On December 28th, NIO owners from Shenzhen created a song called “The Self-Cultivation of Electric Car Owners” at the 2020 NIO Day, which humorously addressed the difficulties NIO faced this year, resonating with NIO enthusiasts.

- Charging requires towing by an oil-powered car

- Billion-dollar investment for the “Niulang’s Hut” to cater guests

- Even slept on Chang’an Avenue

- The stock price dropped to just over one dollar

Three months ago, shortly after the release of NIO’s Q2 financial report, NIO’s stock price reached the lowest point of $1.36 per share, compounded by the self-ignition and recall incidents that happened in Q2. Soon after, William Li was dubbed the “Unluckiest man of 2019”.

However, with the release of NIO’s Q3 financial report on December 30th, overnight the winds of change blew, and NIO’s stock price increased substantially by 53.72% to close at $3.72, and intraday rose by over 100%, reaching a high of $4.87.

What was in the financial report?

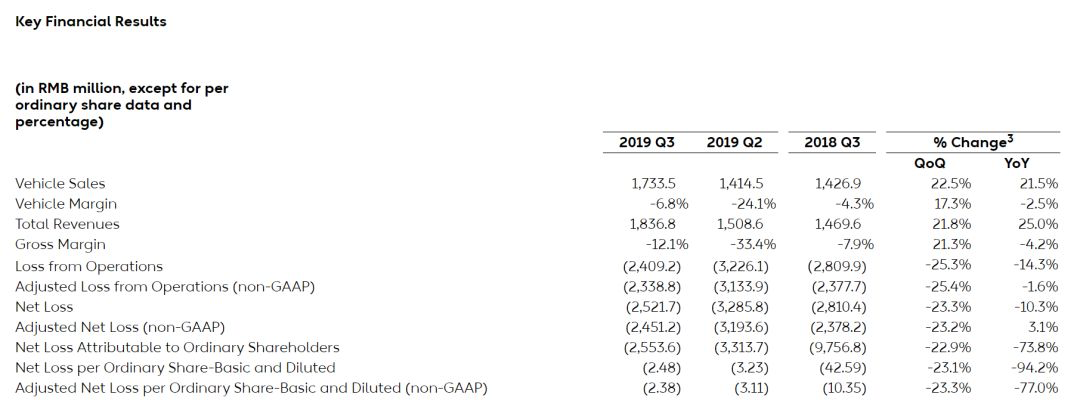

Let’s take a look at the key information disclosed in the financial report:

- Q3 delivered 4,799 units in total, including 603 ES8s and 4,196 ES6s, which exceeded previous quarter predictions, increased 35.1% from Q2, generating sales revenue of RMB 1.7335 billion, with QoQ growth of 22.5% and YoY growth of 21.5%.

- Total sales revenue for Q3 reached RMB 1.8368 billion (exceeding market expectations of RMB 1.632 billion), with a YoY increase of 25.0%.

- Net loss for Q3 was RMB 2.5217 billion, decreased 23.3% QoQ and 10.3% YoY.

- Sales and management expenses for Q3 were RMB 1.1644 billion, decreased 18.1% QoQ and 30.3% YoY.

- NIO expects to deliver 8,000 ES8s and ES6s combined in Q4, an increase of approximately 66.7% compared to Q3. It is estimated that Q4 revenue will be approximately RMB 2.81 billion, with an increase of 53.0% compared to Q3 revenue.

- Gross margin for Q3 was -12.1%, compared to -33.4% in Q2 and -7.9% in the same period last year.- As of September 30, 2019, NIO held a total of RMB 1.9067 billion in cash, cash equivalents, restricted cash, and short-term investments.

From the disclosed financial report, NIO’s key data such as revenue and net loss exceeded market expectations. What’s more surprising is that NIO is expected to deliver 8,000 cars in the fourth quarter.

Many people know that since the subsidy reduction of new energy vehicles at the end of June this year, the entire new energy market has experienced a significant decline. However, NIO has continued to increase its sales since August. As of now, it is known that NIO delivered 2,526 and 2,528 cars in October and November, respectively. Obviously, in order to reach 8,000 cars, NIO needs to deliver at least 2,946 cars in December. For a Chinese car brand with an average sales price of around RMB 400,000, this undoubtedly gives the market great confidence.

