Introduction: G3 is an important strategy for XPeng Motors.

On July 9th, the new G3i model will be launched, and this pioneering work of XPeng Motors will have another upgrade.

Since its official launch in December 2018, the G3 has undergone a major upgrade (in terms of power) and two annual versions (2020 and 2021), of which only the 460c model is available in the 2021 version, which is the lithium iron phosphate version.

Currently, XPeng Motors has two models on sale, in addition to the compact SUV G3 (149,800-199,800 yuan), there is also a mid-to-high-end coupe P7 (229,900-409,900 yuan).

In general, the sales of mid-to-low-end models of car companies are higher than those of mid-to-high-end models, but XPeng Motors behaves in the opposite way, which is an interesting point.

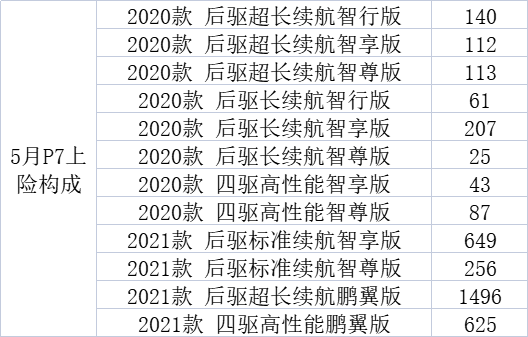

In XPeng Motors’ auto insurance data in May, P7 had 3,814 units and G3 had 1,928 units, almost only half of the former. In fact, since the bulk delivery in July last year, P7’s sales have always been higher than G3’s.

So why does XPeng Motors have such a rare performance in the car market: why can’t the cheap G3 outsell the expensive P7?

I think there are three main factors. The first is the market. Currently, there are two market trends in the new energy market-high-end and low-end, while the mid-end market is in a low trough in the past two years due to the subsidy reduction and the shrinking B-side market.

China Association of Automobile Manufacturers data shows that in May, the proportion of A00 pure electric vehicle sales was 31%, A-class cars were 26%, and B-class was 29%; in the data from January to May, the proportion of A00-class was 7%, A-class was 22%, and B-class was 30%.

Under this market premise, P7 performed better than expected, while G3 was a typical important market factor. Of course, the most important thing is their own product strength difference.

The second is technology attribution: intelligent or electric, which is an unquantifiable factor, but its impact does exist.

Judging from the composition of G3’s May auto insurance data, the least expensive 460c Joy Edition lithium iron phosphate version has become the main sales driver, followed by the 460i Smart Edition, which uses advanced driving assistance features.

XPeng Motors has always emphasized intelligent labeling. However, for G3, the best-selling model is the electric attribute 460c Joy Edition. Of course, the weight of XPeng’s intelligent label is also reflected in the 460i Smart Edition.

Therefore, compared with P7’s more pure intelligent attributes, G3 is a blurry existence between intelligent and electric attributes.For the attribute G3, it is not difficult to understand from the perspective of the overall development of the industry that intelligence is ultimately a new technology, and new technologies are more reflected in the high-end market that is not too sensitive to prices, while the low-end market is more reflected in the electric attribute due to price sensitivity.

Therefore, XPeng has always been playing the intelligence card, essentially aiming towards the high-end direction.

It should be noted that XPeng’s strategy is different from that of NIO. NIO is more traditional in terms of raising high and hitting high. This difference is related to the backgrounds of Li Bin and He XPeng, and will not be reiterated here.

Looking at the sales volume of the P7, the main intelligent high-end model, XPeng’s high-end intelligence strategy is undoubtedly successful.

In May, the highest sales volume of the P7 was the second-highest-end rear-drive ultra-long battery life Pengyi version, which accounted for 39% of the total sales with 1496 units sold, at a suggested price of 366,900 yuan, which is evident.

Thirdly, the sales of the G3 have encountered bottlenecks, and the neglect of the B-end market is also related.

Since they are both playing the intelligence card, the cheaper G3 still cannot surpass the P7, which must be due to product definition problems, either the intelligence attribute is not strong enough, or the electric attribute is not enough.

In January of last year, I suggested to He XPeng not to bury the existing supercharging network and actively use it. The improvement of the supercharging network will be an important supplement to the electric attribute.

In the third quarter of last year, XPeng’s supercharging network accelerated expansion, and XPeng’s sales also ushered in a huge increase.

At that time, XPeng’s sales growth came from two markets. On the one hand, there was an increase in new P7 cars. On the other hand, the G3 experienced a renaissance, with its monthly sales volume increasing from about 500 units to around 2,000 units, tripled.

Although the monthly sales of 2,000 units for the G3 cannot compare with the P7, it is still in the top position in the same level. Moreover, the proportion of C-end sales is very high. Taking the May insurance data as an example, the non-operating proportion is as high as 93%, ranking first in the same level.

Although the high proportion of C-end sales makes XPeng Automobile happy, looking at the entire industry, the lack of the B-end market means that XPeng’s marketing still needs to be improved.

Why can’t we neglect the B-end market? One is attractive incremental sales, and the other is favorable for autonomous driving algorithm learning.

With regard to the first point, taking the Guangzhou Automobile Aion S as an example, as the most popular A+ level car on the market, B-end sales account for about 80%, with monthly sales reaching around 6,000 units, so the B-end sales are about 5,000 units.

Looking at the monthly sales of Aion S alone, it may not seem like much in terms of B-end demand. But if this data continues year after year, it becomes very attractive. Although 2B will reduce points for the brand, it is very beneficial for support enterprises to grow sales scales and establish supply chains.Translate the Chinese Markdown text below into English Markdown text, in a professional way, preserving the HTML tags inside Markdown, and outputting only the result.

Regarding the second point, it is well known that self-driving algorithms need to be learned before they can evolve. Currently, there are two ways to learn: one is to spend money to run, and the other is for OTA to run for consumers. The former consumes a lot of resources and is inefficient, while the latter can not only charge fees, but also has high efficiency.

However, not all manufacturers agree with the second point. They believe that this is using consumers to run data and violates business ethics. Supporters also have their own reasons. They believe that their technology is already outstanding, and it is normal to use and charge consumers.

Both sides are reasonable, so there is no one-sided situation about the above controversy. Regarding this controversy, some manufacturers are actively thinking, such as whether the B-end market can drive the progress of self-driving algorithms. Compared with the above controversy, this idea can be said to achieve a balance.

However, for XPeng Motors, its C-end is currently strong, while the B-end is weak. The reason for this weakness is related to XPeng’s ultimate user thinking, that is, it is too “honest”.

In any case, whether it is to enhance the increment of G3, or to promote the learning progress of self-driving algorithms, whether 2B or not is a very realistic problem for XPeng Motors.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.