Introduction: With the support of power battery technologies such as China’s CTP and thermal management, the energy density and relative safety of lithium iron phosphate (LFP) batteries have reached new heights, making them one of the best battery options for mid-to-low-end car models or those with mid-to-low configurations. Thanks to this technological breakthrough, coupled with inherent cost advantages, LFP batteries are enjoying another spring.

This year’s power battery market is experiencing a resurgence of activity, and the main character is LFP. With the further improvement of comprehensive performance in terms of cost, technology, and safety, LFP has become one of the best power battery options for mid-to-low-end car models and those with mid-to-low configurations.

These subtle changes have not only brought about earth-shattering changes to China’s power battery market but have also stirred up the global power battery market.

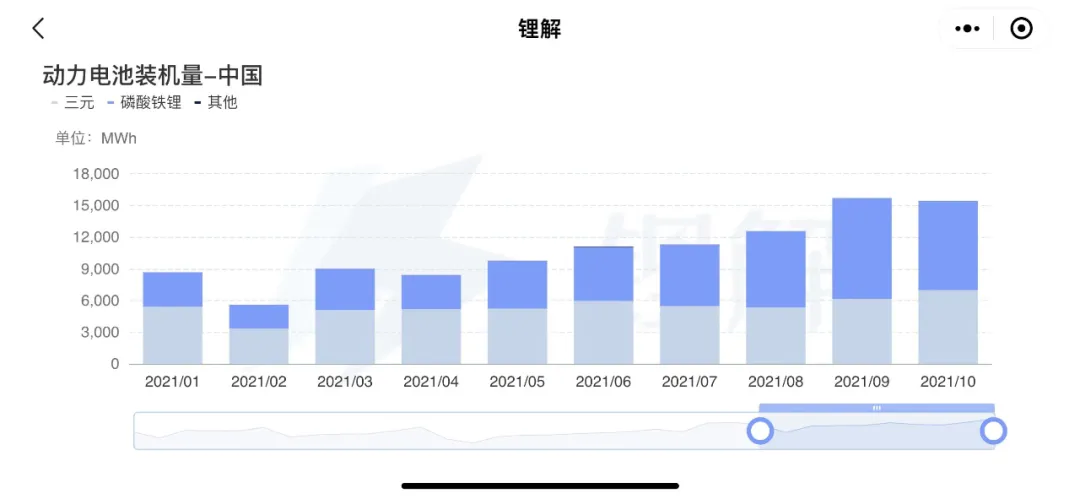

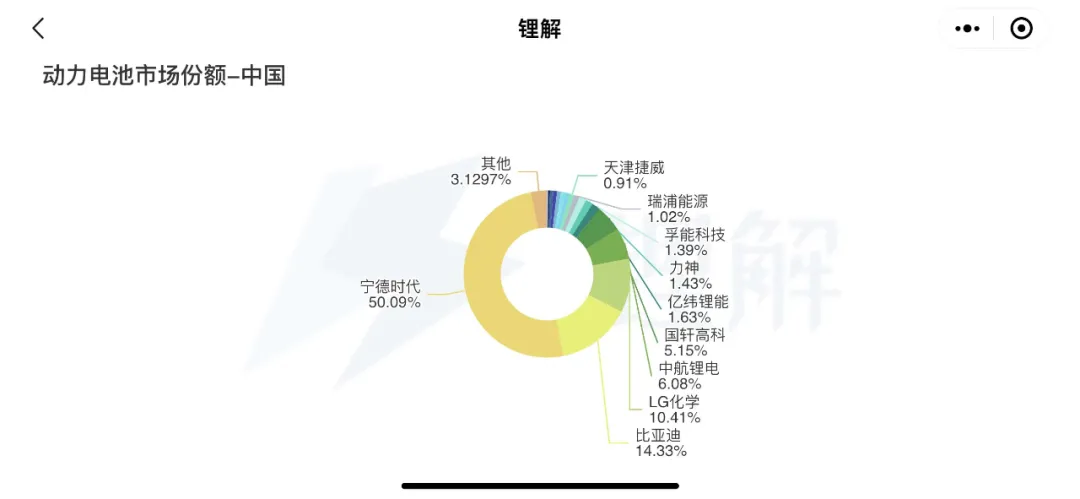

First comes the LFP’s “comeback”. After being beaten by ternary lithium batteries in 2017, LFP has made a strong comeback this year. Since July, the sales volume has surpassed ternary lithium batteries for four consecutive months. It is highly likely that the cumulative sales volume for this year will exceed that of ternary lithium batteries, making LFP one of the most important power battery technology routes and thus capturing the largest market share in the power battery market.

