On April 24th, US Eastern Time, Tesla released their Q1 2019 financial report. As with any financial report, we once again gained a relatively comprehensive understanding of Tesla’s recent business progress.

Tesla’s Most Complicated Quarter in History

-

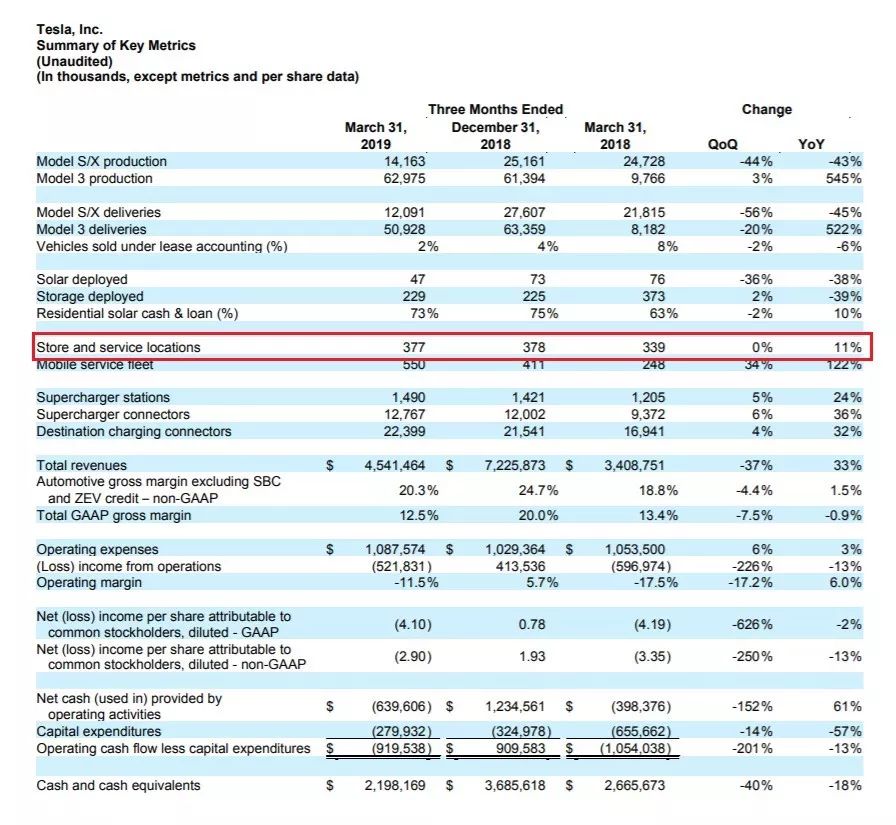

Q1 revenue was $4.541 billion, a year-on-year increase of 33%, and a quarter-on-quarter decrease of 37%

-

Q1 automotive revenue was $3.724 billion, a year-on-year increase of 36%, and a quarter-on-quarter decrease of 41%

-

Q1 energy revenue was $0.325 billion, a year-on-year decrease of 12%, and a quarter-on-quarter decrease of 21%

-

14,150 Model S/X were produced, and 62,950 Model 3 were produced in Q1

-

12,100 Model S/X were delivered, and 50,900 Model 3 were delivered in Q1

-

Model 3 gross margin was 20%

As expected by everyone, including Elon Musk, Tesla once again reported a large loss in Q1. How should we evaluate Tesla’s first quarter of 2019? Tesla CFO Zachary Kirkhorn summarized it accurately with a memorable phrase before the conference call began.

As we reflect on the progress of Q1, this was one of the most complicated quarters that I can think of in the history of the company and it was ambitious even by Tesla’s standards.

When we reflect on Q1, I think this was Tesla’s most complicated quarter in history. Even by Tesla’s standards, Q1 was grand in momentum.January 7th, Elon flew to Shanghai to attend the groundbreaking ceremony of Gigafactory 3; January 18th, Tesla announced a global layoff of 7%; February 5th, Tesla initiated a $218 million acquisition offer for the electrochemical company, Maxwell; March 1st, Tesla released the publication and adjustment plan covering the Standard/Standard Plus Model 3 and Autopilot, sales, and service system; March 15th, Tesla launched Model Y; March 21st, Elon warned in an internal email about “the most challenging delivery challenge in history”; April 23rd, Tesla released an AI chip; April 24th, Tesla released the Model S/X facelift.

Too much has happened to Tesla since January 2019 that it is hard to summarize Tesla’s Q1 with a simple “good” or “bad.” In the following discussion of the entire financial report, we will focus on the above nodes, Enjoy.

