Author: Zhu Yulong

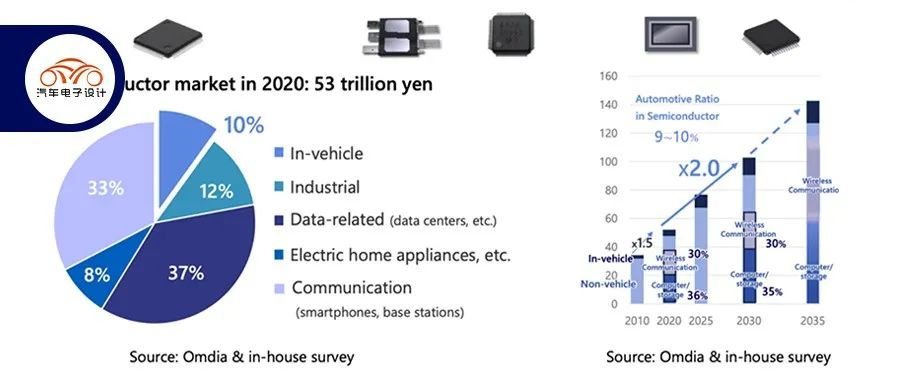

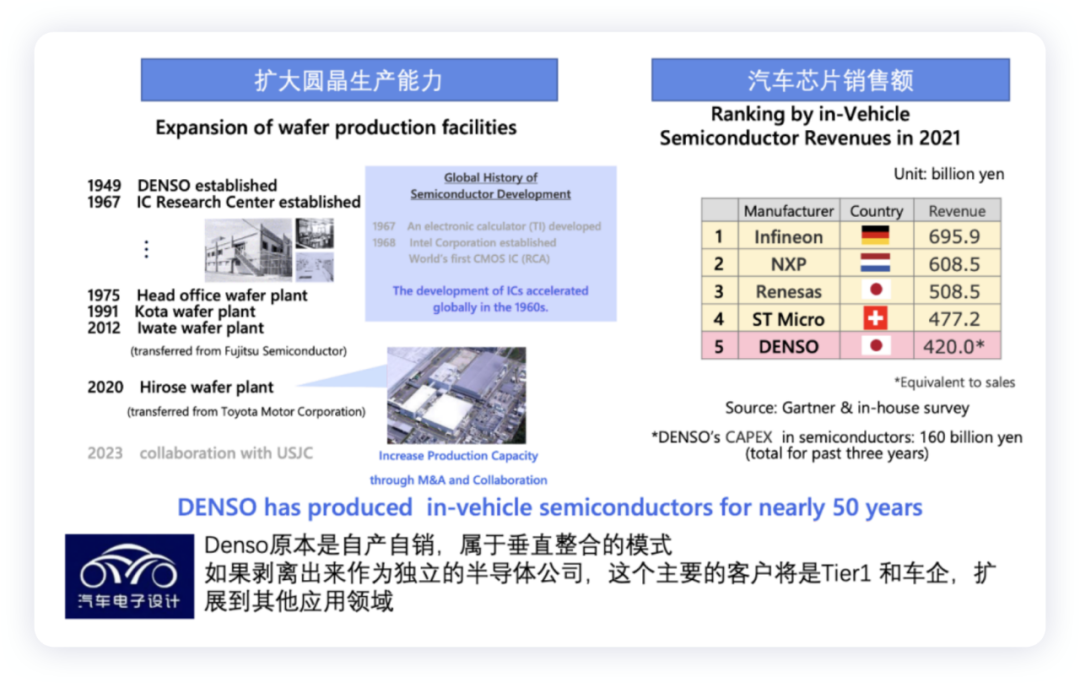

On June 1st, Japanese automotive Tier1 supplier, Denso, released the “Semiconductor Strategy.” Subsequently, we saw media reports that Denso is considering spinning off its chip division. Chief Technology Officer, Yoshifumi Kato, stated in an interview, “We must consider if there will be a time to sell semiconductors separately. Such a structure is worth exploring.” With a 50-year history of developing automotive semiconductors, Denso’s 2021 automotive semiconductor sales reached ¥420 billion, ranking fifth in the automotive field. The goal is to increase production by 20% to ¥500 billion (¥25.7 billion) by 2025. Denso’s primary semiconductor capabilities include Power Semiconductors, Analog Semiconductors, and sensor development for autonomous driving. This transformation is very interesting.

