Special Author: Shui from Qiumingshan

China’s dual credit trading has been implemented for 4 years, with the credits of new energy vehicles fluctuating sharply from being a cheap commodity to a hard currency. New energy vehicles have also flourished under the promotion of credit policies.

Let’s start from the beginning.

On September 28th, 2017, the Ministry of Industry and Information Technology and other five ministries jointly issued the “Method for Parallel Administration of Corporate Average Fuel Consumption and New Energy Vehicle Credits for Passenger Cars” (referred to as the “Dual-Credit Method”), which came into effect on April 1st, 2018.

For the first time, the “Dual-Credit Method” simultaneously manages the credits for fuel consumption (fuel consumption credits) and new energy vehicles, with related designs, and is a globally unique system with Chinese characteristics.

It is different from the ZEV (zero-emission regulations) system implemented in ten states such as California in the United States based on Article 177 of the Clean Air Act, and the carbon dioxide management system implemented in the European Union. Therefore, there is no precedent for dual credits in both system management and trading in the international community. The regulatory authorities and participating companies in the Chinese automobile industry “rushed over the river without a stone to touch.” Therefore, the experience and lessons learned from practice are extremely valuable.

The author believes that the “Dual-Credit Method” of relay subsidies, with the policy combination of carrot and stick, has become one of the key policies to promote the transformation of China’s automobile industry to comprehensive electrification. It is also the true beginning of China’s new energy automobile industry shifting from a “policy-driven” industry of mainly relying on “subsidies and tax reductions” and “purchase restrictions” to a competitive industry driven by the market.

The “Dual-Credit Method” not only accumulated rich experience and lessons for industry regulatory authorities, but more importantly, provided clear policy guidance for the strategic reshaping, technological path selection, and product layout of domestic and foreign automobile companies involved.

It is not an exaggeration to say that the “Dual-Credit Method” has opened a new era for the commercial operation of China’s new energy vehicles, especially pure electric vehicles.

2018: Price of 825 yuan/credit and transaction volume of 840 million yuan

In 2018, credit trading officially began.

Although the “Dual-Credit Method” came into effect on April 1st, 2018, the Ministry of Industry and Information Technology still required automobile companies to account for the average fuel consumption and new energy vehicle credits for passenger cars produced in 2016 and 2017, and to evaluate negative-credit companies in accordance with the “Dual-Credit Method.”

Since there were no new energy credit requirements for both the 2016-2017 credit years, all negative credits to be offset came from fuel consumption negative credits. All new energy credits on the market were used as positive credits, playing the role of offsetting fuel consumption negative credits.According to the recollections of several executives from automotive companies interviewed by the author, due to being the first time for credit trading and pertaining to retrospective management, the Ministry of Industry and Information Technology (MIIT) provided many flexible compensations for enterprises with negative credit scores: enterprises with negative credit scores in 2016 for average fuel consumption would be able to offset to zero in the 2017 credit assessment by using their own generated positive credit scores for average fuel consumption, positive credit scores for new energy vehicles, transfer of credits between associated enterprises, purchase of credits for new energy vehicles, etc. For those unable to offset to zero with negative credit scores for average fuel consumption in 2016 and 2017, they could submit their production or import plans to MIIT, enabling predicted positive credit scores to offset the negative credit scores not yet offset, i.e., allowing credit borrowing. In addition, positive credits for new energy vehicles in 2016 could also be carried forward for one year.

