Translated English Markdown Text:

贾浩楠 发自 副驾寺

智能车参考 | 公众号 AI4Auto

Volkswagen Group has just made a big move: establishing the CARIAD China branch.

Who is CARIAD? It is the software subsidiary of Volkswagen Group, which focuses on intelligence and is led by CEO Herbert Diess.

However, unexpectedly, CARIAD’s role is not a “supreme emperor” located at the headquarters in Germany, but instead is entering the world’s largest intelligent vehicle market – China, where it is establishing a subsidiary.

Among all Chinese joint venture car companies, Volkswagen is the first to promote intelligent transformation in the form of a separate subsidiary.

And at the traditional automaker level, Volkswagen is also the first player to elevate software development to such a high level.

Why was CARIAD created and what will it do? What can it bring to Chinese Volkswagen owners?

Volkswagen China seeks “autonomous substitution” of intelligence

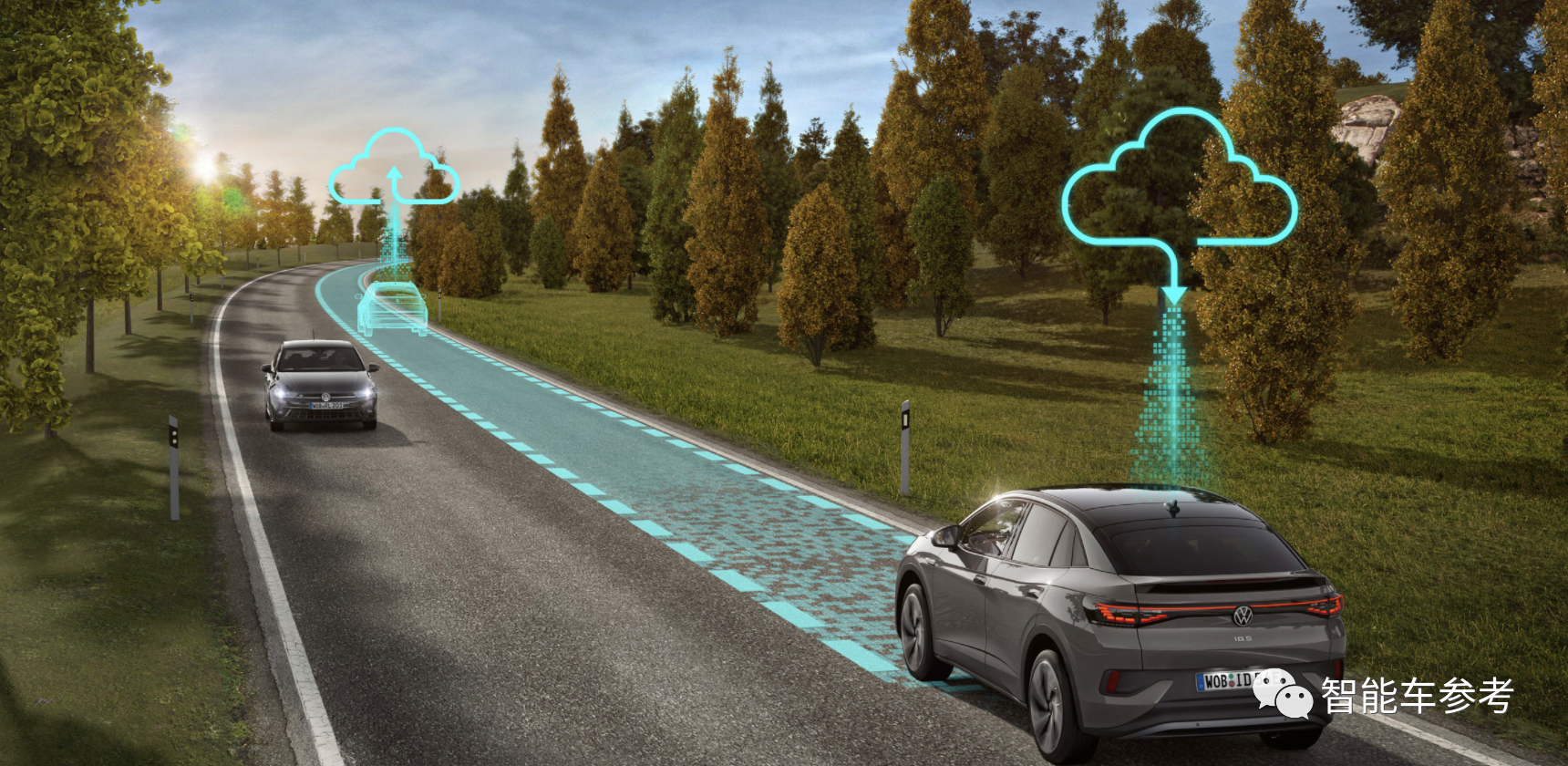

The official statement by the establishment of the CARIAD China branch aims to “develop software products for Chinese consumers,” including a new unified and extendable software platform, advanced driving assist system (ADAS) and autonomous driving, and the next generation of intelligent interconnectivity.