Note: With the decline of Fujitsu, Toshiba, Panasonic, and others in the semiconductor industry, Japan’s major remaining players with influence include Renesas, Denso, and Rohm.

Denso’s chip shortage strategy

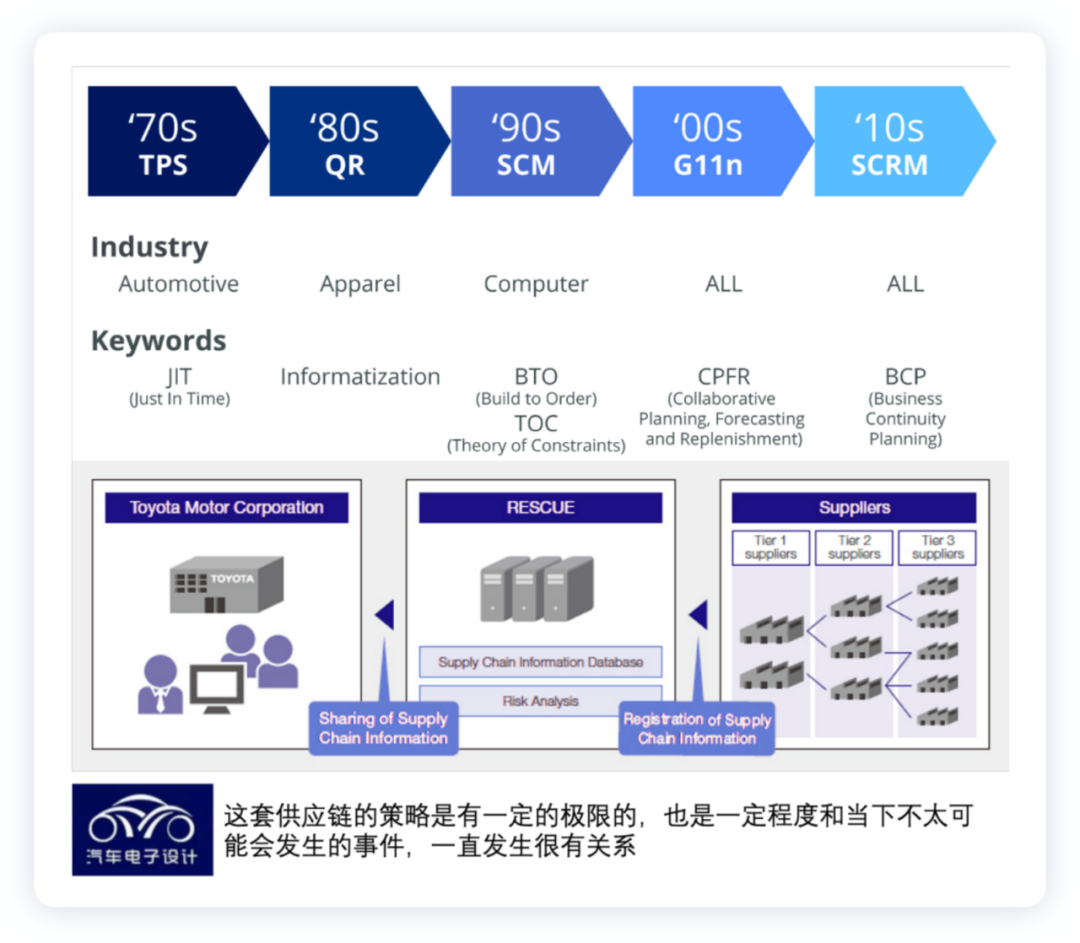

Denso is, in fact, Toyota’s “little brother” and also the most critical player in automotive electronic components. Before the Southeast Asian epidemic in Q3 2021, Toyota’s chip management was among the top rankings. Following the March 11, 2011, Japanese earthquake and tsunami disaster, long semiconductor delivery times left suppliers unable to respond to destructive impacts of natural disasters. Suppliers needed to reserve two to six months’ worth of chips, depending on delivery lead times, and these became long-period procurement risk items. This system also accounted for business continuity planning (BCP) and limitations in the Japanese supply chain from just-in-time (JIT) practices.