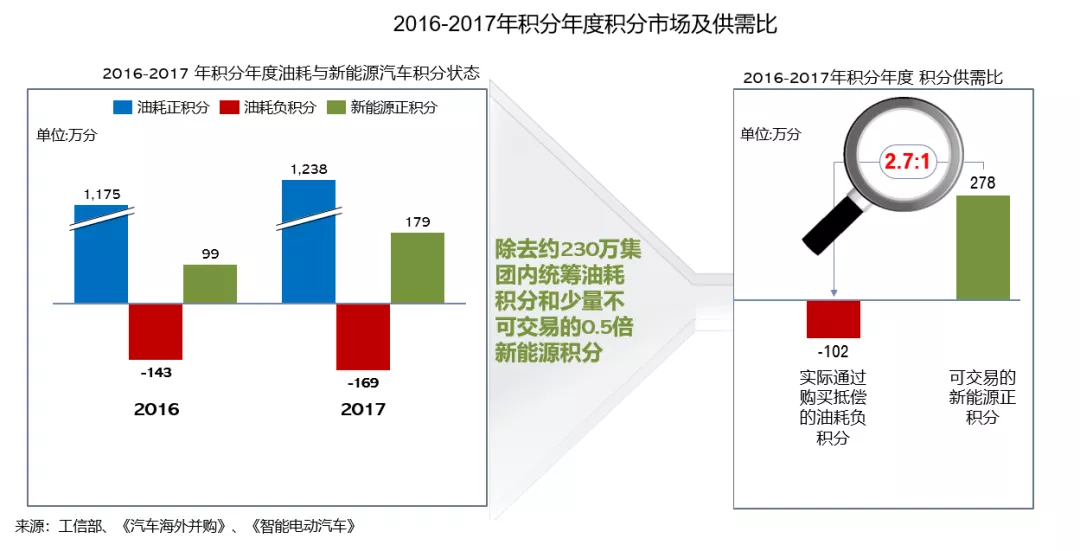

According to the information released by MIIT, 124 passenger car enterprises produced/imported a total of 24.4947 million vehicles (including new energy vehicles but excluding exported passenger cars) in China in 2016, with an average curb weight of 1410 kg and an actual average fuel consumption value of 6.43 L/100 km. Positive credit scores for fuel consumption were 11.7486 million, negative credit scores for fuel consumption were 1.4299 million, and positive credit scores for new energy vehicles were 0.9895 million. Among the 124 enterprises, 80 enterprises met fuel consumption standards, while the remaining 44 enterprises did not meet such standards, requiring offsetting measures for credit compliance.

In 2017, 130 passenger car enterprises produced/imported a total of 24.6929 million vehicles (including new energy vehicles but excluding exported passenger cars) in China, with an average curb weight of 1438 kg and an actual average fuel consumption value of 6.05 L/100 km. Positive credit scores for fuel consumption were 12.3814 million, negative credit scores for fuel consumption were 1.689 million, and positive credit scores for new energy vehicles were 1.7932 million. Among the 130 enterprises, 74 enterprises met fuel consumption standards, while the remaining 56 enterprises did not meet such standards, requiring offsetting measures for credit compliance.

In July 2018, the credit trading window period for the years 2016-2017 officially opened. Because it was the first time for trading, and because the negative credit scores for the two years were merged for offsetting, various variables and flexible measures were involved, making both buyers and sellers cautious in the early stages.

After nearly two weeks of observation, the trading platform did not see its first formal points transaction until July 11, 2018. There were only a few sporadic trial transactions, and overall trading in the points market was relatively weak. After seeing higher quotes of over 2,000 yuan by the end of July, the volume of transactions gradually increased.

After nearly two weeks of observation, the trading platform did not see its first formal points transaction until July 11, 2018. There were only a few sporadic trial transactions, and overall trading in the points market was relatively weak. After seeing higher quotes of over 2,000 yuan by the end of July, the volume of transactions gradually increased.

According to the author’s earlier market simulation and final retrospective analysis of actual transaction volumes, the total supply of points in the market is approximately 2.78 million, while the actual demand is approximately 1.02 million. The supply-demand ratio is approximately 2.7:1, resulting in an imbalanced supply and demand relationship.

According to the value law we learned in middle school textbooks, when supply is less than demand, prices rise; when supply is greater than demand, prices fall. Prices fluctuate around value, and in the long run, prices tend to approach value infinitely.

In the second month of the trading period, selling companies gradually realized the fact that supply is greater than demand, so the number of sales quotes rapidly increased. There even appeared phenomena of price comparisons, clashes, and trampling. Open quotes and cumulative transaction averages fluctuated briefly and then continued to decline significantly.

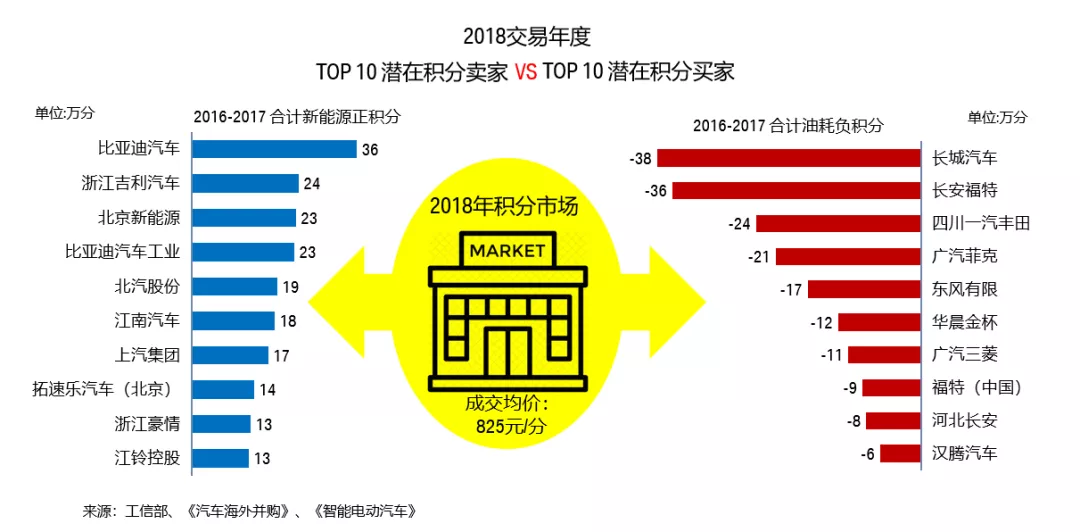

By the end of August, when the trading window period was approaching closing, there were even public quotes of tens of yuan. The final average transaction price for new energy vehicle points was set at RMB 825 per point.

