McKinsey and A2Mac1 analyze design choices for EVs to move towards profitable scaled markets

Will 2017 be remembered as the year when EVs started to be produced at a large scale? This is a thought-provoking question for the automotive industry, and the reason why McKinsey has teamed up with A2Mac1, an automotive benchmarking service provider, to deepen research in this area.

Last year, about 1.3 million EVs were sold globally, which represents only about 1% of total passenger car sales but a 57% increase compared to global EV sales in 2016. There is no reason to doubt that this trend will slow down.

Existing OEMs have already announced plans to release at least 100 new battery-electric vehicles (BEVs) by 2024, accelerating the development of the automotive and mobility industry, and also stimulating the market share of EVs. By 2030, EVs will account for 30-35% of passenger cars in mainstream markets like China, Europe, and the United States (20-25% globally).

This will change the previous “niche role” for EVs – such as performance sports models or mid-range city models, and the new BEV products will also largely come from the mid-size and large-volume segments. A recent example is the Tesla Model 3, with over 450,000 pre-orders.To continue gaining more market share, one of the conditions for EV is that OEMs’ EV range has reached a level where they can focus on lowering costs, such as improving the efficiency of vehicle design or reducing production costs, to make EV more accessible to more customers.

As shown in the figure, once the average range of the tested EVs exceeds 300 km (185 miles), OEMs seem to focus on entering the low-price market and maintaining high range. Thus, the long-awaited scale market for EVs – “mid-size EVs for the masses” – is becoming a reality.

Of course, the definition of “good enough” range varies around the world and depends on geographic location and urban system prototypes. However, the average battery range seems to have already exceeded the expectations of most customers. Coupled with the declining prices of EVs, the EV market is approaching its commercial critical mass.

Whether a scale market for EVs can bring profit to OEMs is still a burning question in this industry. We estimate that the basic models of many EV products, even with different configurations, still have low marginal contributions, especially when compared to the current level of traditional internal combustion engines.

Consider profitability, and based on the rapid progress of technology and new trends in EV design, McKinsey and A2Mac1 conducted a second benchmarking evaluation of EV design trends (see previous article).

In this article, we will interpret the success factors on the road to profitability for bulk EV production and explore the necessary measures for EV to reach a scale market. This includes high-level attention to design and development through architecture, integration, technology, and cost, all of which help describe a profitable business case for mass market EVs.

Create a native and flexible electric vehicleAlthough the initial investment is higher – in terms of engineering time, new molds, and so on – native EV platforms have been proven to have many advantages over non-native platforms.

If the architecture of the car is designed entirely around the EV concept and does not require traditional elements left over from internal combustion engines, this means fewer compromises and higher flexibility on average.

Because native EVs will have fewer compromises, especially in terms of architecture and body structure, these products can accommodate larger battery packs, resulting in longer range. In fact, the average battery pack volume (related to body volume) of native EVs is 25% larger than that of non-native EVs. One reason is that the body structure can be designed to adapt to the battery pack, rather than integrating it into the existing architecture. This additional design flexibility generally allows for larger batteries and other advantages such as longer range, more power, or faster charging.

In addition, with the rapid development of battery technology, range will no longer be a bottleneck for new EVs. We see some signs that EVs are beginning to try some common practices in the mainstream internal combustion engine market, such as offering powertrain options. The inherent flexibility of native EVs also plays an important role here, as battery packs can accommodate different numbers of cells while maintaining the external shape, and variable assembly technology can support the production of products with different drive forms on the same platform, such as rear-wheel drive, front-wheel drive, or all-wheel drive.

Although this may lead to the idea that EVs will begin to move towards modular strategies like internal combustion engines, gradually approaching the typical mass production approach of this industry, we have not yet seen a clear trend towards standardized design solutions. Players need to stay sharp on the road to mass-market EVs.