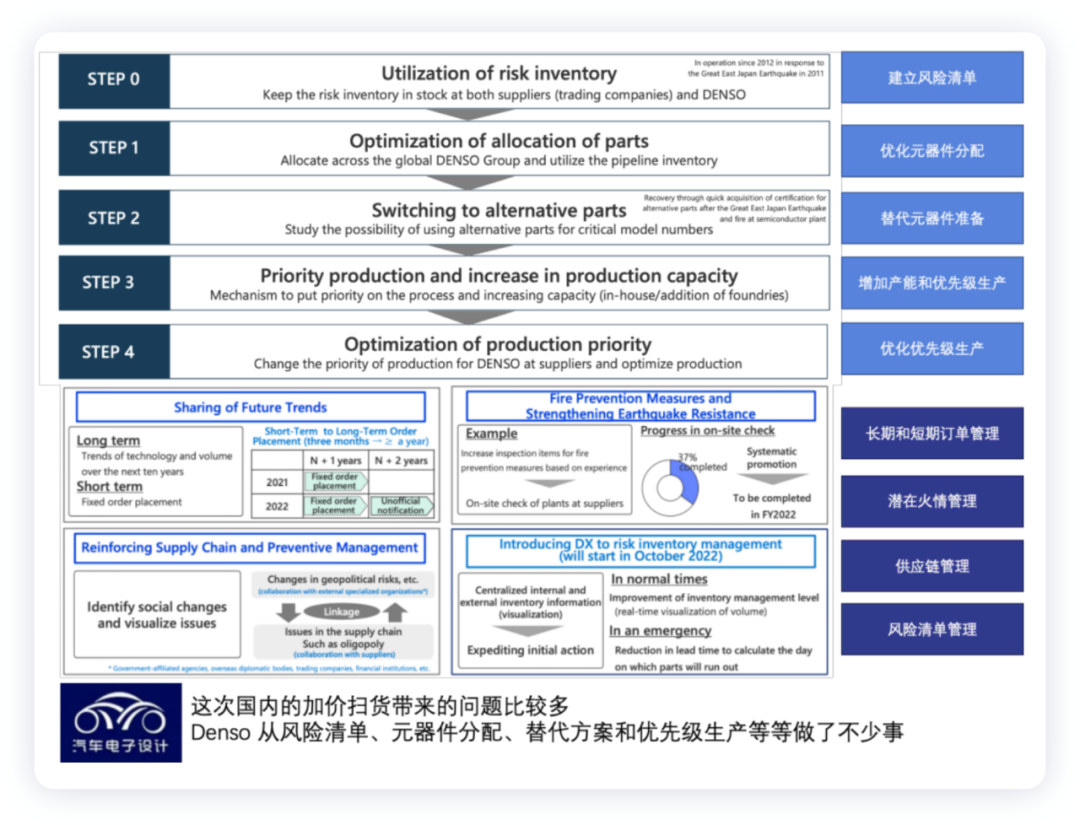

In executing Denso’s strategy, managing complex semiconductor supply chains includes establishing a risk inventory, developing strategies for component allocation, preparing for alternate components, and prioritizing production capacity management. We can understand that chips, which are not expensive under normal circumstances, but become critical components in the face of a shortage, are essential in the future layout of the industry.

Denso, Toyota’s key supplier, has also established a base for producing automotive chips. In terms of sales, automotive chips account for about JPY 420 billion (EUR 2.9 billion). In the past three years, Denso has invested a total of JPY 160 billion (EUR 1.1 billion) in its chip business. For Denso’s microelectronics department, automotive chips are assembled to whole vehicle customers through Denso’s parts, while a different strategy is to sell semiconductors directly to other automakers and suppliers.

