Sales Analysis of A00 Pure Electric Vehicle from Three Perspectives

In the first seven months of 2021, A00 pure electric vehicles continued the sales momentum from the second half of 2020. The main market participants at this level have expanded from Wuling, Great Wall, and Chery to Lengpao, Changan, and JAC Volkswagen. In terms of sales logic, the main selling point of these vehicles is to reduce fuel consumption. In terms of regional distribution, the situation of low overall electrification penetration rate in Henan, Shandong, and Guangxi has been improved.

In this market analysis of this level vehicle, I mainly look at it from three angles: geography, brand, and city penetration rate.

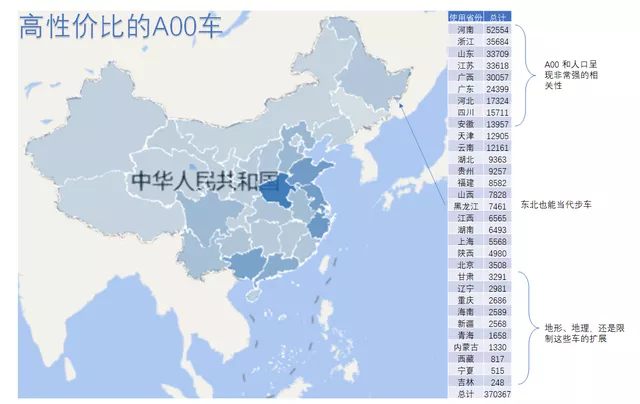

Distribution of Main Sales Areas

From the perspective of geographical structure, the pure electric A00 models show a strong correlation with the population. Except for regions limited by terrain and geographic environment (such as several vast western regions), A00 pure electric vehicles, because of its inherent high cost-effective feature, can even penetrate into Heilongjiang as a commuting car. In theory, the cost-effective strategy of A00 is an important guideline for opening up the market for pure electric vehicles in Class A in the future.

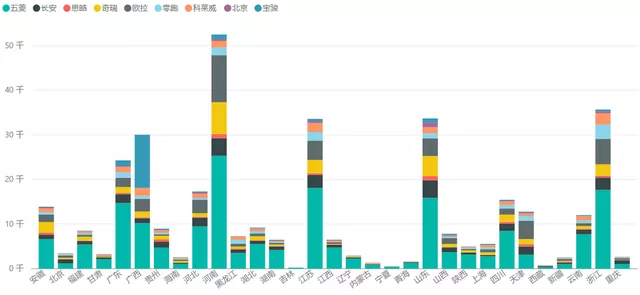

From the perspective of brand, Wuling is almost dominant in all markets. In addition, several points can be noted:

(1) The brand Baojun pure electric vehicles are almost limited to Guangxi. At the same time, Guangxi’s characteristics are almost monopolized by Baojun and Wuling, and it is difficult for other brands to open up the situation here.

(2) Although Wuling occupies a large market in Henan, Shandong, Zhejiang, and Jiangsu, other A00 pure electric vehicle brands are also constantly developing the market, and it can be foreseen that there will be incremental growth in the future.

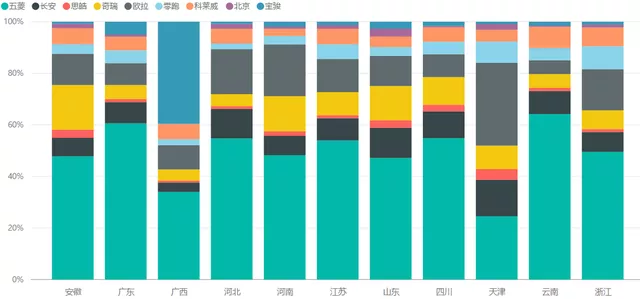

I have extracted the regions with relatively high sales, and the following picture shows the distribution of A00 demands more clearly. The A00 level has successfully opened up a relatively large demand in Guangxi, Henan, Shandong, Yunnan and Hebei, where other vehicle types are not doing well. It can be said that in the long run, this demand is the most real and exists independently of policies in restricted cities.

