Author: Wang Xuan

Recently, a set of imaginary pictures of Little Bull electric cars have gone viral online, and people are speculating whether Little Bull will enter the electric vehicle field.

Based on the imaginary pictures, we can guess that the target market of Little Bull in the future will be the micro electric vehicle market. After seeing the imaginary pictures, I let my imagination run wild. Little Bull’s brand positioning and target market have already been defined, so if I were a product manager, what kind of electric car would I create?

Positioning: Avoiding the Pitfalls of Low-speed Electric Vehicles

Before the news of creating cars came out, Little Bull had been deeply involved in the field of two-wheel electric vehicles, with a good reputation and a deep love of users. “Advocating for a more relaxed and convenient way of travel” is also the corporate creed of Little Bull. Combined with the imaginary pictures circulating online, we can conclude that if Little Bull enters the electric vehicle field, it will still position its product as a micro electric vehicle for urban travel.

In the past five years, many electric vehicle products focused on urban travel have emerged, among which the two most representative and extreme examples are Ideal (originally named Li Auto) ‘s SEV and the most popular electric City car recently, Wuling Hong Guang MINI EV. At the same time, we can infer the product logic of Little Bull electric cars in the future by analyzing these two models.

Why did the Ideal SEV project die before it was born? As for this matter, it can be summed up in three words: “too much thinking.”

On the SEV project, Li Xiang, the CEO of Ideal, did have long-term and more international considerations. The SEV of Ideal is a small City car built to the European standard L6e, meaning that the maximum displacement of a gasoline engine is ≤ 50 mL/diesel engine is ≤ 500 mL, the maximum speed is ≤ 45 km/h, the maximum weight is ≤ 425 kg, and it is a light four-wheeled vehicle with a maximum of two seats including the driver. SEV has passed the WVTA European vehicle type approval and FMVSS United States federal motor vehicle safety standard certification.

Although Li Xiang saw the distant future, the current problem has not been solved. Ideal SEV has not been able to obtain a driving license in China, and four-wheeled low-speed electric vehicles are still in a grey area under the current policy environment in China. According to the relevant provisions of the “Road Traffic Safety Law,” low-speed four-wheeled electric vehicles should be classified as road motor vehicles. The maximum speed of the Ideal SEV of 45km/h coincides with the speed requirement of the “Technical Conditions for Four-wheeled Low-Speed Electric Vehicles” (Draft), which states that the speed must be higher than 40km and lower than 70km and must be powered by lithium batteries.

Due to the rampant “elderly mobility vehicles,” whether low-speed electric vehicles can be put on the road and the standards for putting them on the road have never been resolved, and the Ministry of Industry and Information Technology cannot find any relevant legislation provisions.

The latest proposal on low-speed electric vehicles was made in September 2020, which stated that all parties have reached a consensus on the requirements of “micro, short-distance, low-speed, for specific areas, safe and environmentally friendly” and formed a draft of the “Technical Conditions for Four-Wheel Low-Speed Electric Vehicles”. The use of the term “specific areas” is striking.

From the latest news, it can be vaguely seen that even if low-speed four-wheeled electric vehicles are allowed by regulations in the future, they may not be able to enter the mass market. The conditions for using specific areas may directly bind low-speed four-wheeled electric vehicles with elderly users. Therefore, this market is very uncertain. The vision of the ideal SEV project is good, but it does not conform to China’s national conditions.

The ideal SEV can be regarded as representing the concept of City EV Car in China, while the Wuling Hongguang MINI EV is a “mix-and-match” player. Although its maximum range is only 170 kilometers, its maximum speed can reach 100 km/h. It can not only enter urban ring roads but also run on highways. Its price range of 28,800-38,800 yuan has also established its positioning as a “private elderly mobility vehicle with road rights.

Wuling has never given the Hongguang MINI EV the label of “urban travel” or “lightweight and environmentally friendly”, but which MINI EV user is not using it as a short-distance vehicle? Having the attributes of low price and good quality is enough.

Based on the above two cases, if Xiaoniu wants to enter the four-wheeled electric vehicle market in the future, the product positioning must avoid the gray area of low-speed electric vehicles and the price must be attractive.

Chinese consumers’ car consumption views are still very realistic. At any time, space has the highest priority in their car selection process. Unless they can get a “car” at a very low price, no one will be interested in small electric cars.

