Author | Jean

Editor | Leng Zelin

Ideal Auto CEO Li Xiang and NIO CEO Li Bin have extremely similar experiences. Both are entrepreneurs who transformed from automotive media to new car fields, and the two have stood together but went separate ways due to different beliefs.

The ultimate product, stable sales, and profitability are obviously more favored by investors in the current industry full of uncertainty. After the market closed on June 13th, the market value of Ideal Auto reached $28.033 billion, surpassing NIO’s $27.055 billion. Although NIO completed a reversal on the second trading day, Ideal can already be considered a phase-winning player under the circumstances where the strength of their vehicle models and capital is not equal.

On June 21st, it was the day when Ideal Auto’s second mass-produced car, L9, was released. As a full-size flagship SUV, the price of the L9 was much higher than that of the previous model Ideal ONE, reaching CNY 4.598 million, officially entering the first echelon of the current mainstream new energy vehicle price in China.

Looking at the sales ranking of new energy vehicle models priced above CNY 450,000 over the past year, three out of the top five are products under NIO. Among them, the ES6 with sales of about 46,000 units ranked first, the EC6 with sales of about 28,000 units ranked second, and the ES8 with sales of about 18,000 units ranked fourth.

However, since NIO’s optional fees are relatively high, only the ES8 really has a starting price above CNY 450,000.

Looking at each month in detail, the lower-priced ES6 is still NIO’s mainstay, while the monthly sales of ES8 have basically been below 2,000 in the long term. Although the ES8 ushered in a redesign this month, the competition in the overall new energy vehicle market has accelerated significantly. In the 6/7-seat market (fuel+new energy), ES8 can only occupy a place and is difficult to continue breaking through.

Ideal ONE has won enthusiastic recommendations from Luo Yonghao, Wang Xing, Huang Mingming, Han Han, and others, while the ES8, which has attracted half of the Internet circle, has only been able to “make a name” with users rather than the product itself, although it stands firmly in the middle and high-end price range.

In the early stage of the new car startup, product strength cannot be separated from the founder’s focus.

NIO pioneering

Choosing not to choose BBA at a price between three and four hundred thousand would have made one subject to criticism from relatives and friends almost until the end of 2017. NIO’s efforts are indispensable in gradually loosening this understanding.In December of this year, at NIO’s first NIO Day, which is still talked about today, there was the protagonist of the event – NIO’s first car model, the ES8 – in addition to the Dream Long Band, 8 planes, 60 high-speed trains, and more.

While many domestic new energy vehicles were still focusing on cheaper, smaller cars, the ES8 was priced to compete with BBA’s main selling models, with two versions priced at 3.754 million and 4.754 million yuan after subsidies.

What did the fledgling NIO rely on at that time? Was it JAC’s production or chassis control? Clearly, neither received much recognition, as some car reviewers gave the ES8 negative scores.

Instead, NIO relied on brand culture and a commercial system built by founder Li Bin to open the door to the mid-to-high-end market. As mentioned earlier, Li Bin is a businessman, not a product manager.

Setting up offices around the world, introducing the EP9 that cost 1.2 million dollars to produce, launching NIO House, and promoting a battery swapping model and BaaS solution, NIO made significant preparations to achieve good pricing.

Some of these preparations involved improving on previous experiences, while others were new, such as NIO’s user system, which has become essential for any new energy vehicle company entering the market. Even former high-ranking NIO executives in user departments, such as Zhao Yuhui, former Vice President of the User Center, and Zhu Jiang, former Vice President of User Development, are highly sought after.

However, due to its overly ambitious approach, Li Bin was often preoccupied with meeting investors or customers, and had to personally handle many unexpected events even after resolving funding issues.

As competition in the new energy market intensifies, NIO’s business boundaries continue to expand. Some of NIO’s areas of focus include chassis domain controllers, power batteries, mobile phones, Volkswagen brands, and chips – some of which have yet to be prioritized while others are already in the crucial stages. At the same time, NIO’s product line continues to expand, with a total of 6 models currently available.

