Author: Zhu Yulong

On May 12, 2022, STMicroelectronics announced at its Capital Markets Day that it expects its full year revenue to grow to $14.8-15.3 billion in 2022 from $12.8 billion in 2021, with a new target of $20 billion in revenue for 2025-27. This rapid revenue growth is mainly driven by the automotive sector (including industrial and consumer electronics), with a gross margin increase up to 50%. In the automotive field, semiconductor firms see the opportunity for rapid growth in electrification and digitization and the value of automotive chips will increase significantly, leading to high-speed development over the next five years, not only for Europe’s Infineon and STMicroelectronics, but also for China’s automotive chip companies.

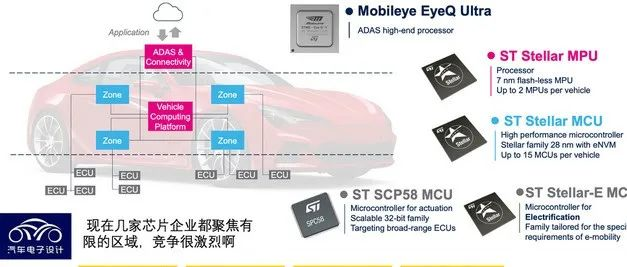

Product Upgrade Plan for Automotive Semiconductors

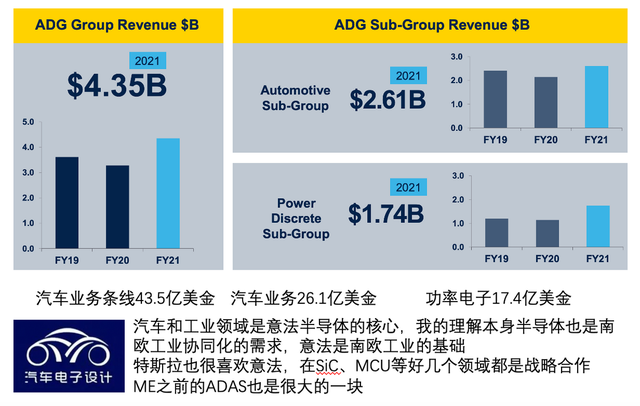

Semiconductors have strong demand transferability. Many demands from European automotive enterprises and Tier1 companies have been transferred to STMicroelectronics, resulting in the development of STMicroelectronics’ automotive business. We can see that due to the pandemic in 2020, semiconductor companies’ overall revenue has declined compared to 2019 but rebounded in 2021.

