*Author: Turbocharged Chubby

On March 8th, 2021, Xpeng Motors officially announced the unaudited financial results for Q4 2020 and the full year 2020. Overall, the key points in this financial report include the first full-year positive gross profit, revenue growth, and narrowed losses…

But compared to NIO, which has earned the most profit and sold the most cars, what will be Xpeng’s future path?

Let’s start with the detailed data of this financial report:

- Deliveries

Xpeng delivered a total of 27,041 vehicles in 2020, of which 15,062 were Xpeng P7, accounting for 55.7% of the total deliveries in 2020.

Affected by the COVID-19 pandemic in the first half of 2020, Xpeng delivered only 5,499 vehicles in the first two quarters. The delivery volume in Q3 2020 improved slightly, with 8,578 vehicles delivered.

In Q4 2020, Xpeng delivered 12,964 vehicles, accounting for 47.94% of the total deliveries in 2020. Among them, 8,527 were Xpeng P7, accounting for 65.77% of the Q4 delivery volume.

The Xpeng P7 model was officially launched in April 2020 and started deliveries in June. Although this model has been on the market for less than a year so far, as Xpeng’s flagship pure electric sedan model, it has already become the “main force” driving Xpeng’s sales.

- Revenue

Xpeng’s total revenue for the full year 2020 was RMB 5.844 billion, and the automotive sales revenue was RMB 5.547 billion in 2020.

The total revenue for Q4 2020 was RMB 2.851 billion, accounting for 48.79% of the total revenue for 2020. The automotive sales revenue for Q4 2020 was RMB 2.735 billion, accounting for 49.31% of the automotive sales revenue for 2020.

- Gross profit

Xpeng’s gross profit margin for the full year 2020 was 4.6%, and the automotive sales gross profit margin was 3.5%. The gross profit margin for Q4 2020 was 7.4%, and the automotive sales gross profit margin was 6.8%.

- Loss

Xpeng’s net loss for the full year 2020 was RMB 2.732 billion, and the net loss adjusted under non-GAAP was RMB 2.992 billion.## Financial Report of XPeng Motors in Q4 2020

In Q4 2020, XPeng Motors reported a net loss of 787 million yuan under non-US GAAP adjustment, compared to the net loss of 713 million yuan under US GAAP adjustment.

Compared to the net loss of 3.692 billion yuan in the previous fiscal year, XPeng Motors is gradually narrowing its losses.

- Cash Reserves

As of December 31, 2020, XPeng Motors had a total of 35.342 billion yuan in cash, cash equivalents, restricted funds, and short-term investments.

Who will dominate among the top three Chinese electric carmakers?

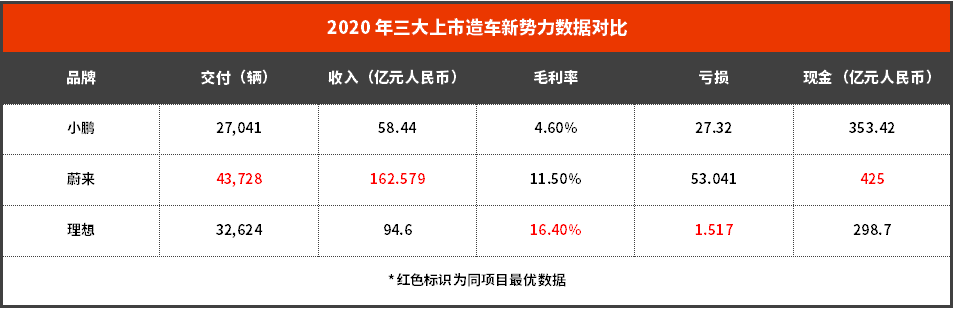

Currently, the financial reports of the top three electric carmakers in China – XPeng, NIO, and Li Auto – have been released for the year 2020. Let’s take a look at the comparison chart of the three financial reports:

After comparing the delivery volume, revenue, and gross profit of the three companies, we can see that XPeng Motors did not have any advantages compared to the other two.

Moreover, XPeng Motors delivered 5,583 fewer vehicles than Li Auto, which was the latest to launch its products and start delivery in the top three new forces.

The only aspect where XPeng Motors surpassed Li Auto was cash reserves. NIO’s financial situation seems to be somewhere between XPeng and Li Auto. After adjusting for cost reduction in 2020, NIO achieved good improvement in revenue and gross profit margin.

Based on the financial reports of the three companies, Li Auto’s data is undoubtedly the best, and it became the first among the three new forces to achieve “quarterly profits.”

In fact, from the analysis of the financial reports of the three leading domestic electric vehicle companies in the past two years, I think Li Auto’s cost control ability is stronger than NIO and XPeng. This may or may not be related to Li Auto’s decision not to form its own brand energy replenishment network for its Li ONE vehicle, which uses fuel cells. Meanwhile, NIO has set up 191 battery swap stations and more than 1,700 destination charging stations across the country, while XPeng has established 159 supercharging stations. The human cost, site cost, and operating and maintenance cost of these charging stations are not trivial. And with the future expansion plan of the two car companies for the energy replenishment network, these costs will continue to increase.

The New Year

Currently, XPeng Motors has a total of 160 sales outlets nationwide, including 72 self-operated outlets and 54 service outlets, covering a total of 69 cities. XPeng Motors plans to further increase the proportion of self-operated sales outlets, with the goal of expanding the number of sales outlets to 300 by the end of this year, expected to cover more than 110 cities.