According to the “Notice of Four Departments on the Management of Average Fuel Consumption of Passenger Car Companies in 2016 and 2017,” if an enterprise wants to use the 2013-2015 oil consumption transfer points to offset the negative oil consumption points in 2016-2017, in addition to a continuous 20% annual discount for three years, the enterprise should also calculate with 6.9 liters/100 kilometers as the target value. This greatly reduces the probability of large-scale oil consumption negative point companies in the mainstream market being able to use the transfer points for 2013-2015.

Against the background of energy-saving and emissions reduction policies, traditional gasoline vehicle companies with large size and heavy emphasis on large displacement and high fuel consumption, such as Great Wall Motors, Changan Ford, and Sichuan FAW Toyota, became the major purchasers in China’s first points trade. Most of these large negative oil consumption point companies in 2016-2017, except for some early transfer points from affiliated companies, need to purchase new energy vehicle points from external sources.

On the other hand, pioneering companies of new energy vehicles, represented by BYD, Geely, and BAIC, finally saw some returns from the points market after years of investment beyond subsidies and experienced the initial development of new energy vehicles.

According to rough statistics for the entire 2018 trading year, the first transaction of new energy vehicle points for compliance with 2016-2017 standards in China reached 1.02 million points, with a transaction income of 840 million yuan.

Thus, the distinctive Chinese “Dual Credit Policy” has successfully undergone its first credit trading under the retrospective management mode, accumulating a considerable amount of experience for regulatory authorities and enterprises.

2019: Price at around RMB 100 per credit, transaction volume of RMB 1.4 billion

After the successful preliminary test during the first trading year of 2018, both enterprises and the industry have encountered the tests of the 2018 credit score year and 2019 credit trading year.

The 2018 credit calculation is the first official year of credit management after the implementation of the “Dual Credit Policy.” As for the 2019 credit trading year assessed based on the 2018 credit score year, it is also the first official year of credit trading after the implementation of the “Dual Credit Policy.” However, since the 2018 credit score year still did not have a proportionally required credit score for new energy vehicles, the 2019 trading year is also the first official credit trading year in a “single assessment” context.

The industry generally regards the compliance to 2018 credit score and credit trading in the 2019 “single assessment” as a transitional phase of credit management.

According to interviews conducted by the author with several automotive industry insiders, the “Dual Credit Policy” has undergone multiple rounds of preheating, internal and public consultations, including publicity by the Legal Office of the State Council and the WTO, since 2016. Therefore, most automotive companies have a relatively comprehensive understanding of the policy content and have already made preparations in terms of product layout and new energy vehicle introduction.

Besides, it was during a period of rapid advancement in new energy vehicles. In 2018, the production of new energy passenger cars exceeded one million units for the first time, reaching 1.038 million units, a year-on-year increase of almost 80% compared with 2017. Moreover, the average cruising range of electric vehicles increased significantly compared to the previous years, with over 50% of vehicle models having an average cruising range exceeding 300 kilometers. The same year also witnessed the first negative growth of China’s fuel vehicle industry in nearly thirty years. These factors have led to a significant increase in the positive supply of new energy vehicle credits and a decrease in the negative fuel consumption credits due to the decline of fuel vehicles (which offset the demands on new energy vehicles).

In addition, based on the experience and lessons of the previous year, enterprise groups strengthened the coordination of positive fuel consumption credits within the group, reducing the need for subsidiary companies to comply by purchasing new energy credits externally.

Unfortunately, situations can sometimes arise. During the final consultation stage before the public release of the “Dual Credit Policy,” the proportion of new energy vehicle credits required for the 2018 credit score year was still 8%. However, it was rumored that due to public relations involving foreign politicians and associations, the 8% new energy credit score requirement for 2018 was canceled at the last minute before the policy was officially released in 2018, leading to an oversupply of new energy vehicle credits that year.According to the data released by the Ministry of Industry and Information Technology, a total of 141 passenger car enterprises produced/imported 23.1391 million passenger cars (including new energy passenger cars and excluding exported passenger cars) in China in 2018. The industry’s average curb weight was 1456 kg, and the actual average fuel consumption was 5.80 liters per 100 kilometers. The positive and negative integral fuel consumption were 9.9299 and 2.9513 million integral points, respectively, and the positive integral points for new energy vehicles were 4.0353 million. Among the 141 enterprises, 66 enterprises met the fuel consumption standards, while the remaining 75 enterprises did not.

