Tesla officially released its 2020 Q2 financial report today, marking the fourth consecutive quarter of profitability that Tesla has handed in to the market.

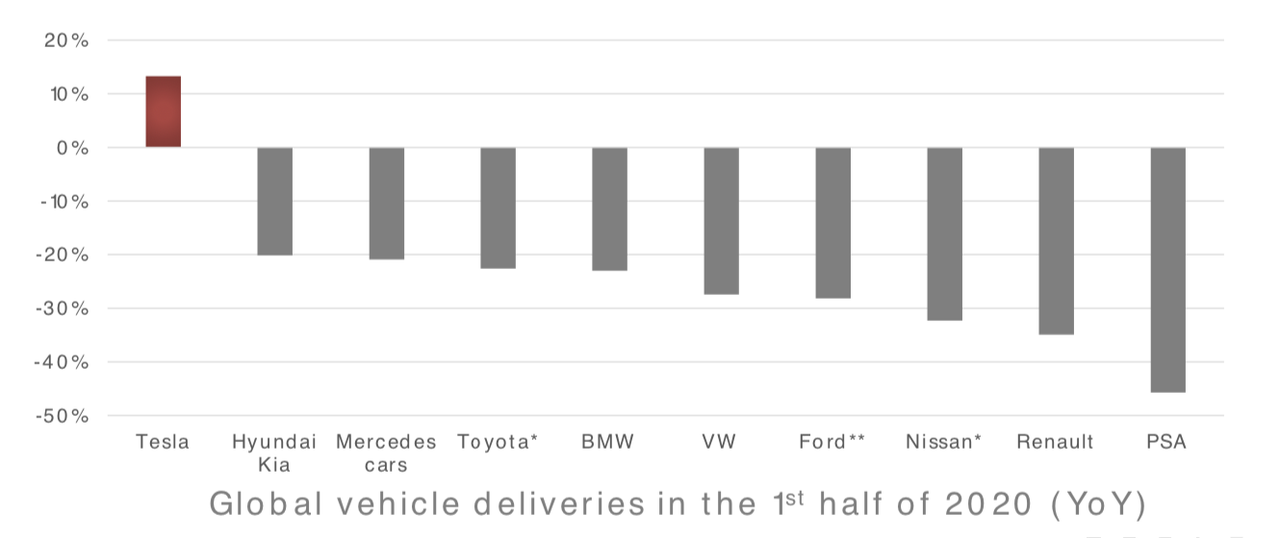

For automakers, the sudden outbreak of the epidemic this year can be described as “earthshaking”. When the Fremont factory was shut down for six weeks and US auto sales as a whole fell 34%, Tesla was outstanding and did not decline but rose.

