Tesla Bids Farewell to Low-profit Sales and Achieves New Heights in Q4 2021 Financial Report

In July 2021, after the release of Tesla’s 2021 Q2 financial report, I titled my article “Tesla Bids Farewell to Low-profit Sales and Achieves New Heights in Q2 2021 Financial Report.” It was the first time that Tesla’s net profit exceeded carbon credit income in its financial reports over the years, indicating that Tesla’s profitability and self-generation ability had entered a new phase, although the company did not officially mention it.

In the following three quarters, Tesla achieved multiple new highs, with a single-car gross margin of 30.5%, over $1.6 billion in net profit, and an operating margin of 14.6%. These data are incredibly exaggerated for the industry. Tesla, which has always been high-profile in its actions and even more ostentatious as a person, also reviewed its performance in the Q4 financial report, stating that in Q3, its operating margin of 14.6% ranked first among all mass-produced automakers at the same period. Tesla did not use the Q4 data because many of its competitors’ financial reports were not yet available for comparison. In plain language, Tesla has the strongest profitability among all car companies.

The Complementary Relationship between Finance & Sales

Bright Prospects

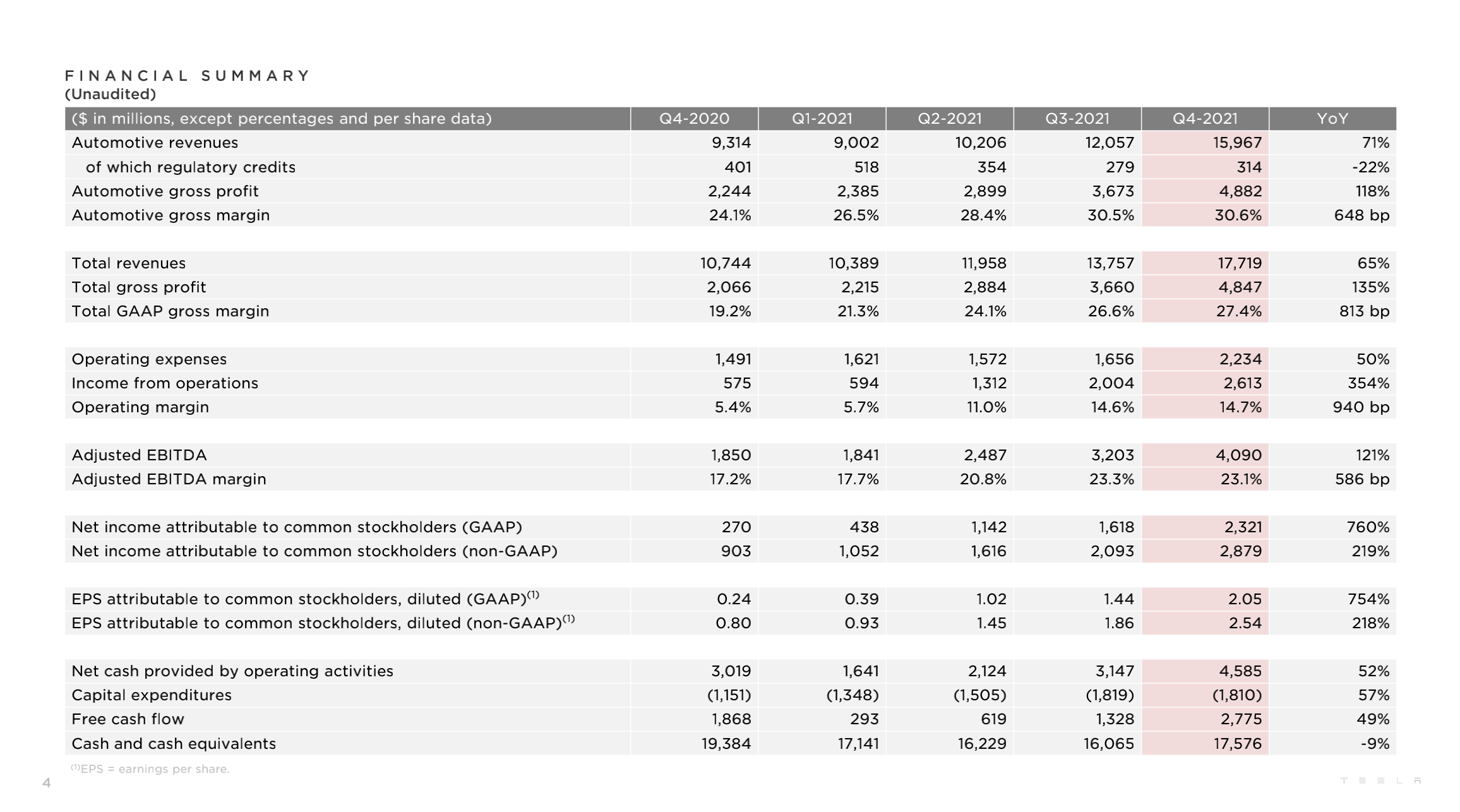

The following is a summary of the main financial information of Tesla’s 2021 Q4 financial report:

- Total revenue of $17.719 billion, an increase 29% QoQ and 65% YoY;

- Automotive revenue of $15.967 billion, an increase of 32.4% QoQ and 71% YoY;

- Automotive gross profit of $4.882 billion, an increase of 32.9% QoQ and 118% YoY;

- Total gross profit reached $4.847 billion, an increase of 32.4% QoQ and 135% YoY;

- Overall gross margin of 27.4%, single-car gross margin of 30.6%;

- Cash and cash equivalents reached $17.576 billion, with $1.5 billion in loans repaid in Q4;

- GAAP net income of $2.32 billion;

- Free cash flow of $2.775 billion;

- GAAP operating revenue of $2.6 billion, with an operating profit margin of 14.7%.

The revenue, total gross profit, single-car gross profit, net profit, and other data in the report once again set new quarterly records for Tesla. However, after the previous financial reports, most readers following Tesla have gradually established the impression of “high gross profit” for Tesla, so the surprise at seeing Tesla’s Q4 2021 financial data is lessened, while the sense of familiarity is more significant.

