Recently, the China Association of Automobile Manufacturers released the insured data for the new energy vehicle market in November nationwide. The “new forces of car-making” continue to make efforts in the new energy vehicle market. Among them, Tesla was in the lead with 21,952 units sold, NIO, with limited production capacity, had a yield of 5,291 units, and Ideal, with only a “single model”, sold 4,646 units. XPeng steadily increased to 4,224 units, and everyone is refreshing their respective delivery records.

Will the historical high sales performance of the “new forces of car-making” make traditional brands feel some sense of crisis and make adjustments in their terminal sales strategies?

With this question in mind, we decided to visit the automobile sales market in Shanghai to investigate the sales status of “new energy vehicles” in 4S stores. However, the information we obtained (see table below) was indeed unexpected.

Where is Euler?

The first store I visited was an Euler 4S store, but unfortunately, Euler did not have its own showroom. After wandering around, I finally found “Hao Mao” parked in the WEY showroom in the corner.

Upon entering the store, the sales consultant, who was not particularly enthusiastic, said that Euler’s sales are currently very good, and it takes about 2 months to schedule delivery.

When I mentioned that I did not have a “fixed parking space,” the Euler salesperson said that I could use the charging station for a fee of approximately 3,000 yuan. When I questioned the high cost of using the charging station, the sales consultant said, “It’s very troublesome to use the charging station if you don’t have a parking space in Shanghai. We need to find connections to help you, and it’s good if 3,000 yuan can solve the problem. Do you understand?”

I then asked about the financial plan, and the response I received was a handling fee of 2,000 yuan plus a cash deposit of 1,000 yuan. When I questioned that the bank does not charge corresponding fees, the Euler salesperson said, “The reason why we charge you a 1,000 yuan loan deposit is to ensure that you do not take the vehicle registration certificate by yourself after receiving the car. Do you understand?”

Overall, this “educating the customer” style of Q&A was not a good experience, and the “additional fees” that need to be borne when buying a car is equivalent to approximately 7.9% of the recommended price of the entry-level model of 103,900 yuan, which adds up to 8,200 yuan, further increasing the cost of purchasing a car.

BMW iX3 to be priced up!The second dealership I visited was a BMW 4S store, which had significantly more customer traffic compared to the Ora dealership. “Hello, welcome, may I know which sales consultant you are here to see?” I was intercepted by the front desk shortly after entering the store. After confirming my information, the front desk politely asked me to wait on the sofa for my “special consultant” to arrive.

It is evident that BMW’s standardized customer reception process places a high priority on the relationship between customers and sales consultants.