Although the number of non-compliant enterprises exceeds that of compliant ones, most of them are subsidiaries of large groups, and most enterprises can reduce their need to purchase integral points through internal coordination. Of course, a few automobile manufacturers and parallel import enterprises did not compensate for various reasons and were eventually punished accordingly.

According to the author’s previous market simulation and final transaction volume analysis, the actual supply and demand ratio of new energy vehicle integral points in 2018 may be close to 3:1, which led to a sharp drop in the price of new energy integral points that year.

According to the author’s communication with many business insiders, in the last one or two weeks of the integral point trading period in 2019, the quoted price was basically around a few tens of yuan per point. The low price of integral points greatly dampened the enthusiasm of new energy leading enterprises. Perhaps because of this, the official average trading price for integral points was not announced in 2019. The author estimates that the average trading price should be around 100 yuan per point.

According to rough statistics for the entire 2019 trading year, the number of new energy vehicle integral points traded for compliance with the 2018 standards in China may have reached around 1.2-1.3 million points, with integral point transaction revenue of approximately 140 million yuan.

Although the low integral point price made new energy integral point heavyweights such as BYD, SAIC, and BAIC annoyed, the negative integral point heavyweights such as General Motors, Nissan, FAW, and Ford were quite pleased as they could save a lot of money.

2020: Price of 1,204 yuan per point, transaction volume of approximately 2.6 billion yuan

In 2020, it was the first time that the “Dual Credit Policy” implemented formal “double assessment” of fuel consumption and new energy vehicle integral points. The industry generally regarded the trading period in 2020 as a year with real meaning in the implementation of integral point management.According to the data released by the Ministry of Industry and Information Technology, 144 domestic passenger car enterprises in China produced or imported a total of 20.93 million vehicles (including new energy vehicles and excluding export vehicles) in 2019, with an industry average curb weight of 1480 kilograms and an actual average fuel consumption of 5.56 liters per 100 kilometers. The positive integral of fuel consumption was 6.4343 million points, the negative integral of fuel consumption was 5.1073 million points, the positive integral of new energy vehicles was 4.1733 million points, and the negative integral of new energy vehicles was 0.8553 million points. Of the 144 enterprises, 62 enterprises met the fuel consumption standard, while the remaining 82 enterprises did not meet the standard, and the number of non-compliant enterprises continued to increase in recent years.

According to the provisions of the “Dual Credit System Measures”, the 2019 credit year is the first year to assess the proportion of new energy vehicle credits. The requirement of 10% new energy credit ratio in that year led to the first negative new energy credit of 0.855 million points in the entire automotive industry.

After coordinating the fuel consumption within the automotive group and its affiliated companies, the industry needed to compensate for fuel consumption and negative new energy credits by purchasing new energy credits, which totaled about 2.1 million. The available new energy vehicle credits for that year reached 4.17 million points, with a supply-demand ratio of close to 2:1, which significantly decreased compared to previous years. Moreover, considering that new energy credits were relatively concentrated in the hands of the leading enterprises, the credit market mainly showed a basic balance of supply and demand, and the transaction price was stable and slightly increasing compared to previous years. The officially announced average transaction price of new energy vehicle credits was RMB 1204 per point.

Based on a rough estimation of the entire 2020 trading year, the number of new energy vehicle credit transactions for compliance with the 2019 credit year reached about 2.1 million points, while the transaction revenue from new energy credits was around RMB 2.6 billion.## Top 10 sellers in the credit market show differentiation

Except for the traditional new energy giant BYD, which continues to dominate the leaderboard, Tesla, a rising star in the new energy automobile field, is starting to show its worth in the credit market in China. Meanwhile, the sales leaders in the fuel vehicle market, such as joint venture enterprises FAW-Volkswagen, SAIC-GM, Beijing Hyundai, and SAIC Volkswagen have already used up all their positive fuel consumption credits from the early stages. In 2020, these joint ventures and their multinational corporations behind them really needed to purchase a large number of credits externally to achieve compliance, and the cost of purchasing credits began to eat into the profits of selling cars. As the contradiction between sales terminals that still mainly rely on fuel vehicles and the increasing compliance costs of enterprises gradually erupts, some companies have had to adjust their product layout and sales policies, tilting their focus towards new energy vehicles.

It can be said that 2020 was a year when multinational corporations and joint venture companies truly began to feel the “big stick” power of China’s Dual Credit Policy.