Continuously pushing the boundaries of integrated EV powertrain

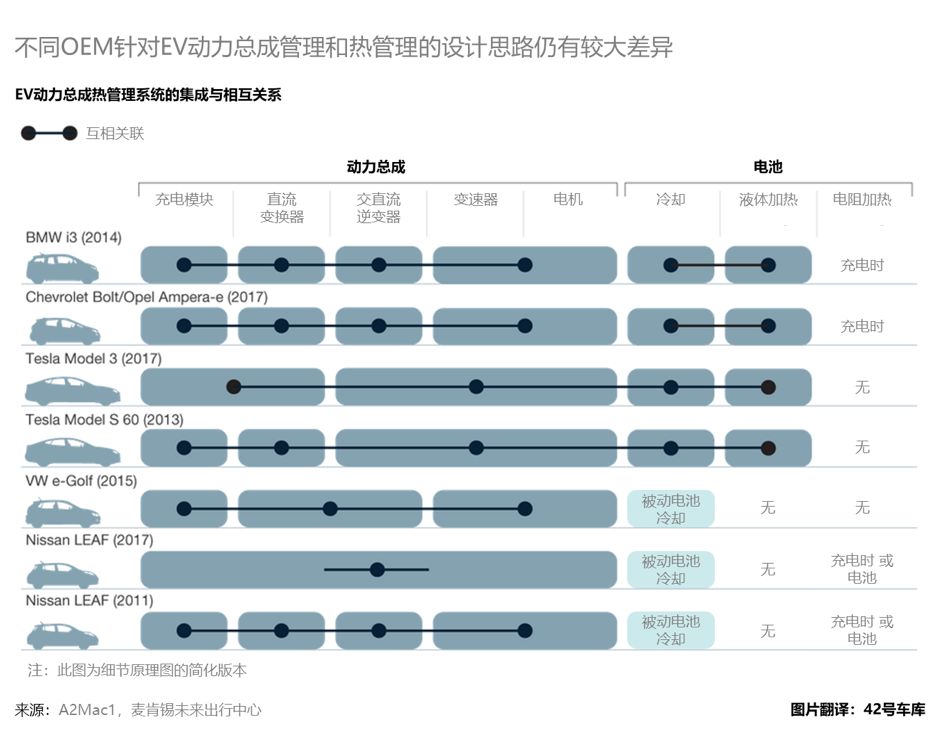

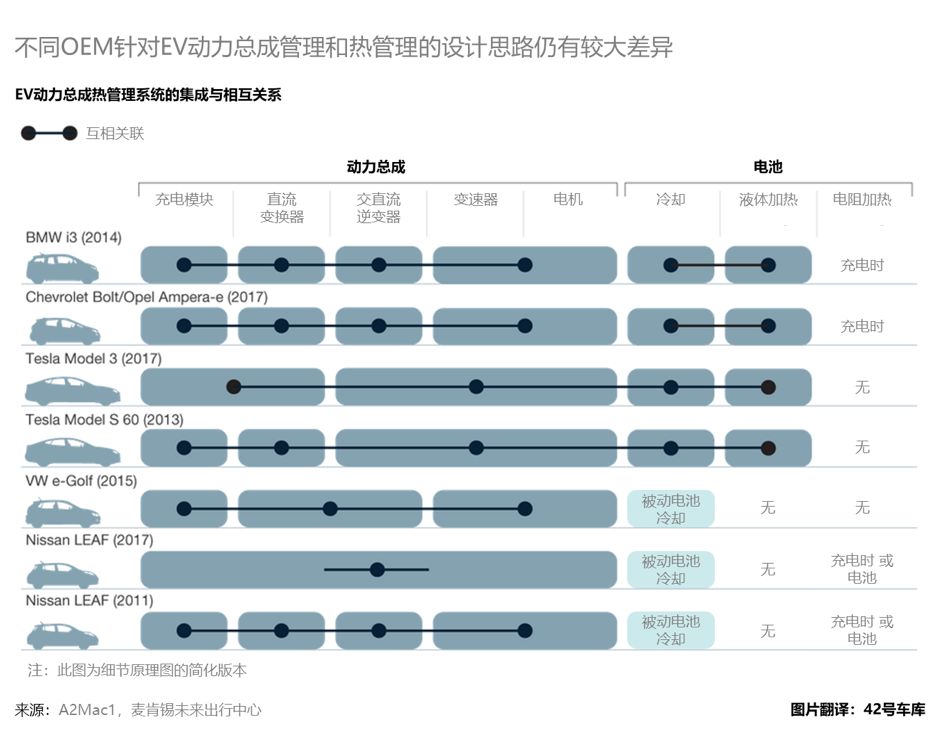

Our benchmark testing reveals the continuous trend of integrated EV powertrain development, where many components of power electronics are getting closer and integrated into fewer modules. However, there is still no “mainstream” EV powertrain design, whether in overall architecture or the design of individual components, despite players repeatedly exploring higher design efficiency.

A good indicator of the level of integration is the electronic wiring harness design that connects EV powertrain components (i.e., batteries, motors, power electronics, and thermal management modules). When observing the total weight and number of components of wiring harnesses in EV products produced by different OEMs, we found that the weight and number of components of wiring harnesses have been reduced in the latest products compared to previous models, reflecting a higher level of integration of the latest EV powertrain systems.

Apart from the physical integration of the main EV components, we have also observed that all of these components have applied more simplified and efficient thermal management solutions. Some OEMs have taken measures to integrate these components, while others still rely on multiple systems, and of course we have not yet seen a clear design trend.

