Karakush

It has been almost two years since Volkswagen got into software.

In 2020, a department called Car.Software Organization drew a €7 billion budget cake. Last year, it became an independent European company, renamed CARIAD, with rich information like YYDS, meaning “CAR, I AM DIGITAL.”

Two days ago, this software company officially established its Chinese subsidiary and released its China strategy.

It’s time to remember its name. Its importance is no less than any treasure brand under Volkswagen because Volkswagen has stacked all software-related work on CARIAD.

According to the latest investment plan, Volkswagen’s software budget has doubled to €27 billion over the next five years, and CARIAD can from it gain an average of €2.5 billion per year. With strong monetary investment, they can quickly integrate 15 software companies and have more than 5,000 employees.

You might be calling out, “Don’t bully me for my lack of education. I’ve seen Volkswagen. The digital cockpit is just so-so, and I haven’t heard of autonomous driving. The whole spirit is still in the primary stage of enthusiastically publishing press releases for the successful launch of OTA updates. Investment and output, like Jinlian and Dalang, don’t match like taking medicine.” So, what exactly is CARIAD doing? Why doesn’t it give people the joy of being digitized like Tesla or Chinese leading new forces? Does the slow-moving Volkswagen just go straight to garbage classification?

Software Construction Starting From Bottoms-up

To understand the means, we must first understand the purpose.

CARIAD wants to build Volkswagen’s full-stack software technology development capabilities, rather than just implement scattered functions that align with market competitors.

This requires a clean sheet of paper, including designing and developing ideas and technical systems from scratch. For traditional automotive companies, the advantages that can be inherited onto software are limited to familiarity with automotive complexity. Over the past two years, Volkswagen has clearly put a lot of effort into organizational infrastructure, and their efforts have mainly been reflected in three simple and boring aspects:

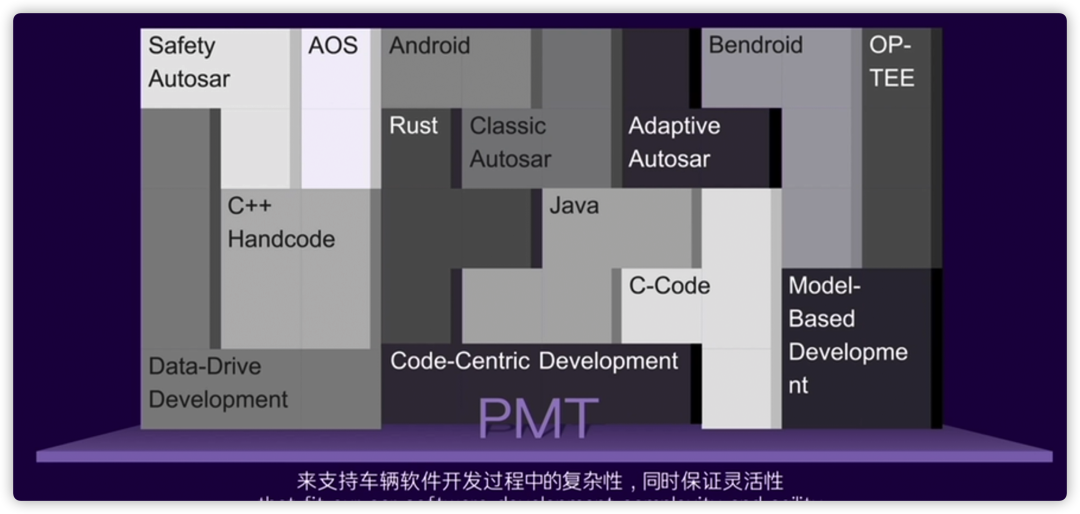

First, it is the Process Management Toolchain (PMT), which includes more than 50 customized and self-developed tools, supporting various technology stacks and development languages. It can address the needs of developing vehicle operating system platforms, in-vehicle applications, and cloud services, all in a one-stop-shop, and ensure that the delivered software is consistent, transparent, rapid, and compliant. Currently, in its primary version, it effectively improves software development efficacy:

Translate the following Chinese Markdown text into English Markdown text professionally, retaining the HTML tags inside the Markdown, and outputting the result only:

Translate the following Chinese Markdown text into English Markdown text professionally, retaining the HTML tags inside the Markdown, and outputting the result only:

For example, in the past, if the demand changed in development, it would make the product manager feel painful because the software requirement document for car parts was smelly and long, and the dependency and causality between paragraphs was complex. A small change could affect multiple documents and subsequent steps. PMT can automatically track changes and improve the agility and flexibility in the face of changes.

