This afternoon at 4 o’clock, NIO announced its sales and delivery figures for June and Q2:

- NIO delivered a total of 3,740 new vehicles in June 2020, a year-on-year increase of 179.1%, setting a new monthly delivery record since its inception;

- Among the new vehicles delivered, 1,264 were ES8s and 2,476 were ES6s;

- As of the end of June, NIO had delivered 10,331 vehicles in Q2, becoming the first Chinese new car company to deliver more than 10,000 vehicles in a single quarter;

- The cumulative delivery volume of ES8 and ES6 reached 46,082 vehicles, including 14,169 vehicles delivered in 2020.

How should we interpret this data? Here is our analysis:

The market is recovering, but NIO encounters production bottlenecks

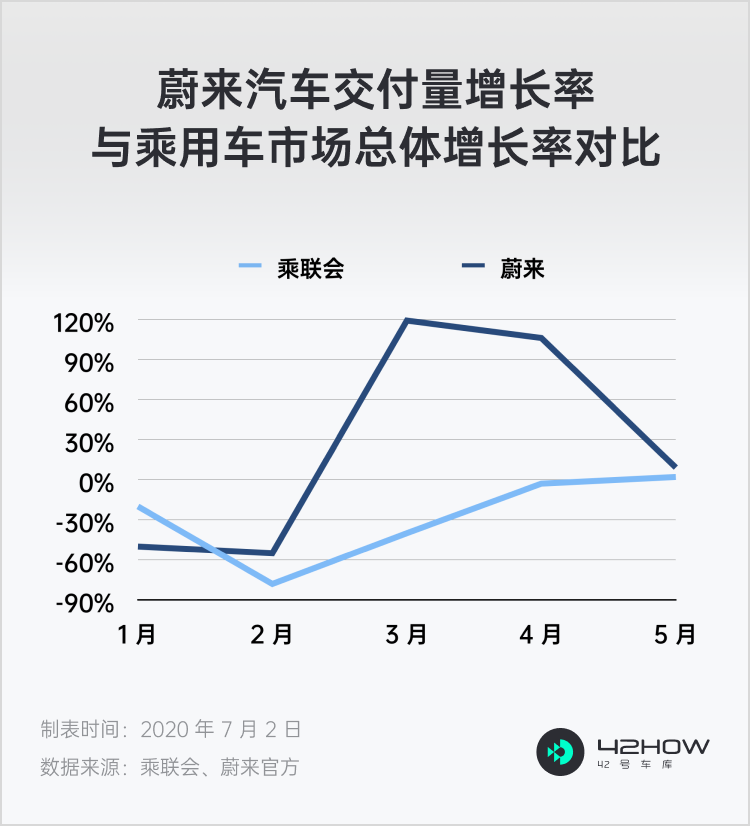

According to data from the China Passenger Car Association, the overall growth rates of the Chinese car market from January to May after the outbreak of the pandemic were -20%, -78%, -40%, -3%, and 2%. From the growth data of the car market, the recovery after the pandemic has been strong.

In particular, in May, the retail sales of passenger cars reached 1.609 million units, a year-on-year increase of 1.8%, making it one of the few months to recover positive growth since June 2018.

This indicates that the Chinese automotive market is showing a V-shaped recovery trend after hitting a bottom during the pandemic.

This is also reflected in NIO’s sales, which have been growing for four consecutive months.

After production capacity recovery, let’s take a look at NIO’s Q2 delivery volume:

- April: 3,155 vehicles (2,907 ES6s and 248 ES8s)

- May: 3,436 vehicles (2,685 ES6s and 751 ES8s)

- June: 3,740 vehicles (2,476 ES6s and 1,264 ES8s)

Now the question is:

- Why can’t they sell more?

- Why are ES6 sales decreasing?

In fact, Li Bin had already answered these two questions in the Q1 earnings conference call on May 28:

- The Hefei factory can produce 4,000 units per shift (15 JPH + 10 hours of work per day), but the current production capacity bottleneck is limited by the supply chain, at around 3,400-3,500 units.

- The company plans to increase the entire supply chain capacity to 4,500-5,000 units between August and September.同时,NIO is facing pressure to maintain a Q2 gross margin of over 5%, which makes it very reasonable to allocate some production capacity to the ES8 with a higher gross margin, but this will inevitably reduce the production volume of the ES6.

In other words, NIO’s biggest problem now is not on the demand side, but on the bottleneck of production capacity.

