NIO finally produces its own battery cells

Creating battery cells has never been a new thing for the automotive industry. As new forces like NIO have been producing vehicles approaching 100,000 units in sales in recent years, and will soon hit 200,000 this year, they are also considering whether to manufacture their battery cells themselves or not.

NIO, as a representative of China’s new energy vehicle enterprises, has taken the lead and stated that “the new model of the new brand will be delivered in the second half of 2024…it will be equipped with our own production batteries.” Li Bin, founder and CEO of NIO, clearly expressed his battery (cell) strategy during the first quarter earnings call: “From a long-term perspective, we are definitely pursuing a strategy of self-production supplemented by external procurement.”

Of course, NIO is not the first company to manufacture their own batteries, nor will they be the last.

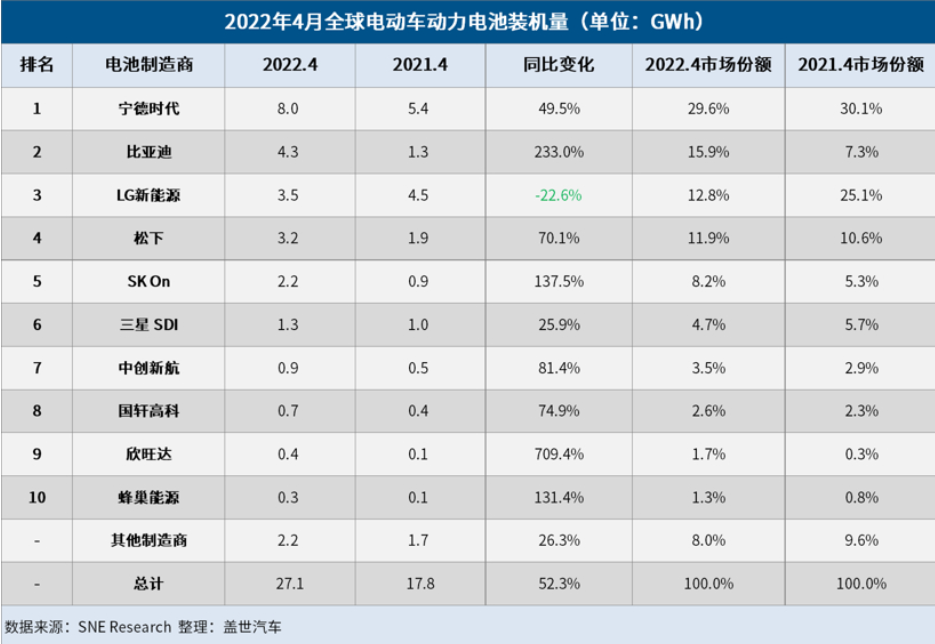

On June 4th, Li Xiang, founder of LI Automotive, revealed on Weibo that L9 battery cells for their new model will be supplied by Ideal and CATL’s joint venture in Changzhou Luyang.

Furthermore, although XPeng has not publicly announced that they are producing their own battery cells, there have been internal rumors of plans to do so.

Outside of new energy vehicle enterprises, more powerful large car group enterprises began constructing their own battery cell plants, investing in battery cell plants or entering joint ventures, consolidating battery supply safety. So, will all automakers produce their own battery cells? What are the challenges?

NIO’s multiple battery cell layouts

On May 23rd, the Shanghai Environmental Public Platform for Enterprises and Institutions showed that NIO is planning to build a new research and development base in Jiading District, Shanghai, for the development of automotive power batteries. The announcement states that the base includes “31 lithium-ion battery cell and battery pack R&D labs, as well as one lithium-ion battery trial production line and one battery pack pack line.”

Combined with the environmental impact assessment report submitted by NIO, the total construction area of this R&D base is 22,090.02 square meters, with a construction period from August to October 2022, and a total investment of 218.5 million yuan. The base is expected to engage in R&D for about 250 days and employ over 400 people.

Of course, the power battery business disclosed in this report still belongs to R&D and trial production, as well as battery pack production lines, and does not include battery cell factories.

However, during NIO’s Q1 earnings call on June 9th, Li Bin stated that in the long-term, the cell will adopt a strategy of external procurement and self-supply. Self-produced batteries will be used for its second brand, which will face the mass market in 2024.

According to the Electric Vehicle Observer’s current understanding, NIO may not have finalized its technical route for battery cell production but is in contact with multiple options.Currently, CATL remains its primary supplier; in the field of semi-solid state batteries, it has reached a deal with Calb New Energy and is expected to start mass production at the end of this year or next year.