From this statement, it can be seen that CARIAD China is a large and comprehensive automotive intelligence supplier whose products include autonomous driving, intelligent cabins, V2X, and underlying software architecture.

This also implies that Volkswagen is trying hard to achieve “autonomous substitution” of intelligent capabilities in the Chinese market, no longer purchasing an off-the-shelf vehicle or ADAS and simply adding it to finished cars.

Who will lead CARIAD China? Volkswagen has provided the following options on a global and technical level:

CEO Chang Qing, who graduated from Nanjing University of Science and Technology and the University of Stuttgart, joined Volkswagen Group in 1990 and has presided over chassis development, whole vehicle engineering, Volkswagen Group platform construction and other work. Since 2020, Chang Qing has been responsible for products in CARIAD.

# CARIAD China’s Product Requirements from the Perspective of China’s Intelligent Automotive Revolution

# CARIAD China’s Product Requirements from the Perspective of China’s Intelligent Automotive Revolution

CTO Sun Wei, a doctoral graduate from Beijing Institute of Technology and with 16 years of experience working at IBM China Research Institute, has been responsible for software R&D and delivery of many projects related to car networking and smart transportation. In 2017, Sun Wei joined Volkswagen China, where he led the R&D of early connected-car and smart mobility projects.

Two key positions at CARIAD China were filled by individuals familiar with China’s automotive industry and market, which was officially explained as “faster response to local market demands.”

As CARIAD China Branch primarily serves the Chinese market, are the demands of Chinese users clear?

From the perspective of China’s current intelligent automotive revolution, CARIAD China’s products should meet several key standards to justify Volkswagen’s establishment of this new joint venture:

- Core Capability Intelligent Driving: Since CARIAD China has already proposed independent R&D, at the very least, it should start with advanced assisted-driving functions as a basic requirement.

Because whether autonomous or joint venture, L2 features are already standard, and most of Volkswagen China’s models come equipped with L2 functions.

If CARIAD China focuses on lower-level assisted driving, it will not only be reinventing the wheel but also affect existing supplier relationships from an internal perspective, and will not be viewed as advanced externally.

- Intelligent Cockpit: Volkswagen’s electric transformation’s flagship ID series has been criticized for having the slowest infotainment system, inaccurate voice recognition, complex operating logic, etc. However, most traditional automakers face this problem during their transition.

Therefore, in terms of the intelligent cockpit, CARIAD China’s minimum goal is not pursue new forces, but to achieve a smooth and user-friendly experience, which will already be considered effective.

- Bottom-Level Infrastructure: In fact, it can be divided into two parts, specifically the intelligent automotive bottom-level electronic and electrical architecture for communicating between the “brain” and execution components of the intelligent automobile, and the software architecture built upon it.

Volkswagen Group has developed the MEB platform for pure electric vehicle models, and the debut of the ID series has been relatively successful globally, with the next generation of MLB platforms in the pipeline.Therefore, the goal of CARIAD China is likely to be to develop the SOA software platform that will be widely adopted for intelligent electric vehicles in the future, achieving functions such as software and hardware decoupling, rapid development, and support for multiple application ecology.

In summary, the positioning and responsibilities of CARIAD China are clear:

As a subsidiary of Volkswagen software, it directly faces the demands of the Chinese market and plays a key role in Volkswagen’s competition with new forces in China.

Here, there is a software subsidiary under the Volkswagen Group, which is personally led by Volkswagen’s CEO.

This move is still very unique in traditional car companies.

What does Volkswagen CARIAD want to do?

CARIAD means “Car. I Am Digital”, and its predecessor is the “DCS” software department established by CEO Herbert Diess when he was leading Volkswagen’s digital transformation.

Software has always been Volkswagen’s weakness, but it is also the core of intelligent transformation. With Diess pushing for Volkswagen’s reform, leading CARIAD is the best fit.

CARIAD currently has 5,000 engineers and developers worldwide. In terms of investment, Volkswagen will invest up to 30 billion euros in the next 5 years.