Core information of Q2 financial report

Financial data

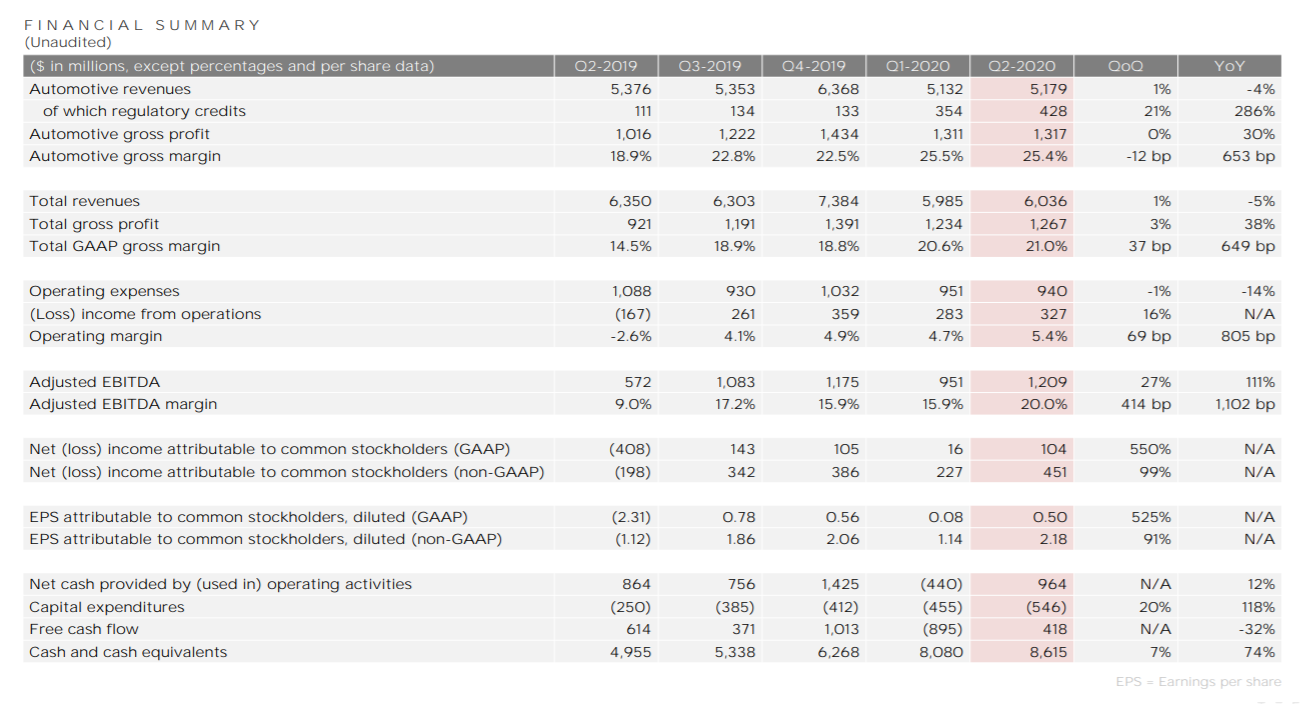

- Total revenue of 6.036 billion US dollars, an increase of 1% compared with the previous month, and a decrease of 5% compared with the same period last year;

- Automotive sales revenue of 5.179 billion US dollars, an increase of 1% compared with the previous month, and a decrease of 4% compared with the same period last year;

- Automotive sales profit of 1.317 billion US dollars, almost the same as that of Q1’s 1.311 billion US dollars, with zero growth month on month and a decrease of 4% year on year;

- Gross profit of 1.267 billion US dollars, an increase of 3% compared with the previous month, and an increase of 38% year on year, with a gross profit margin per vehicle of 25.4%, a decrease of 0.1 percentage point compared with the previous quarter;

- GAAP net profit of 104 million US dollars, achieving GAAP profitability for four consecutive quarters for the first time, and indicating that Tesla can smoothly enter the S&P 500 index;

- The cash and cash equivalents in the second quarter increased by 535 million US dollars to 8.6 billion US dollars;

- Operating cash flow minus capital expenditures (free cash flow) was negative 418 million US dollars.

Delivery data

- The total production and delivery of Q2 2020 were 82,272 and 90,891 respectively;

- Model 3 & Y produced 75,946 and delivered 80,277;

- Model S & X produced 6,326 and delivered 10,614;

- Inventory turnover was 17 days, down from 25 days in the previous quarter.

Factory and capacity

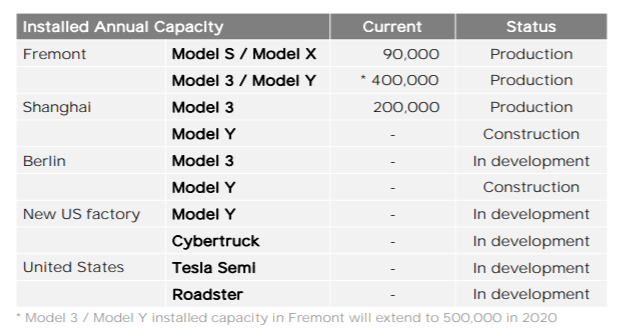

- The site for the next US super factory has been selected, and preparations are underway. The construction of the Shanghai Model Y factory is proceeding as planned and is expected to be delivered for the first time in 2021.- Due to production suspension caused by the pandemic, the Model Y production line only operated for about 4 months in the first half of this year. However, in the second quarter, the Model Y production line was running at full capacity. The ramp-up of production capacity was much faster than that of the Model 3, which took 9 months to reach the same weekly production rate.