2021: Credit trading price is 2,100 yuan/credit, with a trading volume of about 10 billion yuan

2020 was a relatively special year in the history of China’s automobile industry. At the beginning of the year, the COVID-19 pandemic raged, bringing about unprecedented impact to the industry. Fortunately, with effective anti-epidemic measures taken in China and government strong leadership, the pandemic was brought under control in just a few months’ time. All automobile enterprises responded positively, and the total production and sales volume of the passenger vehicle market gradually recovered to a positive growth trend starting from May. The total volume of production and sales throughout the year only decreased by about 6% YoY, which can be considered a considerable miracle.

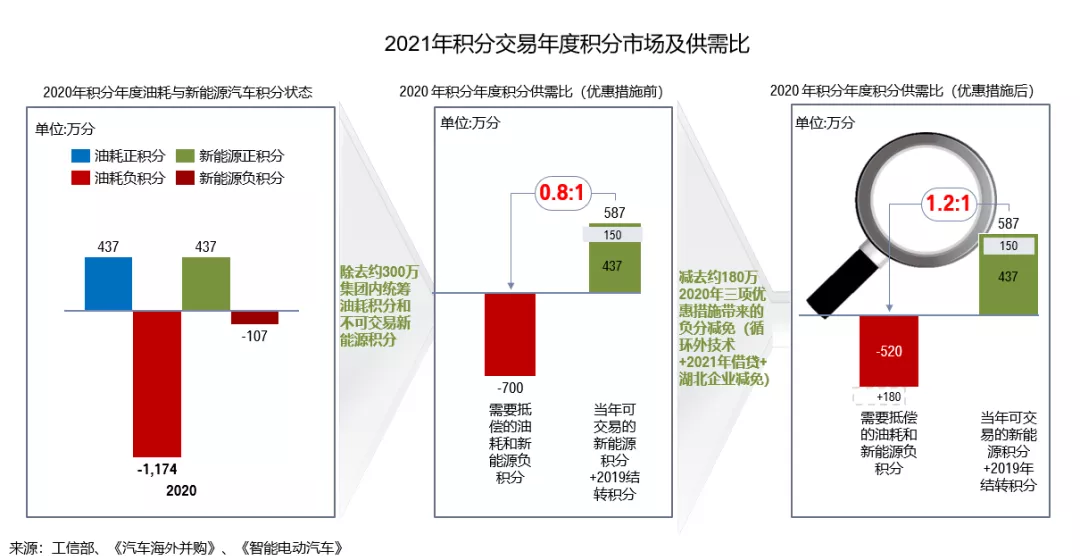

According to the final data released by the MIIT, in 2020, 137 passenger car enterprises in China produced/imported a total of 19.8302 million passenger cars (including new energy passenger cars but excluding passenger cars for export), with an average curb weight of 1510 kg and an actual average fuel consumption of 5.61 liters/100 kilometers. The positive fuel consumption credit was 4.3674 million credits, and the negative fuel consumption credit was 11.7143 million credits. The positive new energy vehicle credit was 4.3700 million credits, and the negative new energy vehicle credit was 1.0655 million credits. Among the 137 enterprises, 44 enterprises met the fuel consumption standard and the other 93 enterprises did not. Non-compliant enterprises accounted for 68% of the total number of enterprises, and continued to increase from previous years, greatly increasing the difficulty of achieving compliance.

According to the “Evaluation Methods and Standards for Fuel Consumption of Passenger Cars” (GB27999-2014), 2020 is the final year of the implementation of the fourth-stage fuel consumption standards, and the entire industry’s fuel consumption target value is 100% of the target value, which is further tightened based on the previous year’s standards (the 2019 target value was 110%). The continued tightening of the regulations has led to a significant increase in the negative fuel consumption points of the entire industry compared to the previous year. According to the “Dual Credit Management Method”, the proportion of new energy vehicle credits in the 2020 credit year is required to be increased from 10% in 2019 to 12%.

According to the “Evaluation Methods and Standards for Fuel Consumption of Passenger Cars” (GB27999-2014), 2020 is the final year of the implementation of the fourth-stage fuel consumption standards, and the entire industry’s fuel consumption target value is 100% of the target value, which is further tightened based on the previous year’s standards (the 2019 target value was 110%). The continued tightening of the regulations has led to a significant increase in the negative fuel consumption points of the entire industry compared to the previous year. According to the “Dual Credit Management Method”, the proportion of new energy vehicle credits in the 2020 credit year is required to be increased from 10% in 2019 to 12%.

Furthermore, the progress of energy-saving and new energy vehicle research and development and listing has been delayed for many automobile companies due to the epidemic, and the trend of large-scale automobile consumption caused by consumption upgrades has made the average fuel consumption of fuel vehicles of automobile companies in 2020 decrease less than in normal years. Although the production and sales of new energy vehicles have rebounded rapidly, the total number is still lower than expected.