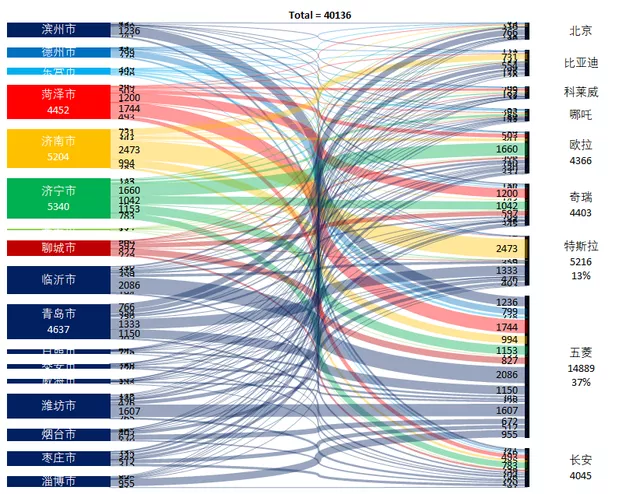

## Distribution in Henan and Shandong

## Distribution in Henan and Shandong

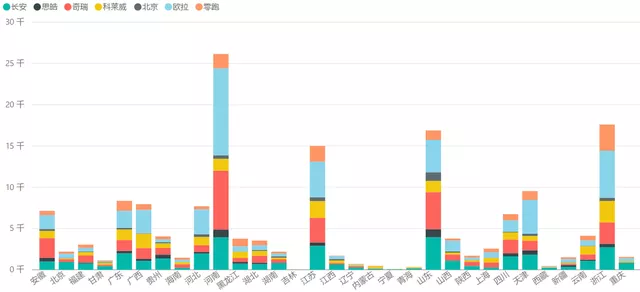

From Figure 5, we can see that in big cities like Tianjin, the demand for higher-end car models is greater than the lower-priced Wuling models. This means that after the A00 pure electric market is opened up, it can cultivate higher-end market demands. It’s a bit like how the demand for 1000 yuan smartphones led to a general demand, and then gradually attracted customers willing to pay for higher-configured and higher-mileage A00 pure electric models.

After removing Wuling and Baojun (Figure 6), we can see that these demands do exist. Just as Tesla drove the development of new energy vehicles by new entrants, Wuling brought about other car companies developing higher-configured A00 pure electric vehicles.