Market: the prospect of making high-end micro electric cars is bleak

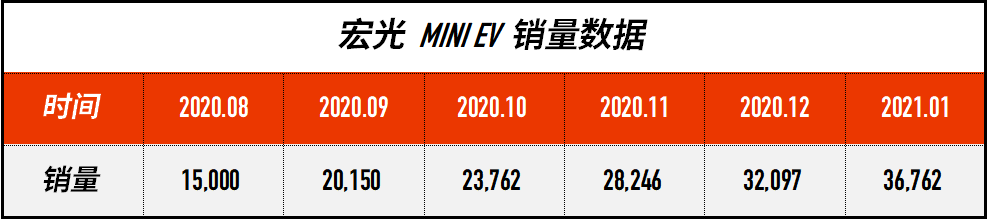

Since the Wuling Hongguang Mini EV was launched, its sales have increased every month and have not declined. In January 2021, its monthly sales volume exceeded 30,000 units.

Therefore, compared with the traditional automobile market, the micro-electric vehicle field is still a blue ocean with great development potential. So, if I were Xiaoniu’s product manager, when the product was proposed, I would think whether it can redefine the market.

Like traditional cars, there are high-end and low-end versions of micro electric cars. The difference is that micro electric cars can enter the sharing and leasing market with lower prices. However, the first wave of sharing market has already passed, and it is unrealistic to build a complete market logic in the next five years.

Like traditional cars, there are high-end and low-end versions of micro electric cars. The difference is that micro electric cars can enter the sharing and leasing market with lower prices. However, the first wave of sharing market has already passed, and it is unrealistic to build a complete market logic in the next five years.

Therefore, for XIAONIU’s products, it is difficult to play new tricks conceptually. Following the rules of the automotive market is the way for XIAONIU to survive.

Apart from the concept of shared cars, there are only two product trends left: high-end and practical. I believe that the price ceiling of micro electric cars is 100,000 yuan. If the selling price exceeds 100,000 yuan, there will be no buyers.

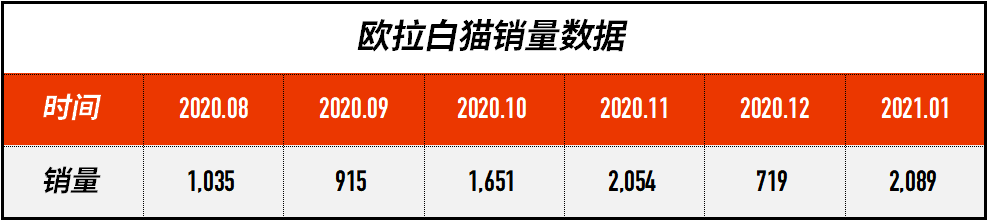

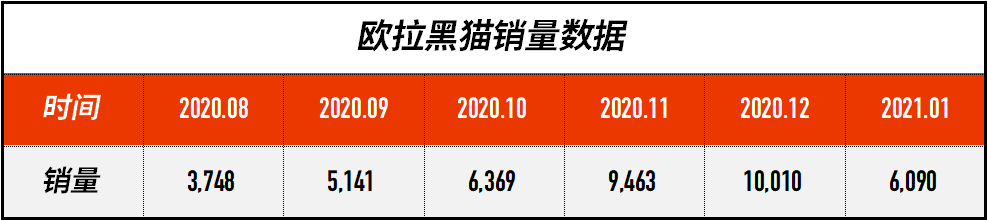

Here we can refer to the sales of the three models under the EULU brand. The GOOD CAT and WHITE CAT were launched in the middle of 2020, and both have been selling poorly mainly due to their high prices.

GOOD CAT has already surpassed the category of micro electric cars and is equipped with intelligent configurations such as ACC, automatic parking, OTA, and dual-screen car entertainment systems. The price has reached 100,000 yuan or more. The price of WHITE CAT is also over 70,000 yuan, and the terminal selling price is over 60,000 yuan. However, the route of BLACK CAT is as cheap and simple as that of Wuling Hongguang MINI EV, so it can sell more than 10,000 units per month.

The only difference is that BLACK CAT achieved a range of 301 kilometers to cater to the current new energy subsidy policy. Electric cars with a range greater than 300 and less than 400 kilometers can enjoy a subsidy of 13,000 yuan in 2021.

The correlation between range, configuration, size, and price is a market rule reflected in the current micro electric car market, which can be described as one thing leads to another.

For XIAONIU, there is no need for them to make high-end micro electric car products. On the one hand, they can cater to consumer demand and boost sales with low-priced products, and on the other hand, they can cater to urban travel positioning.

In my opinion, long range is a product point that contradicts the urban travel attributes and micro electric car positioning. Consumers who buy micro electric cars do not have long-distance travel needs. Although long range is a good-to-have feature, the city is abundant with charging piles, and a product strategy of timely charging instead of high-energy storage reserve can pull the three product points of configuration, size, and price at the same time and better lower the product position.