The negative fuel consumption points in 2020 were more than doubled on the basis of 2019, reaching a record high of over -11710 thousand points. The negative credit points for the entire new energy vehicle industry have continued to deteriorate from 850,000 points in 2019 to over 1.07 million points.

These significant increases in negative credit points have made 2020 the most challenging year for the credit market since the issuance of the “Dual Credit Management Method”. Moreover, as the “hard currency” of new energy vehicle credits is mainly concentrated in a few mainstream new energy vehicle manufacturers, a supply shortage of new energy vehicle credits has occurred in the new energy vehicle credit trading history for the first time.

According to my analysis based on discussions with multiple industry insiders and subsequent information released by regulatory authorities, the actual supply-demand ratio of new energy vehicle credits in 2020 was less than 1:1. I estimate that it was about 0.7-0.8:1, which is significantly lower than the commonly believed normal supply-demand ratio of 1.3:1 to maintain basic balance.

The imbalance between supply and demand has two direct consequences: first, due to information asymmetry, some negative credit companies may not be able to buy new energy credits, thereby affecting their development; second, a supply shortage situation will directly lead to a significant increase in new energy credit prices.

Given the special circumstances of the epidemic in 2020, the regulatory authorities also timely introduced targeted measures to alleviate the supply-demand imbalance in the credit market according to the latest situation.

On February 18, 2021, the Ministry of Industry and Information Technology issued a notice on “Related Matters of Average Fuel Consumption of Passenger Car Enterprises and New Energy Vehicle Credit Management in 2020”, which provided three relief measures for the contradiction of supply-demand imbalance in the 2020 credit year. The first measure is to give preferential treatment to enterprises with out-of-cycle technology equipped vehicles for fuel consumption reduction.- The second measure is to allow companies to use newly generated positive points for new energy vehicles in 2021 to offset the negative points for new energy vehicles generated in 2020.

- The third measure is to take into account the difficulties faced by enterprises in Hubei Province and the actual situation of resuming work and production, in accordance with the principles of the package policies to support the economic and social development of Hubei Province set forth by the central government, and to calculate the negative points for the average fuel consumption and the new energy vehicle points generated by passenger car enterprises registered in Hubei Province in 2020 at a reduced rate of 80%.

With the help of these three preferential measures, the entire industry is estimated to have reduced its negative fuel consumption points by about 1.8 million, and with the equivalent of approximately 1.5 million new energy points from 2019 being carried over to 2020, the supply and demand ratio of the entire point system market has been restored to roughly 1.2:1, which is a lower level that barely maintains a balance between supply and demand. Although there is still some gap compared to the general balance level of 1.3-2:1, this is the best result achieved by the joint efforts of the entire industry.

According to the information disclosed by experts from the China Automotive Technology and Research Center at the TEDA Forum held in September 2021, the average transaction price for new energy vehicle points in the industry was around 2,100 yuan when the trading window closed in August 2021.

According to rough statistics for the entire 2021 trading year, the number of transactions for new energy vehicle points for compliance with 2020 standards in China reached about 5.2 million points, with transaction revenue of approximately RMB 10 billion.

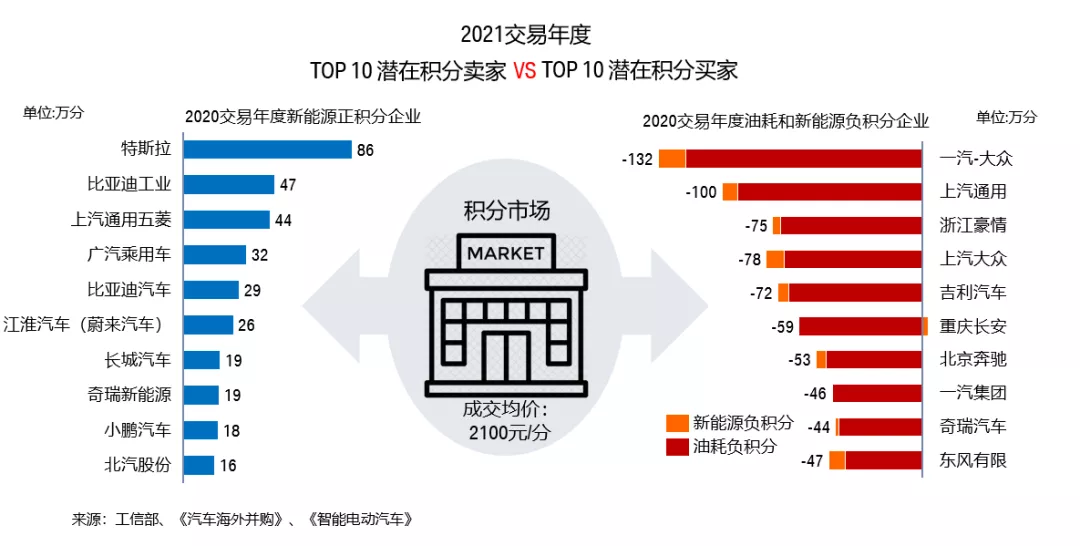

The point system market in 2021 has undergone many new changes. The first is the strong emergence of new carmakers in the point market, earning a lot of money, and secondly, traditional fuel vehicle giants have become “poor performers” in the point market, requiring huge expenditures to “preserve their grades.”

