Ningde Times announced the release of their first sodium-ion battery on July 29th, which has ignited widespread speculation in the industry. On that day, not only the concept stocks of sodium-ion batteries, but also the energy storage-related stocks have almost hit the limit.

Some people believe that sodium-ion batteries will replace lithium-ion batteries in the near future, some say sodium-ion batteries are the “Chinese opportunity”, and some think that the trillion-dollar market value of Ningde Times will continue to grow because of sodium-ion batteries.

Today, we are not talking about autonomous driving and intelligent cabins. Instead, we will talk about Ningde Times’ first-generation sodium-ion battery.

First of all, the relevant performance of this sodium-ion battery is already leading the world:

-

The energy density of Ningde Times’ first sodium-ion battery has reached 160 Wh/kg, which is currently the highest level in the world.

-

It has a cycle life of up to 3,000 times, which is basically equivalent to that of lithium-ion batteries.

-

It has fast charging ability. Charging for 15 minutes at room temperature can reach 80% of the battery’s capacity.

-

It has a discharge retention rate of more than 90% in low-temperature environments.

-

It has already surpassed the safety requirements of China’s power battery industry standards.

Ningde Times organized a special conference to explain and plan the technical advantages and application scenarios of this battery. This raises the question of why Ningde is making sodium-ion batteries.

Sodium-ion batteries step into the center stage

We need to start from scratch to discuss sodium-ion battery technology. In the 1970s and 1980s, sodium-ion battery technology coexisted with lithium-ion battery technology, just like the earliest electric cars coexisted with steam locomotives and gasoline cars.

However, lithium-ion batteries achieved commercial landing faster than sodium-ion batteries. In 1991, Sony released the first commercial lithium-ion battery, which was used in Sony’s own camera. Since there was no precedent to follow, Sony established a standard for its battery: a cylindrical battery with a diameter of 18mm and a length of 65mm. This is the ancestor of the 18650 battery.

Sony’s commercial promotion quickly obtained market recognition for lithium-ion batteries, and they were widely used in portable 4C products. With the rise of new energy vehicles, lithium-ion batteries also entered the automotive power battery field, and become the mainstream with various performance advantages.

As the power source for electric vehicle models, the production of lithium-ion batteries has always restricted the entire world’s OEMs’ car sales, even more severely than the “chip shortage” problem.According to SNE Research, the global demand for power batteries in electric vehicles will reach 406 GWh by 2023, while the expected supply of power batteries will be 335 GWh, resulting in a battery gap of approximately 18%. As time goes on, “battery anxiety” continues to increase rather than decrease, and it is predicted that by 2025, the gap will expand to around 40%!

Among them, the shortage of lithium-ion battery materials is the “culprit”.

In the earth’s crust, the reserve of lithium is only 0.0065%, and it is distributed extremely unevenly. Approximately 70% of the globally produced battery-grade Li2CO3 (lithium carbonate) is concentrated in South America (Argentina, Chile). Although China also has lithium mines, it only accounts for 6% of the global reserves. Due to large demand, currently about 80% of lithium resources need to rely on imported sources. In the face of the push towards deglobalization, there is indeed a risk of being “choked”.

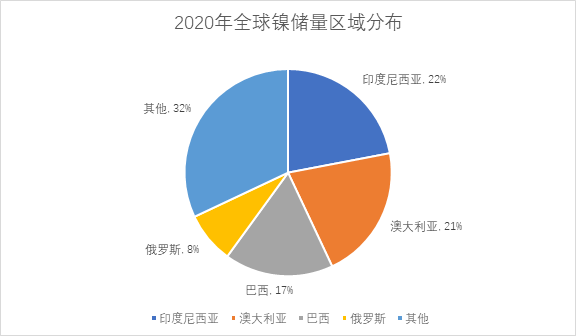

Similarly, the demand for nickel and cobalt, the two elements in NCM (nickel-cobalt-manganese) and NCA (nickel-cobalt-aluminum) as the current mainstream positive electrode materials of lithium-ion batteries, has encountered similar problems as lithium.

China’s nickel ore import dependence exceeds 80%, mainly imported from Indonesia and the Philippines. As the country with the largest laterite nickel ore reserves in the world, Indonesia accounts for nearly 40% of global production and dominates the international nickel ore field. In August 2019, Indonesia announced that it would no longer export nickel ore, causing the price of nickel ore to rise and causing shocks to our country’s battery manufacturers and aluminum alloy enterprises.