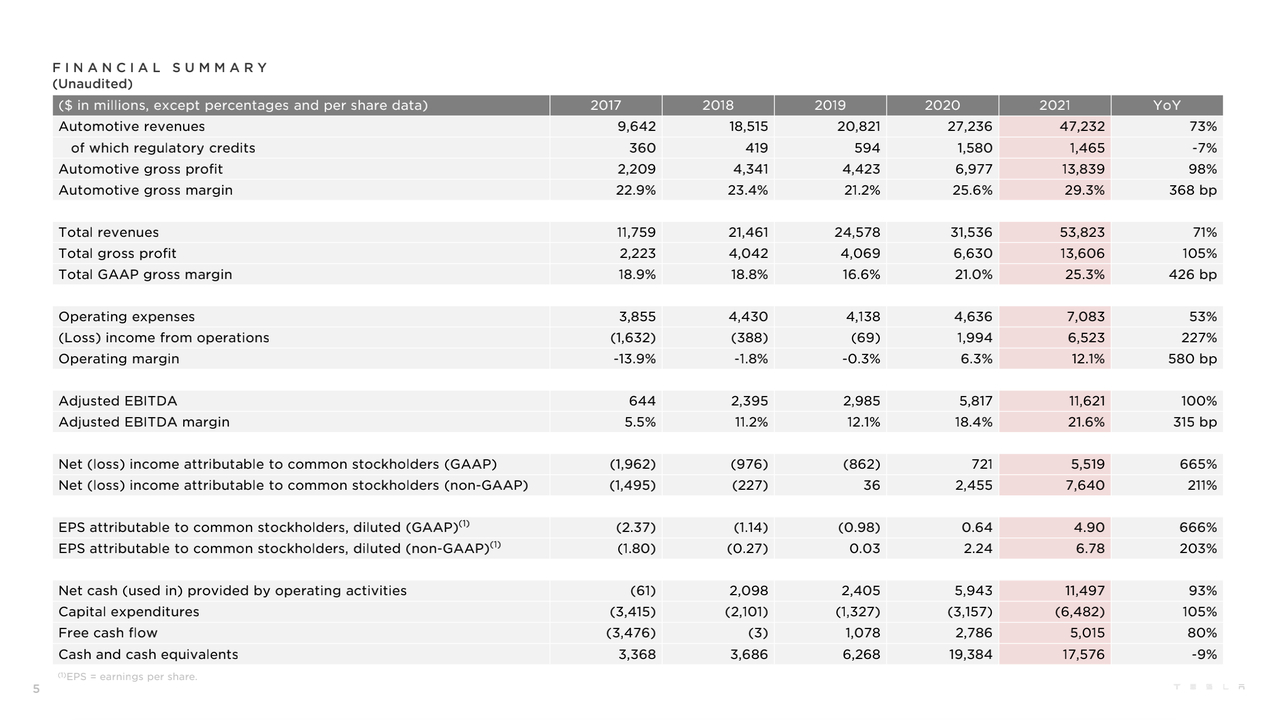

After a perfect ending to Q4, Tesla’s financial data for the whole year of 2021 has greatly improved compared to previous years:

- Total revenue of $53.823 billion, a YoY increase of 71%;

- Automotive revenue of $47.223 billion, a YoY increase of 73%;

- Automotive gross profit of $13.839 billion, a YoY increase of 98%;

- Total gross profit of $13.606 billion, a YoY increase of 105%;

- Overall gross margin of 25.3%, single-car gross margin of 29.3%;

- GAAP net income of $5.519 billion, a YoY increase of 665%;

- Free cash flow of $5.015 billion;

- GAAP operating revenue of $6.523 billion, a YoY increase of 227%, with an operating margin of 12.1%.

From the data, it is clear that while achieving a total revenue growth of 71%, Tesla’s gross profit YoY growth reached an even higher 105%, with GAAP net income YoY growth reaching an amazing 665%, and GAAP operating revenue YoY growth reaching 227%.

Substantial revenue growth, along with a increase in gross profit, which not only didn’t decrease but doubled, with net income and operating revenue more than doubling, indicates one thing: Tesla’s profit model is sustainable during its current expansion phase, and will show better marginal benefits as its scale is further expanded.

Compared to the traditional manufacturing industry, which often features exchanging price for quantity and increasing revenue without increasing profit during expansion, Tesla’s financial report clearly shows the characteristics of a technology company.

Under such a sustainable profit model, the most direct way to predict financial performance is to look at sales volume, which is exactly where Tesla’s outstanding performance in Q4 2021 came from.

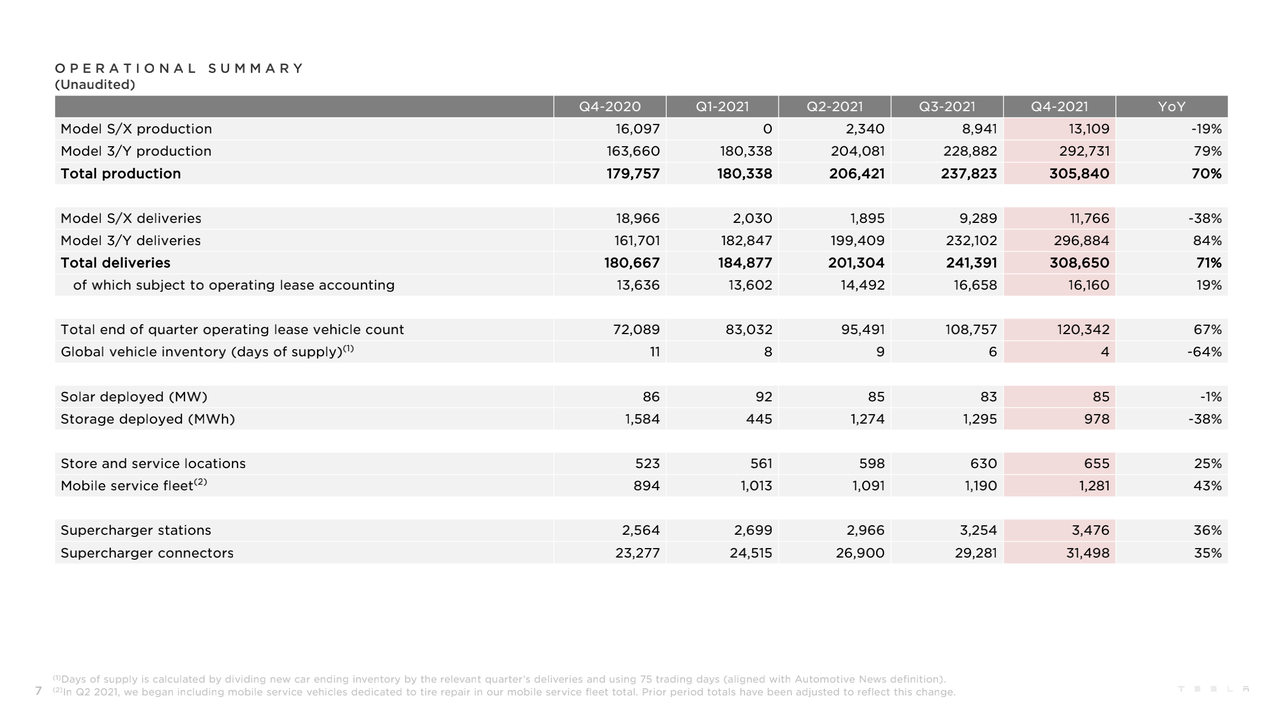

Production and sales data: the over-performing Shanghai factory

In Q4 2021, Tesla produced a total of 305,840 vehicles, including 13,109 Model S/X and 292,731 Model 3/Y, and delivered a total of 308,600 vehicles, including 11,750 Model S/X and 296,850 Model 3/Y.This is the first quarter for Tesla to deliver over 300,000 vehicles in history. Compared with Q4 2020, Tesla’s YoY deliveries grew by 71% without adding new factories or increasing the number of vehicle models for sale. Model 3/Y deliveries increased by 84% YoY, which is a testament to the utilization rate of existing factories.

The average inventory turnover period in Q4 was only 4 days, which is astonishing. It should be emphasized that part of the over 300,000 cars delivered this quarter were still exported across the sea, which takes nearly a month to transport. When Tesla achieved a 6-day inventory turnover period in Q3, people already found it unbelievable. Now, in the severely supply-constrained environment, only Tesla knows the limit of its inventory turnover period.