Whether Denso’s consideration of spinning off its chip division will lead to a better outcome remains to be seen. The main focus is on external supply and expanding into other markets. There is no decision yet to spin off the chip business (no plans to generate additional funding for the company through spinning off the chip business), and the focus is currently on meeting the internal demand for chips within the Toyota system.

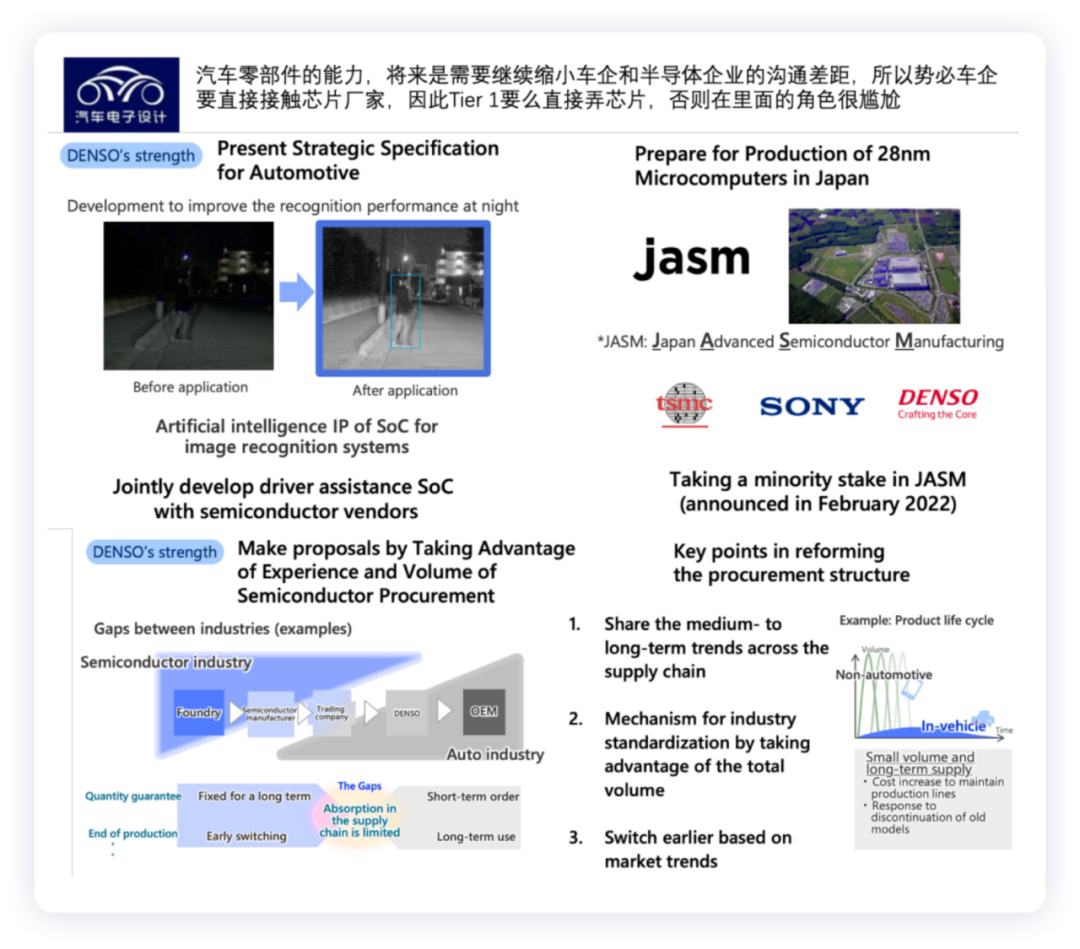

Opportunities for Denso

Denso has purchased a 10% stake in a chip factory built in Japan by Taiwan Semiconductor Manufacturing Company (TSMC) and Sony Group, producing 55,000 12-inch wafers per month from 2024 onwards, helpful for future production of SoC and MCU. The Japanese government is also assisting in the construction of a chip factory on Kyushu Island to produce chips for nearby Sony image sensor factories. Denso, in cooperation with United Microelectronics Corporation (UMC), produces semiconductor wafers in Japan to support power and analog chip production.