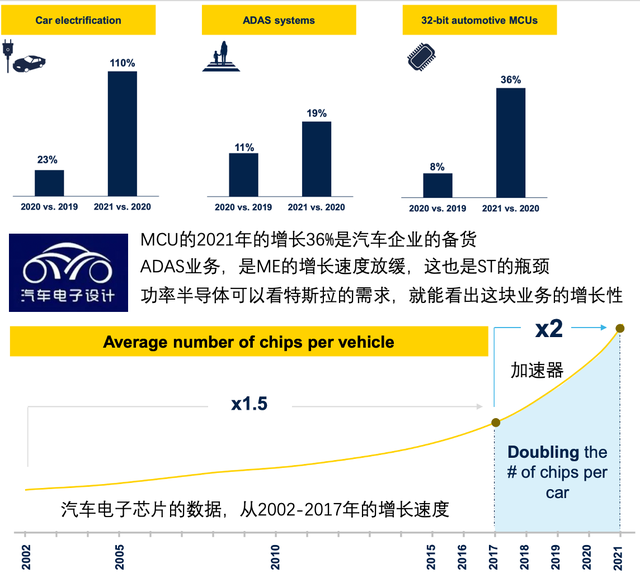

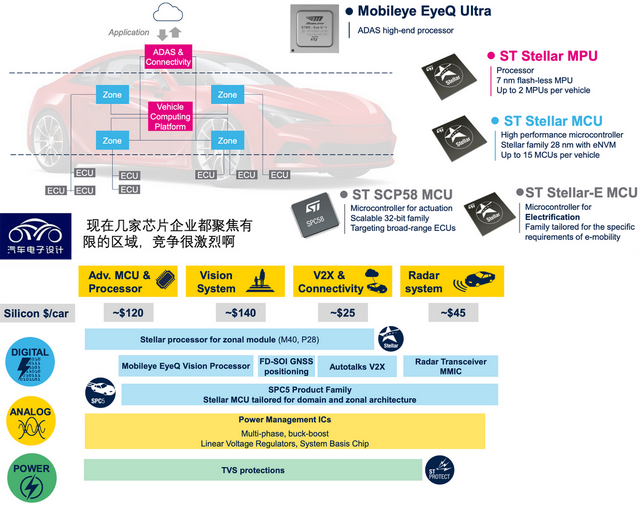

In terms of specific layout (Figure 3), ST’s business is mainly divided into electrification (power semiconductors), 32-bit MCUs, and vision chips. The growth trend also reflects the fact that in 2021, ST was highly associated with Tesla in the field of electrification, while MCU retained a part of IDM and deepened its cooperation with Tesla in 2021. However, the recent downturn of ME also reflected in the growth of ST’s business (ADAS only grew 19%).

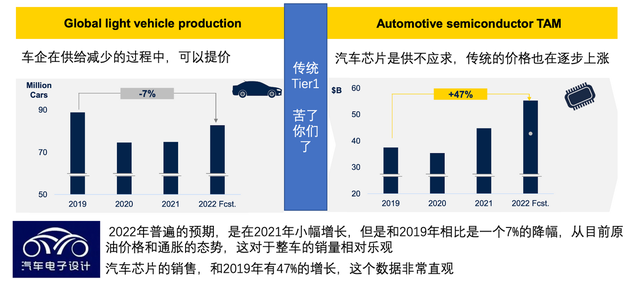

Currently, the way automakers deal with the reduced supply is to concentrate chips and production capacity on higher-priced vehicles, resulting in an increase in the average car price and effectively offsetting the decline in profits. Orders for automotive chips have not decreased, with Tier 1 and automakers saturating their orders. They are building safety stock by purchasing chips, and demand will continue until this goal is achieved. Traditional capacity expansion concerns have prompted automotive chip companies to start raising prices on the chips we commonly use, which is the actual state of the industry.

Currently, the way automakers deal with the reduced supply is to concentrate chips and production capacity on higher-priced vehicles, resulting in an increase in the average car price and effectively offsetting the decline in profits. Orders for automotive chips have not decreased, with Tier 1 and automakers saturating their orders. They are building safety stock by purchasing chips, and demand will continue until this goal is achieved. Traditional capacity expansion concerns have prompted automotive chip companies to start raising prices on the chips we commonly use, which is the actual state of the industry.

I believe that an important perspective, such as regulation requirements, functional safety, information security, and even data-driven EDR, ensures the semiconductor demand for the entire automotive industry, and for fuel vehicles to catch up with the times, updates are also needed in cabins and advanced driver assistance systems, which ensures the entire automotive industry’s dependence on chips.

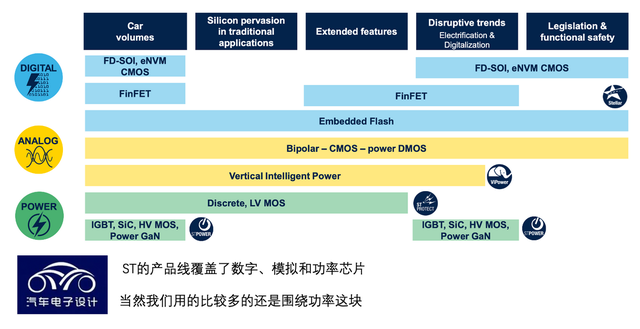

In the following Figure 6, I can see ST’s coverage of different trends in chip products and processes.