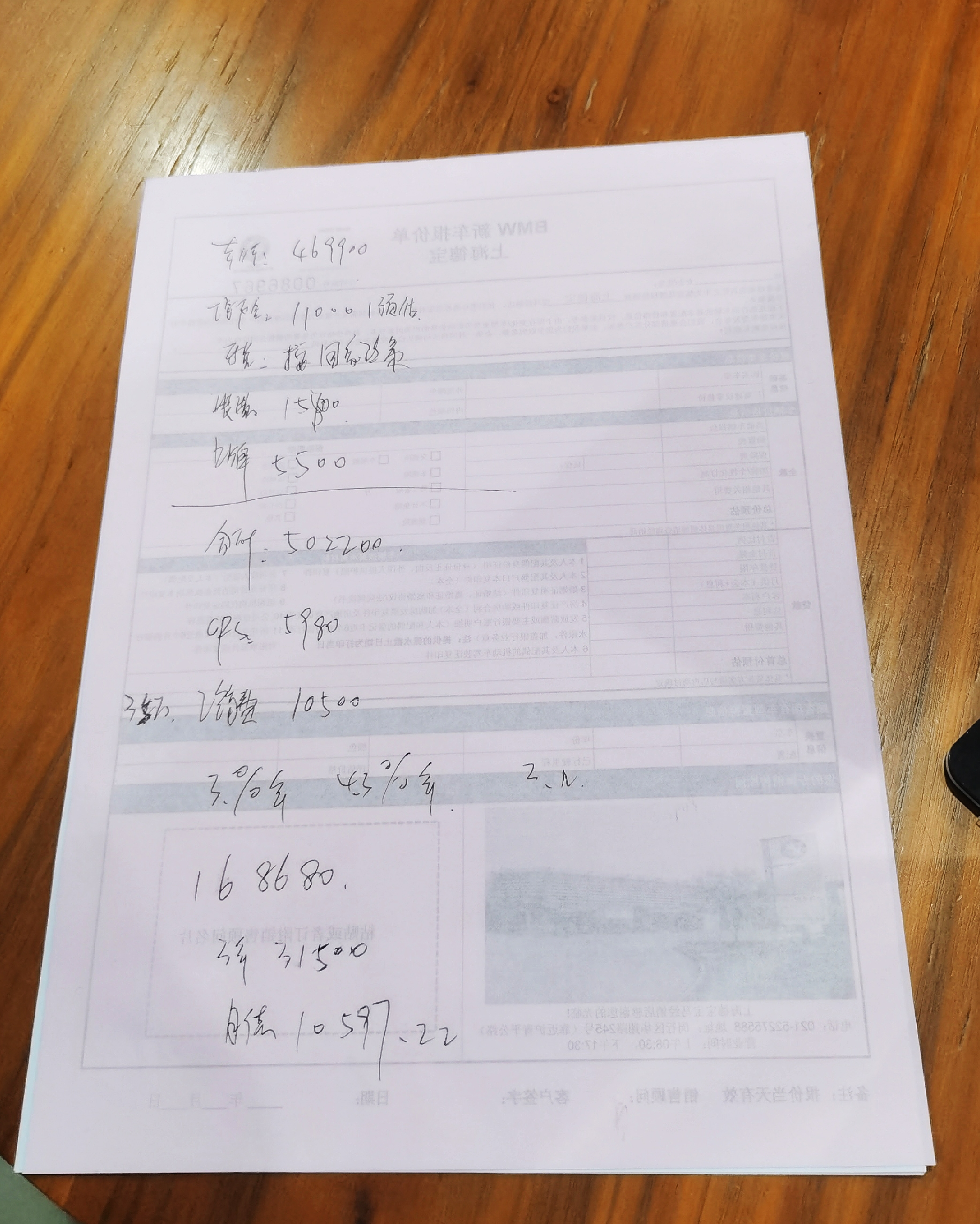

After the sales consultant introduced the relevant information about the BMW iX3, the conversation moved to negotiating the car price. The opening statement from the sales consultant, “let me see if we need to raise the price of the iX3,” set the tone for a “price war.” The 15,800 yuan decoration fee, 5,500 yuan license plate fee, 5,980 yuan GPS fee, and 3% financial handling fee on the loan amount all confirmed my earlier suspicions.

However, the reasons given by the sales consultant, such as “we have to raise the price of all cars sold in our dealership” and “the registration process for new energy vehicles is complicated, so the registration fees are high,” are considered by industry insiders to be “forced explanations.” The total amount of “other fees” has exceeded 37,780 yuan, equivalent to about 8% of the iX3’s suggested retail price.

A long time ago, I heard that BMW salespeople only “quote the real price” after they have clearly understood your intention to buy. But in today’s increasingly transparent information age, how much longer can this “sales technique” last?

Interestingly, the BMW dealership I visited indicated that they had no charging stations available for customers, had no fixed parking spaces, and therefore could not register cars in Shanghai. However, sales consultants from other BMW stores claimed otherwise.

Is the BYD store directly operated?

The third dealership I visited was a BYD dealership, but we didn’t go to a traditional 4S store. Instead, we chose a store that was similar to a “new force” and located in a shopping mall.

