Author: Zhu Yulong

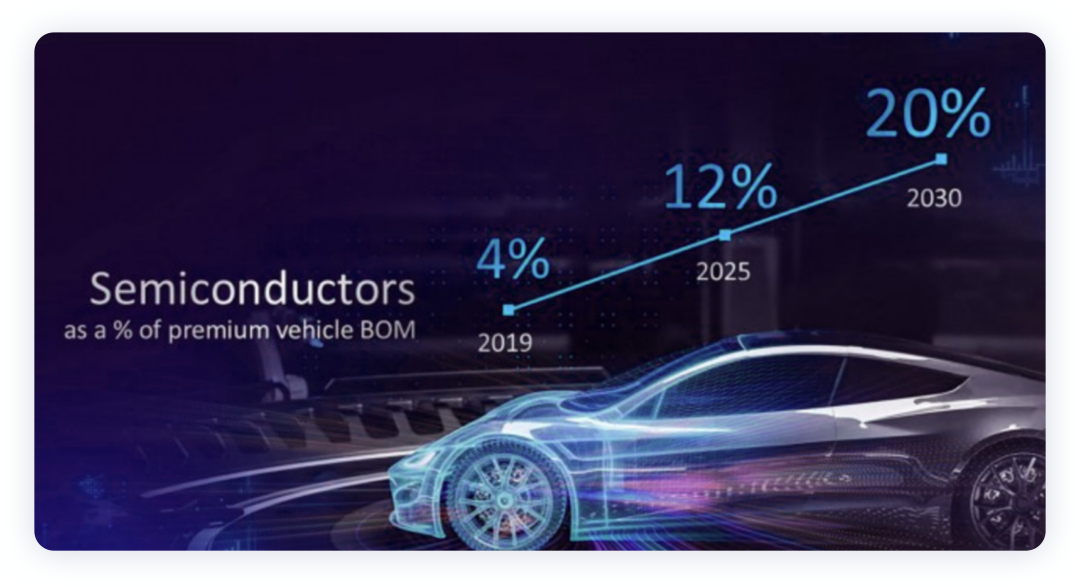

At last year’s International Motor Show Germany, Intel CEO Pat Gelsinger made an interesting prediction in his keynote speech: By 2030, chips will account for more than 20% of the Bill of Materials (BOM) for high-end cars, a five-fold increase from 4% in 2019. By 2025, it will account for 12%, and this trend of increasing chip demand will continue in all industries globally. This is worth discussing.

Can it be 12% by 2025?

