Recently, news from 36Kr revealed that NIO and Farasis had finalized their partnership before Chinese New Year, adopting BYD’s lithium iron phosphate battery. Around the same time, Xiaomi’s car division had also signed a deal with Farasis.

In mid-March, photos circulated on social media of Lei Jun accompanying William Li on a visit to NIO’s Hefei plant, leading many to speculate that the two companies had already formed a partnership.

Many were surprised that NIO and Xiaomi, two new entrants in the auto industry, suddenly chose to adopt BYD’s batteries, but in early 2021, Wang Chuanfu, the CEO of BYD, boldly declared, “Almost every car brand you can think of is in talks with Farasis.”

In 2019, BYD spun off its battery business to establish Farasis. The entire lineup of the FAW Hongqi E-QM5 is currently equipped with Farasis’ blade batteries, and some of Changan’s pure electric models, as well as the Jinlong and Beiqi models, will also use blade batteries. The domestic production version of Toyota’s electric SUV, the bZ4X, is expected to use BYD’s blade batteries, and BYD is even responsible for the vehicle’s production.

Why have major automakers suddenly turned to BYD? First, we need to delve into the story of the battery giant that cannot be avoided, Ningde Times, and the history between domestic ternary lithium and lithium iron phosphate batteries.

It’s tough being “Ning” in the world for so long

For every automaker that wants to make new energy vehicles, it’s hard to ignore Ningde Times. During the start-up phase, the company received an order from one of the BBA giants, BMW, and then dominated the ternary lithium market.