- Currently, Tesla is adding new production machines in the Fremont factory, with the expectation to increase the annual production capacity of Model 3/Y from 400,000 to 500,000 units.

S&P 500 Index is calling

With four consecutive quarters of GAAP profitability, Tesla stock meets the requirements for inclusion in the S&P 500 Index, and has a chance to be included in the next 3 to 6 months.

Words like “crazy” are not enough to describe the recent situation of Tesla. Despite the epic stock market crash in March, Tesla remained strong and quickly rebounded. Its stock price has surged nearly 300% since the beginning of 2020.

With a market cap that is comparable to the total of Toyota and Volkswagen, we won’t dwell on questions like whether Tesla’s stock price is too high or its market cap is too speculative. Let’s look at the financial report itself and see what’s worth paying attention to.

Behind the unexpected profitability

Starting from Q1 2020, the profit from selling carbon credits has risen dramatically and accounted for nearly 34% of gross profit in Q2 2020, reaching $428 million, nearly 4 times that of the same period last year.

What are carbon credits?

Under the US carbon credit program, a car manufacturer is deducted a certain amount of credits if it sells “environmentally unfriendly” cars to US consumers. These credits can be traded between manufacturers.

Although this is a completely legitimate trade, the actual operating conditions of the last two quarters have forced Tesla to exceed Wall Street analysts’ expectations “reasonably” through this revenue.

This is obviously not what shareholders expected from the company. For a car company, sales volume is key.

Commitment to the 500,000 delivery target

Despite the impact of the pandemic, Tesla stated in its latest earnings conference call that the 500,000 delivery target for 2020 would not change.

In the second quarter of 2020, Tesla produced 82,000 new vehicles and delivered 91,000 vehicles, with Model 3 and Model Y as the best-selling products, accounting for over 80,000 units.### Summary of Delivery Performance

Tesla’s overall delivery performance exceeded FactSet’s highest estimated number by 86,000 units. Additionally, with data from Q1, Tesla has delivered a total of 179,000 vehicles so far this year.

After some calculations, it’s found that Tesla needs to deliver 321,000 units, averaged at 160,000 units per quarter, in the upcoming two quarters. This surpasses their previous record of 112,000 units delivered in Q4 of 2019, which accounted for 43% of their all-time peak. Moreover, due to the impact of COVID-19 crisis on production and delivery, Tesla’s China market is becoming increasingly important.

Therefore, if global market recovery is not ideal, China will bear the greatest sales pressure. According to the estimated production and delivery target of 100,000 units, based on China’s weekly capacity of 4,000 units, the company is relying heavily on China’s market growth.

What Models Will Be Available in the China Market?

According to Tesla’s financial report, the Model Y produced in the Shanghai factory will not be available until 2021. Therefore, currently, Model 3 is the only model available in China.

- Product-wise: The Model 3 with a lithium iron phosphate (LFP) battery from CATL is the only model that has not been released yet.

- Pricing Strategy: With the increase of local production rate (from 40% in early 2020 to 80% by the end of this year), Tesla can reduce prices and expand their profit margin.

Despite Tesla’s ambitious plan to deliver 100,000 new vehicles, attracting new users is key to their success.