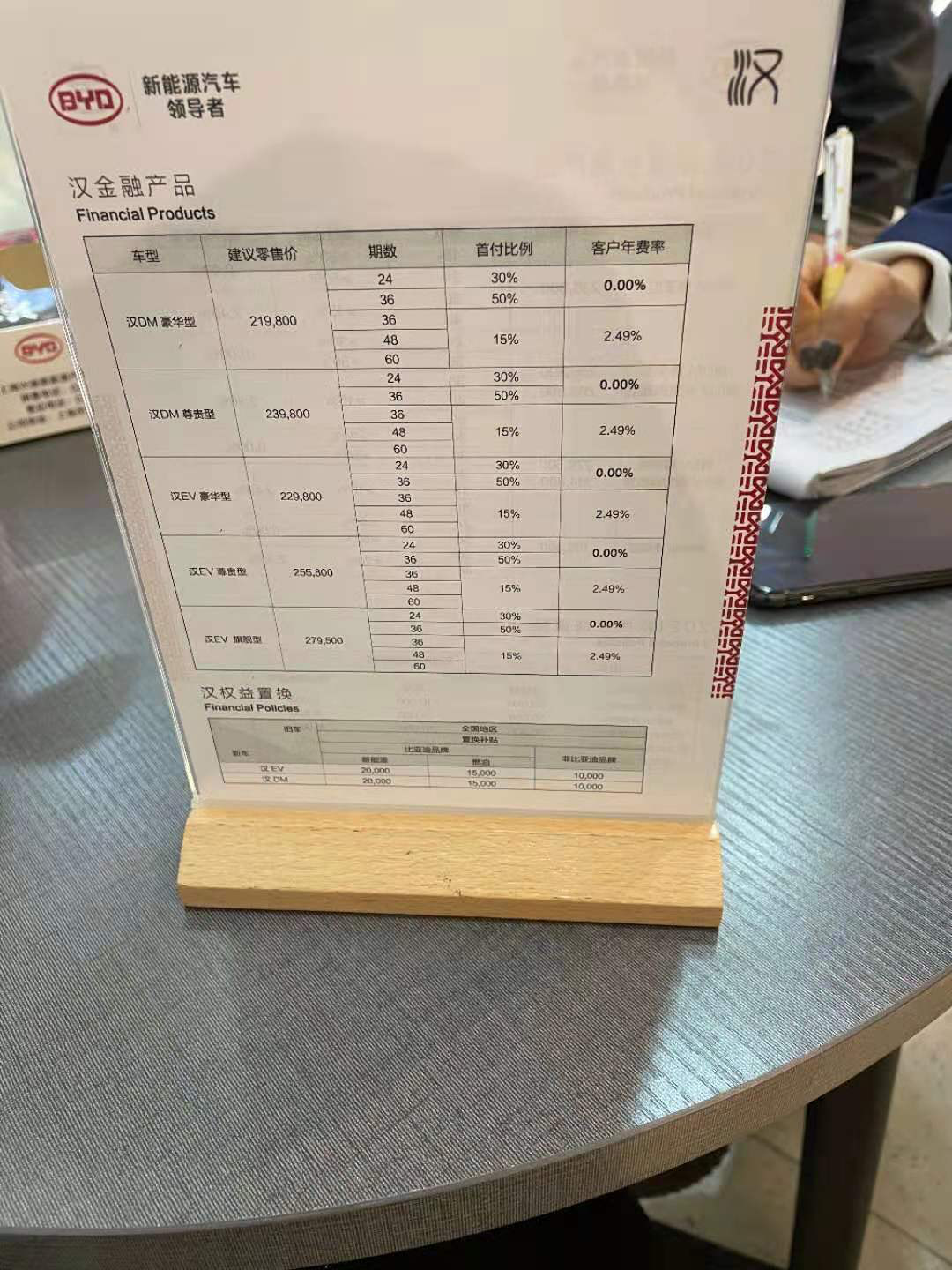

When I asked whether it was a directly operated store, the sales consultant gave a positive answer. But when I clarified by asking whether it was an “official BYD directly operated store,” the sales consultant gave a vague answer. After learning about the 2,000 yuan license plate fee, the 3,000 yuan manufacturer finance service fee, and the 3,500 yuan charging station rental fee, I confirmed that it was actually a “dealership’s directly operated store.”

The “other fees” for the BYD Han, which is equivalent to the entry-level model, totaled 9,000 yuan, which is only 300 yuan more than Ora. Although this is not considered high compared to traditional domestic brands, some “traditional” elements remain.

Lexus teaches you how to implement a standardized customer reception process.After visiting the first three brand stores, we decided to make an unplanned stop at the Lexus dealership because we didn’t experience the level of service we expected. We wanted to see for ourselves what “luxury with warmth” that Lexus advocates really means.

As soon as my car entered the store’s entrance, the security guard notified the sales front desk via intercom that a customer was coming to see the car. When I drove up to the entrance, the sales consultant was already waiting and directing me where to park. This may seem like a “small thing,” but it’s these “small things” that give luxury a different definition.