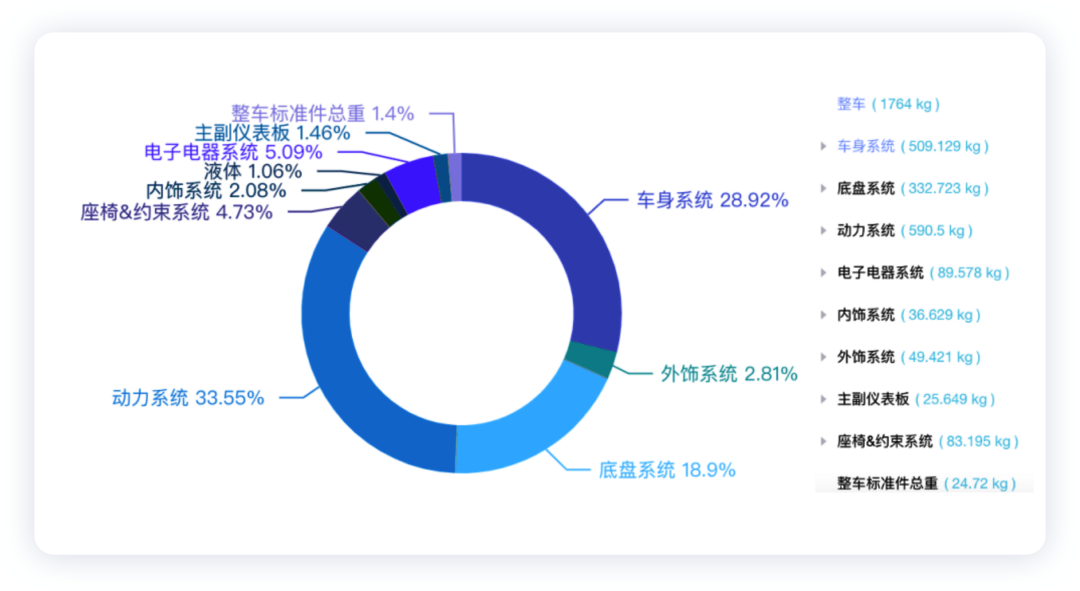

Taking the 1764-kilogram Model 3 as an example, many automakers have previously compared vehicle prices per kilogram to that of crayfish. If we look at it by system and subdivision and assume that the 60-80 kWh battery accounts for about 40% of the Model 3’s entire BOM cost, even if the semiconductor accounts for another 20% (even by 2025’s estimate of 12%), the other various components, which account for less than half of the cost, would account for about 70% of the entire vehicle weight.

Note: To be honest, the current trend is indeed to invest in the value-added part of semiconductors and software.

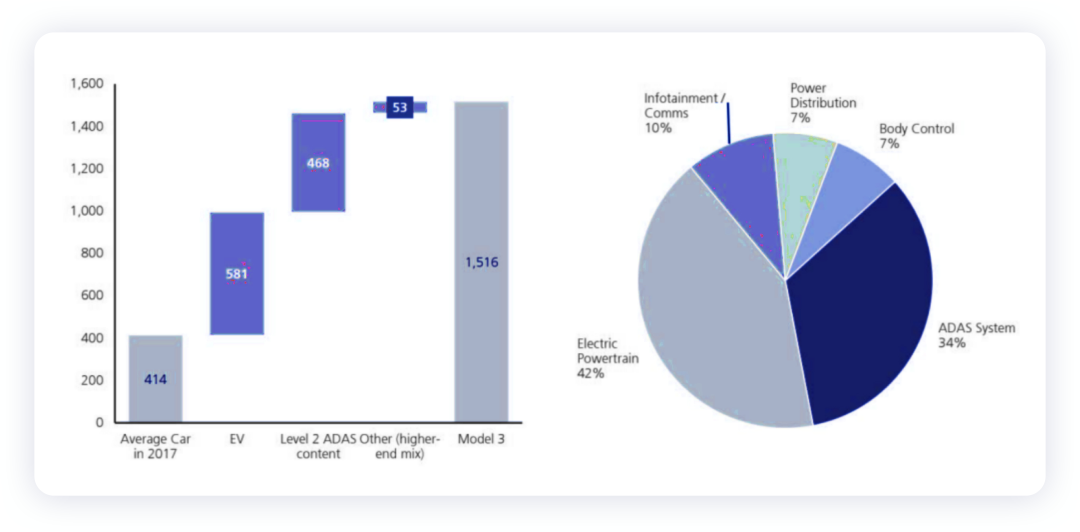

In previous reports from UBS, there is a blueprint for estimating the chip value for electric vehicles such as the Model 3. For the entire cost of the Model 3, the estimation for all semiconductors is $1516 (about RMB 9500). Assuming an average selling price of $42,000, the estimated BOM is $25,000, with the chip ratio currently at around 6%. The highest proportion in the $1516 is the electric drive part, followed by the ADAS part, then the entertainment and PD parts, and the lowest is the body control.

In this itemized breakdown of $636, the entertainment system costs $147, ADAS510 costs $195, body control costs $115, PDS costs $107, and the electric driving system, including BMS, high-end control, OBC, DC-DC, and power semiconductors, costs a total of $636.

In this itemized breakdown of $636, the entertainment system costs $147, ADAS510 costs $195, body control costs $115, PDS costs $107, and the electric driving system, including BMS, high-end control, OBC, DC-DC, and power semiconductors, costs a total of $636.