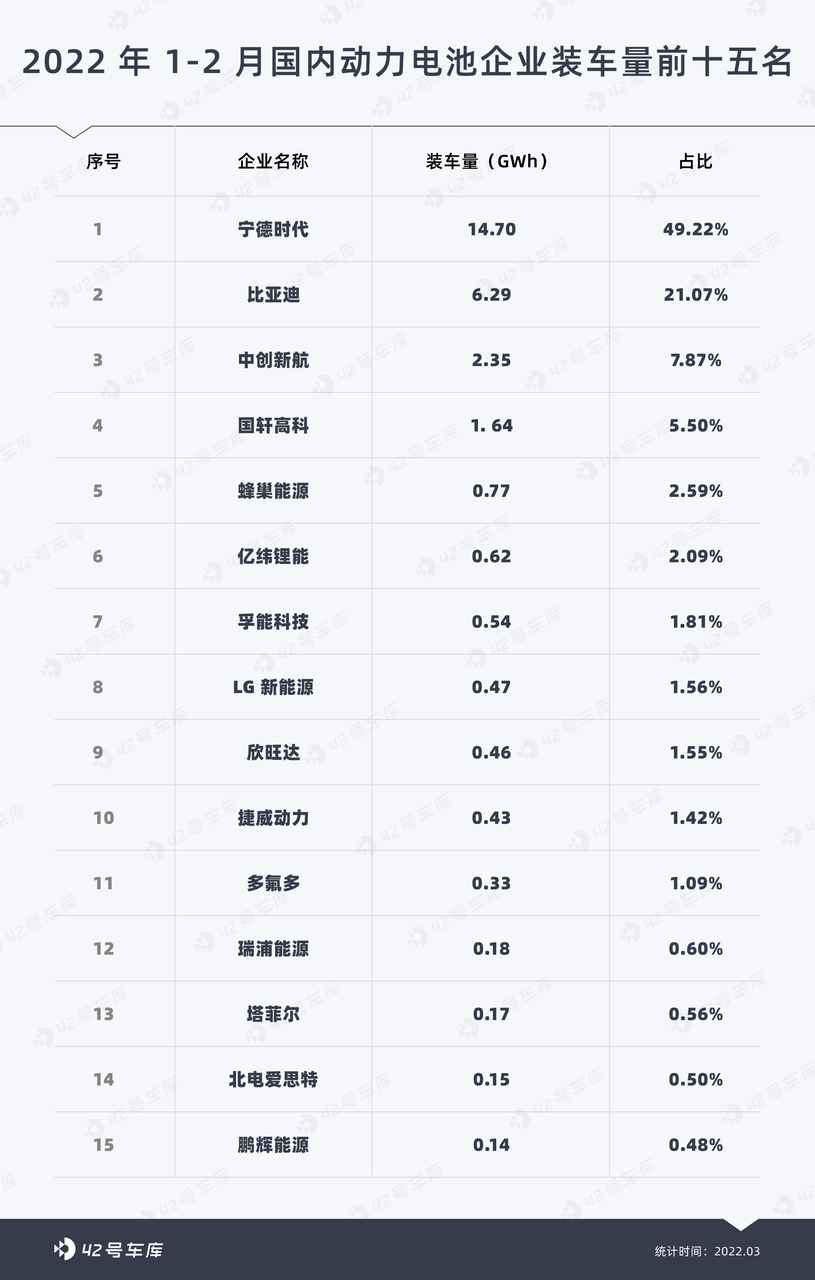

Under the vigorous government subsidies, various “cheating subsidies” irregularities frequently occurred. In order to avoid subsidizing the backward production capacity and technology with real money, the country began to raise the threshold for battery energy density and vehicle range. At that time, it was difficult for Lithium Iron Phosphate batteries to meet the standard, and CATL, who focuses on development and production of ternary lithium batteries, took off. It became the world’s leading company in terms of installed capacity of power batteries for five consecutive years. In 2021, its installed capacity accounted for about one-third of the world’s total, and its market value even exceeded one trillion. In the industry, it was called “Ning Wang”.

Under the vigorous government subsidies, various “cheating subsidies” irregularities frequently occurred. In order to avoid subsidizing the backward production capacity and technology with real money, the country began to raise the threshold for battery energy density and vehicle range. At that time, it was difficult for Lithium Iron Phosphate batteries to meet the standard, and CATL, who focuses on development and production of ternary lithium batteries, took off. It became the world’s leading company in terms of installed capacity of power batteries for five consecutive years. In 2021, its installed capacity accounted for about one-third of the world’s total, and its market value even exceeded one trillion. In the industry, it was called “Ning Wang”.

However, for automakers, especially new forces in the auto-making field, monopolized battery manufacturers is definitely not a good thing. New forces such as NIO, XPeng, and Ideal, and even some traditional OEMs, all appear weak when facing CATL. Paying high premiums for batteries, making advanced payments, and queuing for production capacity are basic operations. In the middle of 2021, there was even news of “He XPeng and Zeng Yuqun quarreling”. Although He XPeng himself later refuted the rumor, the fact that automakers have suffered from “Ning Wang” for a long time is objective.

Lithium Iron Phosphate overtakes Ternary Lithium, BYD welcomes spring?

With the substantial reduction of national subsidies and the rapid development of battery technology, Tesla, as an industry pioneer, has also begun to use Lithium Iron Phosphate batteries in its best-selling Model 3 and Model Y. Suddenly, people realized that Lithium Iron Phosphate is the “real deal.” Firstly, with the application of CTP and other technologies, the energy density of Lithium Iron Phosphate has been significantly improved, coupled with advantages such as not easily losing control in high heat, high cycle life, and low cost, its market share has surpassed ternary lithium batteries.

In 2021, Lithium Iron Phosphate’s installed capacity reached 79.8 GWh, a YoY growth of 227.4%, accounting for 57.1% – nearly sixty percent – of the market share, surpassing ternary lithium batteries. In January and February of this year, the installed capacity of Lithium Iron Phosphate reached 8.9 GWh and 7.8 GWh, respectively. During the same period, the installed capacity of ternary lithium batteries was 7.3 GWh and 5.8 GWh. Whether it is market share or growth rate, they are both behind Lithium Iron Phosphate. People’s preference for Lithium Iron Phosphate is still continuing.

Being a long-time researcher focused on lithium iron phosphate (LFP) batteries, BYD (which also supplies Ford Mustang Mach-E with ternary lithium batteries) has exceeded 20% of China’s domestic battery market share with its own products in January and February 2022, reaching 21.07%, closing the gap with “King Ning” (CATL).