Regarding “other charges,” Lexus sales were frank and said that our traditional model is different from new players, and there may still be some additional fees in some areas, for which we ask for your understanding.

In the end, the “other charges” for the Lexus UX 300e were 8,500 yuan. The decoration fee of 5,000 yuan is only one-third of that of BMW iX3, while the registration fee of 1,500 yuan and the charging dock affiliation fee of 2,000 yuan are lower than those of independent brand dealers. Since we inquired about the financial plan from Toyota Finance, the sales consultant said that we do not have any handling fees.

In fact, the last sentence of the Lexus sales consultant reveals the game in this industry, and the key point is the definition of “we.”

The Dealers Who Play “Leverage”

Regarding the definition of “we,” it actually refers to the dealership itself. Because all kinds of “other fees” are essentially ways for dealerships to recoup profits, and the reason why dealerships do this is because they are losing money selling cars.

And why do dealerships lose money selling cars? That requires tearing apart the surface and looking at the kernel, starting with the underlying logic of dealerships.

First of all, most dealership investors are playing “leverage economics,” selling cars received from the manufacturer as quickly as possible before the bank’s acceptance bills expire, to keep the capital circulating, which is the foundation for a dealership to survive.

In the “ancient times,” there were few domestic car brands, and the capacity of the main factories was limited, and the car market was in short supply. This allowed leverage economics to work smoothly for dealerships, with fast turnover of capital and high profits per car, making those years “lying down and making money” for dealerships.

However, with the 2008 financial crisis, the government introduced a ten-industry revitalization plan, including the automotive industry. Main factories began to expand production capacity, and in 2009, China’s car production and sales reached 13.79 million vehicles, a 47% increase from 9.34 million in 2008.

By 2012, the total production and sales of domestic cars had reached 19.27 million units. That year, 52% of imported brand dealerships were losing money, 30% of joint venture brand dealerships were losing money, and 42% of independent brand dealerships were losing money.This not only confirms the arrival of the “buyer’s market” era, but also the inevitable situation caused by the speed of the increasing number of automobile brands and the industry’s production capacity exceeding the growth rate of market demand.

The main reason for this phenomenon is the “production-to-sales” model of traditional OEMs. Most OEMs set sales targets at the beginning of the year, sign supply contracts with parts suppliers, and arrange production plans according to annual sales targets.

However, this can lead to an “unexpected” situation where the OEM’s production quantity exceeds market demand.

At this time, dealers become the “reservoir” of excess production capacity, and in order to transfer the financial pressure of production inventory, OEMs and dealers reach a car delivery agreement in a “mutual benefit” way for dealers to obtain manufacturer’s delivery rebates, making inventory pressure inevitable.

Although the rebate mechanism varies from manufacturer to manufacturer, generally dealers need to “aggressively deliver the cars and accessories” with detailed requirements broken down by month, quarter, color, and configuration, making it an open secret in the industry.

According to international conventions, a reasonable inventory coefficient is between 0.8-1.2. However, this is an ideal number. I have seen countless dealerships of popular brands with inventory coefficients usually at 1.5 or even higher than 2. If it is a dealer of a luxury brand, the inventory funds can be as high as 100 million yuan. If the capital chain is not enough, dealers can only borrow again, which means they need to use “leverage” again.

With a high inventory coefficient, showroom price reductions and wholesale on the secondary market are the few options for dealers to turn money faster. However, this is also the beginning of price out of control. This is why many car models have “terminal discounts”. Simply put, it’s like the logic of a “small vendor”. When there are too many goods or can’t sell, sell them cheaply to customers or transfer them to peers to keep the money moving.

If you still can’t understand the impact of inventory coefficient on dealer pricing, let me give you a more vivid example. In the snowy winter, due to the tendency of rear-wheel drive models to skid on snowy roads, the same car model’s selling prices of the “rear-wheel drive version” would be cheaper in the north than that in the south, but the selling prices of the “four-wheel drive version” of the same car model would be higher in the north than that in the south.

Unlike the nationwide unified pricing of new emerging car makers, consumers who buy traditional brand cars still need to visit different dealerships because of the different inventory coefficients and slightly different car prices. During this process, consumers need to negotiate with multiple sales consultants in multiple stores, which can be really exhausting.

But is this kind of experience really pleasant?