NIO has stood firm in the 300,000-500,000 class market

Excluding the drop in delivery volume due to holidays and the epidemic in January, February, and March, NIO’s monthly delivery volume has quickly rebounded to the level of 3000+ since April, close to the peak monthly delivery volume of last year. The delivery volume in May and June has reached new highs, with a stable increase rate of 8-9%.

Here, we can draw a bold conclusion: NIO’s monthly delivery volume has reached the level of the 300,000-500,000 class market, and the delivery volume is steadily increasing at a stable rate each month. NIO’s brand and product strength have also gained more recognition from users.

Moreover, NIO is the only domestic brand in China that dares to sell products for half a million RMB. What makes NIO stand out? Can this advantage be sustained?

We believe that NIO’s product competitiveness can be summarized into four aspects based on internal team discussions:

- Luxury: design and materials on par with BBA;

- Service: a service system that leads all competitors, as well as excellent charging infrastructure;

- Technology: still catching up with Tesla, but already far ahead of traditional automakers in terms of technological capabilities;

- Performance: high-performance level with 0-100 km/h acceleration under 4 seconds for the 300,000 RMB class.

However, just brainstorming is not enough. In order to make this conclusion more convincing, we randomly selected 13 owners who just received their vehicles or made large down payments from the NIO community in Garage 42 to discuss. In addition to the advantages of good materials, large space, and low usage costs that everyone has always agreed on, we also discovered several interesting points.

Model 3 open source, NIO “intercepts” flow

When it comes to NIO, it is difficult to avoid mentioning Tesla, which has already surpassed ten thousand deliveries per month ages ago.

But interestingly, we found that among the 13 respondents, 10 of them have considered Model 3, and even 2 owners had already placed orders for Model 3, but ultimately canceled and chose NIO ES6.

It can be said that Model 3 has successfully opened up public awareness of new energy vehicles in the process of competing with BBA, while NIO has successfully converted those users who pay more attention to interior design, workmanship, materials, and space.

Battery swapping is the most important selling point

Among the 13 interviewees, 8 users had a home charging facility, accounting for 61% of the total. Although this is already a high proportion, it is a decline compared to what Dr. Shen Fei revealed in NIO Power 2nd anniversary live stream a few days ago, where over 70% of NIO car owners had home charging facilities. Although the sample size of these two surveys cannot be directly compared, it is reasonable to assume that the majority of car consumers do not have home charging facilities. In order to expand market share, it is essential to address this group of users and solve their charging problems. We conducted follow-up interviews with 5 users who had no home charging ability, and 3 of them mentioned NIO’s battery swapping technology and added that the swapping stations were very close to their homes. Two of the 8 users who had a home charging facility also mentioned the swapping technology. Therefore, although the 430 km NEDC range of the mainstream NIO ES6 model in 2020 may not be impressive, electric vehicle owners who lack home charging facilities do not think the charging experience is bad thanks to the battery swapping technology. Additionally, staff from NIO Power revealed that although the cost of operating free battery swapping stations increases with the increase in sales volume, the cost can be reduced when spread across each newly sold vehicle. The cost of electricity for each new vehicle is about CNY 1-2,000 per year, which is more supportive of sales than other policies. After solving the charging problems of this group of users, the advantage of using NIO electric cars with low running costs can be highlighted. Among these 13 ES6 owners and potential buyers, the ES6 is considered to be the highest cost-effective choice despite being the most expensive one, when considering the daily running costs.

More than half of the users indicated that the investment from Hefei government gave the company courage to overcome “bankruptcy” shadows. “The earliest this year and the latest next year is actually quite scary. Hefei’s investment gave NIO a shot in the arm.” Not only do the users have increased confidence in the company, but the capital market has also reappraised NIO’s valuation. At the time of writing, NIO’s stock price was CNY 9.04, a 170% increase compared to the announcement of Hefei’s investment.

Expectations for NIO’s future:

-

This month, NIO will announce the price of the next product EC6, let’s see how NIO will face off Model Y.

-

It is hoped that NIO can continuously increase production capacity and achieve higher delivery volumes.3. Looking forward to the release of Q2 financial report, let’s witness NIO’s positive gross profit together;

-

Looking forward to the announcement of the specific BaaS plan, which can allow NIO’s products to continue to enter lower price ranges and gain more attention.

Please continue to follow our coverage of each key point, and feel free to join our NIO communication group to get the latest NIO updates.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.