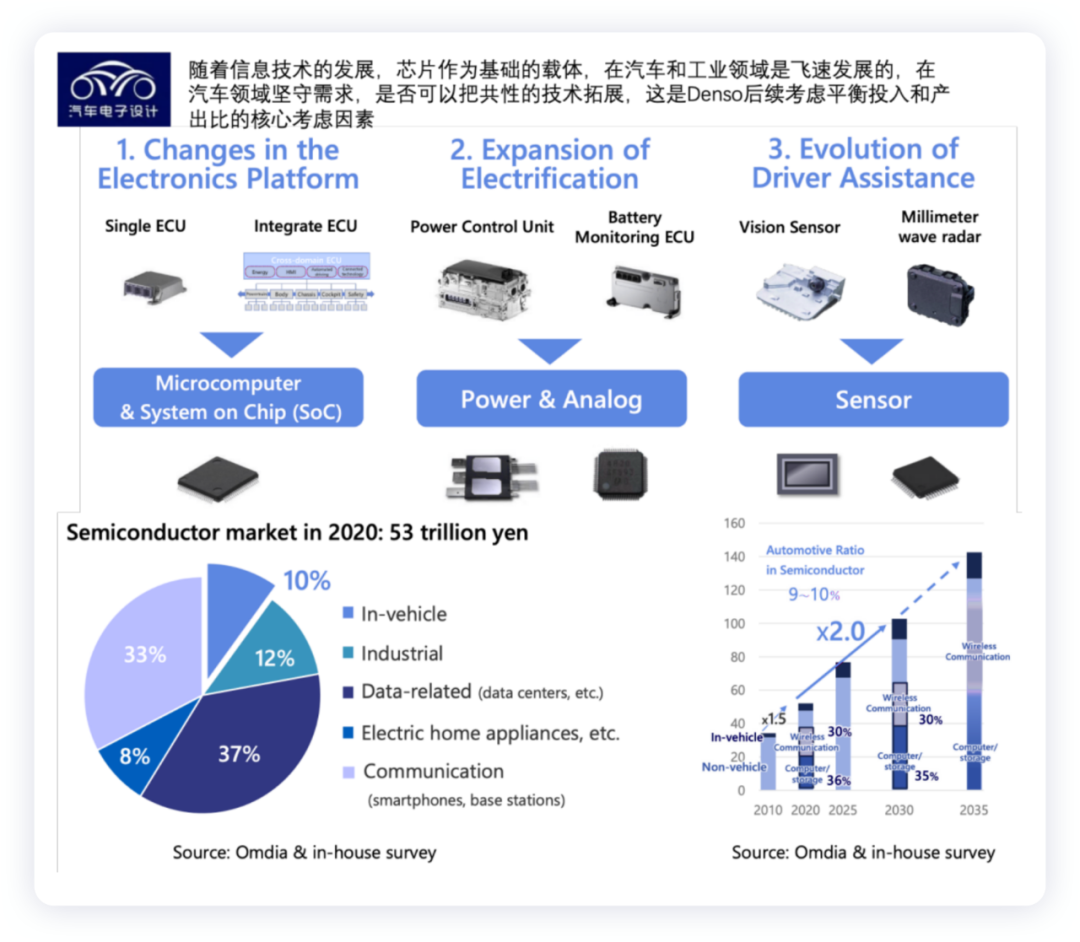

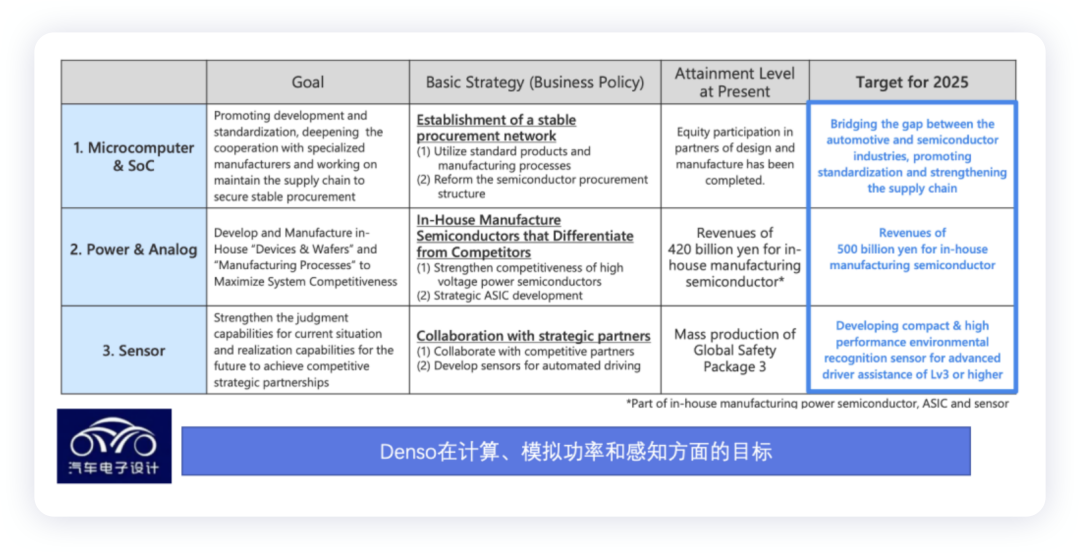

In terms of business, Denso’s business focus is on:

-

MCU+SOC

-

Analog and power chips

-

Sensors

Based on the above, Denso’s goal at its current scale is to develop new automotive electronic chip needs to face changes in the EE architecture, electrification and the field of automated assisted driving.