Of course, our companies will not sit still. In addition to Qinghai Salt Lake Industry’s acquisition of nickel mining rights in Indonesia, CATL also invested in building a plant in Indonesia in June last year.

Although everyone is moving toward the “low-cobalt” direction, Roskill predicts that NCM and NCA positive electrodes will still be mainstream in 2021, accounting for 70% of the positive electrode materials used in sold electric vehicles (based on weight), and the demand for cobalt will still continue to grow. And the distribution of cobalt resources is also uneven, with about half concentrated in the Democratic Republic of the Congo.

However, our companies are also very competitive. In December last year, Luoyang Molybdenum spent $550 million to acquire 95% of the shares of the Kisanfu copper-cobalt mine from the “copper giant” Freeport-McMoRan in the United States. This mine not only contains more than 3.1 million tons of cobalt metal, but is also one of the world’s largest undeveloped copper-cobalt mines. Ningde Times and Luoyang Molybdenum signed a cooperation agreement in April this year to jointly develop copper and cobalt resources.## What is sodium-ion battery?

The scarcity of raw materials for manufacturing lithium-ion batteries, as well as its uneven distribution, have prompted people to seek alternative technical solutions that can make up for these shortcomings. In the past 10 years, the progress of sodium-ion battery technology has shown us another “rising star” in the industry.

