy vehicle companies to achieve overall profitability. Whoever crosses this turning point first will enter into a stage of overall profitability.

“2” Dual superpowers: Cash flow and fixed asset investment both surged

-

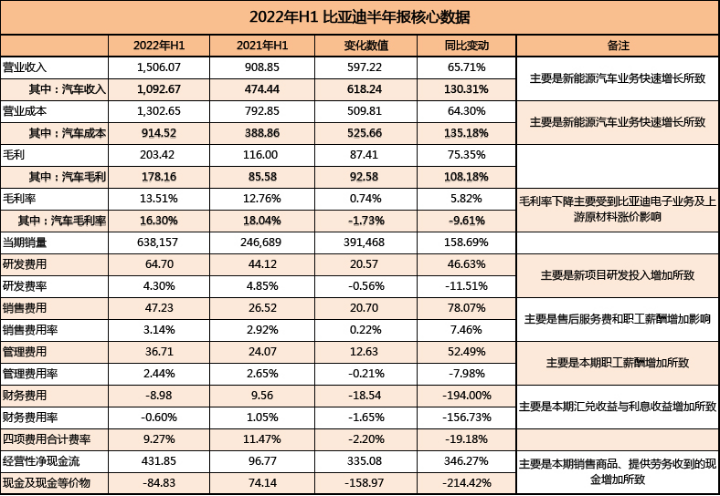

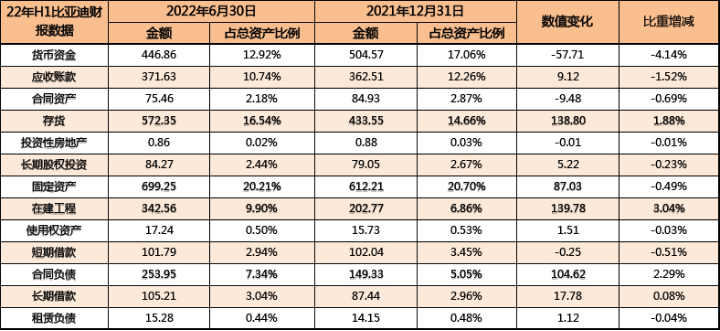

Super strong cash flow generation ability: This is the biggest feature of BYD’s operating data in the past three quarters. In H1 2022, BYD’s operating cash flow was RMB 43.185 billion, an increase of 346.27% compared to the same period last year, far exceeding the sales growth rate. Cash flow generation ability not only means the booming production and sales of the automotive business, but also reflects the ability of strong host factories to occupy payments from upstream and downstream suppliers. Of course, as one of the data that can best reflect operating results, operating cash flow is different from the reserved cash and cash equivalents that new forces promote, which includes financing cash flows (many new forces still have negative operating cash flow for the quarter).

-

Super strong fixed asset investment ability: In H1 2022, BYD’s fixed assets reached RMB 69.925 billion, an increase of RMB 8.703 billion compared to the end of last year. The ongoing construction reached RMB 34.256 billion, an increase of RMB 13.978 billion compared to the end of last year. Whether the increased fixed assets or ongoing construction, all were from the rapid capacity expansion starting in August 2021. Such capacity expansion enabled BYD’s capacity to increase from 600,000 units disclosed in its 2021 annual report to 2.2 million units by the end of 2022, which is also the biggest guarantee for BYD’s sales growth exceeding expectations.

On the one hand, there is super strong cash flow, and on the other hand, there is rapid capacity expansion. This is the best answer that BYD has handed in during the high-speed expansion period in the new energy era.

Three-dimensional growth: Three harvests of sales, revenue and profit

In H1 2022, compared to BYD, it was a harvest time for sales, revenue, and profit, and it set a record high for the same period in previous years.

In terms of sales, BYD’s passenger car sales in the first half were 643,206 units, a year-on-year increase of 159%. Among them, sales of new energy passenger vehicles were 638,157 units, a year-on-year increase of 325%, far exceeding the industry’s 110% growth rate for overall new energy vehicle sales.The sales of plug-in hybrid vehicles reached 314,600 units, increasing by 454.22%, and that of pure electric vehicles reached 323,500 units, increasing by 246.23%, making BYD the fourth place of passenger car brands and the first place of Chinese-branded cars, with a market share of 6.88%. Its market share of new energy vehicles also reached 24.7%, which is 7.5 percentage points higher than the same period in 2021, equivalent to the sum of the second to fourth place.