On the production side, Tesla’s Shanghai factory made significant contributions to its delivery performance in Q4, delivering a total of 178,097 vehicles, accounting for 57% of the total Q4 deliveries. This achievement was made with two fewer vehicle models and an annual production capacity of 150,000 units lower than Tesla’s Fremont factory.

If this data is multiplied by four to obtain an annualized production capacity, Tesla’s Shanghai factory’s current production capacity has exceeded 700,000 vehicles, far surpassing the construction plan. In 2021, Tesla’s Shanghai factory delivered a total of 484,100 Model Y vehicles and achieved a YoY growth of 235%. At the same time, it exported 160,000 vehicles while the construction of the Berlin factory experienced frequent delays, easing the supply shortage in other primarily European markets.

Thanks to Shanghai factory’s better-than-expected performance, Tesla achieved a total annual production of 930,422 vehicles and total deliveries of 936,172 in 2021, realizing YoY growth of 83% and 87%, respectively, exceeding the 50% target of CAGR for the year.

Regarding vehicle models, the redesigned Model S/X delivered 24,964 units in the whole year due to factory renovation at the beginning of the year and an increase in production capacity. Although the annual sales were halved YoY, the Q4 deliveries have returned to over 10,000 units. The Model 3/Y continued to be a hot seller in 2021, with 911,208 vehicles sold.

The sales of Model Y and Model 3 were not separately counted in the financial report. However, another trend that is happening is that in China and the US, where Tesla has local factories, the sales momentum of Model Y has surpassed that of Model 3. More popular models deserve more production capacity allocation, which is why the Texas and Berlin factories will produce Model Y first. Model Y is believed to be the primary target for increased production in the upcoming expansion plan of Tesla’s Shanghai factory.### Other highlights

In Q4 2021 and throughout the year, Tesla added 2,217 and 8,221 new Superchargers, respectively. The ratio of new vehicles to new Superchargers added in 2021 for Tesla was 121.3:1, compared to the previous three years:

- 65.1:1 in 2020

- 89.6:1 in 2019

- 83.7:1 in 2018

From this perspective, Tesla’s Supercharger construction speed is somewhat insufficient relative to its sales. However, it is important to note that a higher proportion of Tesla’s newly added charging stations are the V3 Superchargers, with higher power output, and with improved average charging efficiency. Perhaps Tesla has a new way of calculating the vehicle-to-charging-station ratio.

Energy storage and photovoltaics are businesses that Tesla has been doing, but they have not received much attention from the outside world. In 2021, Tesla added 345 MW of solar photovoltaics and 3,992 MWh of energy storage.

Regarding these two businesses, Musk occasionally mentions them. Recently, in a few statements, he indicated that the growth rate of the energy storage and photovoltaic businesses will increase in the coming years. He also explained that because many of the components used in the energy storage business, such as inverters, are not much different from those used in Tesla vehicles, the shortage of auto industry components this year has affected the growth of these businesses to some extent.

From a product perspective, energy storage and photovoltaics still primarily target B2B customers, rather than the mass market. Therefore, there are more restrictions and uncertainties involved in commercialization. For Tesla, the turning point has not yet arrived.

Conference Call, Main Venue of the Earnings Report

The Q4 earnings report conference call was quite special because at the end of 2021, Musk stated that Tesla’s product planning roadmap needed an update. The company chose the Q4 earnings call to communicate this news. Additionally, Musk had previously stated during the Q2 earnings report call that he might not attend any more conference calls himself, as time constraints were an issue. Indeed, he did not attend the Q3 call.

At this conference call, which marked Musk’s return to the earnings report conference calls, he provided a lot of key information in his opening remarks.

Key Takeaways from Musk’s Opening Remarks

In 2021, it was a breakthrough year for Tesla and the entire electric car industry. Despite enormous supply chain challenges, Tesla achieved nearly 90% growth in annual sales. This growth was not a coincidence, but the result of the creativity and hard work of multiple teams within the company.

Tesla achieved the highest operating profit margin in the industry in Q3. With $5.5 billion in GAAP net income in 2021, Tesla finally achieved cumulative profitability since its inception. This was an important milestone for the company.The Texas and Berlin factories began trial production in the last quarter of 2021, but the company is more focused on the timing of mass production and delivery. Model Y equipped with CTC integrated battery packs and 4680 battery cells will be mass produced first in Texas, and deliveries will begin shortly after final certification is complete.

In the future, Tesla will continue to expand capacity by maximizing production at each factory and building new ones. The locations for new factories are not yet ready, but the timing is expected to be at the end of 2022.

The biggest limitation to Tesla’s production growth in 2022 remains the supply chain. While the chip shortage has eased somewhat, it is still a limiting factor. However, a 50% increase in production is expected to be easily achieved in 2022.

Regarding FSD, Tesla believes it will become the company’s core source of profit in the future. With FSD and Robotaxi combined, Tesla will have a considerable financial imagination.

In terms of timing, Tesla is expected to achieve fully autonomous driving by the end of this year, and the achieved safety level will be significantly higher than the current stage. Vehicles equipped with autonomous driving capabilities via OTA updates may become the most valuable asset ever. In addition, this will also improve overall traffic safety and asset utilization, thereby promoting the world’s development towards sustainable energy.

Regarding product roadmaps, there is no need to go into detail about each product currently in development. Many of these products are worth having separate press conferences instead of just a few minutes of introduction in the financial report. The issue discussed here is Tesla’s deep thinking about the pace of new product launches.

Tesla’s focus this year is on expanding production. If Tesla introduces new cars in 2021 or this year, it will actually have a negative impact on Tesla’s production capacity, but many people don’t understand the key factors.

In 2021, when there was a shortage of overall automotive components, Tesla invested a lot of effort in engineering and resource management to solve supply chain issues, including chip issues:

- Developing alternative chips

- Rewriting relevant software

- Cancelling orders for chips that were in short supply

Chips are only one of the hundreds of core components in short supply faced by Tesla in 2021. With the predetermined supply of components, the number of cars that can be produced is also predetermined. At this point in time, introducing additional car models will not increase the final production capacity. If new cars are launched in this market and timing, Tesla will undoubtedly need to spend a lot of resources and energy on new cars, and attention will be diverted and efficiency will be affected, which will actually reduce production capacity.Supply issues will still be present this year, so Tesla will not launch new car models this year. However, Tesla will still invest heavily in the development and creation of Cybertruck, Semi, Roadster 2, and Optimus (Tesla Bot), and the mass production plan for these products is currently more reliable for next year (2023).

In terms of priority for new products, Optimus (Tesla Bot) is actually Tesla’s most important product this year, and it may be even more important than the automotive business in the future. The logic is: the cornerstone of the economy is labor, and capital is needed to realize labor. Labor is related to population, and when the population is insufficient, labor will be scarce, and the economy will naturally be affected. This is the significance of Optimus (Tesla Bot), so it is quite important.