Continuing to Strengthen Global Service System Construction

In the past quarter, Elon Musk’s adjustment to the sales system has created global discussions. Simply put, Tesla initially planned to close offline stores globally, dismantle sales organizations, and shift entirely to online sales to save rent and labor costs and improve operational efficiency.

However, after internal discussions, the plan was adjusted to continue dismantling sales organizations, but high-traffic stores would be retained, with only half of the low-efficiency stores being closed.

How is the progress of this plan? In the Q1 financial report, we saw the latest developments.

Compared to Q4 2018, the global sales and services outlet of Q1 2019 was reduced from 378 to 377, one less. In other words, the closure plan that sparked a great deal of industry discussion has become nearly unimplemented.

Elon made a 180° turnaround at the financial report conference and said: “Of course, we will continue to operate these stores, and we will continue to expand our store network.” In fact, Tesla has delivered over 200,000 Model 3s worldwide, but the growth of sales and service outlets has been limited.

In addition, Tesla is preparing to invest heavily in the construction of the service system.In Tesla’s March 1st adjustment plan, the company mentioned that it will continue to increase its investment in their service system. The team’s goal is to respond within an hour and provide service within the same day at the latest. Tesla is committed to offering mobile service to perform the majority of services at their customers’ doorstep, rather than having them visit a store. Ultimately, Tesla service will cover all countries or regions where Tesla vehicles are sold globally.

In today’s Q&A session with netizens, Elon reaffirmed that Tesla is strengthening the system infrastructure of their service centers and mobile service vehicles worldwide.

Given the imperfections in workmanship and quality control in Tesla Model 3 vehicles, this announcement is even more exciting than any technological advancements. It is hoped that Chinese Tesla owners will no longer experience poor service such as waiting for two months for vehicle parts and that one-click repair/maintenance will be online soon.

Another new plan that falls under Tesla’s sales and service system is Tesla’s car insurance business. Elon announced during a financial report conference that Tesla is preparing its Tesla insurance products, which will be launched in the next month. Elon stated that Tesla’s insurance products will be much more compelling than anything offered by competitors.

This is a typical Elon-style statement. So, what is Tesla’s strategy in the insurance sector?

In fact, as early as 2016, Tesla established an insurance project- Insure My Tesla in Australia and Hong Kong, in cooperation with QBE Insurance Group and AXA Insurance, respectively.

Tesla’s motivation for entering the insurance field is not complicated. Former Tesla sales and service president, Jon McNeill, once said that compared to competitors, Tesla Autopilot significantly improves road safety, reduces accident rates, and the failure rate of electric vehicles is also significantly lower than that of fuel vehicles, which gives Tesla the opportunity to cooperate with insurance companies and launch more competitive insurance products. This will further enhance Tesla’s product competitiveness.

According to Elon’s statement, Tesla’s insurance products will be developed based on Autopilot usage and driver driving style, among other information, to provide a competitive price.## Shanghai Super Factory Update

There were five Tesla executives attending the Q1 earnings call, including the CEO/CTO/CFO/President of Automotive, and the General Manager of Shanghai Giga 3 factory, who was mentioned by Elon Musk during the earnings call.

The progress of Shanghai Giga 3 factory is unbelievably smooth with the Tesla executive team stationed there. Every day, I receive emails from Tom, the project manager of the Super Factory, containing pictures of the factory, where we synchronize and discuss the latest progress seven days a week. I mean, I pay extremely close attention to updates on Giga 3’s progress.

In terms of execution, the factory is moving very quickly. We have 99% of good status production ready cars. From this perspective, it seems like we’ll achieve mass production at the end of this year. For instance, with vehicle capacity exceeding 1,000 per week, the Shanghai factory may reach 2,000 per week at the end of this year. That’s the current progress.

Tom mentioned in the email is Zhu Xiaotong, who is Tesla’s Vice President for Asia Pacific and General Manager of Shanghai Giga 3 factory. Xiaotong was previously played an important Tesla China role, but before that, he served as Vice President at a construction firm with extensive professional and rich engineering experience in civil engineering. This occupational background is the foundation for ensuring Giga 3’s rapid and efficient progress.

Started construction in January and commencing operations in October. From the progress of the project, Giga 3’s construction speed far exceeds Giga 1. Is this a typical “funded efficiency” strategy?

Tesla explained the Giga 3 project investment and the relationship between the factory and the vehicle project in detail during the Q1 earnings call.

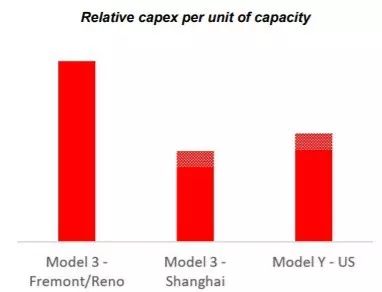

Simply put, a highly-integrated, modular platform is closely related to the investment density of the production line. Tesla spent several years building a new platform. Model 3 is the first car under the new platform, which makes it easier for Tesla to quickly replicate across different geographic locations and vehicle types with economic efficiency. The Shanghai Giga 3 factory and the Model Y production line will be the first beneficiaries of this investment.