Tesla, which quickly gained volume after local production, has become the new dominant force leading the points list with 860,000 points, surpassing traditional Chinese new energy vehicle giants BYD (BYD Industrial + BYD Auto) by 100,000 points. Meanwhile, China’s gasoline-powered vehicle market leaders such as FAW-Volkswagen, SAIC-GM, SAIC-Volkswagen, and Geely Auto have all had a difficult time in the point market, requiring huge expenditures to purchase a large number of new energy points just to barely meet compliance requirements.According to key data since the implementation of the Double Credit Policy, in 2020 alone, FAW-Volkswagen produced a total negative credit score of 1.32 million due to fuel consumption and new energy vehicles, while SAIC-Volkswagen produced a total negative credit score of 780,000. The total negative score of the two North-South Volkswagen joint ventures is about 2.1 million. Although Volkswagen can use comprehensive measures such as intra-group coordination and external technical discounts to alleviate credit pressure in the 2021 trading year, it is estimated that Volkswagen will need to spend at least 3 billion RMB to obtain 1 million credits, or approximately 20,000 cars at an average price of 150,000 RMB per car. This helps explain why regulations like the CO2 regulation in Europe, ZEV in the United States, and the Double Credit Policy in China are forcing Volkswagen to transform towards electrification at all costs, and also why CEO Herbert Diess is risking his position in pushing for Volkswagen’s tough transformation.

Compared with the traditional car manufacturers struggling in the credit market, emerging automakers such as Tesla, NIO, and Xpeng are dominant players in the credit market as they generate only positive credit scores without the burden of fuel consumption penalties. Their credit salespersons have become the VIPs of various enterprises, and the business of buying credits is booming. Volkswagen reportedly bought credits from Tesla at a price of RMB 3,000 per credit, which gained new understanding on Tesla’s profitability. In 2020, Tesla’s financial statement showed that selling carbon credits accounted for $1.58 billion in revenue, well over its net profit of $721 million. Over the past five years, selling carbon credits/credits globally has earned Tesla a total of $3.3 billion. As for emerging automaker NIO, it sold approximately 200,000 new energy credits in the 2021 trading year, generating revenue of RMB 517 million, equal to RMB 2,585 per credit, while the financial report of another emerging automaker, Li Auto, showed that it sold approximately 70,000 new energy credits in the 2021 trading year, generating revenue of RMB 200 million, equal to RMB 2,857 per credit. Emerging automakers are selling credits for high prices.

The 2021 trading year is a turning point for CEOs of traditional internal combustion engine car manufacturers, including multinational companies and joint ventures, to make the painful decision to start transforming towards electric vehicles. It is also a year that has completely solidified the direction of emerging automakers and new, new automakers to go all-in with new energy vehicles.

Key Data Summary since Double Credit Policy Implementation

Since the implementation of the “dual credit method”, including the retrospective period, the output (excluding exports) and imports of China’s passenger car industry have continued to decline, from 24.49 million vehicles in 2016, to 19.83 million vehicles in 2020, with a compound annual growth rate of -5%. The compound annual growth rate of fuel vehicles is -6%, while the performance of new energy vehicles during the same period is remarkable. From 33,000 units in 2016, it has grown to 1.2 million units in 2020, with a compound annual growth rate of 38%.

Thanks to the rapid development of new energy vehicles in China, the actual average fuel consumption of the passenger car industry (including the calculation of new energy vehicles) has dropped from 6.43 liters/100 kilometers in 2016 to 5.61 liters/100 kilometers in 2020, with an average annual decrease rate of 3%. Due to continuous improvement in the range of new energy vehicles and a decrease in power consumption, the points generated by a new energy vehicle have increased from 2.8 points in 2016 to 4.5 points in 2020.

Due to factors such as the continuous tightening of fuel consumption standards, a decrease in the annual compliance factor, and consumption upgrades, the positive points of China’s passenger car industry’s average fuel consumption continue to decline, from 11.75 million points in 2016 to 4.37 million points in 2020, while the negative points have continued to increase from -1.43 million points in 2016 to -11.71 million points in 2020.