Statements from other executives

In 2021, Tesla put a lot of effort into developing the 4680 battery cell and battery supply, including a series of preparations for subsequent rapid shipments. Compared with the shortage of other components, the 4680 battery cell will not be the bottleneck in the supply chain in 2022. The capacity of the Kato factory (the 4680 battery cell factory) is ramping up smoothly, and the CTC integrated battery pack with 4680 battery cells is already being produced every day. The first Texas-made Model Y equipped with this structure will be delivered in the first quarter of this year.

Chips will still be the head of shortages for various components at present, and relief is expected in 2023. After that, the bottleneck will shift to the battery cell production capacity, and the 4680 battery cell will become crucial.

In terms of company operations, the gross profit margin per vehicle in 2021Q4 reached 29.2% after excluding carbon credits, which is the highest in Tesla’s history. The proportion of carbon credit income in Tesla’s profits will continue to decrease in the future. The efficiency of the two new factories that will start production in 2022 will be relatively low during the capacity ramp-up stage, and the trends of inflation and rising component prices have also emerged, which will bring certain cost pressures to Tesla. But with the increase in sales volume and the improvement of operational leverage, Tesla expects that the operating margin will continue to increase.

Q&A Session

Q1: How is the progress of the $25,000 compact car?

A1: It is not being developed currently. There is too much to do at the moment.

Q2: Will FSD consider splitting into different versions, such as a personal perpetual version (FSD with people), vehicle version, and commercial version?

A2: It sounds complicated. Currently, Tesla’s main consideration is to reduce the cost of full life cycle unit mileage travel after being included in the car price, improve travel efficiency and then charge fees in a reasonable manner (meaning no).Q3: When will Dojo be launched and applied? What are the current challenges? Does FSD need Dojo’s help to land and run in New York? Where will the first application of Tesla Bot be?

A3: Dojo will start to be applied this summer. The current challenge is whether it can demonstrate higher computing efficiency than GPU clusters. The current goal is when FSD’s data computing team thinks that Dojo is more powerful than the current computing center, it is the time to launch Dojo. FSD’s operation does not require Dojo, it is a computing hardware specifically designed for neural network training. Although it cannot be guaranteed that it will be better than the current GPU cluster computing center in actual application, Tesla believes that this will become a reality. The first application scenarios of Tesla Bot should be material handling in the factory.

Q4: What is the maximum output expected for each Tesla factory and when will the new factories start operating?

A4: The expected output capacity is not something that can be clearly stated at present. With the increase in sales and the expansion of regions, transportation costs also need to be taken into account. Blindly expanding production in a certain factory is not a sustainable solution in the long run. The Texas factory is expected to provide 2/3 of the Model Y production for the eastern United States. The location of the new factory will be announced at the end of 2022.

Q5: What is the biggest challenge for Cybertruck to achieve mass production? Is it the battery?

A5: The battery may not be the biggest problem in the mass production of Cybertruck. This car has applied many new technologies, and there is a lot of work to be done before mass production. Therefore, what Tesla is really worried about now is how to make the cost of controlling this car affordable for everyone after mass production. Considering this, Tesla believes that Cybertruck needs to achieve a corresponding cost level with an annual sales volume of 250,000 vehicles, but Tesla’s current supply capacity cannot reach this level yet.

Q6: Musk previously stated that FSD is expected to achieve Level 4 autonomous driving this year. Is this speculation based on the feedback trend of FSD Beta or does it require Dojo’s online participation to achieve this?

(Note: The HTML tags have been kept in the translation output.)

A6: Dojo participation is not required for FSD work. The problem is actually a bit misunderstood. The key point is reliability. Can it achieve 99.999\% or 99.999999\%? Tesla aims for perfection, as driving manually is not a high standard, it’s a basic requirement. Human driving has many issues, such as dangerous driving, fatigue, distracted driving while using the phone, etc. Therefore, the safety of machine driving may reach 10 or even 100 times that of human driving. In the coming months, several major updates to the FSD software stack will be made. If Tesla fails to achieve safer autonomous driving than human driving by the end of this year, it will be a shocking thing.

Q7: What are the prospects for the energy storage business in 2022?

A7: The battery type used in energy storage will shift from nickel-based (ternary lithium) to iron-based (LFP). Due to supply shortages, the growth of this business in 2022 cannot be predicted, but if these constraints are removed and the company ensures production capacity, the annual growth rate may be 200\% to 300\%.

Q8: What is the contribution of FSD to the value of vehicles in 2020 and 2021, and how much deferred revenue has been obtained? What is the progress in this regard?

A8: Regarding the revenue generated by FSD in the past two years, we should move forward and not dwell on the past. Our thinking in this regard is that originally, we only used our vehicles for 10 to 12 hours per week, and the rest of the time the vehicle was idle and not generating value. But with fully autonomous FSD, the vehicle can drive without human intervention, and its working hours can increase to 40 or even 50 hours per week, significantly increasing the value of the vehicle. And within one night, several million vehicles can acquire this capability. However, how to quantify this financially is currently unclear.

Q9: According to Tesla’s compound annual growth rate of 50\%, Tesla needs to sell at least 3.2 million cars in 2024. However, Cybertruck has an annual production capacity of only 250,000 vehicles. Can this be achieved without introducing new models?

A9: Obviously, people have not fully understood the revolutionary changes brought about by the FSD to the cost of asset utilization. If the utilization rate of an asset is increased by five times, its cost can be divided by 5. For example, if you have a $50,000 car, after the utilization rate is increased five times, its cost will be equivalent to $10,000. But the cost of building cars remains the same throughout this process, so if this is achieved, our cars will still be made and sold the same way as they are now.

Q10: How is the production capacity of the 4680 battery cells ramping up? What is your view on the 4680 becoming the standard battery cell for Tesla’s suppliers? What will its position be in the future? Will it be used in all Tesla vehicles and energy storage businesses?

(No HTML tags were present in the original text, so none were preserved in the translation)### Transcript of the Telephone Conference

During the telephone conference, the main topics discussed from beginning to end were production capacity, FSD and 4680 cells. Here is a summary:

-

Tesla’s production capacity is bottlenecked by its supply chain, with chips being the main limitation. The chip shortage is expected to ease in 2022, but will continue to affect production until 2023. This is why Tesla will not introduce new cars in 2022. Expanding production will be the main focus in 2022. The site for the new factory will be announced by the end of 2022, and expansions of existing factories will be considered based on localization of production and reducing logistics costs. Several new products, including Semi, Cybertruck, Roadster 2, and Tesla Bot, will be launched in 2023, each with its own release event. The production delay of the Cybertruck is due to the development of new technologies and the need to reach a production scale of 250,000 vehicles to balance costs, which is expected to be achieved by 2023. Tesla Bot, which may become more important than cars in the Tesla system in the future, has strategic significance as a replacement for human labor and will be a key focus of Tesla’s development in 2022.

-

The FSD final version will be released this year, and Dojo, used for training, will start to be used when the efficiency of running it can replace the existing GPU cluster. This is expected to happen in the summer of this year. There will be several major software updates and iterations at the code level for FSD. The reliability level to be achieved may reach 99.99999%. After applying FSD, the utilization rate of vehicles as assets will be feasible to increase by 4 to 5 times. This will make FSD very popular, become Tesla’s main source of profit, and continue to promote the sales of current models in the next few years.