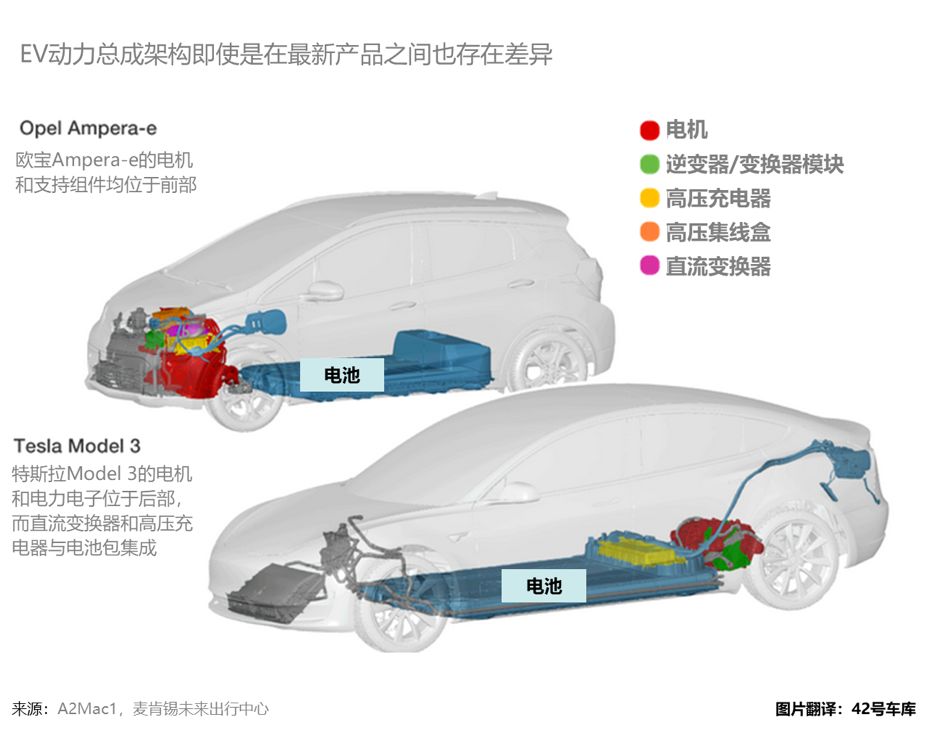

With increasing technological maturity, the diversity of EV powertrain design may also be promoted by its inherently high flexibility. Since the components are generally smaller relative to the internal combustion engine powertrain, and the available space of EV body floors and front and rear compartments is greater than that of an internal combustion engine powertrain, it provides greater design freedom.

As an example of a different EV powertrain architecture, Opel’s Ampera-e (translated as Ampere e, Chevrolet Bolt renamed car) should have placed the power electronics part in the position of the original internal combustion engine, with typical internal combustion engine vehicle body and axle components; on the contrary, Tesla Model 3 directly placed most of these components in the rear of its battery pack and rear axle.

It is worth noting that such a freely placed component location will also make the overall function of the car more diverse, such as choosing to free up space for a larger trunk or reducing the center of gravity to achieve superior driving performance.

Therefore, in the pursuit of mass marketization, EV players may explore new opportunities in the high integration of EV powertrain systems. Accordingly, they will seize some potential benefits, such as reducing development complexity, reducing material and assembly costs, and improving weight and energy efficiency.

Keep Ahead in the Game of Technologies

McKinsey’s research shows that many EV customers are very tech-savvy, and new technologies are largely beginning to be mature enough to be put into practice. This actually creates a test field for OEMs and other players who have been eagerly waiting to equip their cars with the latest and highest-level technologies such as ADAS and connectivity, but it also basically forces EV manufacturers to redefine the driving experience and travel strategy by equipping their cars with these trend-leading technologies.

With the increasing introduction of ADAS technology, OEMs are also using more optimized human-machine interfaces and entertainment systems to meet the needs of EV customers, especially as many different car functions are integrated into a more centralized “smartphone-like” user interface (HMI).

With the increasing introduction of ADAS technology, OEMs are also using more optimized human-machine interfaces and entertainment systems to meet the needs of EV customers, especially as many different car functions are integrated into a more centralized “smartphone-like” user interface (HMI).

For example, control methods have gradually transitioned from physical buttons to touch screens – touch screen concepts were first tried out by a few American manufacturers on a few models in the late 1980s, and now the technology has matured, and customer interest is finally sufficient. In our tests, we found that EV interiors have as few as only seven physical buttons, while many standard internal combustion engine models typically have 50 to 60.

The key driving force behind this progress is the improvement in computing power. The electronic control units (ECUs) of traditional cars are often decentralized and standardized, while the latest EV products rely more on growing centralized computing power.