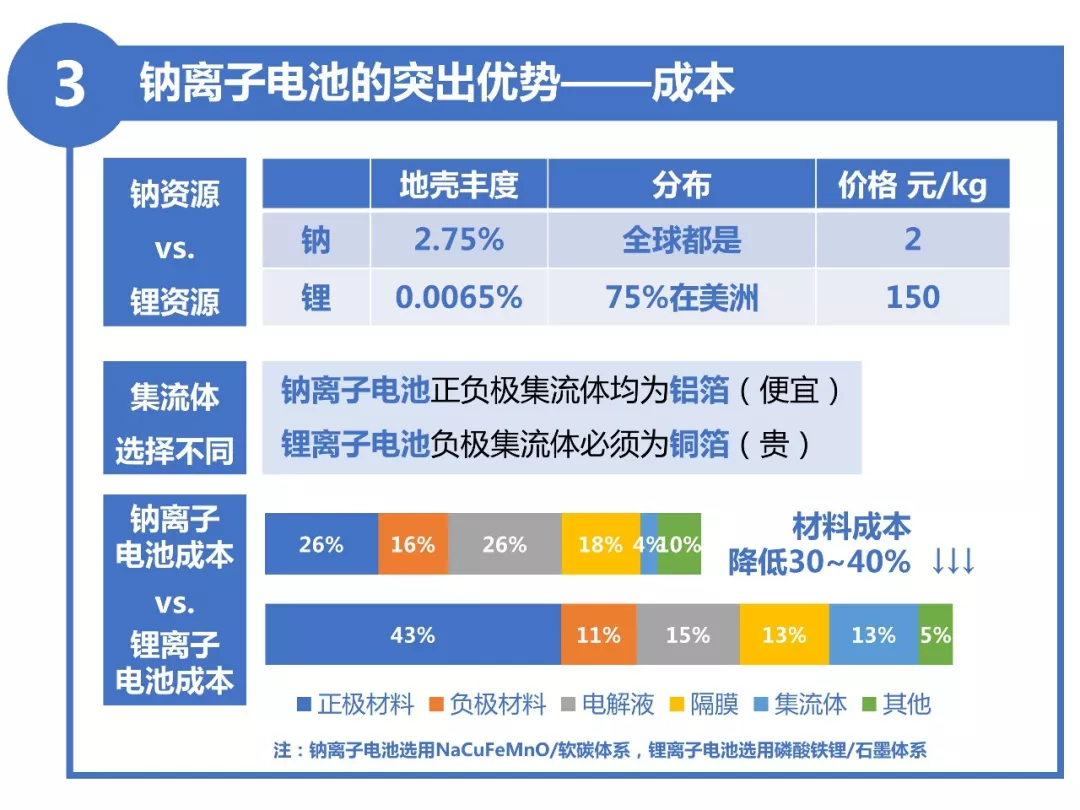

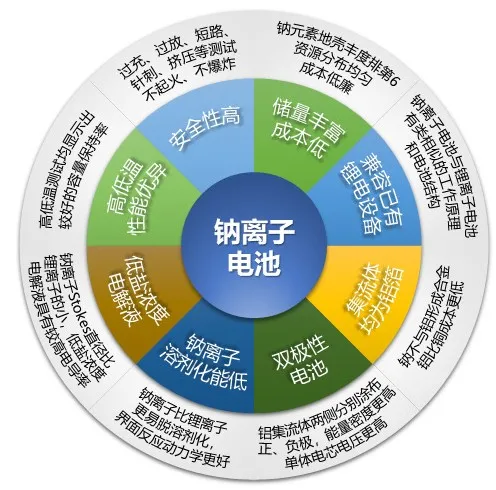

“Salt doesn’t stir-fry well because there is too much sodium chloride,” said Ningde Times Chairman Zeng Yuqun, referring to sodium-ion batteries. Indeed, our earth’s crust is rich in sodium, with a content of up to 2.75%! And the chemicals containing sodium are easily extractable with high grade, and most importantly, they are widely distributed, so there is no bottleneck problem.

The price of sodium per kilogram is only 2 yuan, while lithium is as high as 150 yuan. The BOM cost of sodium-ion batteries can be reduced by 30-40% compared to lithium-ion batteries.

Since sodium does not react with aluminum, the current collectors for both positive and negative electrodes in sodium-ion batteries can use cheaper aluminum foil instead of the copper foil used in lithium-ion batteries, which can further reduce costs by about 8% and reduce weight by about 10%.

Sodium not only has a wide distribution and low cost, but is also easier to manufacture, and its processing process is more environmentally friendly than the evaporative process of lithium brine. However, these production advantages alone are not enough to make sodium-ion batteries mainstream.

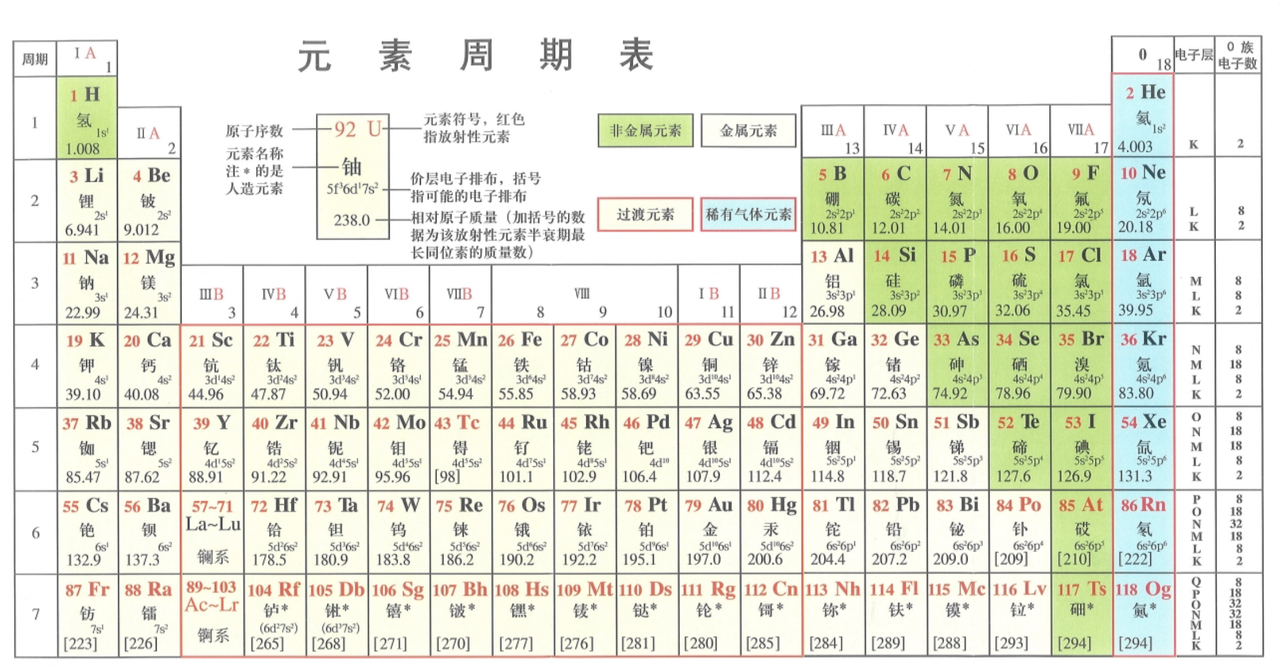

Sodium and lithium belong to the same alkali metal family in the periodic table, and their physical and chemical properties are very similar, even compatible with existing production equipment for lithium-ion batteries.