Then comes the globalization of LFP. In the past, Chinese power battery companies were the ones primarily working on LFP, while foreign brands generally focused on ternary lithium batteries. Nowadays, battery manufacturers such as LG New Energy and SKI have expressed interest in developing LFP batteries, and car manufacturers like Mercedes-Benz and Volkswagen have started to regard LFP as an important battery option.

From China to the world, the era of LFP has arrived.

Cost Advantages Highlighted

This year, the biggest change in China’s power battery circle is that LFP battery sales have exceeded those of ternary lithium batteries for several consecutive months. In July, the sales volume of power batteries in China was 11.3 GWh, including 5.5 GWh of ternary lithium batteries and 5.8 GWh of LFP batteries. In the following months, the sales volume of LFP batteries exceeded that of ternary lithium batteries one after another.

This result is not difficult to understand. When new energy subsidies are exhausted, the difference in driving range between ternary lithium batteries and LFP batteries no longer affects the subsidies received, and therefore, the impact on sales is minimal. At this time, LFP batteries, which enjoy cost advantages, naturally become the realistic choice for car companies.

From July to October, the sales volume of LFP batteries exceeded that of ternary lithium batteries for four consecutive months. From January to October, the cumulative sales volume of ternary lithium batteries was 54.1 GWh, accounting for 50.3% of the total sales volume and increasing by 100.1% year-on-year. The cumulative sales volume of LFP batteries was 53.2 GWh, accounting for 49.5% of total sales volume and increasing by 316.4% year-on-year.So it is expected that the cumulative shipments of lithium iron phosphate batteries will surpass ternary lithium batteries in November, and in terms of cumulative shipments for the year, the former will likely surpass the latter. After 4 years, lithium iron phosphate is set to return to the throne.

The industry generally believes that the return of lithium iron phosphate batteries is due to its significant cost advantage, but how big is this advantage? There doesn’t seem to be particularly convincing data on this. Therefore, I checked the pricing data for ternary lithium and lithium iron phosphate battery materials on the Chinese Lithium Battery Network and was quite surprised.

According to data from the Chinese Lithium Battery Network on November 29th, the average price of power lithium iron phosphate battery materials was 87,000 yuan per ton. In order to verify this data, I also checked the quotes for lithium iron phosphate materials from manufacturers such as DuFang Nanomaterials, BTR, and Guanghua Technology on ShengYiShe, and they were all around 89,000 yuan per ton.

In contrast, the prices of ternary lithium battery materials, according to data from the Chinese Lithium Battery Network, are on average 220,000 yuan per ton for NCM 523 ternary lithium batteries (2.53 times the price of lithium iron phosphate materials), 244,500 yuan per ton for NCM 622 ternary lithium batteries (2.81 times the price of lithium iron phosphate), and 271,500 yuan per ton for NCM 811 ternary lithium batteries (3.12 times the price of lithium iron phosphate materials).

Overall, ternary lithium battery materials are 2 to 3 times more expensive than lithium iron phosphate battery materials. This is more shocking than the commonly understood fact that ternary lithium batteries cost a few cents more per Wh than lithium iron phosphate batteries.

Interestingly, although lithium iron phosphate battery materials have many price advantages compared to ternary lithium batteries, from the price trend from September 1st to November 30th, prices have continued to rise, indicating that the price advantage of lithium iron phosphate batteries is rapidly narrowing. The reason behind this is directly related to the skyrocketing prices of upstream raw materials.

On November 25th, data released by Shanghai Nonferrous Network showed that lithium carbonate, an important positive electrode material for lithium iron phosphate and ternary lithium batteries, had reached a historic high of over 200,000 yuan per ton for three consecutive days, an increase of 359.8% compared to the same period last year when it was 43,500 yuan per ton, and an increase of 277.4% since the beginning of the year.The price of lithium hydroxide, another positive electrode material commonly used in ternary lithium-ion battery, is also skyrocketing. According to data from SCI99, as of November 17th, the price of lithium hydroxide reached RMB 171,940/ton. As of November 24th, Shanghai Yulong Industrial Co., Ltd. has quoted RMB 200,000/ton for battery-grade lithium hydroxide.

Before other better battery technologies such as solid-state batteries mature, lithium-ion batteries will be the best choice for new energy vehicles. In comparison between lithium iron phosphate and ternary lithium-ion batteries, the former’s cost advantage will ensure its place in the market of power batteries.