According to the internal accounting, unit spending on the second-generation Model 3 production line at Shanghai Giga 3 factory will be 50% lower than that of Fremont factory and Nevada Giga 1 factory. The production line for Model Y will be simplified to the same level as the one at Shanghai Giga 3 factory.

According to the internal accounting, unit spending on the second-generation Model 3 production line at Shanghai Giga 3 factory will be 50% lower than that of Fremont factory and Nevada Giga 1 factory. The production line for Model Y will be simplified to the same level as the one at Shanghai Giga 3 factory.

Thus, we maintain our previous judgement: Giga 3 is more advanced than Giga 1 and is the most advanced factory of Tesla globally.

“The most challenging delivery challenge in history”

Why is delivery a topic worth discussing? Elon noted during Q1 that Tesla experienced the most challenging delivery challenge in history, with a total delivery of 63,000 vehicles worldwide; however, in the following Q2, Tesla’s sales guidance reached 90,000 to 100,000 vehicles. Thus, the delivery for the next two months will be very exciting.

Tesla accomplished 50% of vehicle deliveries for the entire quarter in China, US and Europe in the last ten days of Q1. Elon noted during the earnings call that this was the most difficult logistics challenge he had ever seen. Tesla accomplished delivery of 63,000 cars made at the California factory to China, Europe, and the US East Coast within 3 months.

We previously calculated that, with the delivery team staying unchanged or decreasing, Tesla has achieved an average of 5-8 times the average delivery volume in China, the US, and Europe. In order to ensure delivery, Tesla had to redeploy every person in sales, HR, legal, engineering and more to help with delivery. Elon himself admitted that the user experience became very bad.

This is essentially a conflict caused by Tesla’s direct sales system and the quarterly report of a public company.

Q1’s predicament was unique; it was the first time in Tesla’s history that it had launched large-scale production vehicles in two overseas markets simultaneously. Also, as Tesla CFO Zachary Kirkhorn noted, the production pace of international models in the first half of the year and North American models in the second half of the year, as well as the significant increase in low-level errors such as nameplates and accessories, greatly increased the delivery challenge.

Tesla plans to optimize profitability throughout Q2 and significantly reduce operating costs.

Tesla has already avoided potential production errors by establishing regionally balanced policies. According to Zachary, regional balance can also allow Tesla to operate stably throughout the entire quarter. Tesla no longer needs to equip special delivery sites and logistics for the fleet, thus saving a lot of operating costs. The policy of regional balance has been implemented for Model 3, and Model S/X will also be implemented in the next 1-2 weeks.Elon further explained the meaning of regional balance – instead of manufacturing different models in batches for different markets like in Q1, production plans will now be based on the global market demand for the entire quarter.

Elon’s conclusion is that regional balance will reduce Tesla’s delivery pressure, provide a better delivery experience for customers, and have a very positive impact on Tesla’s operating costs.

Sales Guidance of 90-100,000 Units & 25% Long-term Gross Margin

Like you, two Wall Street analysts were also shocked by the high sales guidance. But Elon provided enough confidence: “We expect orders to increase significantly, matching our production capacity.”

First is the cheapest Model 3 Standard Plus model. Elon believes that it will bring a certain increase in orders; secondly, Elon has high hopes for demand for the Model S/X redesign: “Many old car owners are waiting for the Model S/X redesign, and Q2 will see the release of the backlog of demand.” Finally, right-hand drive countries/regions worldwide, such as the UK, Japan, Australia, New Zealand, and Hong Kong, will begin delivering Model 3s in Q2.

Considering Tesla’s experience in Q1 with the US subsidy cutback and traditional off-season factors, even without product upgrades, sales will still see a small increase.

Let’s analyze it. Calculate according to the guidance median of 95,000 units, and the Q2 sales volume of Tesla will increase by 51% month-on-month and 133% year-on-year.

Following Elon’s logic, the quarterly sales of Tesla’s Model S/X have remained stable at an annualized level of 100,000 units in the past two years, of which 28,425 units were delivered in Q4 2017. Considering the demand for Model S/X redesign orders, we are optimistic that sales in Q2 will reach 28,000 units.

The remaining question becomes simple: Model 3’s Q2 sales are 67,000 units, compared with 50,900 units in Q1. Of course, this data has the impact of a large number of orders in transit included in Q2, which were not delivered by the end of the quarter, but Q2 also lost the benefit of the release of a large number of backlogged orders in Q1 in Europe.