The working principle of sodium-ion batteries is also similar to that of lithium-ion batteries. Essentially, they belong to the class of concentration gradient batteries. By means of redox reactions, sodium ions are embedded/dislodged and inserted/removed between the positive and negative electrodes, achieving energy storage and release. Because these ions constantly shuttle between the positive and negative electrodes to transfer energy, they are also vividly referred to as “rocking-chair” batteries.

However, what really makes lithium-ion batteries commercially viable is the breakthrough in positive and negative electrode materials technology, since sodium-ion batteries are not compatible with the existing ternary or quaternary positive electrode materials and graphite negative electrode of lithium-ion batteries.

Currently, there are three typical types of positive electrode materials for sodium-ion batteries recognized by the academic community: layered transition metal oxides, poly anions, and Prussian blue.

It is widely believed in the industry that Prussian blue materials and its analogues have great potential. These materials have high capacity, high structural stability, excellent cycling performance, and can be compatible with sodium-ion battery electrolytes in two different systems: aqueous and organic. Meanwhile, as a by-product of steel production, the price of Prussian blue is relatively low at 20,000 yuan per ton.Negatives, too, need to be reconsidered. Since the radius of lithium ions is as small as 0.076 nm, while the radius of sodium ions is considerably larger, reaching 0.102 nm. Therefore, using the original graphite negative of lithium-ion batteries would make it difficult for lithium ions to deinsert from the graphite layer, break the layered structure of graphite, and ultimately cause battery failure.

In response to the characteristics of sodium ions, scientists have tested carbon-based negatives, titanium-based compounds, conversion reaction compounds, intermetallic compounds, etc. for the negative of sodium-ion batteries. So far, hard carbon that is difficult to graphitize is a better negative material for sodium-ion batteries. However, due to the need for a high-temperature process above 1,000℃ during the preparation, the manufacturing cost is relatively high, at around 100,000 RMB/ton.

As for the choice of electrolyte, sodium-ion batteries are relatively easy, as the electrolyte can be transformed from lithium hexafluorophosphate to sodium hexafluorophosphate, and lower concentrations can be used to achieve sufficient dynamic performance, which further reduces the cost of the electrolyte solute.

Safety is also considered an important advantage of sodium-ion batteries.

At the testing stage, they have passed safety tests such as puncture, squeeze, overcharge, and overdischarge without catching fire or exploding. Moreover, as aluminum foil with better stability is used as the negative current collector for sodium-ion batteries, the battery can be completely discharged before transportation to ensure safety without affecting the subsequent battery performance.

Sodium-ion batteries, a new path for “overtaking in the bend”

There are already many domestic and foreign companies conducting research on sodium-ion batteries. I found several to show you.

Including FARADION, the world’s first sodium-ion battery company founded in 2011. They have chosen a technology route of nickel-layered oxide positive, hard carbon negative, and organic electrolyte. The energy density of sodium-ion batteries is 150Wh/kg to 160Wh/kg, and the 80% DOD cycle life is 1,000 times.

ALTRIS, a Swiss sodium-ion battery company, chose Prussian blue positive and water-based electrolyte. Their products have an energy density of 140Wh/kg, and the volumetric retention rate can be maintained at 94\% for 25 cycles.

The recently mentioned scientist Chen Li-quan founded Zhongkehai Na in 2010, which is a leading company in the sodium-ion battery industry in China. The company’s Chairman and CTO is Hu Yong-sheng, a researcher at the Institute of Physics, Chinese Academy of Sciences. In June 2018, Zhongkehai Na launched the world’s first sodium-ion battery-powered (72V*80Ah) low-speed electric vehicle, and in March 2019, they released the world’s first 30 kW/100 kWh sodium-ion battery energy storage station. At the end of June 2021, the Institute of Physics, Chinese Academy of Sciences, and Zhongkehai Na jointly launched the first 1 MWh sodium-ion battery photoelectric storage and charging intelligent microgrid system in the Taiyuan Comprehensive Reform Zone, Shanxi.