Strengthening of Performance Shortcomings

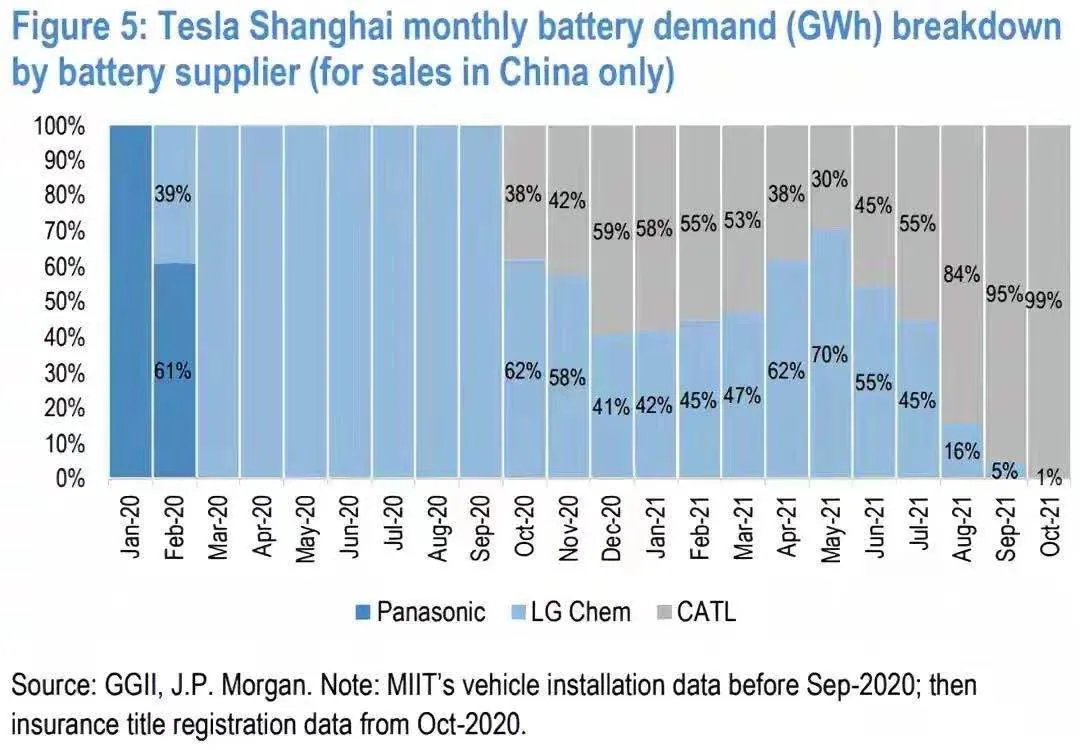

Recently, a chart of the monthly battery loading of Tesla’s Shanghai factory has been circulating widely within the industry.

The focus is on the fact that 99% of the models sold by Tesla in the domestic market are equipped with batteries from Contemporary Amperex Technology Co., Ltd. (CATL). Currently, CATL cooperates with Tesla to supply lithium iron phosphate batteries. This means that 99% of Tesla models sold in the domestic market are equipped with lithium iron phosphate batteries.

For us practitioners in the new energy industry, this data is very insightful, as it is well-known that Tesla was previously a staunch supporter of ternary lithium-ion batteries, but is now exclusively supporting lithium iron phosphate, indicating that this has attracted everyone’s attention.

Obviously, if lithium iron phosphate batteries are only attractive due to their cost advantages and not technological advantages, they are not enough to attract a brand like Tesla, which is picky and demands higher technical requirements. We can get an answer to this from the data comparison before and after switching batteries for Tesla’s Model 3.

The 2020 Standard Range Plus upgraded version of the Model 3 uses LG Energy Solution’s 811 cylindrical battery, with an energy density of 161 Wh/kg, a capacity of 52 kWh, a curb weight of 1614 kg, and an NEDC range of 445 km.

After switching to Contemporary Amperex Technology Co., Ltd.’s lithium iron phosphate battery, the Model 3’s battery pack energy density reached 125 Wh/kg, the capacity was 55 kWh, the curb weight was 1745 kg, an increase of 131 kg, and the NEDC range was 468 km. Also, the zero-to-100 km/h acceleration time for both models is 5.6 seconds.