In terms of revenue, BYD’s overall revenue in the first half of the year was CNY 150.6 billion, an increase of 65.71% year on year. The revenue of its automotive segment was CNY 109.267 billion, which is close to the full-year revenue of 2021 (CNY 125.489 billion), with a YoY increase of 130.31%. It accounted for 72.55% of its revenue, an increase of 20.3 percentage points YoY. With the expansion of new energy vehicle business, BYD has completely shifted its revenue structure from relying on the revenue of BYD Electronic (50%) to being driven by new energy vehicles.

In terms of profit, the company’s overall gross margin and net profit margin increased by 0.75 and 0.62 percentage points respectively, reaching 13.51% and 2.61%. While the gross profit margin of its automotive segment decreased by 1.73 percentage points YoY due to upstream price increases, its net profit grew by 1.94 percentage points to reach 16.30% and 2.71%, with a YoY increase of 108.18% and 709.95% respectively.

BYD’s Q2 revenue was CNY 83.78 billion, increasing by 67.92% YoY and 25.37% QoQ. Its net profit attributable to shareholders of the parent company was CNY 2.787 billion, increasing by 197.67% YoY and 244.74% QoQ, and its non-GAAP net profit was CNY 2.515 billion, increasing by 458.6% YoY and 389% QoQ.

In terms of single-car profit data, the single-car profit of BYD in H1 2021 was only CNY 828, while it increased to CNY 4,577 in H1 2022, a YoY increase of 452.38%. The net profit per car in Q2 was nearly CNY 5,000 higher than that in Q1. This further shows that with the complete cessation of production of fuel vehicles and the optimization of high-value products, BYD’s single-car profit level is being effectively strengthened, and it is expected that the single-car profit in the second half of the year will reach CNY 10,000.

Product System No.4: Fully Laying Out the Passenger Car Market# By 2022, BYD has come up with fresh ideas for branding and distribution networks.

First, they upgraded the original e-Net to a brand new Ocean-Net and separated it from the Dynasty-Net, starting independent development. Second, they announced the acquisition of the shares of DENZA [pronounced as: TENG-sher] and would strive to build a mid- to high-end brand in the 300,000 to 600,000 RMB range. Most importantly, they officially announced that a brand new high-end product priced at 800,000 RMB and above will be launched in the second half of this year.

As a result, BYD has covered the full range of passenger car products from 100,000 to 2 million RMB through its four major product systems.

-

Dynasty-Net is intended for the mainstream market with mainstream products priced at 100,000-350,000 RMB. Among them, Han, Tang, Qin, and Song have become explosive series with monthly sales exceeding 10,000 units.

-

Ocean-Net is oriented towards younger people, with products ranging from 80,000 to 350,000 RMB. The marine life series features pure electric vehicles. Its bestseller, the Dolphin, has become a product with over 20,000 monthly sales, and orders for the Seal, which will soon be delivered, have already exceeded 80,000 units. The navy series features super hybrid vehicles. Its flagship vessel, the destroyer 05, will soon be selling over a thousand units a month. The newly launched escort ship 07 at the Chengdu Auto Show is also believed to have the potential to become a blockbuster product.

-

DENZA products are aimed at the middle class, priced at 350,000 to 600,000 RMB. They have planned three products: the DENZA D9, a luxury new energy MPV; the INCEPTION, a luxury mid-size SUV; and a luxury mid-to-large-size SUV. It is further reported that a C-class sedan will also be launched in the future.

-

The Star X is positioned in the high-end market priced at over 800,000 RMB. R-Series (R&D code) has planned four heavyweight products: R1, R2, R3, and R4, representing tough off-road vehicles, luxury sports cars, luxury SUVs, and super sports cars, respectively.

In 2022, with the introduction of many Ocean-Net products, the launch of DENZA D9, and the release of high-end brands, BYD has begun to comprehensively lay out different segmented markets at various price points.

In 2023, we will see a more comprehensive range of BYD brands and product systems.