Therefore, overall, the sales guidance for Q2 is quite challenging.Regarding financial performance, Elon’s statement “raising capital may be effective” has sparked extensive discussion, but in fact, Elon has almost dismissed this line of action.

Raising capital cannot replace more efficient company operations. The key is strong financial discipline to ensure that we do not have inefficient expenditures. So far, finance has not restricted the growth of the company. Tesla’s organizational operational efficiency today is far better than it was a year ago, and we have made comprehensive improvements. Of course, I think raising capital may be effective at this point.

In the forward-looking guidance of the financial report, Tesla mentioned that the capital expenditure for 2019 is expected to be 2-2.5 billion US dollars, most of which will be used for production capacity expansion and new vehicle model development, including the Shanghai Giga 3 factory, Model Y and Semi tractor project, as well as the expansion of the global supercharger and service network.

That is to say, there will be no additional investment in the existing production lines of Model S/X/3 in Q2, and with the significant reduction in operating costs mentioned earlier, Tesla expects the losses in Q2 to narrow sharply, which seems difficult to explain, and only return to profitability in Q3.

Tesla CFO Zachary mentioned that one reason for the greater-than-expected loss in Q1 was the several pricing adjustments, which has added pressure to the 25% gross margin. After the release of the new Model S/X, the pricing of these two models was not adjusted compared to the old models.

This may be one of the reasons why Tesla’s Q2 sales growth guidance is high, but it still expects to incur losses. In his later statement, Zachary also pointed out that Tesla is committed to improving business cost efficiency without sacrificing growth, combined with the decrease in operating costs brought by deliveries, to achieve the ultimate goal of restoring profitability in Q3.

Finally, Tesla continues to strive for the unchanged long-term gross margin goal of up to 25% for Model S/X/3.

Battery Investor Day

One big event in Tesla’s Q1 was the invitation to acquire Maxwell Technologies. In November 2016, Tesla acquired Solarcity and became a one-stop energy solution provider covering energy production, energy storage and energy consumption. However, in the past year, Tesla’s energy business has become smaller and smaller, and energy revenue is the only business that has declined both year-on-year and sequentially in Q1.

Regarding this issue, Elon pointed out that the real challenge is the scarcity of batteries. In the past year, due to the priority of the Model 3 principle, all of Giga 1’s energy storage battery production lines have been converted to produce power batteries. Tesla’s energy storage business is resolved by purchasing batteries from external partners.In 2019, Tesla will allocate 5%-10% of its battery production capacity to its energy business. Specifically, the expected sales growth of energy storage batteries Powerwall and Powerpack will reach 300%, far exceeding the growth rate of its automotive business.

Regarding Giga 2, which is committed to producing SolarRoof and battery panels but has not shown progress, Elon explained that Tesla has made some significant improvements internally, including a redesigned third-generation SolarRoof, simplified installation procedures, and a lifespan of 30 years.

Tesla’s goal is to make solar products more eye-catching and cost-effective.

At the Autopilot investor conference earlier, Elon also mentioned that the design life of the Model 3 powertrain is one million miles (1.6 million kilometers), and the 1.6 million kilometer battery pack is currently in the research and development phase and is expected to be produced in late next year.

Combining Tesla’s acquisition of Maxwell, we are also curious about Tesla’s electrochemical technology roadmap. When answering analyst questions, Elon said that the combination of Maxwell and Tesla’s battery technology is some super confidential information.

At the end of this year or early next year, Tesla will hold an electrochemical technology investor day to review cell and battery pack technology and disclose future strategies, and a lot of information will be released.

As we mentioned at the beginning, it is difficult to summarize Tesla’s Q1 simply as “good” or “bad.”

Compared to a year ago, Tesla’s organizational and operational efficiency has greatly improved, and unit capital expenditures for Giga 3 will drop to 50% of Giga 1. Does this mean that the construction of Giga 1 and the huge waste in human, financial, and resource operations a year ago? When preparing for a new car company’s press conference in China for a month, Elon announced major business adjustments or developments at an average pace of once every ten days. When the Model 3 topped the US luxury brand rankings for three consecutive quarters, Tesla challenged the limits of users with its unique workmanship and quality control.Tesla has faced some real challenges but one thing can’t be ignored: Tesla’s size is constantly growing and it is gradually participating in the competition on the world automotive stage. Tesla is facing some real challenges, but it is also in the process of fast and continuous error correction. Q1 has become history, and we say hello to Q2.

Production of Tesla’s Autopilot Chips: A Long-Planned Attack

Elon Musk Fires, Can You Avoid?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.