The recently mentioned scientist Chen Li-quan founded Zhongkehai Na in 2010, which is a leading company in the sodium-ion battery industry in China. The company’s Chairman and CTO is Hu Yong-sheng, a researcher at the Institute of Physics, Chinese Academy of Sciences. In June 2018, Zhongkehai Na launched the world’s first sodium-ion battery-powered (72V*80Ah) low-speed electric vehicle, and in March 2019, they released the world’s first 30 kW/100 kWh sodium-ion battery energy storage station. At the end of June 2021, the Institute of Physics, Chinese Academy of Sciences, and Zhongkehai Na jointly launched the first 1 MWh sodium-ion battery photoelectric storage and charging intelligent microgrid system in the Taiyuan Comprehensive Reform Zone, Shanxi.

The sodium-ion battery products of Zhongkehai Na adopt a copper-layered oxide positive electrode, coal-based negative electrode, and organic electrolyte system, with an energy density of 145 Wh/kg and a cycle life of 4,000 times, which is at the forefront of the world in battery performance.

Many people may recognize Dr. Chen Li-quan, as he was once the Ph.D. supervisor of C.Y. Chu, the founder of CATL. Therefore, it can be said that CATL and Zhongkehai Na are from the same family tree in the development of sodium-ion batteries.

Now, Contemporary Amperex Technology (CATL) has launched its first generation of sodium-ion batteries, which have surpassed the products of other sodium-ion battery manufacturers in various parameters and are leading the industry. Furthermore, the company has used new materials and new formulas in the following aspects:

- For the positive electrode material, CATL has chosen two types of materials with potential commercial value, including Prussian white and layered oxide. Recently, they increased the gram capacity to 160mAh/g, which is almost the same as the positive electrode material in the current lithium-ion batteries. For the Prussian white, the material phase structure was rearranged to solve the problem of rapid capacity decay during the cyclic process.

- For the negative electrode material, CATL has developed a hard carbon material with a unique pore structure, with a gram capacity of more than 350mAh/g. This material has excellent cycling properties and is comparable to the graphite negative electrode in lithium-ion batteries.

According to the researcher Hu Yong-sheng from the Institute of Physics, Chinese Academy of Sciences:

From the perspective of core technology, our country’s technological reserves have fully prepared for the industrialization of sodium-ion batteries in China. Our country is at the forefront of sodium-ion battery research and development and has completely independent intellectual property rights in the core material system. Some patents have also been authorized by the United States, Japan, and the European Union.This indicates that there is a great opportunity for Chinese sodium-ion batteries to enter the foreign market in the field of sodium-ion battery applications in the future, and to gain an advantageous position with advanced technology and mature commercial systems.

CATL is a “new energy technology” company

Regarding the application direction of sodium-ion batteries, according to its characteristics, the industry mostly uses them in the fields of energy storage and electric two-wheeled vehicles. Since Liu Guijiang, the chairman of CATL, announced in May’s shareholders’ meeting that he would release sodium-ion batteries in July, the industry generally speculated that CATL was laying out energy storage.

In fact, CATL has set three major strategic development directions for itself, and it is no longer just a simple battery supplier:

-

Replace stationary fossil energy with renewable energy generation and storage;

-

Help the development of electric vehicles with power batteries, replacing mobile fossil energy;

-

Accelerate the replacement process of new energy in various fields with the integration of electric and intelligent applications.

Therefore, we got half of the guessing right about energy storage. But we need to know that CATL is a “new energy technology” company.

In 2018, the total electricity consumption of national data centers was 160.9 billion kilowatt-hours, accounting for 2.35\% of China’s total electricity consumption;

In 2018, China abandoned 102.2 billion kilowatt-hours of excess wind, solar, and hydropower;

With the acceleration of the construction of 5G base stations, China needs to build or renovate at least 14.38 million base stations, with a capacity of 15.5 GWh of batteries, and the demand for energy storage batteries will inevitably increase significantly.

Academician Chen Liquan made a detailed analysis of the current situation of China’s energy storage industry and affirmed the broad market prospects of the future energy storage field. Naturally, CATL will first lay out its first-generation sodium-ion batteries in the energy storage field where it is most suitable.

According to the analysis of Bloomberg New Energy Finance, the market scale of power batteries and energy storage batteries has reached 17.4 GWh in 2020, and the compound growth rate in the next 10 years is expected to exceed 30\%. By 2030, the demand for lithium-ion batteries for transportation and energy storage will soar to 5.9 TWh!