Dealers Seeking “Profit”

Another problem with OEMs “production-to-sales” model is, even if the product produced is “unpopular in the market,” OEMs still have to produce it due to the contract signed with parts suppliers at the beginning of the year.Translation:

The host factory will not bear the “loss” itself, so the dealer becomes the “savior”. The usual tactic is to bundle the well-selling cars with the poor-selling cars.

For example, a few years ago, Guang Feng had a bundle package of one Highlander and three Corollas.

Under such policies, the “inventory” of Corolla in the dealer’s parking lot is bound to increase, and the dealer has to accelerate the pace of digesting Corolla, and price reduction is one means. This is also the reason why the end-user discount of a Corolla priced at just over 100,000 yuan once reached more than 20,000 yuan. A phenomenon of new car price inversion has emerged, in other words, selling one is losing one.

But losing money cannot stop the pace of car sales for the dealers, because once the capital is in a stagnant state, it is fatal for a dealer. Not to mention the interest pressure brought by the acceptance bill, the pressure of after-sales maintaining inventory is even greater, and more are from the manufacturer’s urging for delivery.

Some people may feel that the dealer can offer a lower discount, “less routines, more sincerity”, would the outcome be better?

In fact, under the concept of channel-winning and terminal-customer-oriented, manufacturers rapidly expand their sales network and implement flattened channels. Harvesting the secondary distribution channels cultivated by large dealers into primary direct management, continually narrowing the scope of dealer’s power. in plain words, “there are more and more car dealers in the same area.”

After such a large-scale expansion of the network, the phenomenon of “peaceful coexistence” is difficult to exist, and the degree of intensity between each other cannot be pacified by “a piece of gentleman agreement.” After all, no one is willing to watch the car that has been brought back at a considerable cost “sunbathing” in their own car parking lot, and no one is willing to be marginalized in the manufacturer’s eyes more and more.

However, always losing money on selling cars, and making a fuss to make a profit is not the scenario that the group and investors want to see. Based on this background, dealers finding profit points becomes very important.

Like the Corolla model, it is a loss, but the Highlander not only makes money but also “makes money by increasing prices.” This partly makes up for the pit buried by the Corolla.

Roughly estimated, the terminal user discount of more than 20,000 yuan for a Corolla, combined with all sales and market rebates, the loss of three Corollas, and the profit of a “high-priced Highlander” are roughly equal, but this does not include shop rent, water and electricity, and employee costs.

Is it possible to earn more than 60,000 yuan on one Highlander? Of course not, Corolla has not “abandoned treatment” yet, it is still trying to dig fewer pits.

Financial service fees, license plate fees, out-of-stock fees, PDI inspection fees, boutique decoration, in-store insurance and GPS fees, and even less known financial interest rate differences are all methods that dealers use to retrieve profits. As for how much profit should be retrieved, it is not determined by the sales consultant’s negotiation, but more depends on the dealer’s single-month sales progress and inventory ratio.

But can this achieve sustainable profitability?According to the data of the Automotive Distribution Association, in the first half of 2020, the sales revenue of car dealers was only 37.6% of the full-year revenue for 2019, with only 21.5% of dealers seeing a year-on-year increase in sales volume and 38.3% of dealers in deficit. In November 2020, the inventory warning index for car dealers was 60.5%, up 6.4% from the previous month but down 2.0% from the same period last year, with the inventory warning index above the prosperity line.

From the data, it seems that the survival of traditional car dealers is still not optimistic.

“Dealers Selling Electric Cars”

After saying so much, which is a bit off topic, let’s return to the issue of traditional dealers selling new energy vehicles.

According to the previous logic, new energy vehicles should be heavily discounted by dealers, so why should they raise prices? This is actually a problem with inventory.

Let’s take the BYD Han EV for example. Since its launch in July, the monthly sales volume of this car has increased rapidly. As of now, the monthly sales volume of the BYD Han EV has reached five figures, but this data does not represent the actual monthly sales volume, but mainly reflects the production capacity of the BYD Han EV. Because it is still in the period of digesting the backlog of orders, when the dealer’s inventory is not enough for sale, the absence of excessive price hikes already shows manufacturer’s control and dealer’s restraint.

As for the situation of the Ora Cat and BMW iX3, it is easier to understand. These are newly launched models, and dealers may not have such a large volume of vehicles available. When the dealer’s inventory is almost non-existent, it is too difficult to try to take advantage of dealers.