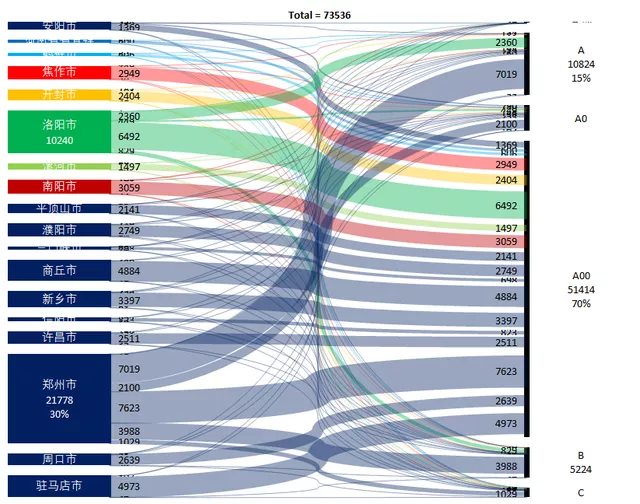

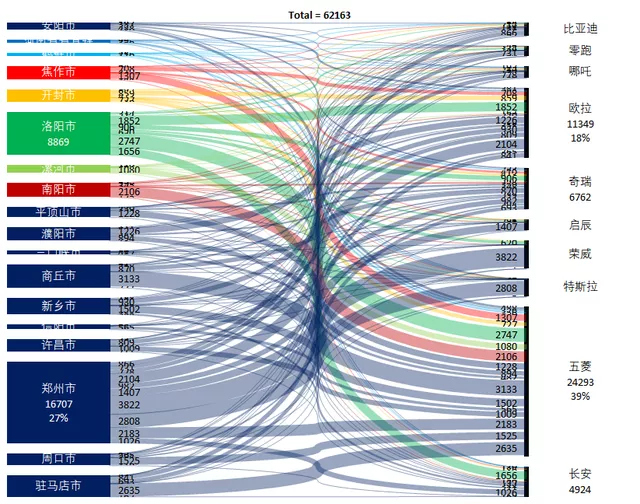

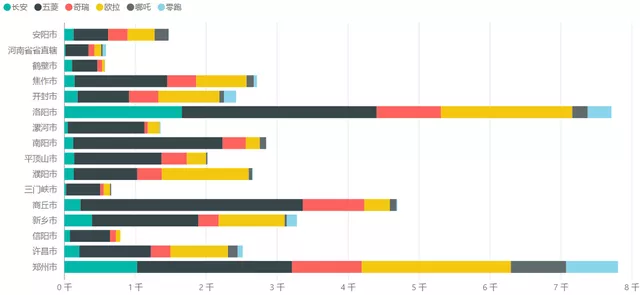

Distribution in Henan

Sorting out the distribution in Henan can provide everyone with a more intuitive reference. In Henan, 70% of the overall demand for pure electric vehicles is centered around the A00 level. In fact, 15% of the A-class and 7.5% of the B-class demands in Henan are almost all focused on Zhengzhou and Luoyang.

The following figure shows it more clearly: almost all Tesla, Roewe, and Qi Chen sales are concentrated in Zhengzhou, especially Tesla, which has almost all of its sales in Henan concentrated in Zhengzhou.

Once we focus on the A00 level, the correlation between the sales of A00 pure electric vehicles and the economic development of the city is no longer obvious, but rather positively correlated with the population. Therefore, I believe that the real demand for using A00 as a basic commuting tool is present and not small in all prefecture-level cities in Henan. It is this kind of demand that has led to the slow increase in the penetration rate of A00 in various cities. Therefore, based on the data from Henan, although the demand for A-level and above in the B-end and private end is still limited to Zhengzhou, the universality of A00 has indeed developed.Based on this inference, producing high-quality small cars from A00 to A0 levels in Henan is logically feasible in the next three years. The constraints imposed by Euler on Wuling Mini EV are evident from the data in Luoyang and Zhengzhou and have proven to be effective. The strategy adopted by Changan to copy Wuling is also feasible; it all comes down to how much money the car manufacturer is willing to subsidize the consumers at the A00 level, as this market primarily focuses on cost-effectiveness.

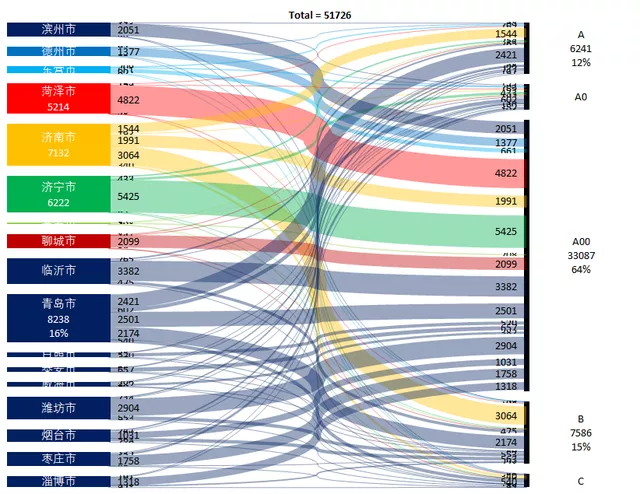

In Shandong, A00 level cars account for 64% of sales, with 12% and 15% coming from A and B levels, respectively, with the most significant demand in Jinan and Qingdao. Even in a place like Shandong, which does not have a purchase restriction, the factors that promote the use of these cars are primarily the installation of charging equipment by local governments, the replacement of 2B fleets (taxi and ride-hailing companies), and the ability of private consumers to afford Tesla and other A-level cars.

In Shandong, most of Tesla’s demand comes from Jinan and Qingdao, and only A00 levels can penetrate into lower-tier cities. Currently, we can see some A0 level car models trying to penetrate into these regions with high configuration and low prices.

In conclusion, I believe that there is a real market demand for high-quality pure electric small cars that do not rely on policy support, mainly from the A00 level, plus the high configuration of pure electric A0 level cars with a price range between 60,000 to 80,000 yuan. This logic is entirely the same as the demand increase trend from thousand-yuan smart phones to entry-level machines worth 2,000 yuan.

New car manufacturers represented by Tesla are gradually infiltrating medium-sized cities around large cities, and the speed of this infiltration depends on economic development. To be honest, promoting pure electric vehicles not only requires consumer recognition and payment but also has a direct relationship with the charging network gradually established by local governments, which requires continuing investment. This wave of promoting pure electric vehicles in 2021 fully demonstrates the support force of the previous restriction period (2015-2020) and the basic work in large cities. To further penetrate lower-tier cities, investment by local governments is required to support the popularization of all types of cars, other than A00, in combination with energy storage and new energy generation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.