Author: Zhu Yulong

The first quarter earnings conference of NIO reflected many interesting pieces of information, and I have made some excerpts here:

-

NIO is developing the next generation of vehicles, including an 800V system for charging and swapping batteries. The strategy is a combination of external procurement and self-production.

-

In April, the battery cost will float according to the price index of raw materials (battery material index) based on a new agreement with the battery supplier.

-

Currently, NIO’s demand is not a problem, mainly constrained by production capacity. The supply chain issues include chips, and the bottleneck of capacity improvement.

-

NIO’s second brand (mass market brand) plans to deliver in the second half of 2024, equipped with NT 3.0 technology. The main product positioning is a 200,000 to 300,000 RMB exchangeable battery architecture. NIO’s self-produced batteries will be used, and they expect it to be a very competitive product.

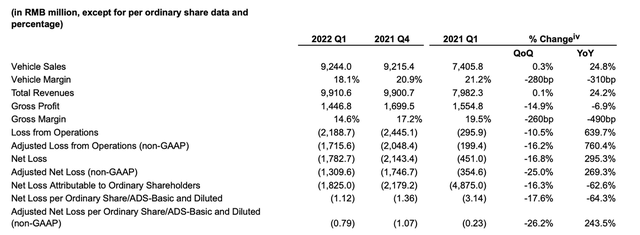

Here are some key figures (Q1 data):

-

Car sales revenue was CNY 9.244 billion, a year-on-year increase of 24.8% and a quarter-on-quarter increase of 0.3%.

-

The vehicle profit margin was 18.1% compared to 21.2% in Q1 2020 and 20.9% in Q4 2020.

-

Total revenue was CNY 9.9106 billion, a year-on-year increase of 24.2% and a quarter-on-quarter increase of 0.1%.

-

Gross profit was CNY 1.4468 billion, a year-on-year decrease of 6.9% and a quarter-on-quarter decrease of 14.9%.

-

Gross profit margin was 14.6% compared to 19.5% in Q1 2020 and 17.2% in Q4 2020.

-

Operating loss was CNY 2.1887 billion, an increase of 639.7% YoY, and a decrease of 10.5% QoQ.

-

Net loss was CNY 1.7827 billion, an increase of 295.3% YoY, and a decrease of 16.8% QoQ.

-

R&D expenses were CNY 1.7617 billion, an increase of 156.6% YoY.

-

As of March 31, the reserve funds were CNY 53.3 billion.

Information about batteries

I think the main points about batteries can be summarized into the following:

(1) Strategic adjustment

Since its establishment, NIO has only used batteries from CATL (as of June 10, 2022). Although they initially used SDI’s main program, objectively speaking, a plan with a single supplier persisted for many years. CATL is NIO’s second-largest passenger vehicle customer and has collaborated with the supplier to develop a mixed battery of ternary and lithium iron phosphate and a 100 kWh battery.

The strategy of self-made + external procurement was explicitly proposed at this conference.

(2) From an investment perspective, increase investment in the power battery field.Currently, there is a battery-related team of over 400 members, deeply involved in the research and development of battery materials, cell and pack design, battery management systems, and manufacturing processes, in order to establish the ability to enhance battery systematization and industrialization.

In publicly available information, the battery cell pilot line, cell testing, and research laboratory have been established. Regarding the Pack line, more discussions are taking place on the coverage of 400V/800V systems for charging and swapping.

(3) Design of 800V

The next generation of cars will definitely have an 800V high-voltage swapping and charging platform. I am trying to understand that the current 400V system, together with the SiC driving system, and the 800V system with the SiC system, complements the direction of fast charging and swapping. Currently, there are 960 swapping stations (in 197 cities) and 829 supercharging stations. In the future, there is potential for fast charging, indicating that NIO can use the current system for energy storage and smoothing fast charging power.

(4) In-house Battery Production

Considering that the secondary brand will be delivered in the second half of 2024, the main product is the 200,000 to 300,000 swappable battery architecture. It will use batteries produced by NIO themselves, which will be a great challenge for their battery cost. Whether to choose lithium iron phosphate (LFP) or 4680 batteries for their future productions is something we should pay attention to.

Supply Chain Issues

- Battery Supply

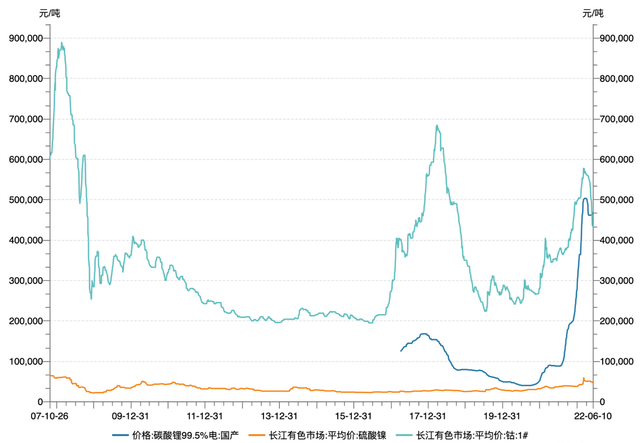

As the second-largest passenger vehicle customer, we have accepted a new agreement, which will link battery costs to raw materials, i.e., battery material costs will fluctuate based on the price index. Specific material pricing indexes have not been disclosed yet, but this data is determined based on the battery material prices of the previous month.

This means that from April, battery prices will be linked to prices, and NIO believes that overall battery material costs will go down, but the specific amount remains uncertain.

- Chips

For NIO, the current demand is not an issue. The main issue is the supply chain, specifically the shortage of chips. Indeed, there is a shortage of uncertain chips during the process of ramping up production.

Currently, most automakers will determine production capacity based on the upstream chip supply situation (basic chips, TI/NXP, etc.). Note: the sampling chip for BMS is also in short supply.

That is to say, there will be a bottleneck list of around one or two dozen chips each month in production scheduling, which will change from month to month.Summary: US-listed companies tend to disclose more information during earnings calls for reference.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.