The situation with the Lexus UX300e is completely different from the previous three. The coordination between the manufacturer’s estimation of market sales volume and production capacity for the Lexus UX300e is relatively reasonable. So when stimulated by the new energy limit policy in Shanghai, Lexus dealers emptied their inventory very quickly. In the absence of inventory and rebate pressure, Lexus dealers continue to have an easy time.

So the question is, why doesn’t the manufacturer control the dealer’s price hikes to ensure a better consumer experience? This involves the relationship between the manufacturer and the dealer, as the “catcher” for the overcapacity of the manufacturer, the dealers’ days of “only eating bones and not meat” also have to come to an end.

Looking at the life cycle of a generation of car models, the sales situation can be roughly understood as a curve in the shape of a ∩. The difference between each model lies in the duration of the climb, peak, and decline periods. So you can simply understand that the rise and peak of a car model’s sales is the period for dealers to “feast”, while the decline period is the time for dealers to “donate blood for nothing.”If you still don’t understand, let me give you a historical example. The F18 BMW 5 Series, which I believe is quite familiar to everyone and has high visibility on the road. When the F18 5 Series launched in 2009, it was too competitive compared to its rivals, the Mercedes-Benz E W212 and the Audi A6L.

This led to a price increase of tens of thousands of yuan in terminal transactions in the initial sales period of the F18 5 Series. However, as production capacity increased and market popularity declined, along with timely follow-up by competing models, the F18 5 Series fell to a discount of around 20% in BMW’s Eastern and Southeastern terminals in 2015. In other words, the price was cut by twenty percent, and this situation continued until the arrival of the G38 5 Series.

The key point is that BMW dealers not only sell 5-Series, but the brand also features a wide range of car series that cycle through their respective lifecycles. The skill of “robbing Peter to pay Paul” is the foundation of an excellent sales manager, while the BMW iX3, a model with lower inventory pressure, is not qualified to enter the “clearance sale” list, and so the only option is to raise prices.

Like BMW, many manufacturers will develop and produce models with market heat not too high in order to enrich their product lines. However, such models are potential risks for dealers. If the inventory pressure is not high, dealers can slowly digest it. But if the inventory pressure is too high, it will result in a wave of “big sales.”

Some people say that dealers allow the automakers to “play with” them, and I think this description is not inaccurate. But automakers also understand the principle of “don’t push a honest person too far.” In order to maintain a stable and ongoing cooperative relationship with dealers, and based on the delicate relationship between dealers and manufacturers, under the condition that the public opinion is not affected, manufacturers usually do not interfere too much when dealers “make a profit.”

But how long can this model last?

In conclusion

Under the influence of various “harsh taxes and fees”, traditional 4S stores still retain the concept of cars needing to be “sold,” while new car-making forces are almost providing a “second-level pickup” experience.

After saying so much, it seems that the dealers are very innocent, and everything seems to stem from the automakers’ blind expansion. But in fact, the poor service capabilities of dealers have aggravated the current situation of dealer losses.

Based on the current relationship between dealers and automakers, it is more profitable to serve the automakers than to serve the customers. This also means that the “invisible benefits,” such as customer loyalty, are not as important as actual car sales. This reminds me of NIO, which has a 69% referral rate among old customers.

But if the pricing system of dealers is a “distorted experience” under pressure from automakers, then the service system of dealers is “floating with the wind” under self-regulation.As the after-sales department of the dealer responsible for consumer service, various new tricks and tricks keep emerging. In certain 4S stores where there is a lack of proper management system, after completing the original maintenance projects, the vehicles are found to have no maintenance records. What is happening behind the scenes? Who has benefited from this?

Regardless of pre-sales and after-sales, customers entering the store are more like “lambs waiting to be slaughtered” than “gods consuming”. The sales rhetoric of frontline employees clearly underestimates the cognitive level of the public consumers.

According to J.D. Power data, in 2017, car owners first chose independent after-sales channels 17 months after purchasing a car, which was advanced to the 15th month in 2019. In other words, consumers will not go to 4S stores for car repair after 15 months of purchasing a car.

For dealers who no longer make profits by selling cars, if the service level remains unchanged, consumers will definitely vote with their feet.

In the end, who abandoned whom – consumers or 4S stores?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.