Meanwhile, BYD’s expansion is still accelerating. In 2021, BYD expanded eight production bases in Shandong Jinan, Anhui Wuwei, Jiangsu Yancheng, and Hubei Wuhan, with a total incremental capacity of 205 GWh. In January 2022, the Xiangyang plant with 30 GWh capacity landed with a total initial investment of CNY 10 billion. In February, the Changchun plant, with 45 GWh capacity, was officially under construction. In March, the Huangpi plant in Wuhan began construction with a project investment of CNY 10 billion.

Data shows that BYD’s battery production capacity is expected to reach 285 GWh and 430 GWh in 2022 and 2023 respectively, compared to the global total installed capacity of power batteries of 311.1 GWh in 2021, expecting to reach 1,096 GWh of battery production by 2023.

By 2023, BYD’s planned production capacity is expected to account for 40% of the world’s total, but will its blade battery’s competitive edge keep up with such ambitious goals?

What about the competitive strength of Blade Batteries?

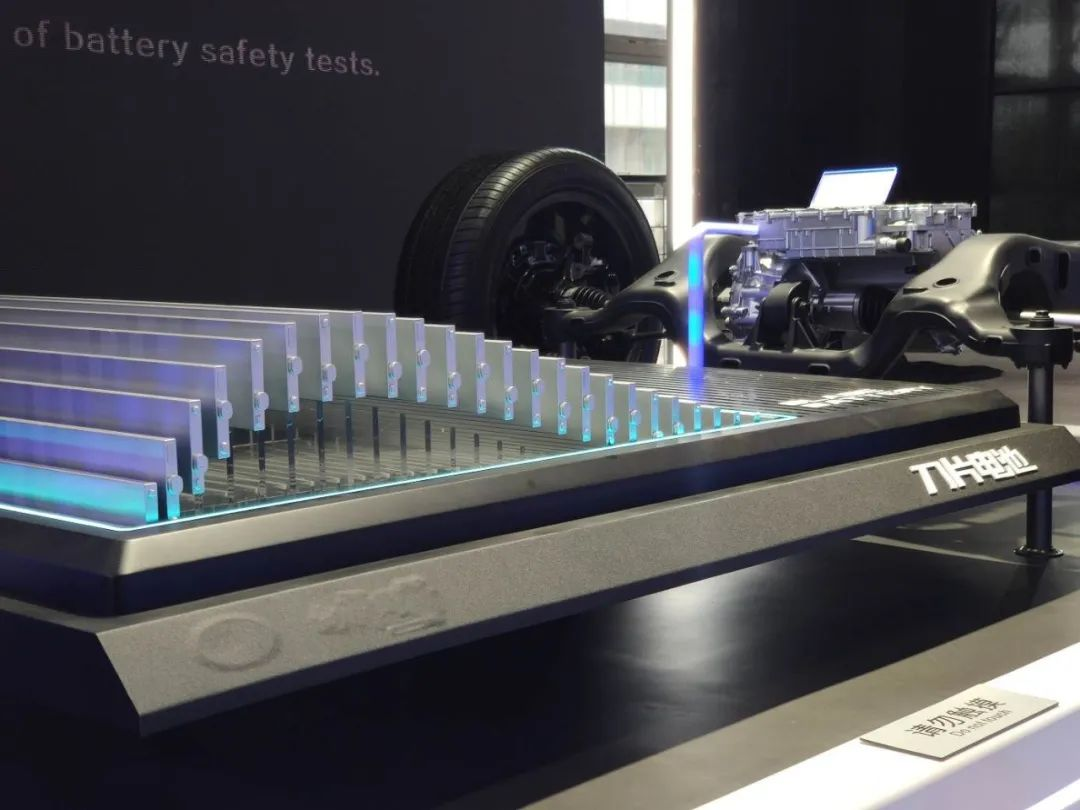

Even for the same type of battery, the technical paths and final effects vary greatly among different manufacturers, and Blade Batteries is significantly different from ordinary lithium iron phosphate batteries.