In addition, NIO Capital and other affiliated enterprises of NIO have invested in Calb New Energy and become relatively large shareholders. Semi-solid state technology may also be one of NIO’s options for future battery production technology routes.

In mid-March of this year, a photo widely circulated on WeChat Moments: William Li and Wang Chuanfu standing in front of the NIO House entrance at the JAC NIO factory in Hefei, communicating with an ET7 (pictured).

Some people speculated that NIO would cooperate with BYD, but William Li denied it: “It’s completely a rumor.”

However, insiders say that NIO is indeed exploring the possibility of cooperating with BYD to produce blade-shaped cells.

In addition, NIO is also researching on 46950 large cylindrical cells. In terms of material routes, NIO may also be involved in both lithium iron phosphate and ternary materials.

Three Major Driving Factors for In-house Battery Production

After 2020, more and more automakers have announced their plans for in-house battery production, and Tesla, Volkswagen, EA and NIO have successively announced their plans for in-house battery production. In the view of some industry experts, this is mainly due to three driving factors: First, the demand for guaranteeing supply chain security has increased; Second, car companies believe that the technology of batteries has entered a relatively mature period, and the speed of technological iteration has slowed down; Third, they are optimistic about future sales forecasts and, from the perspective of the entire industry chain, want to reduce costs.

Ensuring Supply Security

Tesla and Panasonic have been at odds for a long time. When tensions escalated, Tesla announced its own in-house battery production.

In 2014, Tesla was already famous in the industry. At this time, Musk believed that Panasonic’s production capacity limited Tesla’s progress and became dissatisfied with Panasonic.

In 2019, Musk accused Panasonic’s battery production line of producing insufficient capacity on Twitter. The annual production capacity of Panasonic’s battery production line at the Tesla Super Factory is only 24GWh, and its battery production capacity has been limiting the production of Model 3.

This made Musk determined not to let third-party battery companies become bottlenecks and to personally build batteries and reduce costs.

Chinese car companies also have similar anxieties.

As the world’s largest battery manufacturer, the demand for CATL’s production capacity is very strong both domestically and internationally. However, due to the fast iteration of battery technology in recent years, as well as the mixed bag of car companies, CATL is more inclined to “payment upon delivery” and even “payment before delivery” to ensure the security of its own funding chain.

36kr previously reported that in 2019, NIO was mired in financial difficulties. CATL applied the principle of “only deliver when paid” to new car production. A NIO executive had to present house deeds before CATL agreed to deliver the batteries.In April 2021, Ningde Times Chairman Zeng Yuqun mentioned two typical cooperation methods with automakers during the celebration of the 125th anniversary of Shanghai Jiao Tong University.

One is that automakers have their own plan, for instance, a 5-10 year cooperation with a cooperation amount of 100GWh, in which automakers can take over the production line or pay for the cost of buying the production line.

The other is a long-term cooperation including signing a long-term cooperation agreement and requiring automakers to maintain their annual output fluctuation within ±15%. If the output does not meet the requirement, the difference must be paid.

Zeng Yuqun believes that “promises without money are not serious.”

However, even if the cooperation is successful, the supply of batteries still cannot be guaranteed.

In the Q3 2021 earnings conference, Li Bin admitted that the battery was still a big constraint on the delivery volume, despite establishing an exclusive supply agreement with Ningde Times.

The shortage of supply and the strong commercial policy may be the reasons for more enterprises to choose the second or third supplier.

Another driving factor for automakers to manufacture battery cells is that battery technology has entered a relatively mature period.

Technologically Mature

In the early stage of the development of new energy vehicles, battery technology was not mature, and there were many technological routes, including the two major routes of ternary batteries and lithium iron phosphate batteries, and other technological routes such as fuel cells.

Both automakers and battery companies were indecisive and even had to deal with multiple routes simultaneously.

Especially driven by subsidy policy, the energy density of batteries has increased rapidly, and the products of battery companies have been iterated and improved almost every year.

It is challenging for battery companies to keep up with the pace of technological requirements, and the entry threshold and risk of automakers can be imagined.

However, the situation has improved significantly in recent two years. In the view of experts in the battery industry, battery products are relatively mature nowadays, and the iteration of technology has slowed down significantly. Nevertheless, there is still considerable space for the improvement of battery performance, and the risk of automakers is significantly reduced.