Regarding the 4680 cells, Tesla has collaborated with multiple suppliers who share the same viewpoint as Tesla that 4680 cells are a way to reduce costs and improve production efficiency. However, due to the impact of material and size on costs, Tesla will not use 4680 cells in all battery-containing products and businesses, such as lithium iron phosphate batteries which are not compatible with 4680 cells. Tesla will not produce lithium iron phosphate 4680 cells.### Translation

- The production capacity of 4680 battery cells is currently not the bottleneck of mass production. Tesla’s Texas factory has been producing Model Y with CTC structured 4680 cells, which will be delivered in the first quarter of this year. In addition, Tesla and multiple suppliers have cooperation on 4680 cells, but these cells will not be applied to lithium iron phosphate cells thus models that need large output and energy storage will basically have nothing to do with 4680 cells. Moreover, after the problem of component shortage is solved in 2023, the production capacity of 4680 cells may become the next bottleneck on the supply side.

Tesla, Apple, and FSD

At the end of the article, I want to discuss this earnings report and Tesla from three topics.

When it comes to high gross margins, short inventory, streamlined product lineup, and simultaneous increase in volume and price, I believe everyone easily associates them with another great company – yes, it is Apple.

The view that “Tesla is the Apple of the automotive industry” has actually become a cliché. Let’s not mention topics such as product philosophy or software is king. I want to talk about the valuation of the two.

How Far Tesla is from Apple?

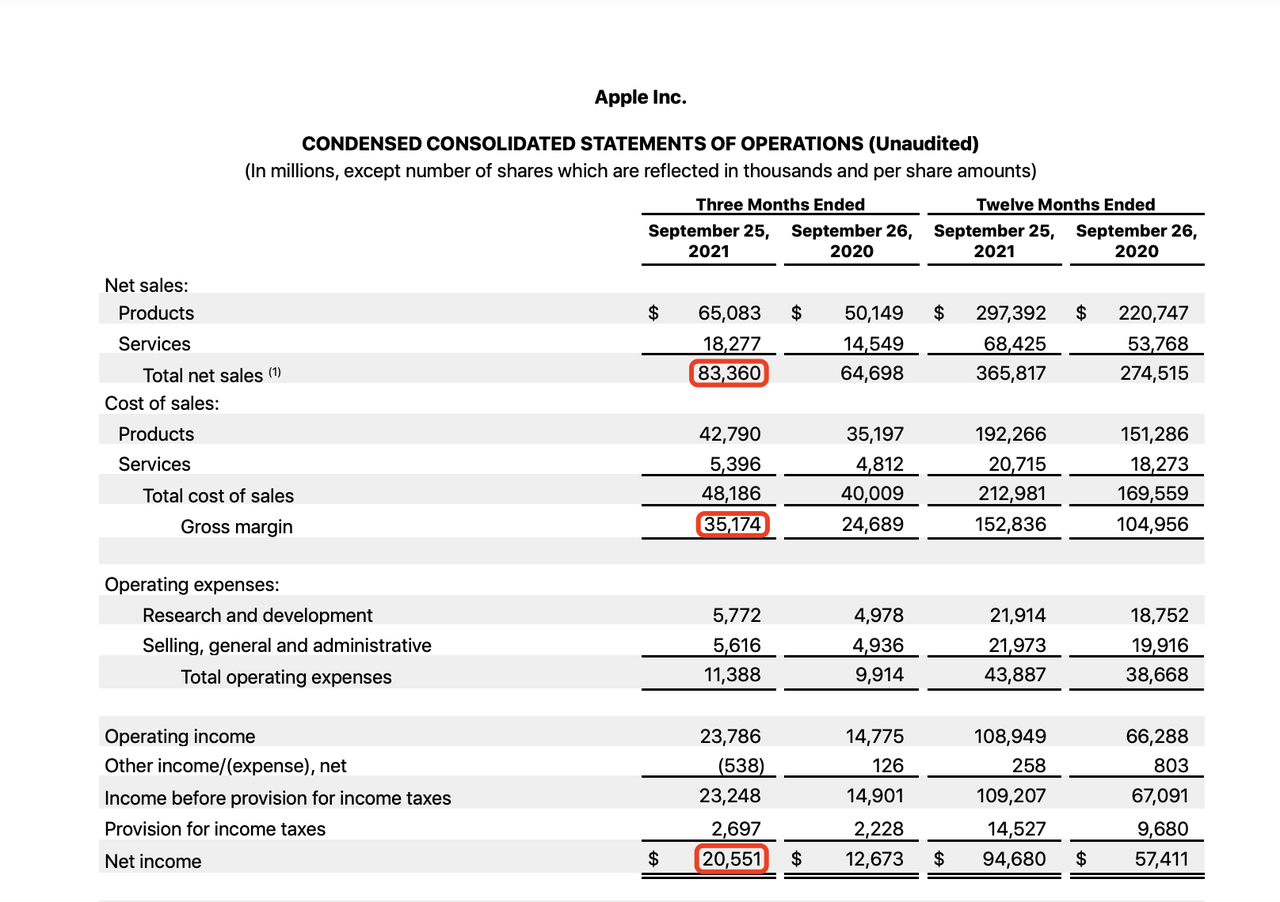

After learning about Tesla’s financial data in the first half of the article, let’s take a look at Apple’s financial data in 2021Q3:

- Total revenue $83.36 billion

- Total gross profit $35.174 billion

- Overall gross margin 42.19%

- Operating net profit $20.551 billion

- Operating net profit margin 24.65%

- In the previous four quarters, Apple’s overall gross margin was 41.77%.

As a mature technology company at its peak, with the above financial data, Apple’s market value of over $2.6 trillion is around 29 P/E ratio.

Looking at it from another perspective, to achieve the valuation level of Apple, Tesla’s financial performance should reach the Apple level, that is, a quarterly operating net profit of $20 billion.

This has never been achieved in the automotive industry, and it is something that no one in the industry dares to think about. With its earning ability has reached the first place in the automotive industry, Tesla, which sold more than 300,000 cars in a single quarter, currently has a market value of $870 billion and a P/E ratio of about 158.

Then the problem is further simplified: can Tesla increase its current profit eightfold?

If Model 3/Y is the main sales, and the leverage ratio of operating return remains unchanged, then the sales volume that is most closely related to Tesla’s revenue has to move towards this direction, that is, delivering 2.4 million vehicles in a single quarter.According to Tesla’s annual compound growth rate formula, achieving this goal will take around 2028. In an industry of rapid iteration, these assumptions will become highly uncertain when the time period is extended so long.

If the time is set to three years later in 2025, then Tesla’s annual delivery volume will be approximately 3.8 million vehicles, and the quarterly delivery will be roughly 3 times the current amount. Under the premise of other conditions remaining unchanged, the quarterly operating profit will also roughly triple, reaching $8 billion US dollars. This data is still far from that of Apple.

However, Tesla’s valuation is partly due to its growth rate and partly due to its profit composition. The latter is critically dependent on the negligible marginal cost of software revenue, namely FSD.

The second topic I want to address is the true value of FSD.