Product: Even if the positioning is low, it must be different from traditional ones

For XIAONIU, the car market is cruel and realistic. Sometimes to gain more market share, it is necessary to compromise on positioning. However, when it comes to the product itself, in terms of style, quality, and power, XIAONIU will never compromise.Traditional automakers are always plagued with engineering problems when developing mini electric vehicles. The biggest problem with the appearance of Wuling Hongguang MINI EV and Baojun E200 is that the proportion of the car body is not coordinated. In order to maximize the interior space, engineers have to make the size of the wheels as small as possible, and small wheels are also beneficial to reduce energy consumption and improve the range.

However, I believe that Little Nut’s products should not compromise on appearance. Little Nut, who just entered the field of two-wheeled electric vehicles, has won a large number of young users with its novel design. And now, the product lineup of Little Nut electric vehicles has formed a family design language in terms of appearance.

Therefore, Little Nut’s four-wheeled electric vehicle products can completely sacrifice a small part of the interior space and energy consumption to leave more possibilities for appearance design. The smaller the product volume, the less space the designer has to play with. This is also the reason why the product design of the current mini electric vehicle market is dull, and it is also the focus of Little Nut’s future efforts, making it not difficult for the actual car to achieve the effect in the rendering.

Little Nut’s products do not need to add too many configurations to the car, but can enhance the interior texture, such as providing optional racing steering wheels similar to the new Tesla Model S style and the flip instrument panel screen on the McLaren 720S. For a low-priced product, the “sense of ceremony” brings more allure than smart and comfortable configurations.

In addition, Little Nut’s four-wheeled electric vehicles can be different from traditional mini electric vehicles in terms of power. Most of Little Nut’s target audience are young people who favor Little Nut’s products because of their faster acceleration than traditional two-wheeled electric vehicles. In the automotive market, Little Nut can still maintain this product positioning, and power is also an attribute that is currently lacking in the mini electric vehicle market.

Compared with the positioning of “legal elderly mobility vehicles”, Little Nut’s products should be positioned as “kartings that can be driven on the road”, even if the maximum speed can only reach 100km/h, it can also provide more driving pleasure by shortening the acceleration time for one hundred kilometers.The range of Little Bull’s product can be set between 150-200 kilometers, using a small battery pack of about 15 degrees. Although the range is less than 300 kilometers and does not qualify for policy subsidies, the small battery pack is cost-effective and can benefit consumers. Little Bull can be configured without any requirements, but fast charging is definitely necessary.

Currently, fast charging piles are the main charging network in China’s first-tier cities. Taking Beijing as an example, the proportion of fast charging piles to slow charging piles is 1.8:1. Slow charging piles are already difficult to find, and longer charging times will also cost users more parking fees. The Wuling Hongguang MINI EV is rare on Beijing roads because it lacks fast charging.

If Little Bull is equipped with a small battery pack, the time it takes for fast charging to replenish the battery will be very short, and it may only take the time for a user to buy a cup of Starbucks coffee to fully charge the battery. Fast replenishment can also reduce users’ anxiety about energy consumption.

I have always advocated for Little Bull to lower its stance in car-making, but I believe Little Bull’s electric vehicles will still adhere to the brand’s high-end image. Here, “high-end” does not refer to “hard high-end” stacked with configurations like traditional automakers, but rather a “soft high-end” created through product character, even doing things contrary to the priority on energy consumption in the micro-electric vehicle market. Its price will certainly be more expensive than the Wuling Hongguang MINI EV, with a price range of 40,000 to 60,000 yuan.

If I were the product manager of Little Bull, I would create a pure, fun, and unique product under the Little Bull brand for its four-wheel electric vehicles. Of course, this only represents my personal opinion.

Can Little Bull really make cars?

The situation where elderly mobility vehicles dominate the streets indicates that low-speed electric vehicles are a potential market, and this market is in a gray area. The emergence of the Wuling Hongguang MINI EV fills this gap in the name of a car. If Little Bull enters the electric vehicle field, it needs to consider how to sell cars to young people with a different concept. However, the main market will be in second and third-tier cities, and Little Bull already has technical reserves in the field of electric vehicles. The structure of micro-electric vehicles is relatively simple, so it is reasonable for Little Bull to enter the micro-electric vehicle market.

However, these are just my speculations. After all, Little Bull still has to make its own decisions. So, do you think Little Bull will make cars? And what would a Little Bull electric vehicle look like, in your opinion?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.