With the team, money, and top leader in place, CARIAD’s goal is to build a unified software platform for all brands under the Volkswagen Group by 2025, including a unified and scalable architecture.

It can be simply understood as Volkswagen’s own “Android”, on which brands such as Volkswagen, Audi, Porsche, etc. can perform secondary development to form software applications that meet their brand positioning.

Whether it is self-developed or purchased, Volkswagen’s different brands’ autonomous driving and intelligent cockpit functions will all be based on this platform. This is actually the same nature as SAIC’s self-developed “Zero Bundles” software platform.

However, SAIC clearly stated that it is doing “store assistant” by purchasing and providing functional suppliers, while Volkswagen has greater ambitions.

Previously, Smart Car Reference has synchronized the news of the major updates to the intelligent functions of the Volkswagen ID series electric vehicles. From the content, it covers autonomous driving, intelligent cockpit, high-precision maps, and so on.

And the update frequency even once surpassed Tesla, which at least indicates that Volkswagen has established its own data closed-loop system and iteration capability in the field of intelligent research and development.Perhaps there is still a big gap between user requirements and the specific experience of autonomous driving and smart interaction in Volkswagen, but the algorithm team and technical expertise are already in place.

After all is said and done, we can now evaluate Volkswagen’s intelligent transformation:

First and foremost, their understanding is the clearest and their attitude the most resolute.

While all other traditional car manufacturers are still promoting the software of intelligent vehicles as part of their secondary or tertiary departments, and some even fantasize about solving the problem by relying on their old ways and procurement, Volkswagen first realized the importance of “software-defined cars” and unprecedentedly promoted their software department to the same level as the entire vehicle and chassis, with the head of the company personally leading the effort.

Second, their results are the most significant and their progress the fastest.

At the market level, the pure electric ID series can be considered a success worldwide. In terms of product development, although the intelligent experience is still far behind, Volkswagen has not been like other traditional car companies that are still using oil-to-electricity conversion or L1 systems to cater to their users. Instead, they have come up with a “complete” new energy, intelligent vehicle.

Of course, Volkswagen’s transformation from industry giant to innovator will not be without its difficulties, especially internally.

First, reformer and Volkswagen CEO Herbert Diess’s leadership has shrunk dramatically after several scandals. Apart from the software department, he has lost decision-making power in other major departments.

Second, its large number of employees and unions pose huge obstacles to Volkswagen’s transformation to advanced manufacturing of automation and unmanned production, and currently, there seems to be no solution in sight.

Finally, can Volkswagen’s intelligent technological strength hold up against Tesla and other new competitors in the market? After all, just having a team and technical expertise is not enough. An insufficiently intelligent vehicle is equivalent to an entirely unintelligent car.

Nevertheless, Volkswagen’s actions still have significant implications, especially for the transformation of the century-old automotive industry.

New trends in traditional automakers’ transformation

The establishment of Volkswagen’s CARIAD China Branch is a new attempt at traditional car manufacturers’ intelligent transformation:

Localize their research and development work in the domestic market.

This move is a quick response to the poor performance of the ID series in terms of software, which has been criticized by domestic users.

Furthermore, there are at least three other meanings behind this move.

Firstly, there is a strong presence in China, the world’s largest automobile market and also the fastest growing market for intelligent vehicles. This presence is not about sticking to the old ways and displaying an air of superiority by driving foreign cars, but about transforming into a technology enterprise.

Firstly, there is a strong presence in China, the world’s largest automobile market and also the fastest growing market for intelligent vehicles. This presence is not about sticking to the old ways and displaying an air of superiority by driving foreign cars, but about transforming into a technology enterprise.

Secondly, Chinese consumers have the highest level of recognition and acceptance towards intelligentization, and the widespread popularity of intelligent vehicles in China provides a competitive environment for automotive companies to understand and quickly respond to real market needs, while also being able to gain the fastest access to learn the latest technology and recruit the best AI talent.

Lastly, and most importantly, CARIAD’s first subsidiary was established in China, as the Volkswagen Group hopes to develop a team, system, and technological reserve to compete head-on with new players like Tesla in the intelligent automobile revolution in China, in turn feeding back into Volkswagen Group’s transformational undertakings.

After all, Europe is not that interested in intelligent vehicles, and North America is still dominated by Tesla…

Volkswagen is now playing with its cards on the table when it comes to transforming into an intelligent enterprise.

Finally, Volkswagen’s all-electric ID models have been sold in China for more than a year now. Is it one of your considerations when buying a car? Or do you know someone who already owns an ID? Please share your experience!

— The end —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.