Investment direction of chips

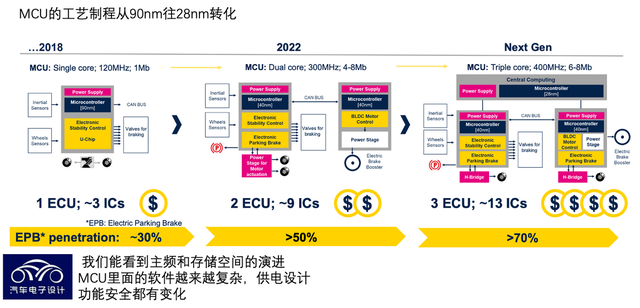

MCU changes

In this figure, which I didn’t see specifically mentioned, the most interesting aspect is that as distributed architectures move toward centralized architectures, the functionality of MCUs is polarized, with 8-16-bit or even 32-bit microcontrollers being integrated into other chips to create intelligent sensors and actuators, while high-end MCU demands mainly focus on high clock frequency and multi-core designs, performing real-time calculations on zonal and computing platforms while providing security features.

During this process, changes mainly include:

- Iterating from single-core 120MHZ 1Mb to dual-core 300MHZ 4-8Mb, and then to triple-core 400MHZ, 6-8Mb

- The process evolves from 90nm to 40nm, then 28nm, and even higher processes for investment

- The integration inside the MCU evolves from power supply + MCU + ASIC to more integrated (power + MCU + motor drive) designs, which is still very interesting.

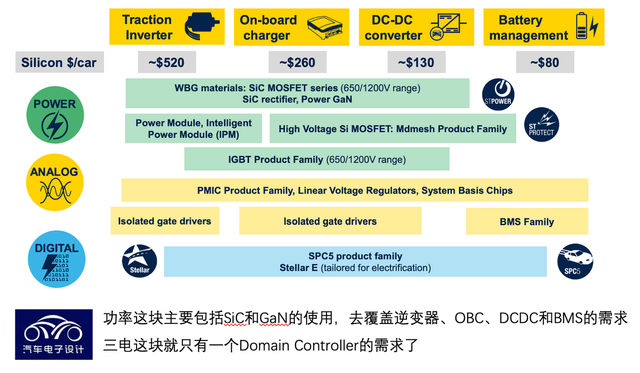

Electrification# ST’s Strengths in Electrification

In the field of electrification, ST has a strong presence, with revenue from silicon carbide products expected to reach USD 500 million in 2021, USD 700 million in 2022, and USD 1 billion in 2023. The main customer of ST’s silicon carbide products is Tesla, which utilizes TPAK silicon carbide modules in Model 3 and Model Y. ST invested USD 2.1 billion in the fiscal year of 2022 to increase silicon carbide production capacity and expand the 6-inch silicon carbide wafer plant in Catania, Sicily, as well as to invest in the new 6-inch silicon carbide wafer plant in Singapore, which is set to begin operations in 2022. ST is strategically investing in silicon carbide substrate production to achieve vertical integration in the supply chain, with the aim of meeting 40% of the substrate demand through internal supply by 2025. In terms of production technology, STMicroelectronics Silicon Carbide A.B. is beginning to experiment with 8-inch silicon carbide materials in the laboratory, with corresponding technology expected to mature around 2025 and be applied to the planned 8-inch silicon carbide production line in Singapore.

In terms of chip design, ST continues to explore the technical potential of planar-designed silicon carbide MOSFET, and the fourth-generation planar gate silicon carbide MOSFET is expected to enter mass production in Q2 2022. The trench gate design product has become ST’s fifth-generation silicon carbide MOSFET, which is currently in the engineering sample testing phase.

Regarding the overall product trend, it is clear that ME is a major focus. Under a zonal architecture, chip design will become more complex, but at the same time, it is closely tied to strategic partnerships with carmakers.

Conclusion: I believe that the decision-making power for chip selection is transitioning from Tier 1 to more influential and capable carmakers, making the development of chip enterprises more complex and closer to end demand. The faster carmakers will be able to take control of this leadership position.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.