Yes, after switching to the lithium iron phosphate battery, the standard range plus version of the Model 3 not only did not slow down due to an increase in curb weight (maximum torque increased by 29 Nm), but also increased its range by 23 km, and it also became cheaper by RMB 22,100.Switching from ternary lithium to lithium iron phosphate, the Model 3 has achieved “increased quantity and decreased price”, who wouldn’t like that? As mentioned earlier, Tesla’s Shanghai factory produces 99% of its capacity using lithium iron phosphate batteries, showing consumers’ great enthusiasm for them.

In terms of quality, the lithium iron phosphate Tesla did not disappoint. According to feedback from users in the Northeast, “the actual range of the lithium iron phosphate Model 3 in winter can still reach about 380 kilometers, and there is no phenomenon of breaking in half, so it is acceptable as a whole.”

In addition, this year’s reports of Tesla self-ignition have also decreased significantly compared to previous years, especially for domestically produced Teslas equipped with Ningde era lithium iron phosphate batteries, which have performed quite “safely” and have not yet had a single self-ignition incident. Their “self-ignition sales” are excellent.

Overall, the switch from LG new energy’s ternary lithium to Ningde era’s lithium iron phosphate for the Model 3, and even the Model Y, was a complete success, even greatly exceeding expectations.

The good technological and market performance of lithium iron phosphate Teslas has even caused Musk to praise it. In late August, in response to user inquiries about choosing between ternary lithium Model 3 or lithium iron phosphate Model 3, Musk stated that he “preferred lithium iron phosphate” and his reason was that “lithium iron phosphate can be charged up to 100%, while ternary lithium batteries are best charged to 90%.”

We don’t know if Musk regrets not using lithium iron phosphate batteries earlier, but what is certain is that he will reassess Tesla’s battery technology roadmap, with lithium iron phosphate batteries occupying a more important position.

On October 29th, it was reported that Tesla had ordered up to 45GWh (equivalent to meeting the demand for 820,000 rear-wheel drive Model 3s with standard range) of lithium iron phosphate batteries from Ningde era for use in next year’s Model 3 and Model Y vehicles.

Though this heavy news has not been confirmed by both Tesla and Ningde era, they have not denied it either. One is the biggest and most technology-focused new energy vehicle brand, and the other is the largest and most comprehensive power battery brand. The cooperation between the two sides has long been tacit understanding.

With the help of CTP and thermal management and other power battery technologies, the energy density and relative safety of lithium iron phosphate have been taken to a new level, making it one of the best battery options for mid to low-end or low-configuration models. With such technological breakthroughs, plus inherent cost advantages, lithium iron phosphate batteries are experiencing “another spring.”

It’s not hard to imagine that if CTC technology is popularized, the advantages of lithium iron phosphate batteries will be further amplified and the market will be even more promising.

Awakening of Korean Battery

Tesla’s successful application of the LFP (lithium iron phosphate) battery from CATL (Contemporary Amperex Technology) has been referred to as the “butterfly effect”. This not only set the stage for CATL and Tesla to renew their agreement for a 45 GWh super order, but also triggered jealousy among other foreign battery manufacturers who began to pursue this technology.

LG Energy Solution, as the biggest loser under the CATL-Tesla collaboration, turned its focus to LFP. According to a report by South Korean media outlet THE ELEC in early September, LG Energy Solution started developing LFP battery technology at its Daejeon laboratory at the end of last year and is expected to build a pilot production line as early as 2022.

In addition to LG Energy Solution, South Korean battery manufacturers SK Innovation and Samsung SDI have also announced their entry into the LFP battery field almost simultaneously. With all South Korean battery manufacturers entering the LFP battery market, it means that there is only one major power battery brand in the TOP10 global that has not entered the LFP battery market, which is Panasonic from Japan.

One important reason why Panasonic did not enter the LFP battery market is that they are focusing on Tesla’s next-generation cylindrical battery, the 4680 battery. On October 25th, Panasonic officially released the prototype of the 4680 battery. Kazuo Tadanobu, the head of Panasonic’s battery division, said that “this battery will help to deepen the commercial relationship between Panasonic and Tesla”.

Panasonic’s refusal to enter the Chinese market with Tesla has not only led to the loss of its reputation as the world’s leading power battery brand but has also made its relationship with Tesla more delicate. Panasonic hopes to make a comeback through the 4680 battery, but this may not be so easy as 99% of Tesla batteries in China are LFP. How much demand there will be for the 4680 battery remains to be seen.