However, there are actually some dangers hidden behind this beautiful financial report.

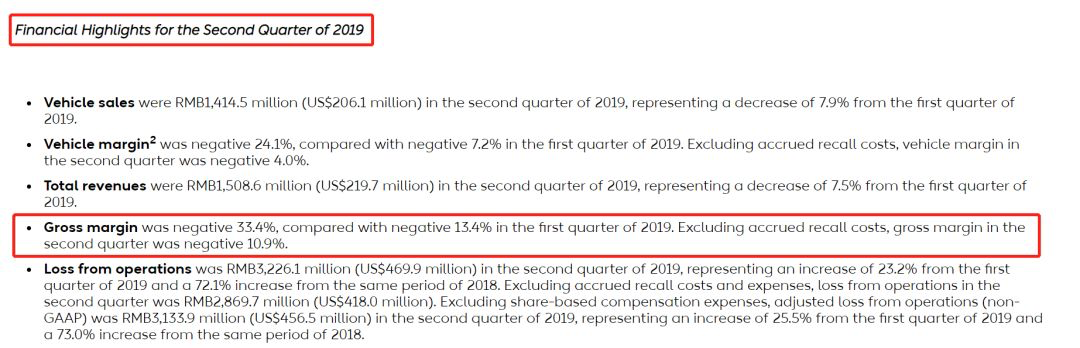

NIO Q2 2019 Financial Report

Although the gross profit margin of Q3 financial report showed a significant increase to -12.1%, compared with -33.4% in Q2. However, the 4,803 ES8 recall incidents in Q2 resulted in a gross profit margin of -10.9% after deducting the recall cost. In other words, the gross profit margin of Q3 actually decreased.

Why did the sales volume increase while the gross profit margin decreased?

The most obvious difference between Q3 and Q2 is that with the large-scale delivery of ES6, the sales of ES8 has shown a significant decline. As the price of ES6 is lower than ES8, but the cost difference is not significant, it affects the gross profit margin.

As gross profit margin is one of the key operating indicators for evaluating corporate profitability, it is of great significance for NIO to quickly improve its gross profit margin.

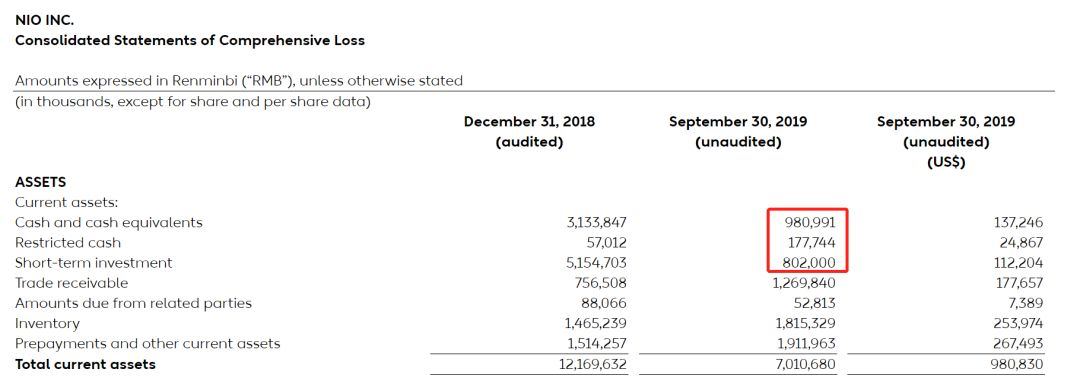

Another key piece of information in the financial report is NIO’s cash flow. As of September 30, 2019, NIO held a total of RMB 1.9067 billion in cash, cash equivalents, restricted cash, and short-term investments.

Let’s take a look at another piece of data: the net loss in Q3 was RMB 2.5217 billion.On September 5th, NIO issued $200 million convertible bonds, with Tencent Holdings and Li Bin subscribing for $100 million each. Tencent’s $100 million has already been received, and Li Bin’s personal subscription of $95 million has not yet been received. If this $95 million is received, NIO’s cash flow will be approximately RMB 2.6 billion.

In other words, even if NIO saves money in Q4 2019, it will only have enough money to sustain itself until Q1 2020.

For NIO, open-sourcing and cutting costs are necessary.