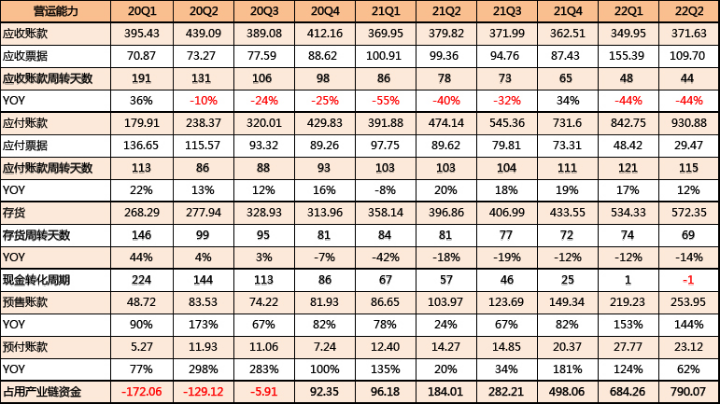

Five Hidden Figures: Comprehensive Improvement of BYD’s Operational Capabilities

If financial statement data mainly reflects BYD’s operating results, there are five hidden data that better illustrate BYD’s operating capabilities. They are: accounts receivable turnover days, accounts payable turnover days, inventory turnover days, cash conversion cycle, and the industrial chain funds occupied.

-

Receivables turnover days: The shorter the time, the better. From Q1 2020 to Q2 2022, receivables turnover days of 44 days are at the best level for BYD in nearly three years.

-

Payables turnover days: The longer the time, the better. It basically reflects the occupation of supply chain funds. 115 days are the best data except for Q1 2022.

-

Inventory turnover days: On the one hand, it shows production efficiency. On the other hand, it also shows that production is equal to sales. 69 days represent the best historical data.

-

Cash conversion cycle: The shorter the time, the better. Even in Q2 2022, this data has become negative, which means that the volume of orders booked is far higher than the volume of orders deliverable.

-

Industrial chain fund occupation: By Q2 2022, BYD had occupied 79 billion yuan of industrial chain funds. Comparing with the data of Q1 and Q2 2020, we can understand that in less than two years, the status of BYD in the industry has undergone earth-shaking changes.

Here is another set of data that can prove the visible progress of BYD: In 2020, BYD’s market share was 2.13%, ranking 14th on the brand list and fifth among independent brands; by 2021, BYD’s market share was 3.44%, ranking fifth on the brand list and second among independent brands. In H1 2022, BYD’s market share was 6.88%, ranking fourth on the brand list, and it has already become the No. 1 independent brand!

The BYD semi-annual report shows the operating results achieved by BYD after crossing the threshold of scale. Many institutions begin to judge that the sales volume of BYD in the second half of the year is expected to be between 1 million and 1.2 million units, corresponding to revenue of about 170-200 billion yuan (if BYD Electronics is also taken into account, it should be around 230-250 billion yuan, and the corresponding annual revenue should be around 380-400 billion yuan). The profit per vehicle is between 8,000 and 10,000 yuan, which means that there is still a profit of 8-12 billion yuan (corresponding to 11.5-15.5 billion yuan for the whole year) to be realized in the second half of the year.

However, is BYD really worry-free? The answer is naturally negative.First, the contradiction between the increasing consumer demand and the slow growth of production capacity. It now takes at least one month and up to 5-6 months to purchase a BYD new energy vehicle. Delivery has become the biggest “risk” for BYD, and many consumers have already missed out on local subsidies due to delayed delivery. If they also miss out on the end-of-year deadline for new energy subsidies due to delivery inspections, the dissatisfaction of consumers who have waited too long will definitely erupt.

Second, the challenges of quality management and service management brought about by large-scale expansion. BYD has already announced two recalls in the first half of the year. They have suffered losses due to quality control issues before, and hope not to repeat the same mistakes this time.

Third, the difficulty and speed of passenger car going overseas. Since August, BYD has started official delivery in the Australian and New Zealand markets and announced their entry into the Japanese and European markets. They are also set to participate in CES exhibition for the first time in 2023.

The threshold and difficulty of overseas markets are generally very high, especially for the automotive industry. I hope BYD can leverage the advantage of commercial vehicles to steadily bring the “world’s best-selling new energy brand” to the world.

In any case, we hope that China’s independent brands can stand at the forefront of the new energy vehicle industry.

–END–

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.