Author: Li Ka-shing

Editor: Leng Zelin

The formerly inactive Futian has recently become active. On May 3, a virtual product launch was held, during which Lu Qun announced that the company would launch a customized business model, and revealed the upgrade details of the RT customization version K50, as well as the K50 convertible co-creation plan and the upcoming reservation of K20.

On June 6, Futian Automobile’s founder, Lu Qun, brought the company’s second product, the Futian K20, to the online pre-sale launch of a virtual scene.

In fact, this car was released three years ago, but over the years it had disappeared, and many people even thought the Futian brand had collapsed.

The pre-sale price of this car is significantly lower than the previous model, ranging from RMB 86,800 to RMB 149,800, less than a seventh of the K50.

In terms of appearance, according to the official picture, the new car is slightly different from the K20 prototype released in 2019. The differences mainly focus on the front bumper, but the overall design is still quite similar, seemingly reminiscent of a hint of Mazda.

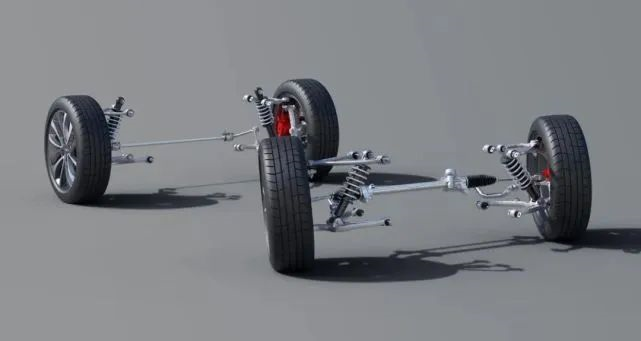

In terms of the car model, the Futian K20 adopts a two-door, two-seat, frameless door, and low-slung design, and also offers a hardtop and convertible version.

In addition, the customized services provided by the Futian K20 to users include color combinations of the body, pattern decorations on the hood, and the colors of the calipers and A-pillars, all of which can be freely selected, and the car will be produced after the selection is completed.

Users can also choose from more than 40 types of car configurations according to their personal driving preferences, including the power system, safety system, lighting, air conditioning, seats and advanced driver assistance system.

In today’s trend of consumer youthfulness, these designs and customization services of the K20 are clearly aimed at trying to capture the young market.

However, customization has its advantages and disadvantages, and in some cases it actually adds to the complexity of purchasing a car, while also requiring the host factory to have strong supply-chain management capabilities.

In fact, what is known as customization is largely similar to a promotional activity, i.e., by offering more accessory options, making consumers pay more money.

New energy vehicle start-ups once conducted research on customized services, but the results were almost fruitless. Take the example of the WmAuto C2M model, which hardly any new energy vehicle start-ups are now mentioning, while it’s the standard features of Ideal Automobile that have won market favor.## Will “persistence” bring a turning point to the future?

Since its establishment, FOMO has always been obsessed with building sports cars, from the K50 priced at over 700,000 yuan to the K20, which starts at just over 80,000 yuan today.

Persistence is great, but from the perspective of consumers and the entire market, FOMO’s strategy may not be reasonable.

Since being founded in 2015, FOMO obtained qualifications from both the National Development and Reform Commission and the Ministry of Industry and Information Technology in 2016 and 2018 respectively. Its first car model, the K50, was launched in August 2018, with a starting price of 6.868 million yuan, representing a relatively smooth process for FOMO.

However, due to the high price of its first product and its niche positioning as an electric sports car, the cumulated sales of K50 were over 200, and FOMO lacked financing support, leading to a broken capital chain and a two-year-long silence.

For new energy vehicle companies, poor initial product sales can have many negative impacts, but it is not an unsurpassable hurdle.

There are many companies launched with similar standings, such as Leap Motor, whose first product, the S01, was an electric sports car, with poor sales.

But the company became more “honest” when it came to the design of its second product, turning to entry-level cars and launching cost-effective models such as T03. Its C11 and C01 have gradually gone back on track, and in April 2022, the company delivered more than 9,000 vehicles, briefly holding the new energy vehicle sales champion title.

For new energy vehicle companies, in the face of a poor start, it is essential to survive the difficult period with strong financial support. But ultimately, only through the product’s competitiveness and strength can they win in the long term.

At present, FOMO is gradually solving its short-term funding problems and has received investment from Tsinghua University alumni. Its future challenges will be in its product development and market strategy.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.