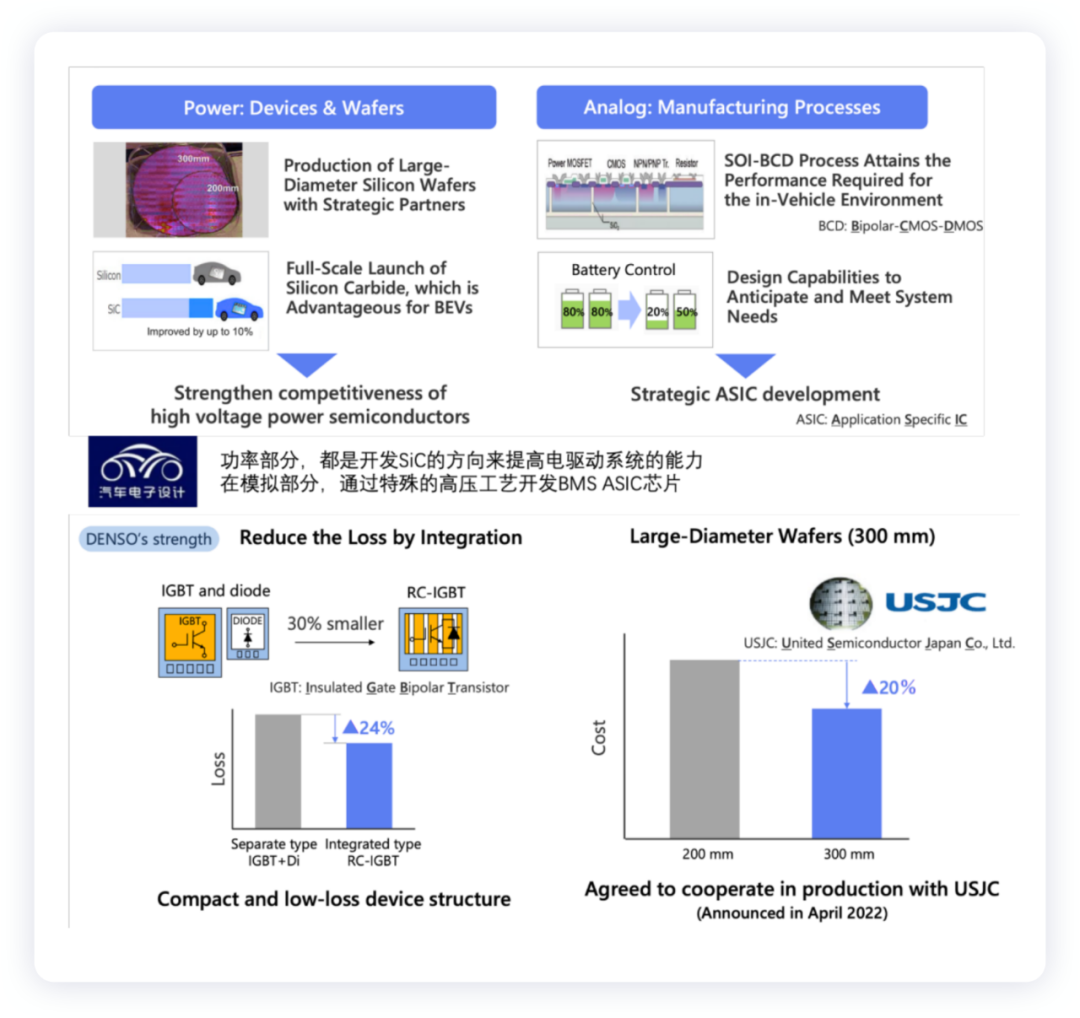

The advantage of Denso lies in its new generation IGBT and SiC devices, which are jointly developed with USJC to create 300mm wafers.

The advantage of Denso lies in its new generation IGBT and SiC devices, which are jointly developed with USJC to create 300mm wafers.