NIO’s “open source” journey

There are two ways to open source: financing and selling more cars. Financing is the only and fastest way to solve the financial crisis in Q1. Regarding financing, NIO’s new CFO, Feng Wei, said in a conference call after the financial report:

“We want to update you on the progress of our financing project. We have made significant progress in financing projects, but these projects are still ongoing, and we cannot disclose any confidential information at this time.”

Since there are no details yet, we won’t make any guesses here.

To achieve sustainable profitability, we still need to return to selling cars, and NIO needs to sell more cars next year.

Now let’s take a look at NIO’s sales in the second half of the year.

As mentioned earlier, NIO expects to deliver more than 8,000 vehicles in Q4, meaning that the delivery volume in December is likely to exceed 3,000 vehicles.

The growth of NIO’s deliveries is mainly due to three factors: first, the widespread layout of NIO Spaces; second, referrals from existing car owners; and third, the product itself has enough strength.

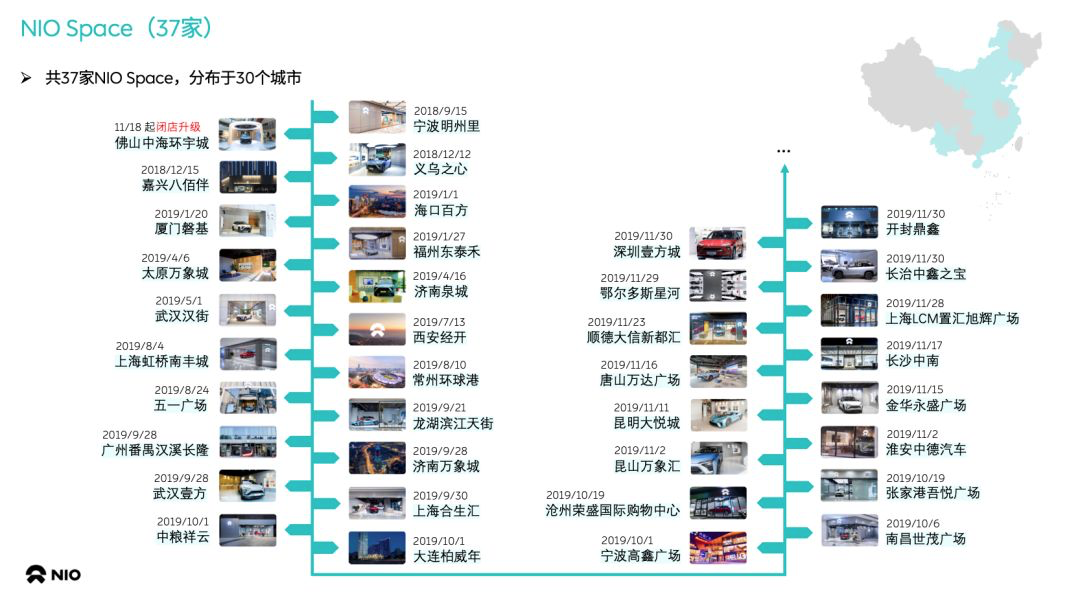

NIO aims to open 48 NIO Spaces and 22 NIO Houses by the end of this year, covering 52 cities.

Regarding the actual benefits brought by NIO Spaces and NIO Houses, Qin Lihong, co-founder and president of NIO, said in a media Q&A:”I think we can’t tell which salesperson is from which store. We look at overall efficiency. We are not dealers, and we encourage users to visit NIO Space in Foshan to check out the cars, and then come to NIO House in Shenzhen to participate in activities. When the user goes to Suzhou, they can visit Suzhou NIO House and have a cup of coffee. It takes time for a user to go through the process from hearing about us to making a purchase. Multiple touchpoints are essential to finally make a sale. I can distinguish by region, but it’s difficult to do so by store.”

Although NIO has not officially specified the difference in sales contributions between NIO Space and NIO House, it is clear from the sales figures that after NIO Space expanded its storefronts through channels in October, it brought significant benefits. NIO also stated that it plans to double the number of NIO Space stores next year.

From a sales channel perspective, the doubling of NIO Space stores next year will have a significantly positive impact on sales growth.

Next is owner referrals.

This is a road that Tesla has already taken, and NIO has also successfully replicated it.