First of all, through structural innovation, Blade Batteries has achieved the power density and energy density of the battery which is equivalent to ordinary ternary lithium batteries. To some extent, they make up for the inherent shortcomings of lithium iron phosphate batteries. The specific energy density of mainstream NCM 523 ternary lithium batteries is around 160 Wh/kg, and the specific energy density of 811 ternary lithium batteries can reach around 180 Wh/kg. The quality energy density of BYD Blade Batteries can reach 140 Wh/kg, with a very small gap. At the same time, the volume energy density is easily ignored, and the system volume energy density of Blade Batteries can reach 247 Wh/L, which is not much different from ordinary ternary lithium batteries.

To achieve these parameters, it is inseparable from the structural innovation of the blade battery. First of all, this strip-shaped single cell itself is an ultimate CTP “module-less” structure. To make an analogy, the battery is an egg, and the module is the tray for holding eggs. Now, the blade battery not only eliminates the tray, but also makes the egg into a blade shape, which can naturally accommodate more “eggs” in the same chassis space.

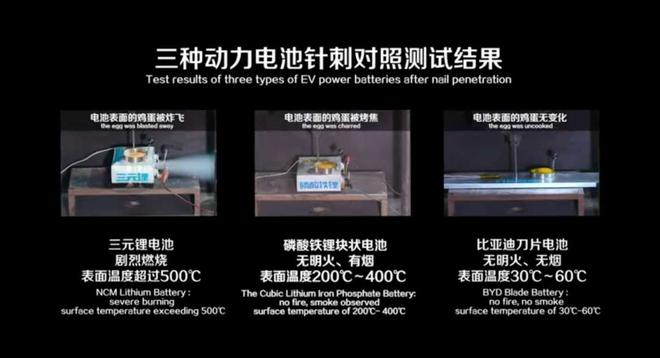

Solving the most critical problem of energy density, the blade battery has also made further progress in safety. It is believed that the “needle puncture test” has already penetrated into people’s hearts. There is the innate advantage of phosphate iron lithium batteries with high thermal runaway temperature, and there is also the acquired effort of the blade battery’s long strip structure with large heat dissipation area, long circuit loop, and low heat generation capacity.

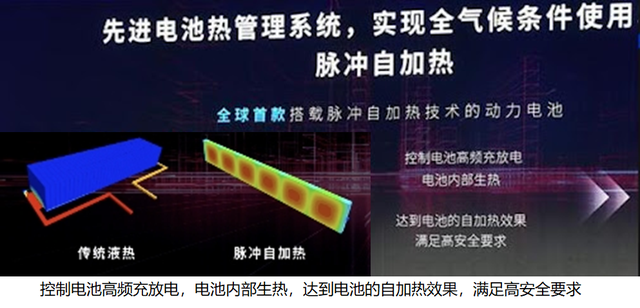

In addition, low temperature has always been one of the biggest nightmares of phosphate iron lithium batteries (ternary lithium batteries are also afraid of low temperature, but they are better than phosphate iron lithium batteries). Therefore, the battery’s temperature control technology is very critical. The BYD blade battery not only uses a relatively efficient “cold refrigerant direct cooling,” but also uses the battery’s pulse self-heating technology, which is equivalent to not adding extra clothes in winter, but using the self-movement of the battery cell to generate heat to prevent low-temperature polarization and allow the battery to enter the appropriate temperature. In some professional media tests, the Han EV has a higher “driving range completion rate” than many ternary lithium battery models in winter.

Of course, do not mythicize the blade battery. In last year’s “DCDB” program, the BYD Han EV caught fire on its own 48 hours after colliding with the Alpha S from Lynk & Co, and the safety of the blade battery has been questioned by many people.