Leaving aside the possibility of achieving “Full Self-Driving” by the end of this year, let us focus on the new story that Musk told on this earnings call: fully realized FSD can reduce a car’s total cost of ownership by 4 to 5 times. The prerequisite for achieving this is a 4-to-5 fold increase in the usage rate of vehicles equipped with FSD. Musk did not explicitly state during this earnings call that this increase in usage rate translates into a 4-to-5 fold reduction in cost; rather, it is the transformation model of turning vehicles equipped with FSD into Robotaxis that earn money by picking up guests during idle time.

One cannot deny that this is a highly imaginative business model. However, Musk first mentioned this in April 2019 during the Autonomous Day.

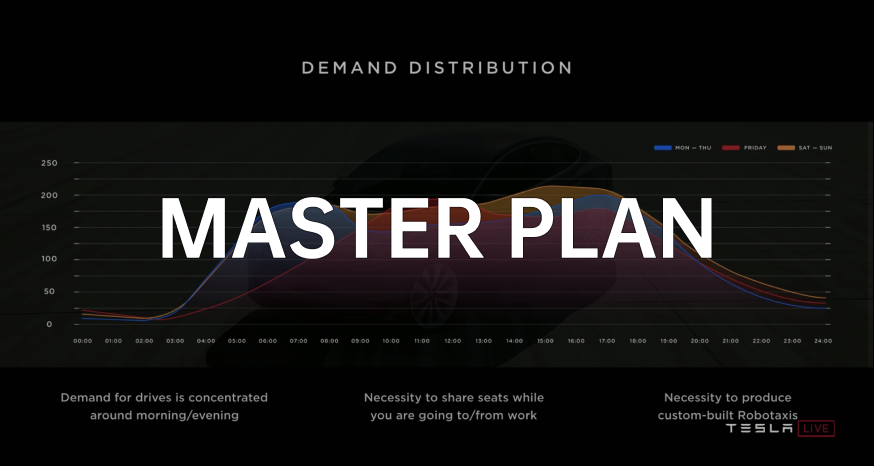

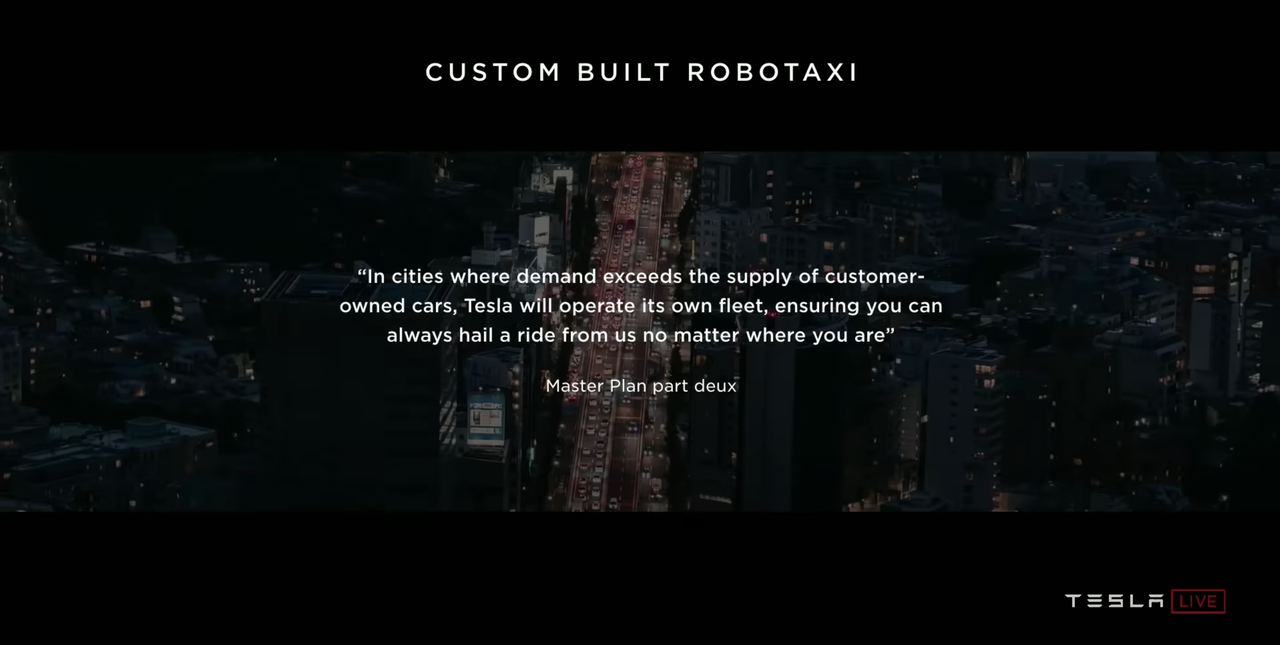

At the event, Musk stated that Tesla would use mass-produced vehicle models with automatic driving capabilities to create the Robotaxi fleet when regulations permit. The corresponding system is called “Tesla Network,” and vehicle owners who join the system can set their own vehicles to “shared travel mode” at certain times. However, there are restrictions on intimate relationships among the users after the vehicle is shared, and only friends, colleagues, or friends on social media platforms are allowed to use the vehicle.Users can open the “Riding-Sharing” app to check for available cars in the area and select a vehicle just like using shared bikes when they need a car. They can also use the summoning function to automatically bring the vehicle from the parking lot to them. Tesla will extract 25% to 30% of the fee generated from the shared car and give the rest to the car owner as profit.