This is the second driving factor for automakers to enter this market.

Rapid Market Growth & Optimistic Automakers’ Sales Expectations

In 2021, China’s sales of new energy vehicles reached 3.521 million units, an increase of 1.6 times YoY, and the proportion of new car sales soared to 13.4%, an increase of 8 percentage points YoY.

The annual sales volume of China’s new energy vehicles increased from 50,700 units in 2016 to 1.367 million units in 2020, with a CAGR of 28%. The achievements of the new energy vehicle industry in 2021 exceeded the predictions of some experts and institutions.

In 2021, the industry predicted an even greater sales number of six million new energy vehicles.

Under such rapid growth, each new energy vehicle enterprise is expected to seize a bigger share of the market. Automakers are generally optimistic about their development prospects.

Different Solutions from Different AutomakersIn the early stages of electrification, companies such as Daimler, Volkswagen, BMW, and Nissan have conducted in-depth research on whether to produce their own batteries, with many of them being practitioners.

According to the Electric Vehicle Observer, the exploration of automakers in the battery field can be roughly divided into five categories.

“First, there are companies that have failed in producing their own batteries, such as Daimler and Nissan.”

“Second, there are companies that have tried to produce their own batteries, such as Tesla, Volkswagen, Geely, XPeng, NIO, and Aiways.”

“Third, there are those that incubate cell companies, such as Great Wall’s incubation of Honeycomb Energy.”

“Fourth, there are those that started with batteries, with BYD being a typical example.”

“Fifth, there are car companies that do not consider producing their own batteries for the time being, such as BMW, which only conducts research and investment, not producing cells; and Ideanomics, which has explicitly stated that it will not produce batteries.”

Companies that have failed in producing their own batteries – Nissan and Daimler

AESC was one of the earliest companies engaged in power lithium-ion batteries. In 2007, Nissan decided to join forces with NEC and NEC Tokin to establish AESC, a lithium-ion battery company specializing in electric vehicles, with Nissan holding a 51% stake.

In 2010, AESC began supplying batteries for the LEAF model. With the success of the LEAF, AESC became the world’s second-largest electric vehicle battery manufacturer in 2014, second only to Panasonic, with a market share of 21%.

AESC is renowned for its safety and has created a record of having no major safety accidents so far. Unfortunately, cost became its fatal flaw. In 2014, Reuters reported that the Nissan-Renault alliance had some disputes over the high price of AESC batteries compared to those of LG Chemical. According to reports, Nissan had signed an agreement with NEC that it would purchase all of the electrodes NEC produced, regardless of the amount, which led to Nissan being unable to bear the high cost.

By 2016, Nissan decided to sell AESC, and it was acquired by China’s Envision Energy.

Daimler’s situation is similar. In 2008, Daimler teamed up with Evonik Industries AG to establish Li-Tec, and built a lithium-ion cell production plant in Kamenz, which began production in 2010. Shortly after its launch, Li-Tec announced in November 2014 that all cell production would cease by the end of 2015, with Li-Tec becoming a wholly-owned subsidiary of Daimler, and most of its employees being absorbed by Daimler.

Daimler CEO Dieter Zetsche later publicly stated in an interview, “with existing technology, Daimler cannot gain any economic advantage in producing lithium-ion batteries on its own.”

“Today, Daimler is more interested in investing in new battery technologies and start-ups to keep up with the latest trends in the battery field, but it will not invest too much in battery production.”

The high cost made the two giants abandon their own battery production plans.

Here are some typical cell supply plans of some car firms:

Self-production attempts by Tesla, Volkswagen, and Geely

Just because others have not been successful, does not mean one cannot be successful. Perhaps it is the evolution of technology, the decline of battery production costs, and the growth of the scale of new energy vehicles that have inspired many auto companies to produce their own batteries.

The most famous of these is Tesla. With annual sales of nearly one million vehicles, it seems that Tesla’s confidence lies in their own production of batteries. Its founder, Musk, is a master at reducing costs and even designs the battery cells himself.

In September 2020, Tesla released the 4680 battery cell, which has an energy density 50% higher than the first-generation 18650. Compared to 2170, the energy density of the 4680 has increased by 5 times, the driving range has increased by 16%, the power output has increased by 6 times, and the cost per kWh has been reduced by 14% at the battery pack level.

According to their plan, the 4680 battery cell production volume will reach 100 GWh per year in 2022 and 3 TWh in 2023.