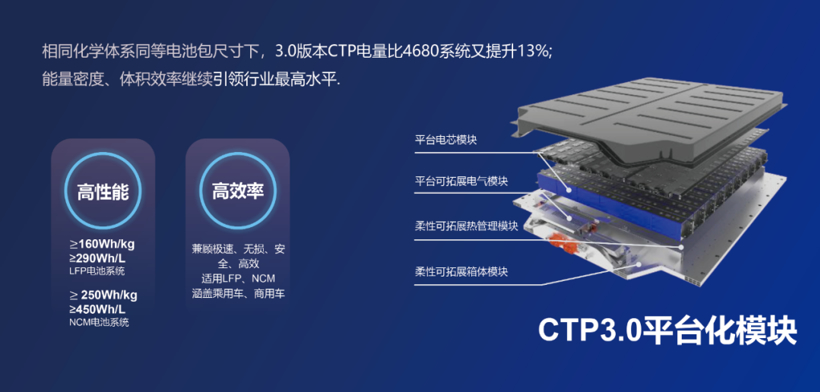

At the same time, there are many rivals for blade batteries. Tesla’s 4680 battery has already begun trial installation and its combination with CTC technology will trigger a new “arms race”. At the just-concluded EV100 Forum 2022, CATL proposed its third-generation CTP technology-the Kirin Battery, which has a 13\% higher capacity than the 4680 battery. At the conference, BYD Battery, EVE Energy, and Panasonic also expressed their optimism for large cylindrical batteries, namely 46 series cylindrical batteries.

Both the Kirin and 46 series batteries are theoretically innovative in structure, and can accommodate both ternary lithium and lithium iron phosphate, putting pressure on blade batteries. Currently, there are reports that BYD’s second-generation blade battery is already under development, and its system energy density can reach 180 Wh/kg. The competition in the future battery technology route will be very intense and exciting.

Will BYD become the Samsung of the Automotive Industry?

For many years, the question of who is the “Huawei” in the automotive industry has been debated. In fact, BYD and Huawei have many similarities, such as being “self-developed maniacs”. Wang Chuanfu has also made a bold statement: “not only can we make batteries, but we can also make motors and controllers. Currently, BYD is the only one in the world that can do it all.”

However, at Huawei’s recent annual report meeting, rotating chairman Guo Ping reiterated that “Huawei will not make cars”. Therefore, I believe that BYD at this time is more like wanting to become the “Samsung” of the mobile phone industry.

Firstly, Samsung is not only the world’s largest smartphone manufacturer in terms of shipments, but also a supplier of core components such as memory, screens, and chips, with many self-owned smartphone brands using Samsung’s screens and memory as a selling point.

Currently, BYD’s battery business and semiconductor business have already been split and are waiting to be listed, and other departments such as auto parts, in-car software, and molds may also go down the path of spin-off and independence in the future.

Therefore, BYD is not only an OEM manufacturer with increasing sales (February sales exceeded SAIC Volkswagen), but is also gradually becoming a Tier 1 level supplier.

Of course, there are significant differences between cars and mobile phones, and Samsung’s market share overseas is difficult for companies like BYD to match. Of course, BYD and other domestic brands are also striving to catch up. For example, BYD’s commercial buses have begun to spread to major countries such as Europe, Japan, the United States, and Canada, while passenger cars have been stationed in Norway, the Middle East, South America and other places. At the same time, in 2021, they began preparing to establish a battery factory in Europe, and PSA, Mercedes-Benz, BMW, and others may all be potential customers of BYD.

Of course, there is also an aspect of Samsung that BYD and other companies cannot reach in the short term. Samsung’s mid-to-high-end products are selling very well. In addition, the chips and screens they provide are high-end and high-premium products. For example, the biggest selling point of the recently popular Redmi K50 is Samsung’s E4 2k screen. According to insiders, BYD has given a lot of discounts in the commercial terms they provided to Xiaomi and NIO. In short, BYD is still emphasizing “cost-effectiveness” with its blade battery. NIO and Xiaomi are expected to use BYD’s blade battery for mid-to-low-end products, while high-end products may continue to purchase other brands of ternary lithium batteries.

Overall, it is not surprising that Xiaomi and NIO will purchase BYD’s blade battery. With the widespread recognition of lithium iron phosphate in China, the next few years will still be a period of rapid expansion for BYD, and Fudi battery is on its way to becoming the “second Ningde era”.

Finally, welcome everyone to download the Garage App to learn about the latest new energy information. If you want to have more timely communication, you can click here to join our community.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.