Updates on Self-Driving Technology

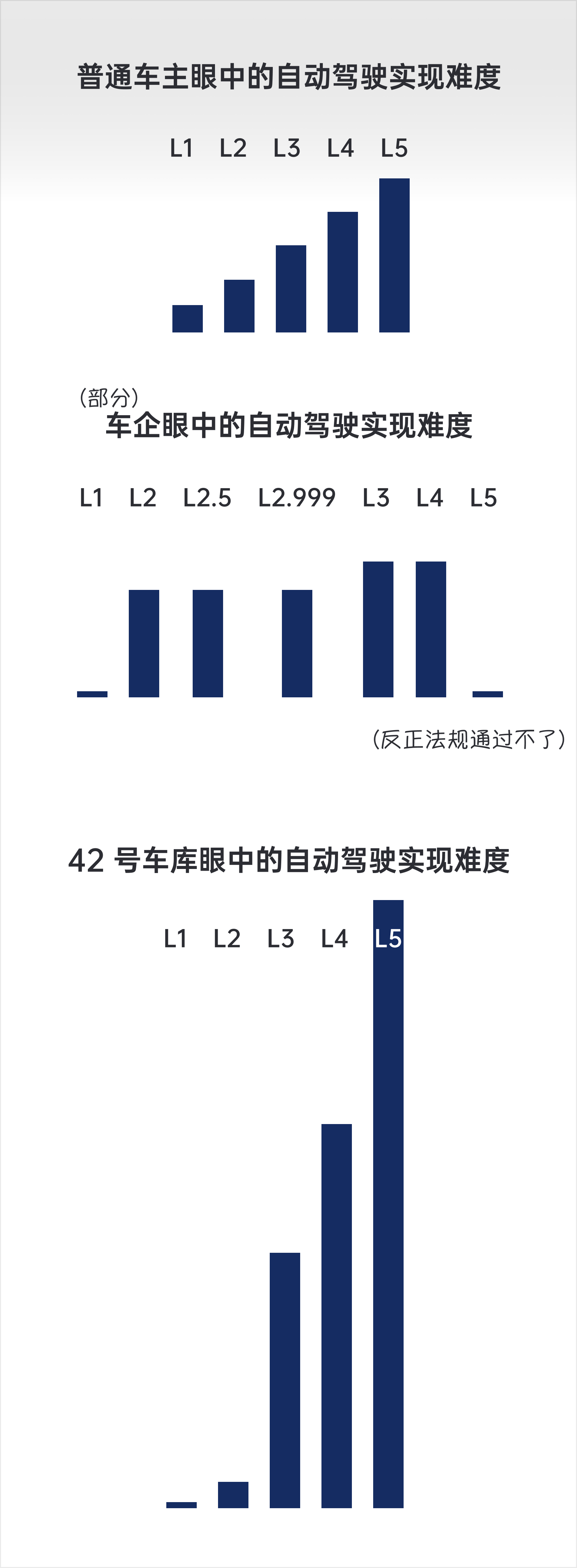

During the conference call, the latest progress in self-driving technology was shared, including the testing of fully automated driving through intersections, city streets, and narrow roads.

At present, Elon has been using the Alpha version of the software, and “the (FSD) can almost drive from my house to the company without intervention, including abnormal road conditions, such as road construction.” “So I am confident that we will achieve full self-driving functionality by the end of this year, because I actually drive it myself.”

Regarding the world of self-driving, Elon claimed that Tesla will create “the biggest asset value increase in history”, and cars equipped with FSD functionality will “instantly appreciate 5 times.”In view of Tesla’s tradition of delaying projects, we have not yet translated “by the end of this year” from Martian time back to Earth time. However, we have prepared a picture as a reference for the difficulty of implementing autonomous driving.

New development of the factory: Alien Battleship 1.0

…The long-term sustainable advantage of Tesla I think will be manufacturing.

— Elon Musk

Tesla has always regarded factories as its most important product. At the 2017 Tesla financial conference, Elon explained the concept of “building factories with product thinking”:

The most fundamental differentiation is to truly treat the factory as a product and to create a vertically integrated product. Problems encountered in factory construction are more viewed as engineering or technical challenges to be solved.

During the Q2 2020 earnings call, Elon reiterated:

“We invest a lot of energy in manufacturing and designing the machine that builds machines. We think the factory is worth ten times or even a hundred times more than (electric) cars themselves, and we call it ‘Alien Battleship.’

If you say the Gigafactory in Nevada is 0.5 version, then the new factory we are building is approaching version 1.0. In Berlin, Model Y’s infrastructure has already begun to differ. Although the product may look the same, the internal components will be very different. In terms of architecture, the Model Y produced in Berlin will have higher utilization efficiency.”