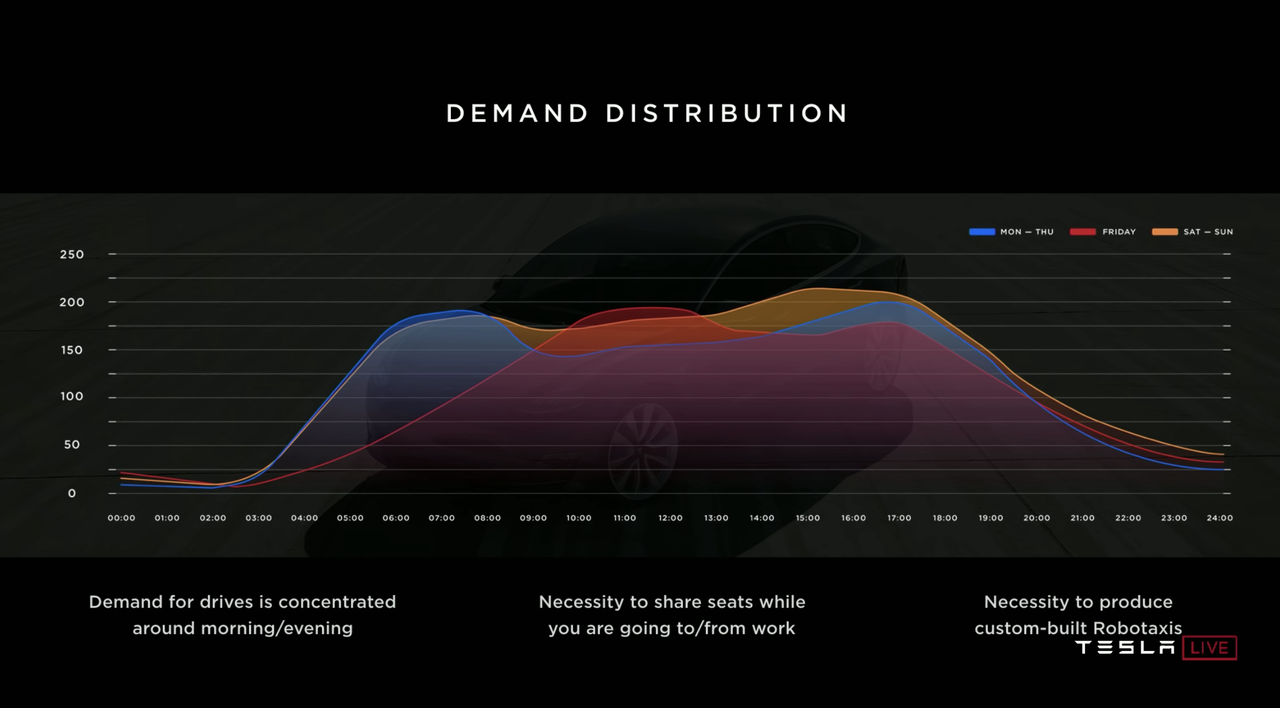

This turns the car into an asset that can generate income during idle periods. At the conference, Tesla also released a peak time curve graph for people’s car usage. According to Tesla, people mostly use cars for about 10 to 12 hours a week, and the rest of the time is idle. A car with self-driving capabilities can utilize nearly 1/3 of the idle time in a week, which is 50 to 60 hours, to run Robotaxis.

In this project, Tesla hopes to use the Model 3 as the first operating vehicle in the first stage. After the lease ends, Tesla plans to repurchase all the Model 3 long-term rental cars as the official Robotaxi fleet to expand the overall Robotaxi sharing car fleet.

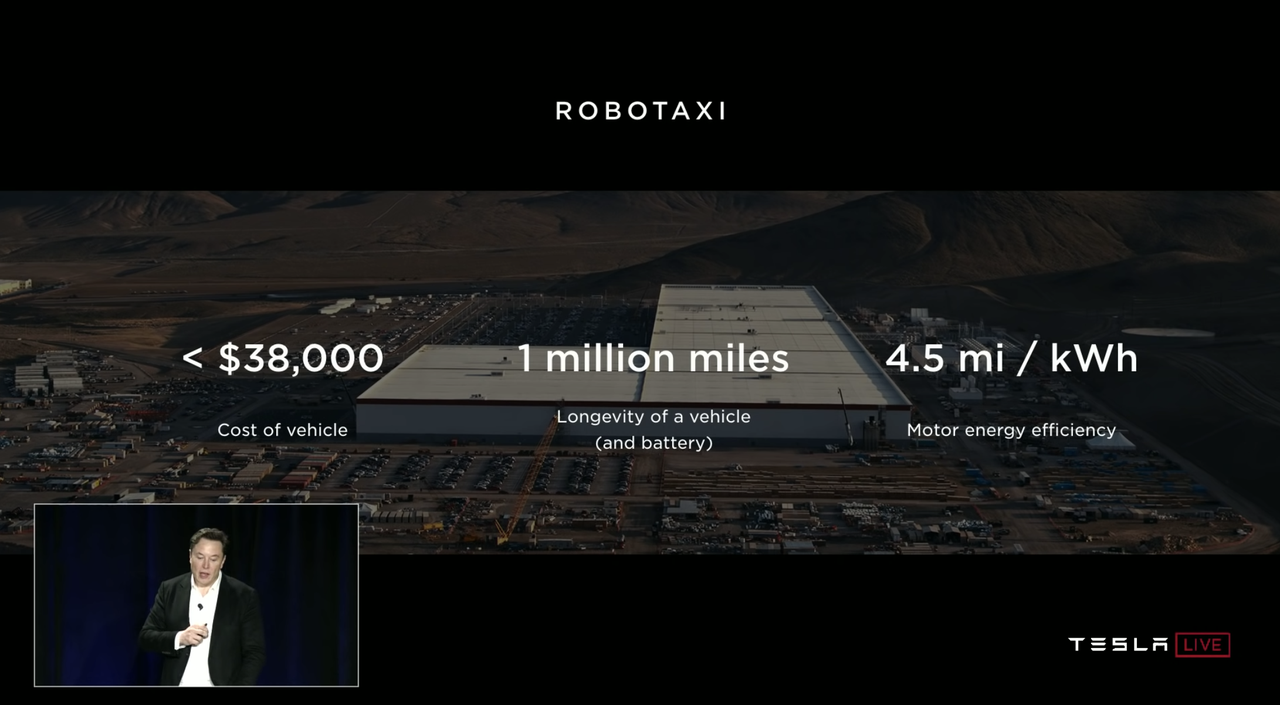

Tesla will also directly produce Model 3 models for Robotaxi, and potentially eliminate vehicle and driving-related components such as the steering wheel, gear selector, etc. to achieve lower costs and better production efficiency. The car’s design has been increased from the original 30 to 50 thousand miles to 1 million miles, like American commercial semi-trailers, and will use more extreme low rolling resistance tires to achieve lower energy consumption.

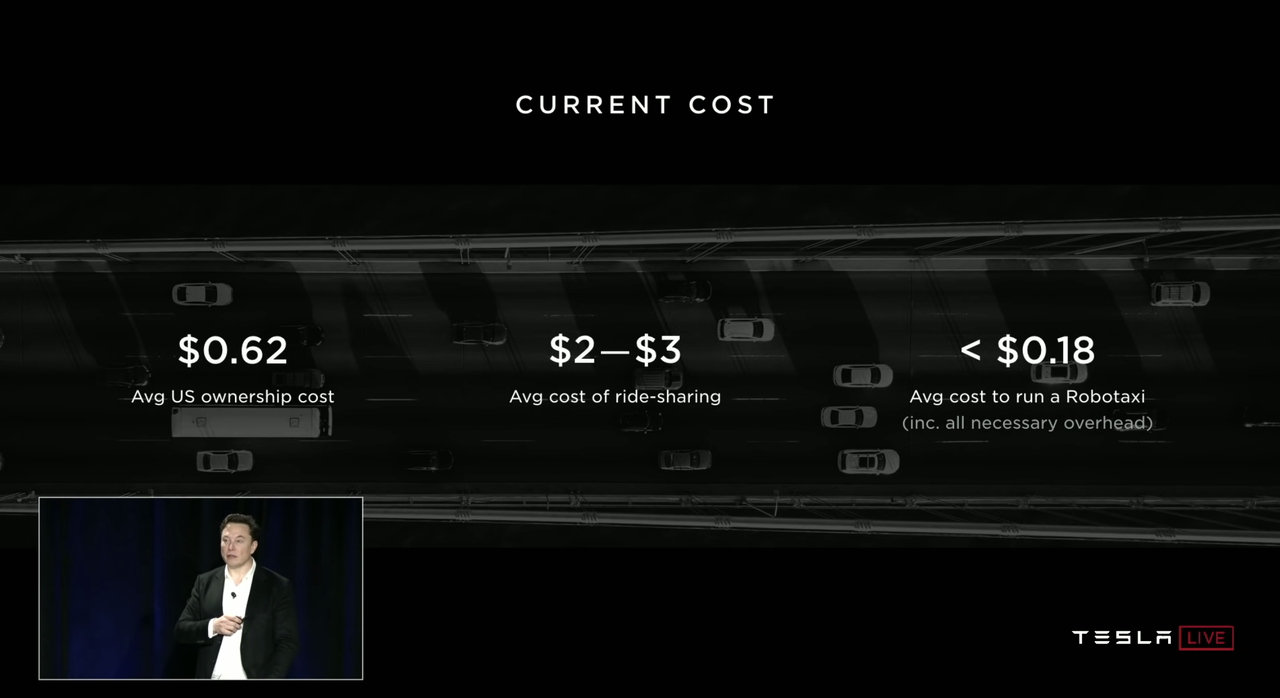

During the conference, Tesla calculated that the average cost per mile per car in the United States was 0.62 USD, and the cost of using a shared car was 2 to 3 USD per mile. However, the cost of using a Model 3 Robotaxi per mile is less than 0.18 USD.