With sales supports and the technical support of Jeff Dahn, an internationally renowned lithium-ion battery expert, Tesla’s self-produced batteries have certain feasibility.

Volkswagen has also shifted its focus from R&D to building its own production capacity. In March 2021, at Volkswagen’s “Power Day” event, they unveiled ambitious plans for battery production, planning to establish six large-scale factories with an average annual production capacity of 40 GWh per factory.

In the early stages, Volkswagen cooperated with Northvolt to build factories, promote battery standardization, and have standardized battery cells applied to 80% of their models. The remaining 20% applies independent, customized battery designs to achieve economies of scale.

Geely is one typical company in China that has established a self-built battery production line. In 2014, Geely established a joint venture company to develop and produce battery cells. In 2015 and 2018, they set up two more joint ventures and independent companies, respectively, to produce battery cells.

However, from the data, it seems that Geely still depends more on outsourced battery cells.

Battery cell companies incubated by Great Wall Motors

The newcomer in China’s battery field, “SVOLT Energy,” was incubated by Great Wall Motors. In 2016, SVOLT Energy was the power battery department of Great Wall Motors. In February 2018, SVOLT Energy was officially established as an independent company.

Currently, SVOLT Energy has achieved sales partnerships with 25 mainstream brands, including Geely and Dongfeng, and has a global cooperation project worth 16 billion RMB with Stellantis.

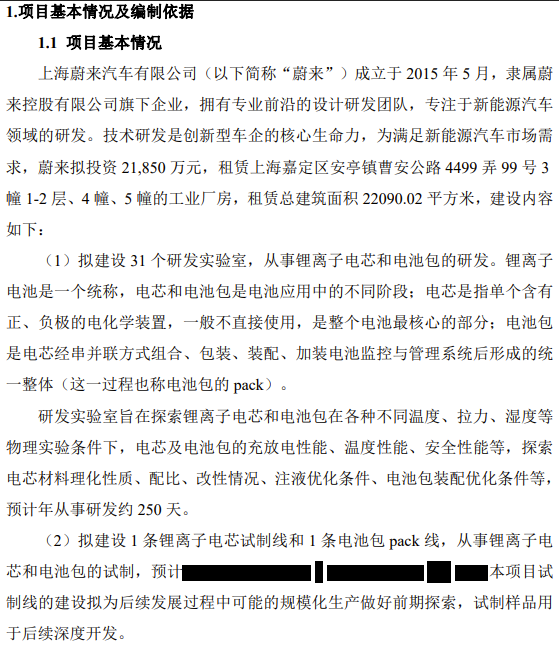

According to the latest data from SNE, in April, SVOLT Energy has entered the global top 10 in terms of installed capacity.

Perhaps learning from the experiences of Nissan and Daimler, Great Wall Motors’ strategy is to spin off its battery business. By continuously reducing Great Wall’s shareholding and demand proportion, Honeycomb (the battery subsidiary) becomes an independent third-party battery supplier and fully participates in market competition.

Starting with batteries- BYD

Another company that controls both battery and vehicle technology is BYD. Unlike Great Wall Motors, BYD started with battery technology before venturing into vehicle manufacturing. BYD’s advantage is a deep accumulation of battery technology, while the disadvantage is difficulty in sourcing externally.

To solve this problem, BYD is also adopting a strategy of continuous divestment by establishing Fudi Battery. According to BYD Chairman Wang Chuanfu’s previous goal, BYD plans to separate and independently list its battery business by the end of 2022.

What sets BYD apart is that, in addition to its impressive sales figures, it is also a giant in consumer-grade batteries. In 2000, BYD became Motorola’s first Chinese lithium-ion battery supplier and soon after became Nokia’s first Chinese lithium-ion battery supplier. Currently, BYD’s consumer-grade batteries still include global brands like Samsung, Dell, and Ecovacs.

As a result, BYD has a significant advantage in terms of battery cost allocation.

Companies that don’t consider in-house production – BMW and Li Auto

In fact, more automakers are not interested in entering the field of battery production.

BMW has been deeply involved in battery cells for more than ten years, focusing solely on R&D and trial production, but not personally producing battery cells. BMW’s research on vehicle lithium-ion batteries began in 2008 with the Active Hybrid project in collaboration with A123. In 2012, the BMW Group established a power battery research and development project, and in 2017, the BMW battery cell research and development department employed more than 300 people. In 2020, BMW began trial production of power battery cells.