The demand market for energy storage will become CATL’s next profit growth pole. But CATL’s expectations for sodium-ion batteries are not limited to energy storage batteries.

They hope to achieve an energy density of 200 Wh/kg on the second generation of sodium-ion batteries, surpassing the 180 Wh/kg of lithium iron phosphate and meeting the requirements of power batteries.

In 2023, CATL’s sodium-ion batteries will form a basic industry chain, and the position of lithium iron phosphate batteries may have to be rearranged. To accelerate the improvement and development of the sodium-ion battery industry chain, Huang Qisen, deputy director of the CATL Research Institute, launched an invitation to research institutions, upstream material suppliers, and downstream battery application terminals during a live stream.

In 2023, CATL’s sodium-ion batteries will form a basic industry chain, and the position of lithium iron phosphate batteries may have to be rearranged. To accelerate the improvement and development of the sodium-ion battery industry chain, Huang Qisen, deputy director of the CATL Research Institute, launched an invitation to research institutions, upstream material suppliers, and downstream battery application terminals during a live stream.

To quickly bring sodium-ion batteries into the power battery market, CATL has developed the AB battery solution, integrating sodium-ion batteries and lithium-ion batteries in a PACK and using them together.

The mixed use of different batteries requires very high requirements for BMS. But the combination of sodium and lithium, is clearly more advantageous than the “lithium iron phosphate ternary” battery. The energy density of the first-generation sodium-ion battery is raised by the lithium-ion battery in this combination, while still exhibiting its advantages of high power and good low-temperature performance. Based on this system structure innovation, it can expand more application scenarios for lithium-sodium battery systems.

CATL has already been in contact with car companies and customers in the energy storage field regarding the use of the first-generation sodium-ion battery.

Zeng Yuqun called the relationship between sodium-ion batteries and lithium-ion batteries “mutually compatible and complementary.” Sodium-ion batteries are more about making up for the shortcomings of lithium-ion batteries, entering more subdivided fields and jointly filling the gaps in the energy storage and power battery markets.

Lastly, on July 29th, SNE Research also published the share of the global power battery market in the first half of 2021. CATL took the lead with 29.9% of the share, with an installed capacity of 34.1 GWh.

As a new energy technology company, CATL will not be satisfied with just its current position as the leader in the power battery field. Standing in front of the trillion-dollar market value, Zeng Yuqun needs to create a new path of “maturity” to create a new track for CATL.

The importance of sodium-ion batteries to CATL has both historical inevitability and contingency. China is the world’s largest importer of oil and gas due to its local energy structure having less oil and more coal. At the same time, due to the large use of coal, China has the highest carbon dioxide emissions. This is not a good thing. Reducing reliance on imported energy and increasing energy security is essential.It is no coincidence that sodium-ion battery technology is being pursued worldwide. In 2020, the US Department of Energy announced its plan for battery research, clearly identifying sodium-ion batteries as a development system for energy storage batteries. The EU energy storage plan “Battery2030” project has announced the future battery development system, including lithium-ion batteries, non-lithium-ion batteries, and future new batteries. Sodium-ion batteries are listed as the first non-lithium-ion battery system. The EU’s “Horizon 2020 Research and Innovation Program” also focuses on sodium-ion materials as a key component in the manufacturing of durable batteries for non-automotive applications, with a funding of 8 million euros.

Unlike lithium-ion batteries, sodium-ion batteries do not require expensive and imported raw materials, and China has advantages in sodium-ion battery technology research and development, patent quantity, and industry layout. Choosing sodium-ion batteries is therefore a “call of the times” for CATL.

Coincidentally, on July 29th, Huawei’s flagship phone P50 was finally released after a four-month delay due to chip constraints, but the entire series does not have 5G.

It is noteworthy that Huawei’s consumer electronics business has fallen out of the top five since being sanctioned, despite having the ability to design its own chips. However, it has not mastered the most critical chip manufacturing capabilities, and there is not even a company in China that can provide high-precision lithography machines.

Perhaps in view of this setback, CATL has chosen to take the initiative to innovate battery physical and chemical technology, and carry the banner of sodium-ion batteries, avoiding being constrained with courage and foresight, much like building its own “lithography machine”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.