Data released by NIO shows that 48% of this year’s deals were made through referrals by existing owners. Hunan owner Xiao Li Fei Dao-Li Li successfully recommended 45 friends to buy ES8 in the past 400 days. In this regard, NIO is a very successful user enterprise.

In the words of Qin Lihong, “Our user base has grown larger. At the end of last year, we had more than 11,000 users, and at the end of this year, we have more than 30,000. Our user base has tripled. If our referral ratio does not change much, I will naturally grow. This is the driving force of the user community.”

Therefore, the sales contribution of car owners is also significant, and NIO, as a truly user enterprise, is now starting to collect customers. It not only helps NIO acquire customers at low cost and high efficiency but also builds a moat that is difficult for other brands to imitate or learn from.

Of course, all referrals are inseparable from the quality of the product itself. At this year’s NIO Day, NIO released three products: the new ES8, the third car EC6, and a 100 kWh large battery.

Can these three products bring sales growth to NIO? Definitely.The heaviest of the three products is equipped with a 100 kWh battery. After being upgraded to a 100 kWh battery, the NEDC range of ES8 reaches 580 km, and the NEDC range of ES6 and EC6 series models all exceed 600 km, completely eliminating the anxiety of NIO’s range, and the upgrade only costs 58,000 yuan, which is deemed as a price acceptable to many car owners based on their feedback.

Well, I know that the battery will not be delivered until Q4, but the difference of NIO lies in supporting battery swapping. That means I can take advantage of it right after purchasing, and then upgrade to a larger battery after delivery.

The above is NIO’s initiative in terms of open source. Only open sourcing is not enough. NIO has also been criticized for excessive spending, so cost-cutting measures are essential.

Li Bin said in an interview after the NIO Day, “In the qualification stage, we must do our internal work well, and never spend money that is not needed. We need to use every penny well. For example, can we stop spending on the FE racing team? What we should do and what needs to be done with less money to achieve better results. Lower costs, higher efficiency, and more outstanding product services. This is what the whole company needs to do in the qualification stage.”

For NIO, the easiest way to reduce costs and increase efficiency is to cut jobs. On August 22, NIO’s founder and CEO Li Bin released an internal letter announcing that NIO will conduct layoffs in September. NIO stated that this round of layoffs will mainly focus on operational support departments, such as human resources, legal affairs, and finance, and will have little impact on strategic core departments such as research and development and user service.

By the end of December, NIO’s global workforce will be reduced to less than 7500 people (the highest number was 9900). Obviously, during NIO’s rapid development, there were a lot of personnel redundancies.

In addition to layoffs, NIO has also tried to control costs in its service and sales systems.

Qin Lihong stated, “Our service system is the priority. We can expand the number of users without doing anything now, so everyone doesn’t need to worry too much. The practical problem we encountered in 2019 was financial pressure because the market forecast for this year was a bit optimistic based on the previous two years, with too much priority, and thus some financial pressure occurred. But what we have to do now is definitely not to retreat, but to slightly delay the expansion of our service system until the increase in the number of users.”

The service system has long been one of NIO’s indispensable core competitiveness. The well-established service system has attracted more potential consumers, while expenses have gradually become controllable.The NIO House, which costs 100 million yuan and has been scoffed at by car owners, as mentioned above, is not just a matter of throwing money away, as NIO has gradually begun to deploy NIO Spaces with low investment and good effect.

According to Qin Lihong, “Without the NIO House, our entire brand might have to reduce prices by 20% and we might not even be able to sell as much.”

With staff cuts and refined operations, NIO’s internal operating efficiency has greatly improved, as evidenced by the 18.1% month-over-month reduction in sales and management expenses in Q3.

In conclusion, NIO is making great efforts towards a healthy development. Li Bin stated in the Q3 earnings conference call that “The improvement of gross profit is our very important task in 2020, which will continue with changes in sales volume, product mix and pricing, as well as sustained declines in battery costs.”

According to our current expectations in these three areas, we are fully confident that we can achieve positive gross profit for the full year next year. Although we hope it will happen earlier, we also need to consider factors such as not only sales volume, but also the decline in battery costs and the improvement of management efficiency. But I can say with great certainty that we are very confident that we can achieve positive gross profit for the full year of 2021.”

If 2019 was NIO’s toughest year, then 2020 is the year that will make or break NIO’s future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.