Note: The estimated cost of the SiC inverter seems to be missing some of the costs.

Within this $636, some disassembly was done, as shown in the following figures:

Figure 4. Breakdown table of $636 within the power system.

Figure 5. The value breakdown (supplier) of chips in the powertrain.

Before replacing Nvidia chips, Tesla’s allocated chip costs were $200 per vehicle, which they subsequently renovated using their own team. In other words, the procurement costs were disassembled into chip development and chip foundry costs (the cost of maintaining the team and chip IP is considered a development cost), effectively reducing costs.

Figure 6. Non-powertrain and overall chip costs.

I believe that car companies will follow the path of mobile phones, where chips will indeed account for a significant portion of the cost. However, we see players like Tesla reducing chip costs by independently designing and simplifying architecture. Tesla’s biggest advantage before was the ability to replace a large number of underlying MCU chip designs.

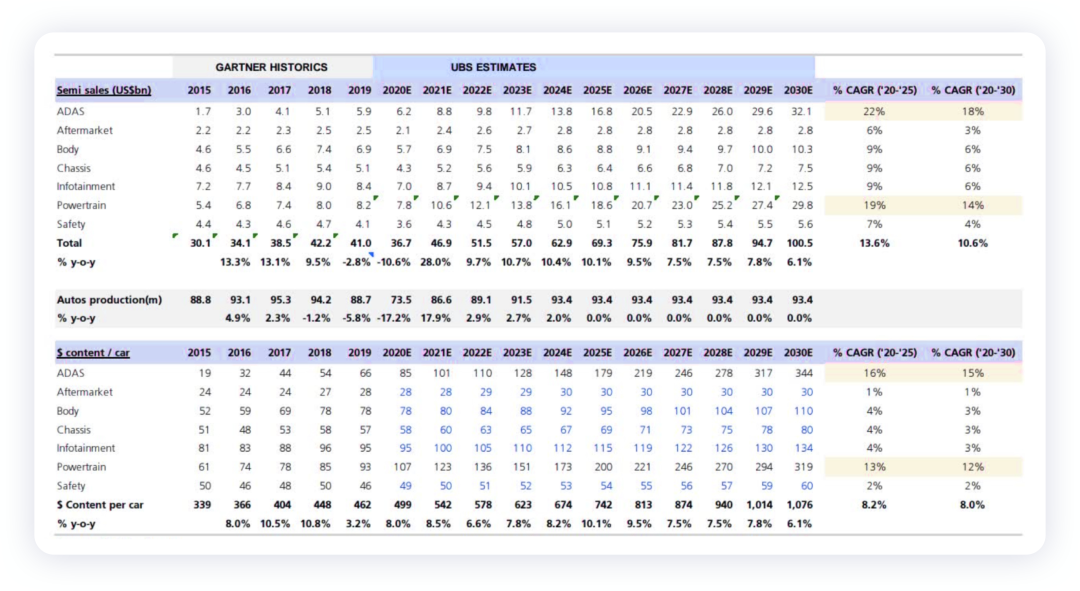

We also see that Intel’s Mobileye revenue growth is slowing, hovering around $300 million per quarter. In other words, in the current L2 era, the largest chip investment in luxury cars (non-electric) still lies in the cabin and intelligent driving systems. The electrified powertrain may increase costs by $600-800, but the overall proportion is still very limited.

Figure 7. Mobileye’s quarterly revenues under Intel.The CEO of Intel estimates that in the coming L4 autonomous driving era (2030), high-end electric vehicles equipped with multiple Lidars and high computing power may reach the expected cost of 5000 US dollars (20% increase) with a possible cost of 3500 US dollars under multiple perception and high computing power. The largest incremental portion will be in the ADAS area.

Summary: The assessment of value can be constantly updated and broken down. My main consideration is how to think about the overall investment framework in the future. By taking a fresh look at these reports, we can draw interesting insights and continuously speculate on the value within.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.