Another example, in the past, after the programmer finished writing the code in the local environment, it had to go through the integration process to merge the code into a testing branch and complete a series of checks before being allowed to move on to the next step of testing. PMT can complete this process with one click to automate a lot of manual operations.

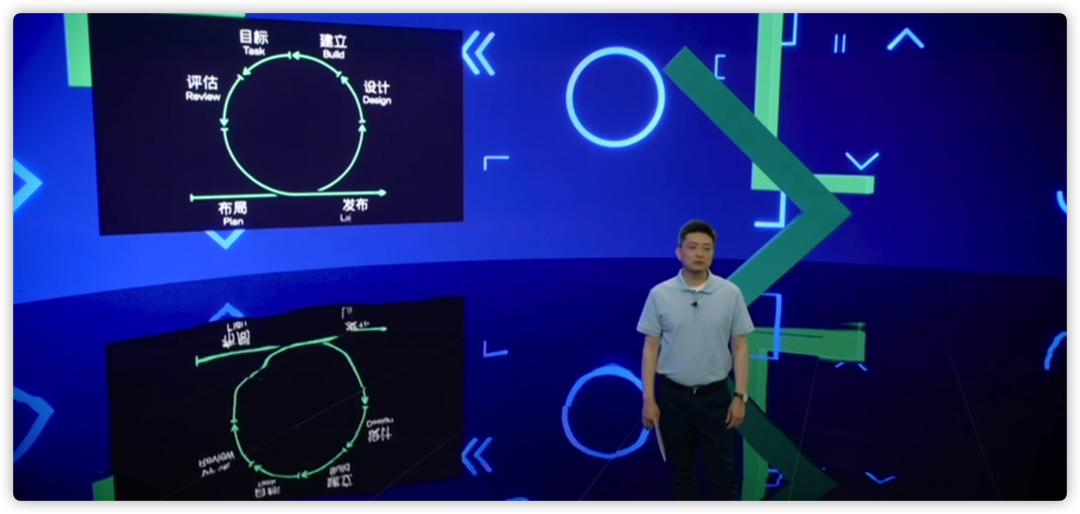

Second, it is to establish a faster software development process. Software cannot still follow the 3-5 year development rhythm of the automotive industry. CARIAD adopts a rolling innovation process called “Forward” to integrate new projects into the product line on a quarterly basis. In the first quarter of this year, there were more than 80 proposals for the first “Forward”, including 6 projects with the most market potential, planned to be developed in the next 3-6 months.

These projects can be in various fields such as ADAS, intelligent cockpit, remote services, basic infrastructure. For example, there is a “Rainbow” project that provides a toolbox for freely combining vehicle functions, which can quickly customize new scenario applications.

Similar tools have been seen on competitor platforms. Volkswagen has used it to create something interesting, that is, when you sit in the car, the car will automatically configure the digital elements of the central control screen theme, ambient light, music, etc. based on the color and style of the clothes you are wearing, to match your OOTD.

Its foundation is a flexible technical architecture. This is included in CARIAD’s current main task, which is (third) a software platform suitable for all brands under the group.

In addition to a unified and scalable architecture, the platform also includes Volkswagen’s self-developed operating system VW.OS and Volkswagen’s car cloud VW.AC.

We can consider “Rainbow” as the primary version of the architecture, which integrates dozens of electronic control units into several domain controllers, such as ICP acting as the intelligent cockpit domain controller, carrying related software operations and updates. Other sensors and controllers, including in-cabin cameras, air conditioning, and ambient lighting, are accessed by the Zonal Controller to the software operating system.

We can consider “Rainbow” as the primary version of the architecture, which integrates dozens of electronic control units into several domain controllers, such as ICP acting as the intelligent cockpit domain controller, carrying related software operations and updates. Other sensors and controllers, including in-cabin cameras, air conditioning, and ambient lighting, are accessed by the Zonal Controller to the software operating system.

This architecture can support more flexible software definition, compositional development, and continuous iterative updates, simplifying the service issues brought by complex integration of multiple ECUs, and there is a great opportunity to reduce approximately 55% of the wiring harness on the current body.

A more mature and complete platform will be launched around 2025.

Before that, CARIAD is still working towards OTA updates. The ID series in China will achieve the first OTA update in the second half of this year. In the next two years, high-end software for the PPE platform will be launched, including “advanced information and entertainment systems and advanced driving assistance systems,” as well as OTA updates on Audi and Porsche…

After that, there doesn’t seem to be any high-energy warnings from current efforts.