Although BMW does not produce batteries in-house, it also invests in next-generation technologies. Last year, BMW and Ford expanded their joint development agreement with manufacturer Solid Power and invested USD 130 million in the solid-state battery field. In addition, BMW also invests in start-ups, such as the US start-up Our Next Energy (ONE), which is currently researching a dual-battery system.

Li Auto also does not produce battery cells in-house. In the eyes of Li Auto founder Li Xiang, if electric vehicles become popular in the future, battery manufacturers will be equivalent to today’s gas stations or refineries, and OEMs will not need to worry about being controlled by battery factories even if they do not produce batteries. So far, Li Auto has opted to trust companies like BYD and Contemporary Amperex Technology (CATL), and does not plan to produce batteries in-house.When it comes to supply, most car companies still prefer the joint venture and partnership model. Li Xiang, founder of EV maker Li Auto, announced on Weibo that the company would build a production line with battery maker CATL.

It’s clear that there’s no consensus among carmakers about whether to produce their own batteries. Most manufacturers still prefer to buy batteries from external vendors due to the high cost of developing and producing batteries, which is still comparable to setting up a new car company.

Currently, the most popular way for carmakers to handle their batteries is to spin it off into a third-party supplier.

High Barrier to Battery Production

What’s the bar for automakers to produce their own batteries?

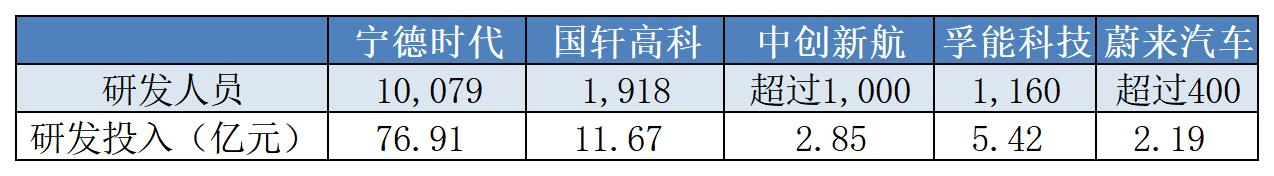

According to a report from Electric Vehicle Observer, which compares R&D staff and investment, leading battery manufacturer CATL employs over 10,000 R&D staff and has investment of nearly CNY 7.7 Billion ($1.2 Billion USD), compared to newcomers like Tesla and NIO.

Even second-tier battery manufacturers have R&D staff in the thousands. By comparison, the battery team at NIO numbers a little over 400, which is roughly half the average size of second-tier battery manufacturers in China.

Battery investment figures for selected companies in 2021:

R&D investment figures for selected automakers in 2021:

This doesn’t even take into account the cost of building and equipping production facilities. Currently, construction costs for a 1GWh lithium-ion battery plant are between CNY 300 million and CNY 400 million ($46 million to $62 million). By extension, it would cost CNY 3 billion ($462 million) to build a plant for 10GWh. This is still small compared to the scale of the largest battery makers in China, whose plants have annual output capacity of hundreds of GWh.

An important factor automakers need to consider when building their own battery plants is sales volume support. In 2021, Tesla sold 936,000 electric vehicles globally, BYD sold 594,000, and Volkswagen sold 762,000, while NIO only sold 91,000.

In the long term, Tesla is likely to surpass the annual one-million EV sales threshold this year. Volkswagen CEO Herbert Diess has declared that the Volkswagen Group will surpass Tesla and become the world’s largest EV seller by 2025.

Electric vehicle sales figures for selected automakers in 2021:

At present, neither the R&D investment of battery companies nor the sales support of car companies are sufficient for NIO to support self-produced battery cells.

However, the fact that NIO is investing in the field of battery cells suggests its confidence in its own sales.

Amidst the current backdrop of rising raw material prices and insufficient supply of high-quality battery cells, it has become a trend for car companies to produce their own battery cells. After all, if the sales volume is large enough, controlling the battery cells that account for about 40% of the cost in their own hands can not only reduce costs by reducing intermediate links, but also increase their bargaining chips with third-party battery suppliers, thereby gaining the power of speech. It can be said to kill two birds with one stone.

In fact, as early as last year, Li Bin, the founder of NIO, expressed in public his development goal for NIO in the next five years: to roughly make up 3 million of the luxury car market and strive for a third of the market within 5 years or more.

In other words, NIO is trying to challenge the goal of 1 million vehicles in a single market in China in 2025.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.