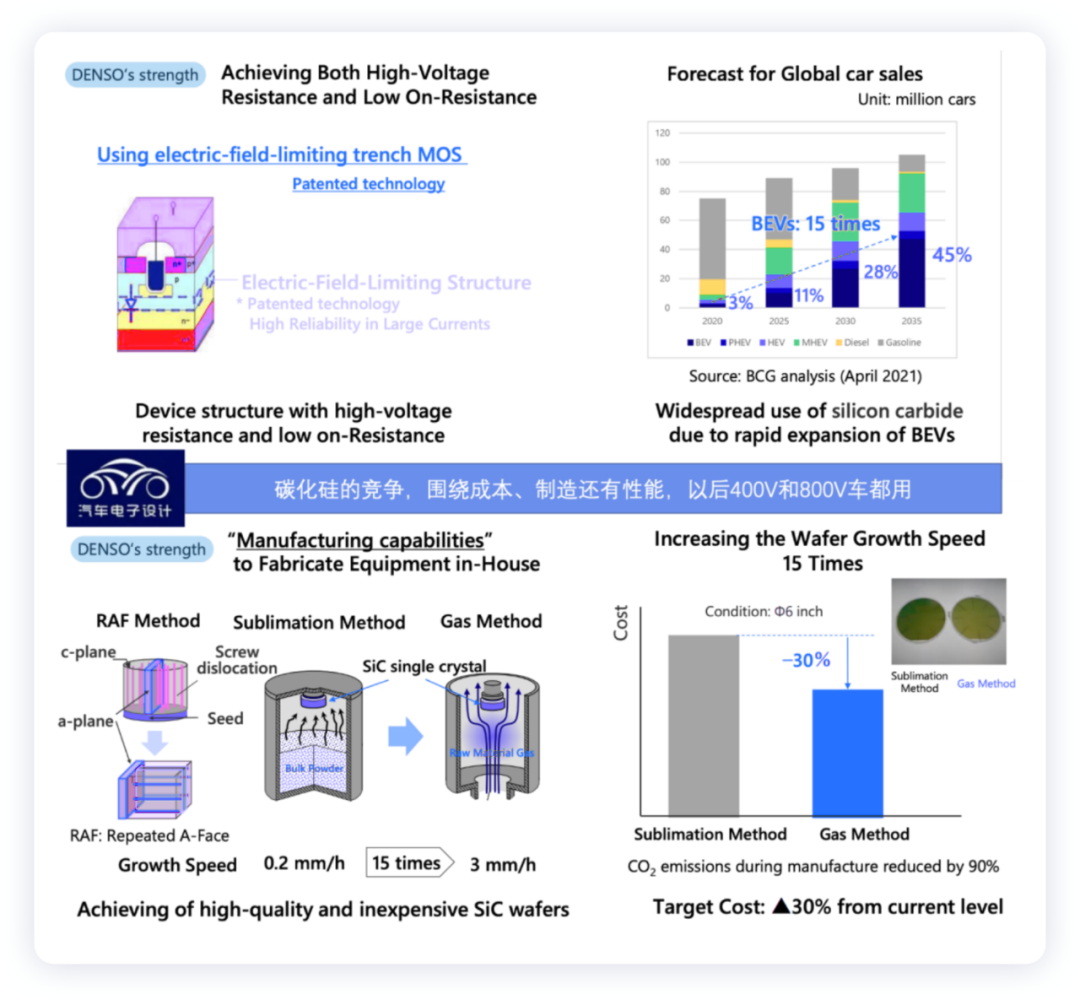

Simplification of electric vehicles means that everyone can make inverters, and the competition is about whether you have cheaper and better-performing SiC products.

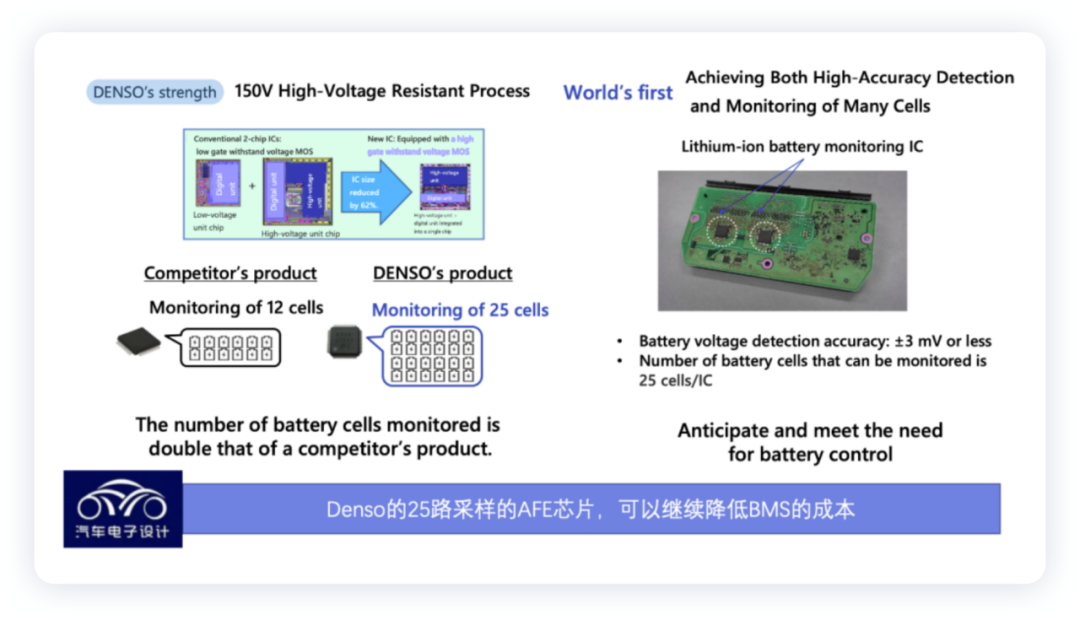

Regarding AFE, Toshiba and Renesas have been working on it, and Denso’s 25-channel cell sampling can reduce the cost of using four AFE chips for 100-series batteries.

Having gone through the above, Denso sees opportunities and challenges in the automotive semiconductor field. In this round of global Tier 1 components evaluation of business continuity, the goal is to expand investment and achieve better independent operation concerning semiconductors.

Unlike most Tier 1 companies in Europe (similar to Bosch’s layout), this is a matter of life and death.

In summary, the considerations in the automotive chip field still revolve more around who is closer to the demand, which design is more universal and reasonable. At least this field requires sustained attention.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.