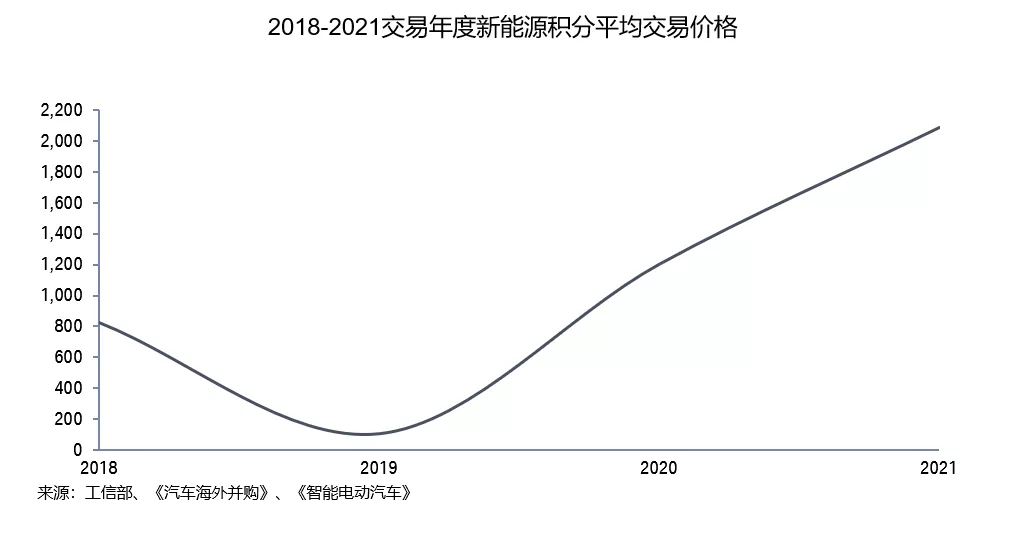

The rapid development of new energy vehicles has increased the new energy positive points from less than one million points in 2016 to 4.37 million points in 2020, a growth of 3.4 times. The negative points have slowly increased from -0.86 million points in 2019 to -1.07 million points in 2020 due to an increase in the point ratio requirement.Since the establishment of the self-owned credit trading market, there have been four trading periods. The trading price of new energy vehicle credits has increased from 825 yuan per point in 2018 to about 2,100 yuan per point in 2021, which is a growth of 1.5 times. The cumulative trading volume over the four years is close to 10 million points, and the cumulative profit of the credit market is approximately 14 billion RMB. The average profit created by a single new energy credit over the past four years is about 1,400 RMB, which plays a crucial role in promoting the rapid development of China’s new energy vehicle industry.

Future Development Trend of Credit Policies

On June 15, 2020, five ministries, including the Ministry of Industry and Information Technology, jointly issued Decree No. 53, which announced the “Decision on Amending the Method for the Parallel Administration of Corporate Average Fuel Consumption and New Energy Vehicle Credit.” The “Dual Credit Policy” for 2021-2023 was thereby launched.

The revised “Dual Credit Policy” has made substantial modifications in the ratio of credits, testing methods (NEDC à WLTC/CATC), credit calculation formulas, definitions of associated companies, and the 50% transfer of new energy vehicle credits, low fuel consumption vehicles, and other areas.

As 2021 is coming to an end, the credit calculation for 2021 and subsequent credit transactions will also begin in 2022. In the short term, although affected by the chip supply, China’s new energy vehicle production and sales still showed strong growth in 2021, and the annual production of new energy vehicles is expected to reach 3.3-3.4 million units. There will undoubtedly be a state of oversupply in the credit market in 2022.

With the announcement of preferential credit policies for the credit calculation of braking energy recovery and efficient air-conditioning for models equipped with out-cycle technologies, the credit market which was already in a state of oversupply in 2021 will experience a historical situation of severe oversupply. I estimate that the supply-demand ratio for the 2021 credit market may exceed 2.8:1, and the situation of oversupply will undoubtedly force the credit trading price to drop significantly. I predict that the average trading price of new energy credits in the 2022 trading year will be lower than 2,000 yuan per point.

In the medium term, in order to avoid significant fluctuations in the credit market and provide the Chinese automotive industry with a stable policy expectation, the industry has been calling for modifications to the new “Dual Credit Policy” based on the experience and lessons learned from several years of credit trading and compliance practices after the policy was launched.

I predict that in the future, there will be significant modifications required in the new energy credit proportion, fuel credit trading, credit market supply-demand adjustment mechanisms, etc. Specifically, with the proposal of the “Dual Carbon” targets, it is necessary for the competent authorities and industry to carefully consider how to connect the policy framework for China’s dual credit management and the carbon management policy framework and carbon market quota trading in an orderly manner.

In the long run, the author expects that when Chinese new energy vehicles occupy the majority of the market share and each company’s product layout is mainly based on new energy vehicles, the dual credit management system with Chinese characteristics, which promotes China’s automotive industry to fully transform towards electrification with the “carrot and stick” strategy, will also exit the historical stage after completing its specific historical mission.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.