The key lies in the performance improvement of the 4680 battery, cost control ability, and safety guarantee. Especially safety, as new energy users wake up, a Tesla that frequently self-ignites is no longer tolerable.

Ten years ago, because of the low energy density, LFP was looked down upon. Today, with the help of CTP and other technologies, the energy density has risen and LFP has been rediscovered. The underestimation of LFP batteries by Japanese and Korean battery companies reflects their strategic mistakes.

Even if Panasonic in Japan is still reluctant to change, LFP has already conquered two of the most important markets in China and South Korea.

Furthermore, as the LFP battery patents in Europe and the US expire one after another, it is not ruled out that some new LFP manufacturers will emerge. It is reported that the LFP patent in Europe has already expired in 2021, and the patent for LFP batteries in the United States will expire in 2022. In fact, China was once blocked by LFP battery patents, but China “did not fall for it”.In 1997, the three giants of lithium iron phosphate batteries, EnerDel from the USA, Hydro-Québec from Canada, and A123 Systems from the USA, began to apply for patents worldwide in an attempt to control the development of lithium iron phosphate globally and profit from it. In 2005, EnerDel and A123 began building factories in China to produce lithium iron phosphate batteries and formally opened the door for lithium iron phosphate in China.

A few years later, China’s lithium iron phosphate battery industry began to take shape and became one of the top three battery-producing countries globally. At that time, the biggest problem facing China’s lithium iron phosphate industry was the patent lock, particularly Canada’s Hydro-Québec’s CN 100421289C patent, which was a typical patent monopoly.

According to reports, Hydro-Québec relied on patent barriers and made many demands that were considered quite unreasonable by industry enterprises, such as the requirement that domestic lithium iron phosphate manufacturers must obtain authorization from them, with an entry fee of $10 million, and a patent fee of at least $2,500 for every ton of lithium iron phosphate produced.

“If we let them continue their practices, they will spread their nets far and wide, and our battery industry development in China will be severely restricted or may not even develop at all,” said Li Zhongdong, Chairman of Henan HuanYu Group, in an interview with the China Intellectual Property News.

In 2009, to maintain the healthy and sustainable development of China’s battery industry and prevent future new energy vehicle industries from being subject to others’ control, the China Battery Industry Association filed an invalidation request against Hydro-Québec’s relevant patents for lithium iron phosphate, and China’s State Intellectual Property Office declared their patent invalid after reviewing it.

Whether it be technological breakthroughs, market demand, or monopoly-breaking patents, all developments are pointing in the direction of lithium iron phosphate. It went from being China’s little-known product to a global war.

Does ternary lithium still have a market?

Seeing Tesla’s success with lithium iron phosphate batteries, other car companies are starting to reassess them. This year, multinational car companies such as Hyundai-Kia, Volkswagen, and Mercedes-Benz have announced that lithium iron phosphate will be one of their new energy product’s battery options.

In addition to recognizing the value of lithium iron phosphate batteries, another reason these multinational car companies are turning to them is due to the string of spontaneous combustion incidents caused by LG’s ternary lithium batteries, which have become a nightmare for multinational car companies. More than ten spontaneous combustions have occurred in Hyundai electric cars, and General Motors has issued recalls after recalls.

Once lithium iron phosphate batteries value has been recognized by all global car companies, a perennial question comes up: does ternary lithium still have a future? The answer is yes.

