*Author: Michelin

In today’s automobile industry, it can be said that “when one side sings, the other takes the stage.” Today, internet giants and mobile phone manufacturers are rushing into the field, and tomorrow, various car companies and technology companies will announce their next generation of products in a military competition-like atmosphere. Despite the upheavals in automotive technology brought about by emerging technologies, automobiles are still a down-to-earth technology. We welcome the “new nobility” of automobiles to bring new vitality to intelligent automobiles, but the tactics and strategies of century-long veteran suppliers may help us see the true face of the beach after the waves have passed.

The product behind the product

In this automotive revolution, the spotlight is often on automatic driving, batteries that can be charged to 80% in 15 minutes, the main characters of the computing power battle-system chips, etc., but ignore the “products” behind the product, and the technologies that may become trends in the future but are not yet used in cars. Paying attention to these is a manifestation of the forward-looking and sensitivity of the automotive supplier industry.

If a “hot-selling” product is selected at the 2021 Shanghai Auto Show, Qualcomm’s 8155 chip will surely be among the top. With a 7 nanometer process and 3 times the performance of the previous generation platform with 3.6 million operations per second, this chip has become the first choice for newly released car models this year.

As a hardware, chips provide space for the function of the vehicle, but how to maximize their capabilities and meet the different needs of each car company requires suppliers to rely on years of experience and work closely with the car companies to achieve this. This ability to build basic software and experience with the entire vehicle system is what Bosch is good at.

In other words, although we rarely hear the name Bosch in recent new car releases, as a low-key traditional supplier, their presence cannot be ignored in the electronic architecture, basic software, and middleware behind the system chip.

In addition to our focus on system chips, Bosch also showcased its silicon carbide (SiC) wafers and silicon carbide chips. Due to their higher power density and better conductivity, SiC chips have lower energy consumption than traditional silicon chips, and are therefore often used in inverters, on-board chargers, charging piles, DC/DC converters to obtain higher energy conversion rates. According to Bosch’s statement, “using SiC can increase the range of electric and hybrid vehicles by up to 6%”.# This small silicon carbide power chip may be the key to solving our range and charging anxiety in the future, enabling electric cars to charge faster and drive further.

Although software and hardware are decoupled, automobiles are still an integrated whole.

With the increasing intelligence of automobiles, we have seen one new player after another emerging in the automotive field, occupying a place in a certain area or function of software or hardware. “Software and hardware decoupling” separates the software and hardware functions of the car; however, as a highly integrated whole, automobiles not only require each function to perform well, but also need excellent integration capabilities to enable each function to play its most suitable role.

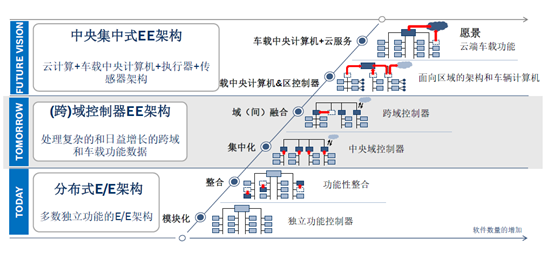

Therefore, we see more and more centralized electronic and electrical architecture and more and more interconnected functions.

The Bosch Cross Domain Integration (XC) division, which officially established earlier this year, combines Bosch’s comprehensive capabilities in driver assistance, automatic driving, automotive multimedia, powertrain, and body electronics.

The establishment of the XC division is not just a simple departmental integration, but also a kind of Bosch’s attitude towards the future of automobiles and the development philosophy of “taking the vehicle as a whole and developing hardware and software solutions that are suitable for the future electronic architecture from the perspective of overall requirements.”