Whether it’s tools, processes, or platforms, the essence is to make distant and upstream preparations for improving development speed, like running to raise chickens before eating fried chicken. However, under the premise of enterprise-level large-scale agile development, the chicken dinner curve has its significance. Because software, even more than traditional automobile manufacturing, can generate higher economies of scale.

No longer a second-class department

Software is certainly an economic account.

It is relatively expensive in automobiles, especially as a one-time expense. Purchasing software with embedded systems inevitably results in huge waste because the basic software stacks are highly similar. Doing your own software stack, even though the initial investment is enormous, is advantageous when spread over long-term economic value.

This is also the basis for Volkswagen to build a common software platform, maximizing the commonality of scale. One of its goals is to run the CARIAD technology stack on more than 40 million vehicles worldwide by 2030, with internal software development accounting for 60%, compared to only about 10% currently.

For all giant corporations, the synergistic effects and economies of scale are both valid.# Translate Markdown Chinese text to English Markdown text

Stellantis, another car group, will base its 14 brands on four electric vehicle architectures and three software platforms in the future. Tang Wei said that this sharing can make Stellantis 30% more efficient than its competitors, reduce the cost of electric vehicles by 40%, and ensure that the overall breakeven point is at 50% of the shipment volume. Stellantis expects to achieve five billion euros in merger synergy by the end of 2024.

At the same time, “soul” is also a problem. At an internal meeting last year, Diess emphasized to managers that if Volkswagen wants to maintain independence, it must be able to develop software in cars itself, and cannot transfer data sovereignty, interface, or the final “brain” to large technology companies. “For us, this is the only way to ensure long-term success.”

“On a unified platform, brands have tools and freedom to differentiate between sport/comfort/luxury positioning.” Differentiating cars in the future will become more difficult, it is already difficult, and everyone is half-siblings, but it is still very likely to be achieved through software.

In the traditional business model of car companies, software is considered as a subordinate department of hardware. However, today’s software is in a core position in terms of economic benefits and the relevance to defining the brand. Volkswagen’s software service revenue will account for more than one-third in ten years.

Last week, Volkswagen’s board of directors met in Berlin and aligned the group’s new business model: as a vertically integrated mobile travel company, consisting of five components: brands, platforms, software, batteries, and travel solutions. CARIAD, as a software development entity, will coordinate and make decisions with the supervisory board and working committee. Competing with opponents like Apple, Google, Mobileye, and Tesla.

The three pictures leaked during the meeting were scrutinized by everyone repeatedly because of Chinese names such as NIO, XPeng, BYD, CATL, and Foxconn. Even though they are far away, they are still electric car powers.

China’s role

This year, Volkswagen’s three key tasks are: CARIAD, China business, and business model.

CARIAD China is obviously an implementation action. This is CARIAD’s first branch outside of its headquarters in Europe. The Chinese team will lead 70% of the research and development work involving the entire new software platform technology stack and product line, including local R&D and adaptation.

The visible reason needs no explanation. China is very important and is Volkswagen’s most important market outside of Europe, accounting for 40%.The overlooked issue here is talent reservoir. By 2030, the high demand for software in the automotive industry will increase the demand for software engineers by three to four times, forcing car companies to compete with tech giants and participate in the war for talent.

Brands like Volkswagen have a poor image among young programmers in Europe due to their ingrained hierarchical systems, bureaucratic processes, lack of professional upward mobility, powerful labor unions, and unattractive locations like Wolfburg and Ingolstadt.

However, there have been some improvements, such as CARIAD, which has a trendy work culture that can be seen on its website. In our previous piece “Volkswagen’s Big Bet on Software,” we mentioned that the company has invested in programming schools that anyone over 18 can attend without requiring prior experience, training them in basic software development over two years. Many of the students come from Volkswagen’s blue-collar production lines and switch careers after graduation.

Similarly, Stellantis, as mentioned earlier, created a similar software academy in February aiming to train 1,000 software engineers each year. Car companies are pressured to engage in education, reflecting the dire situation in Europe in terms of constructing software resources. The European Commission estimates that Europe currently needs 500,000 IT professionals. That’s why global expansion has become a solution, such as CARIAD in China, whose team has already grown to over 600 individuals, primarily by integrating the existing talent from Volkswagen and Audi. The number is expected to double by the end of 2023. Over 90% of them will be local software professionals, ultimately establishing a nationwide distributed research network.

In addition to a larger population base, Volkswagen is also looking for specific software capabilities in China and the United States that cannot be found in Europe. For example, OOTD’s application is clearly a Chinese invention.

To put it into perspective, it is unrealistic to expect Europeans to develop something like in-car TikTok.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.