Shanghai’s Vehicle Registration Data

2021 has seen a visible increase in the penetration of new energy vehicles in Shanghai. According to data released by the Shanghai Economic Information Center, let’s review the situation of the first half of the year and also my opinions on Shanghai’s new energy vehicles.

1) In June, 20,833 new energy passenger cars were registered, an increase of nearly 5,000 compared to the previous month. In the first half of 2021, a total of 116,600 new energy vehicles were registered, which is almost the same as the total annual number of 117,200 in 2020.

2) In the first half of 2021, a total of 311,900 passenger cars were registered in Shanghai, and the penetration rate of new energy vehicles in Shanghai has reached 37.5%.

Between January and May, a total of 95,791 new energy vehicles were registered in Shanghai, while the total number of registered passenger cars was 260,196, resulting in an overall penetration rate of over 37% in 2021.

3) Challenges exist in the auction system of Shanghai license plates and the overall development of new energy vehicles. Of the 69,000 car owners who spent 100,000 yuan on Shanghai license plates, Shanghai vehicle owners who choose new energy options will increase in the future.

4) In June, 1,859 A00-level new energy vehicles were registered. The management of Shanghai’s new energy vehicle license plates may become more refined, rather than one-size-fits-all.

5) Demand for Tesla in Shanghai is actually declining. In June, the total sales of Model 3 in the sub-segment market fell from 2,623 in May to 4,681. This increase should be the increment of Model 3, and it is estimated that Model 3’s sales in Shanghai this month will be around 2,500 (the policy of insurance giveaway is still somewhat useful). The SUV market increased from 8,412 to 9,887, and it is estimated that the sales volume of Model Y in Shanghai will be around 2,500, adding up to 5,000.

In summary, these are the new developments of new energy vehicles in Shanghai.A00 level increased by around 1,800 units, and this was reflected in the concentrated registration of Wuling Mini EVs.

B-segment cars increased by around 2,000 units, with the impact of Model 3 being the most direct change. There were no special models delivered in May and June.

SUVs increased by 1,475 units. Recently, there has been an increase in the number of PHEV vehicle updates, and Model Y will also be delivered in June.

Pure electric SUVs accounted for 44% of the market share in Shanghai, so the significant price reduction of Model Y in the future will still have a big impact on this market. Whether Model 3 is reduced in price or upgraded from 450+ km to 500+km in terms of mileage, the cost-effectiveness will further improve. The consumption structure of new energy vehicles in Shanghai maintains a clear separation between high-end and low-end.

According to Tesla’s retail sales of 28,000 units in June, I estimate that they sold around 5,000 units in Shanghai. Therefore, based on the breakdown, I estimate that the market share of Model 3 in the B-segment sedan market in Shanghai has returned to 50%. The expected delivery volume of Model 3 in Shanghai in June is about 2,500 units.

Note: This data is mainly compared based on previous monthly changes. Other models should be a balanced process and the fluctuations are not significant. The increase in sales volume in June and the insurance policy for Model 3 deliveries in June should have a strong correlation.

The biggest price change this time was for Model Y, with sales of around 2,500 units in June. The delivery of the standard continuous version for 276,000 yuan in August will have a significant impact on the existing long-range version, as the difference in their mileage is not significant. This will likely be a corresponding measure to address the depletion of the order pool in many markets.## New Energy Vehicle Data from China Association of Automobile Manufacturers

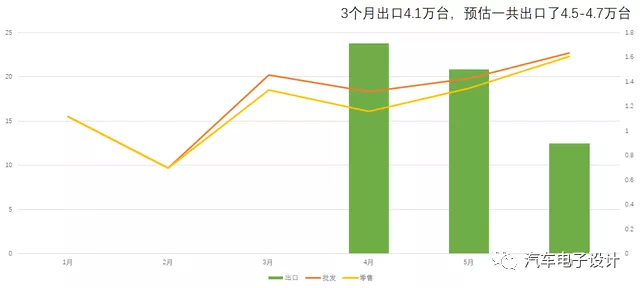

Firstly, let’s take a look at the overall data situation. In the first half of this year, the wholesale volume of new energy passenger vehicles was 1,087,000 units, representing a year-on-year growth of 231.5%. The corresponding retail sales volume of new energy vehicles in the first half of the year was 1,001,000 units, which grew by 218.9% compared to the same period last year. At present, the estimated export quantity is between 45,000 and 47,000 units, but due to the chip shortage, companies do not have too much inventory. Hence, a difference of 20,000 to 30,000 units is considered normal.

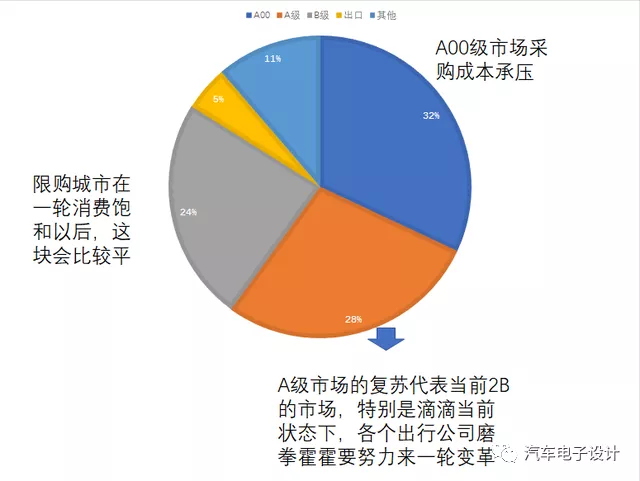

Looking at the breakdown of wholesale sales, the total volume was 227,000 units, and the export volume was approximately 9,000 units. The overall domestic wholesale volume is about 218,000 units, with 175,000 units for pure electric vehicles and 41,000 units for plug-in hybrid vehicles. The wholesale sales of A00 level vehicles were 59,500 units with a market share of 32%. This sector is limited by the cost increase caused by the rise in material prices, and an estimated 60,000 to 70,000 units per month is expected to be the ceiling. A-level electric vehicles rose to 52,000 units, and demand in the 2B market began to increase, accounting for 28% of the pure electric vehicle market share. B-level electric vehicles reached 49,500 units (5,000 were for export). Therefore, once the demand from consumers in the cities with purchase restrictions has been met, there is a need for further cost-effective models to support the market. The 11% vehicle models mainly consist of some high-end models and other classifications, which have always been a supplement.

In summary, the penetration rate of new energy vehicles in 2021 is relatively fast. One reason is that the 2C market continues to be stimulated by competitive products. Additionally, since the policies on carbon peaking and carbon neutrality were introduced, the demand from the 2B market has also accelerated conversion. Next, the replacement of 2B vehicles will accelerate, and from this perspective, we can update the forecast for the second half of the year over the weekend.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.