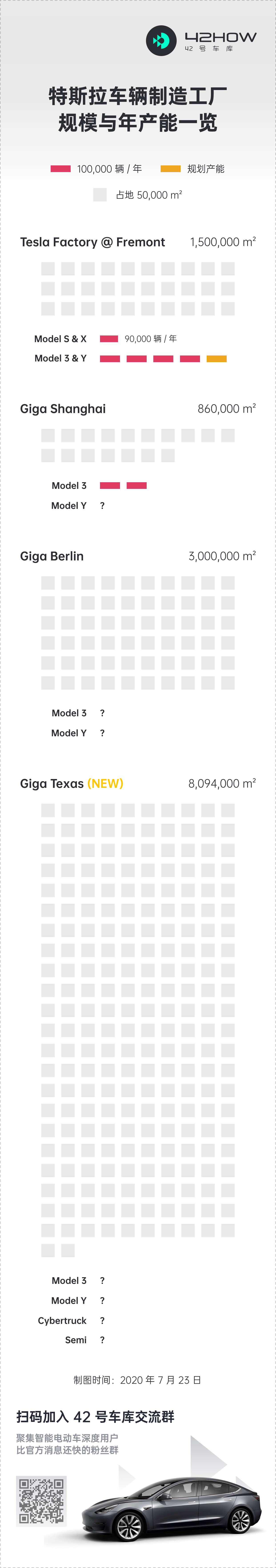

Currently, Tesla is building three factories on three continents at the same time. At the earnings call, Elon announced that Tesla will build another vehicle assembly plant near Austin, Texas. The specific location is located on the Colorado River, 13 minutes drive from downtown Austin, covering an area of 2,000 acres.

Elon said in the conference call: “This will be an ecological paradise open to the public.”Note that this factory occupies nearly 10 times the area of the Shanghai factory, which is about 1,200 acres larger. Let’s illustrate the size of this factory with a picture:

In addition, Elon also mentioned that Tesla will consider building a factory in Tulsa, Oklahoma.

In terms of production expansion and product planning, Tesla is installing additional equipment in its Fremont factory in the United States, and expects the total production capacity of Model 3/Y to increase from the current 400,000 units per year to 500,000 units per year.

The Model Y production line at the Shanghai Gigafactory is progressing as planned, with expectations that domestically-produced Model Ys will be delivered in 2021. In addition, the Berlin Gigafactory in Europe is also under construction.

A charging company that doesn’t do energy storage isn’t a good new energy company

I think long term, Tesla Energy will be roughly the same size as Tesla automotive.

—Elon Musk

An excellent new energy company must have two abilities:

- Manufacture excellent products with long ranges (Model 3, ES6 + 100kWh, P7);

- Solve the problem of energy supplement difficulty (Tesla Supercharger network, NIO Battery Swap network, XPeng Supercharger network).

A great new energy company needs to take a more macro perspective and promote the popularization of sustainable energy. Elon explained the three key elements:

- Wind + solar power generation;

- Electricity storage;

- Power transportation.

Corresponding to Tesla’s three major products/business lines:

- Solar Roof: The price of $1.49 per watt is already one-third lower than the industry standard;

- Megapack & Powerpack \& Powerwall: Megapack is a highly-integrated, megawatt-scale battery that can be quickly deployed and connected to the grid, with a capacity of 419 MWh deployed, and has achieved profitability;

- Autobidder: More information below.