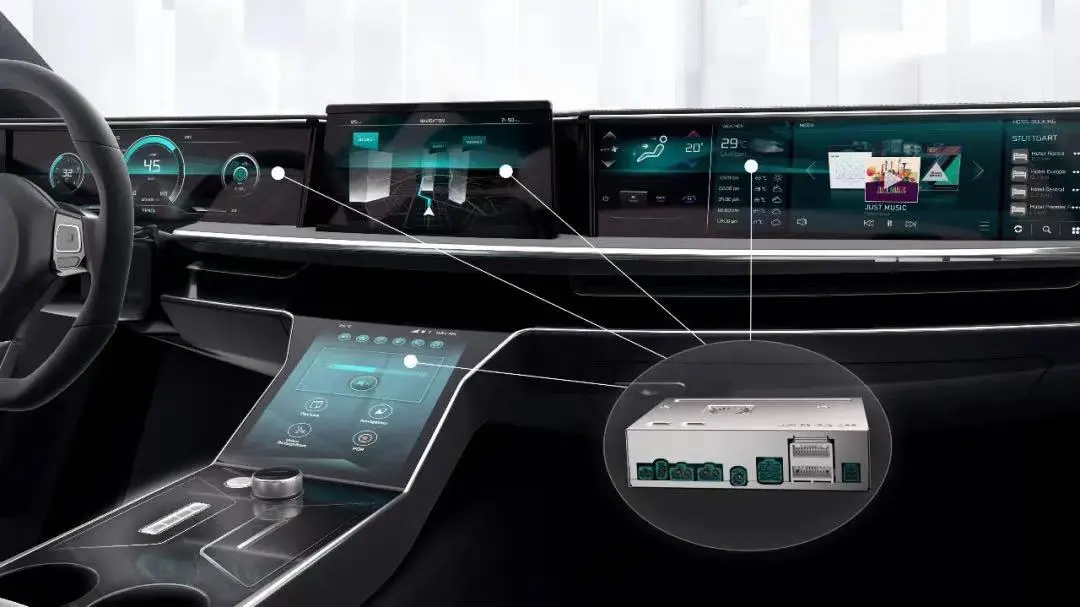

At the same time as the XC division was introduced, there was also a cockpit domain controller that is about to be mass-produced this year. Equipped with the popular Qualcomm 8155 chip as the main chip, the domain controller controls five screens, including the instrument panel, central control screen, co-pilot entertainment screen, HUD, and rear display screen, as well as the driver and passenger monitoring (DOMS), 360° surround view (AVM), face recognition (FaceID), multi-microphone input, and active noise reduction.

This highly integrated “one chip for five screens” requires connectivity from the beginning of the design, and collaboration between different departments. Only in this way can the coordination between different functions be achieved in a seamless manner. This “1+1>>2” mode cannot be achieved by a single department or function development alone.

In this way, various car companies can develop differentiation on top of a smooth underlying architecture and basic software, introducing their own ecosystem to truly empower the cockpit.

L2++, Making Autonomous Driving Steadily Ahead

At this year’s Shanghai Auto Show, under the labels of “L4 autonomous driving passenger vehicles” and “on-board LiDAR”, the autonomous driving PK battle among various manufacturers, made me feel like it won’t be long before the streets are filled with self-driving cars.

However, the implementation of autonomous driving requires not only hardware and algorithms, but also a balance between industrialization and functional dimensions.

For example, autonomous driving products need to meet users’ real needs, especially in scenarios such as highways and parking lots. At the same time, product consistency and stability must be guaranteed, with safety being the top priority. On the basis of these two factors, cost is also an issue that has to be considered for mass production.

Only when these three factors are balanced and taken into account, will people trust an autonomous driving product, get used to it, be willing to pay for it, and can afford it. Only then can autonomous driving be truly implemented.

Regarding Bosch’s autonomous driving plan, Li Yin, President of Bosch’s Mobility Solutions and Control division in China, said that they will launch an L2++ autonomous driving control system within the next 2-3 years to achieve safe, “hands-free” driving in urban areas.

We are accustomed to using the terms L2, L2+, and L3, so L2++ may be unfamiliar to some. In fact, it means using more powerful hardware and truly useful functions to enrich the autonomous driving scenarios, and step by step establish our trust in autonomous driving.

Only when these gradual “quantitative changes” accumulate into “qualitative changes” can we come closer to fully autonomous driving.

Bosch’s autonomous valet parking (AVP) solution, which is aimed at “strong demand” scenarios like parking lots, was showcased at the auto show. As an SAE-L4 level autonomous driving technology, it uses real-time monitoring data provided by parking lots to plan the path and safely and accurately park the car in an empty parking space, aiming to address issues such as poor parking lot signal, inaccurate positioning, and incomplete high-precision maps.

However, this location-based AVP technology also has certain requirements for the adapted parking lot, which needs to have a large number of sensors and communication facilities, and needs to be gradually popularized in future smart parking lots.

In addition to autonomous driving solutions, Bosch also showcased sensor hardware for autonomous driving, such as:

- Sixth-generation ultrasonic sensors using pulse-echo principles, with a minimum detection range of 15 centimeters, which can detect obstacles and curbs in small parking lots and parking spaces.### Conclusion

Today, as cars are heading towards electrification and intelligence, we see more and more challengers emerging. Faced with these challenges, Bosch, a traditional giant, responds more like challenging itself.

On the road of Bosch’s digital transformation, we see a dual-pronged approach: on the one hand, it swiftly responds to the digital demands of the automotive industry by establishing new business units and software centers tailored to the Chinese market, as well as joint ventures with local companies such as Qingling; on the other hand, Bosch is using its profound understanding of the automotive industry cultivated over a century to guide this transformation, enabling the modern industrial gemstone, the crown of the automotive manufacturing industry, to go further and become more solid after being infused with more new attributes.

The 360° surround view camera, consisting of four close-up cameras and one control unit, can detect the surrounding environment of the vehicle during low-speed and parking with the detection results presented through 3D visualization effects.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.