Then there is the profit that runs through the entire lifecycle: Assuming a car travels at an average speed of 16 miles (25.75 kilometers) per hour for 16 hours per day, it can travel 90,000 miles (144,800 kilometers) in a year. Assuming that half of these miles are empty, the final gross profit per mile is $0.65, with an estimated annual gross profit of approximately $30,000. With a design lifespan of 1 million miles, one car can run for 11 years, so the estimated gross profit produced by each car’s 11-year full lifecycle production is $330,000.

One has to admire that this is a very imaginative business model, but it also has to be said that Tesla has always been keen on excessive publicity. Too many steps in the entire shared Robotaxi mode are based on overly idealistic assumptions. In the main sales regions that Tesla targets, such as China, the United States, and Europe, even regulatory issues and operational licenses are sufficient to cause huge obstacles to Tesla’s noble ideals. In addition, the shared Robotaxi operation also faces a series of challenges including but not limited to charging, unexpected maintenance, and vehicle damage compensation.

Moreover, in the 2019 Autonomous Day, Musk confidently stated that he had great confidence that Tesla would begin delivering Robotaxi in certain areas in 2020. However, as we can see from the results, the past three years have passed, and Musk has not mentioned this matter much since the conference, nor have we seen further implementation of this plan.

One can guess that the event encountered resistance in execution. One of the sources of the resistance was that Musk’s expectations for the complete FSD were not met in 2020.

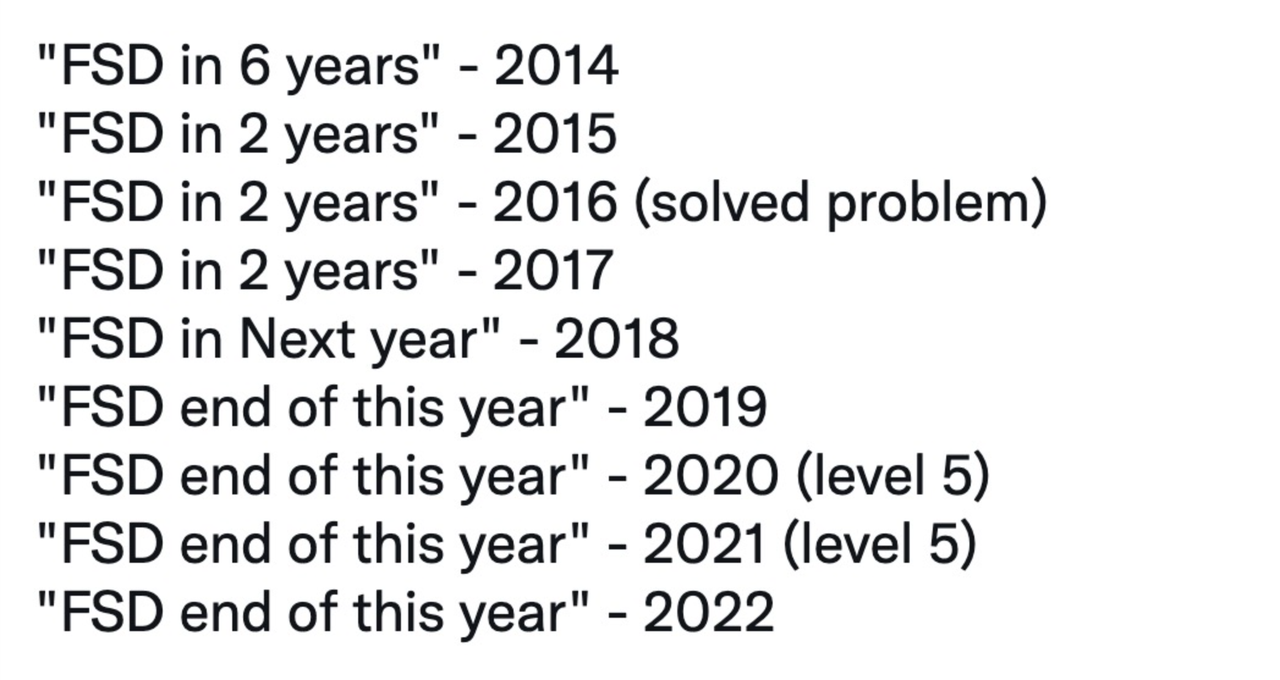

Readers who are familiar with Tesla should quickly understand the joke about the FSD delay when they see the following picture.

Delaying is common in Tesla, but to be fair, when you plan to do something that no one in the industry or even the world has accomplished, the time commitment given is often used for self-motivation.But when you read about the Robotaxi above, were you excited? Were you looking forward to it? Assuming uncertainties in business, politics and law are excluded, do you think there is a fundamental flaw in the logic of creating value through shared Robotaxi by FSD?

I believe Tesla and Musk have also considered the problems that this model will encounter, but this has not completely prevented them from doing it. So at the 2021 Q4 quarterly earnings conference three years later, we heard once again the explanation of the value of FSD, which is not just about safer automated driving, but about completely changing the definition of assets for cars in human society history and subverting the profit structure of car companies.

It is worth mentioning that at the same press conference in 2019, Tesla released the HW3.0 chip, announcing an approach of fully automatic driving through vision and neural networks. Musk’s famous “lidar is unnecessary for automated driving” also came from the QA session of that press conference.

I believe that by now, after three years, we all have a deeper and clearer understanding of these matters.

Regarding FSD and shared Robotaxi, the reason why Tesla believes it will be competitive in doing so is also based on a fundamental reason: Tesla has the conditions to become the manufacturer with the highest degree of vertical integration in the world for Robotaxi.

Tesla has its own high degree of vertical integration electric cars, a self-developed hardware team for automated driving, and mass-produced chips. It also has a self-developed software team for automated driving, a closed-loop system for data collection and iterative training, and the world’s largest fleet equipped with video material collection and embedded automated driving hardware capabilities, each of which is among the best in the world.

Using high-sales To C mass-produced cars sold worldwide to build a part-time shared and part-time full-time operating mode of Robotaxi achieves a win-win-win situation for car owners, riders, and host factories, so is there no commercial potential?

The first domino in this series still depends on whether FSD can turn Tesla’s expected automated driving into a reality.

The final topic I intend to discuss in the ending part is something I really want to hear your opinions about in the comments: in the long run, can FSD help Tesla surpass Apple?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.