In January 2021, XPeng Motors delivered a total of 6,015 vehicles, including 3,710 XPeng P7 and 2,305 XPeng G3. In February 2021, the total number of deliveries was 2,223, including 1,409 XPeng P7 and 814 XPeng G3.

In December 2020, XPeng Motors completed the issuance of 55,200,000 American Depositary Shares (“ADSs”), with each ADS representing two Class A ordinary shares, at a public offering price of $45 per ADS. The newly issued ADSs after the offering include an additional 7,200,000 ADSs to be exercised by the underwriters.

In January 2021, XPeng Motors signed strategic cooperation agreements with several major domestic banks, obtaining a credit line of RMB 12.8 billion to support the company’s business operations and optimize efficiency while enhancing its manufacturing, sales, and service capabilities.

On January 26, 2021, XPeng Motors conducted an important OTA upgrade for Chinese P7 users, pushing the new version Xmart OS 2.5.0 of the P7 operating system. The highlight of this OTA upgrade is XPeng’s NGP automatic navigation assistive driving (beta version), which constitutes the core function of the XPILOT 3.0 system.

The Chairman of XPeng Motors stated in the earnings call that the company strives to have the world’s leading autonomous driving technology. In 2021, XPeng Motors will continue to increase research and development investment in autonomous driving related technologies. It will also develop an overseas version of XPILOT 4.0 based on XPILOT 3.5 in China to promote the overseas market layout in developed countries and regions such as Europe.

On March 4th, 2021, XPeng P7 rear-wheel drive standard range smart and smart ultimate models were officially launched, both of which use lithium iron phosphate batteries. The prices of both standard range models have been further reduced, with subsidized prices of 229,900 yuan and 239,900 yuan.

On March 4th, 2021, XPeng P7 rear-wheel drive standard range smart and smart ultimate models were officially launched, both of which use lithium iron phosphate batteries. The prices of both standard range models have been further reduced, with subsidized prices of 229,900 yuan and 239,900 yuan.

During the conference call with investors, XPeng He mentioned that “currently, about 20% of XPeng P7 orders are for the rear-wheel drive standard range version with lithium iron phosphate batteries.” He also stated that “I believe that in the past 6 months, the battery has been a point of focus for our suppliers.”

With the advent of lithium iron phosphate batteries, new challenges will arise for the new P7 and G3 models in the second quarter due to battery issues.

For XPeng Auto, the second quarter will be a climbing process for lithium iron phosphate batteries, but He believes that there will be a significant increase starting in the third quarter. Based on our experience of launching a range of less than 500km on the G3, we have strong confidence that lithium iron phosphate can be rapidly scaled up. “

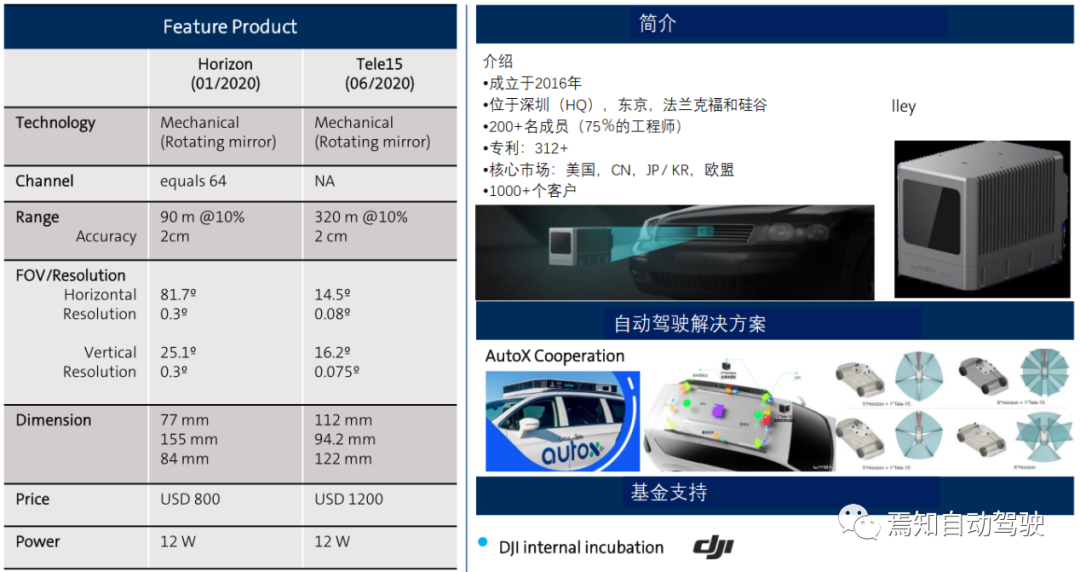

In order to further improve its product line, XPeng Auto plans to launch a third mass-produced model in the second half of 2021. The new model is an A+ level intelligent pure electric sedan, which will be equipped with Livox’s vehicle-standard lidar technology, equipped with a third-generation intelligent cabin, and will also support XPILOT 3.5 function. Delivery is expected to begin in the fourth quarter of 2021. In addition, the mid-term facelift model of G3 will also begin delivery in the end of the third quarter of this year.

Overall, from XPeng Auto’s financial data, we can see their efforts to turn losses into gains. We can also see that the XPeng P7 has become the mainstream pure electric sedan model in China, driving XPeng Auto’s overall sales.

In the new year, XPeng Auto’s focus in 2021 will be on autonomous driving and new product development. Of course, for XPeng Auto, “reducing costs and increasing gains” and “turning losses into gains” are still the most important goals in 2021.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.