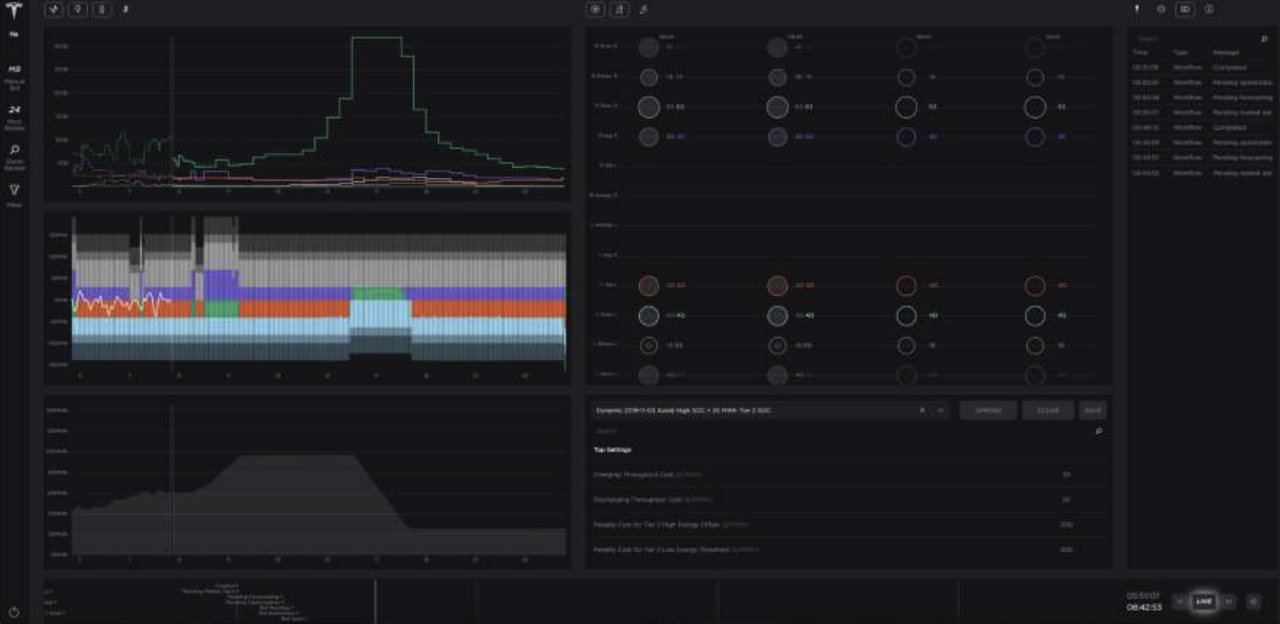

Now let’s focus on this new face, Autobidder.

In the financial report, Tesla briefly introduced Autobidder: “Autobidder is a real-time energy trading platform designed to maximize energy revenue from our utility scale batteries and continue to play an important role in our energy storage strategy.”

“In a renewable energy world, you can’t plan to generate electricity by the hour, but you need to plan down to the minute. That’s what we’re doing,” said Andrew Baglino, Senior Vice President of Powertrain and Energy Engineering at Tesla.

Outside the United States and Australia, Tesla has officially deployed this system in Europe and conducted transactions with the European Power Exchange.

As of the publication of this article, the news that “NIO will establish a battery asset company, and CATL is expected to invest” has also finally come out. We are also looking forward to how NIO will present its BaaS (Battery as a Service) product in the energy storage sector.

In conclusion

For Tesla, this financial report is another test that has been successfully withstood by the market. Despite uncertain factors, its delivery volume remains strong, FSD development is continuing, and the new factory is being constructed orderly.

Tesla is sprinting ahead, but this time it is no longer the “inscrutable catfish”. Tesla has presented itself comprehensively to the world, and its next opponent can only be itself and the invisible hand.

As early as 2013, Tesla pointed out in documents submitted to the SEC that “our production capacity growth is limited not by market demand, but by the supply of battery cells from suppliers”.

In the Q2 2020 earnings call, Elon explained this issue again:>The real limitation to Tesla’s growth is the price of cell production. That is the real constraint. Therefore, on Battery Day we will discuss this more extensively as it is a fundamental scaling constraint. Any step in the supply chain or processing at the cell level will be a limiting factor, from mining to refining, and from refining to cathodes, anodes and cell formation. Whatever the bottleneck is, that will set the growth rate. That is why we plan to expand our business with Panasonic, CATL, LG, and possibly other companies, and there is much more to say about that on Battery Day. This also explains why Tesla is trying to use cobalt-free batteries, but at the same time actively hoarding cobalt material – reducing the cost is Tesla’s goal. As for questions related to self-developed batteries, Elon remains tight-lipped at this earnings call. It seems like we will have to wait for Tesla Battery Day in September to see what new secrets and weapons will be unveiled.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.