Clearly, Li Bin today has difficulty dedicating enough attention to the details of each product. Nevertheless, despite the current status of the ES8, it represents a turning point in the development of domestic new energy vehicles, making consumers realize that BBA’s cars priced between 300,000 and 500,000 yuan and above are not necessarily their top choice anymore.

Idealogical Carnivore

The ES8 is NIO’s first product, and apart from the lack of experience in car manufacturing, the maturity of the market was also a major obstacle to its success in this sector. Idealogical ONE was released in the second half of 2019 and, thanks to NIO and other companies, the new energy vehicle market in China was on the verge of explosive growth, and consumers’ awareness of new energy vehicles was just starting to form.

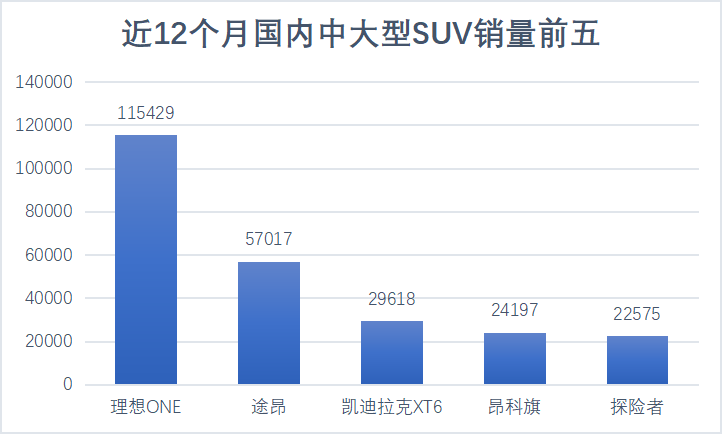

With the “Li Product Philosophy,” Idealogical ONE was successful upon its timely release and became the best-selling new energy SUV in that year; in 2021, the new model of Idealogical ONE went on sale, further expanding its absolute advantage into the fuel car market.

The Ideal L9 is obviously aiming to become a popular model in the 400,000-500,000 yuan price range.

The body size of the Ideal L9 is 5200/1998/1800mm, with a wheelbase of 3100mm, which is a full circle larger than the Ideal ONE.

Among the new energy models of the same size, the only competitor of the Ideal ONE with a higher price is the Red Flag E-HS9. In the fuel car market, the benchmark is the Mercedes-Benz GLS, Maybach GLS, BMW X7 and other models with a price of over one million yuan. If limited to the 6/7-seat market, the Ideal L9 has certain advantages over other models in the same price range, such as the Cadillac XT6 and NIO ES8.

Simply put, among vehicles of the same size, the Ideal L9 is the cheapest, and among vehicles of the same price range, it is the largest. This is the advantage of the product manager, who can accurately find the positioning of their own brand in the complex and ever-changing automotive market.

I don’t know if it’s to match the higher price, but a few days before the press conference, Ideal Motors conducted a brand 2.0 upgrade, changing the logo, UI interface, and offline stores, indicating that Ideal, which used to prefer to save costs even at the expense of quality, is beginning to change.

Conclusion

At the Q1 2022 conference call, Li Xiang revealed that three models, including an extended-range one, an all-electric one, and a 200,000-300,000 yuan price range one, would be launched in 2023. At that time, Ideal Motors’ product line will also expand to five products, and Li, as a super product manager, will have to focus on each product.

In the future, Ideal will release a heavyweight product every 100,000 yuan in price range, including pure electric and extended-range models, and Li Xiang will target the Apple Pro, Pro Max, Mini, and other products. However, the complexity of the automotive industry requires more precise user portraits, with much higher levels of energy and input required compared to the smartphone industry.

Li Xiang’s hands-on approach may not be able to replicate the popularity of his previous products, but from the confidence he displayed at the L9 launch, he seems to have already secured the next ‘hot item.’

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.