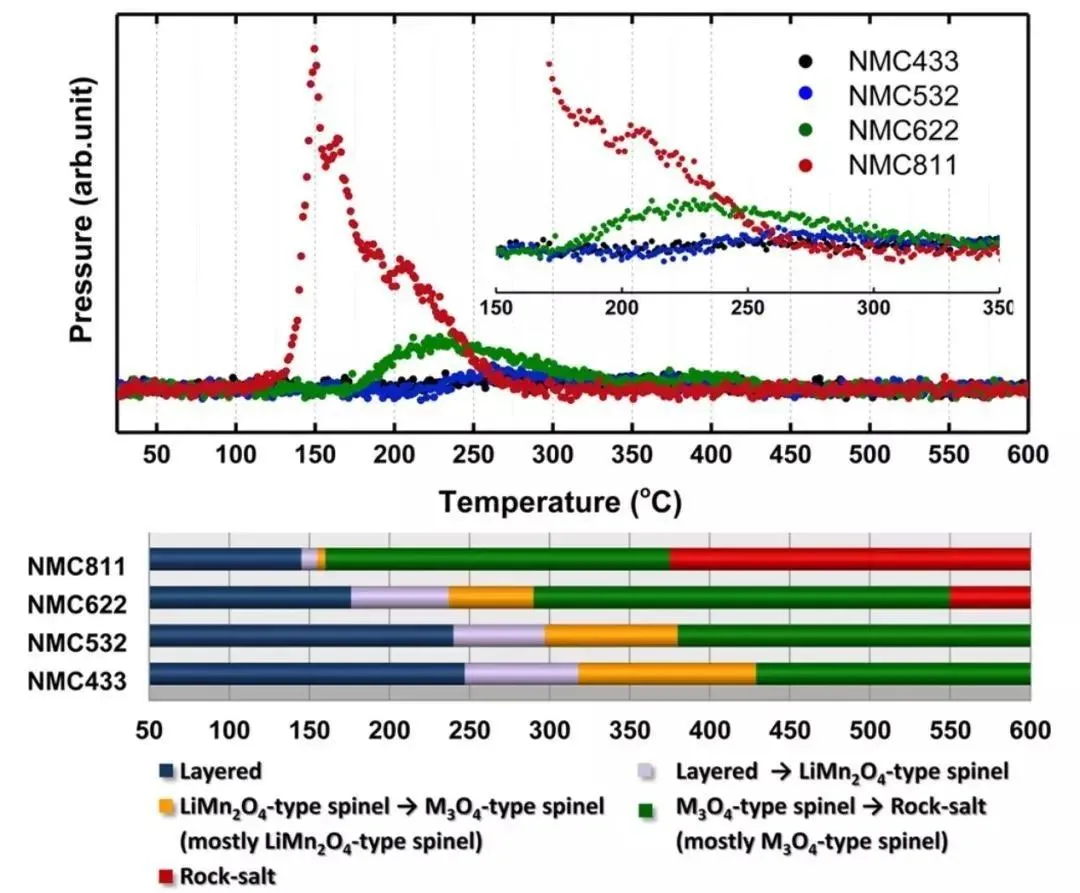

The main concern about ternary lithium is its relatively poor safety compared to lithium iron phosphate. However, this concern is baseless. The reason batteries carry safety risks is because of thermal runaway. As long as thermal runaway is controlled, any type of battery can be relatively safe.People commonly mention that lithium iron phosphate batteries are safer because their thermal runaway temperature is higher than 500 degrees Celsius, while ternary lithium batteries are generally below 300 degrees Celsius. Judging the safety of batteries based on the high or low thermal runaway temperature is a fallacy.

So how to control the thermal runaway of batteries? The key lies in battery pack technology.

On November 6th last year, NIO released a 100kWh battery pack that uses CATL’s “heat-resistant propagation safety design” technology, which can make the battery pack “only smoke, not catch fire”. This is also the world’s first non-burning ternary lithium battery pack.

Li Bin emphasized that we do not talk about “never catching fire.” Everything is about probability. We have reduced the probability of “catching fire” to a very, very low level. Li Bin is likable, probably because of his straightforwardness.

In addition to CATL, other companies are also continuously working in this direction. For example, BYD has launched blade batteries, GAC Aion has launched clip batteries, Great Wall Motors has launched Da Yu batteries and Lantian has launched amber batteries.

The improvements are evident in the results. Although BYD’s blade batteries still experienced several spontaneous combustions, the number is much lower than before. Also, GAC Aion had several self-ignitions last year but none this year so far, which is impressive. As for Great Wall Motors Da Yu and Lantian amber batteries, we can also look forward to them.

After the safety issue is solved, ternary lithium batteries can basically open up and fly, especially in the mid-to-high-end market with light cost and heavy performance. Recently, Markus Schaefer, chief operating officer of Mercedes-Benz, revealed that the Mercedes-Benz Vision EQXX will be released on January 3rd next year. This is a compact car, but its range is as high as 1,000 kilometers.

CATL Chairman Zeng Yuqun predicted in April this year that “in the power battery market, the market share of lithium iron phosphate will gradually increase, and the proportion of ternary batteries will decrease, but there will still be many high-end models with demand for cruising range and high energy density, so ternary batteries will still have market space.”

Therefore, it is not difficult to predict that until better power batteries appear, lithium batteries (lithium iron phosphate and ternary lithium) are still the most realistic power battery choices for automakers. As for the proportion of market share between lithium iron phosphate and ternary lithium batteries, it is not surprising which is higher or lower. The main thing is that the two have a symbiotic relationship rather than an opposing one.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.