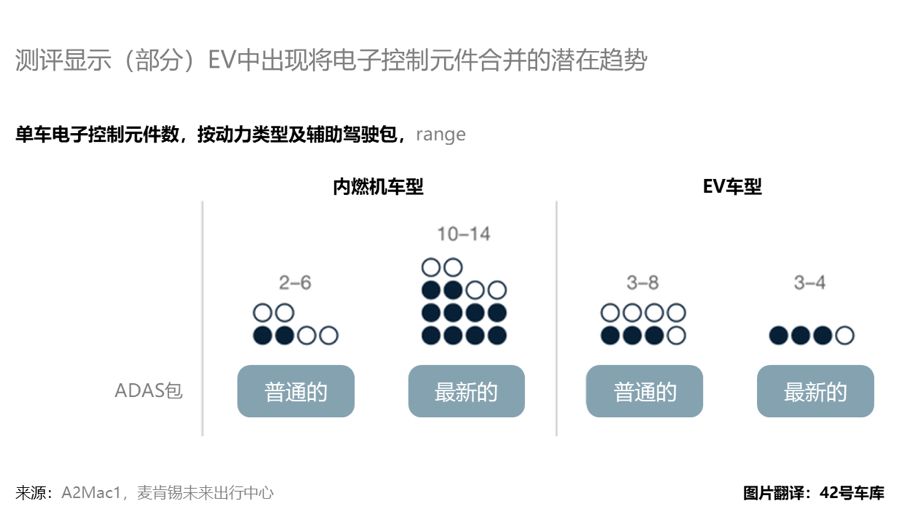

Take ADAS technology as an example, which requires processing of signals from different sensors, thus requiring significant computing power. If the latest ADAS solutions – such as adaptive cruise control, automatic braking, or even autonomous driving capabilities – are integrated into a centralized ECU background, EVs equipped with these ADAS technologies will further drive the trend of multiple ECU integrations compared to internal combustion engine vehicles that have similar or fewer such technologies.

The decision of whether to adopt a centralized or decentralized ECU architecture for OEMs is a strategic issue driven by various factors. One of the main reasons for a centralized strategy may be to “own” the key control points in the car by integrating them, which could promote more advanced software development and open up potential new revenue streams, such as new businesses from OTA wireless updates.

In addition to strategic considerations, ECU architecture can also affect weight and cost. For example, a centralized strategy can optimize harness efficiency and simplification by using more bundles. Compared to decentralized ECUs, the required protocols are simplified and the number of connections is reduced – thereby reducing the number of possible operational errors – that is, centralized ECUs will improve reliability.

From a development perspective, each additional ECU means one more team that must ensure system quality through efficient collaboration and communication. Centralized ECUs will reduce the number of teams and simplify the development process, thereby achieving a shorter development cycle through this simplification. In addition, high-performance central ECUs are the cornerstone for developing a complete set of autonomous driving products, which prepares EVs for the characteristics and customer expectations of future scale markets.However, the final decision on ECU architecture will depend on the strategic choices of different OEMs, particularly with regards to centrality, which may require significant improvement in internal skills. Therefore, the relevant decisions will always depend on individual business circumstances.

Leveraging Design-to-Cost (DTC) for EVs

Profitability remains a daunting task for EVs, particularly due to cost pressures from components. Since OEMs seem to already have achieved acceptable range, DTC will play an even more important role in paving the way for the mass market entry of EV, by helping achieve more attractive prices without harming OEM’s margins.

Cost efficiency is the core strength of mature OEMs and suppliers, who have an advantage from the experience and knowledge accumulated through traditional DTC levers.

Therefore, it is not surprising that non-native EV and internal combustion engine manufacturers are more proficient in DTC than native EV manufacturers, given their record of continuous cost optimization and possibility to transplant highly-optimized components from existing products.

However, new players in native EV may quickly catch up. For instance, native EVs have switched to more cost-effective material solutions, such as applying steel to the white body, due to their advantage in battery technology. They also apply more stringent downgrading measures (such as in dashboard controls and air outlets) and invest in mass production processes, such as aluminum pipe seats to replace high-strength stamped steel.

The march towards the mass market continues, and experimentation with EVs is becoming increasingly mass-produced. Non-traditional OEMs may learn DTC approaches from traditional OEMs, such as purchasing standardized components, finding better ways to narrow cost-benefit gaps, and therefore improving profit margins from a product cost perspective. Nevertheless, the ability of mature OEMs to achieve excellent cost-benefit ratios will remain a competitive advantage, and they will seize this opportunity to face potential new markets and players.

Outlook: Can OEMs make money in the mass EV market?

Recently, many OEMs’ newly released products feature a large proportion of EVs. However, EV models have not contributed much to overall profitability, unlike internal combustion engine cars. Against the backdrop of a global market where the share of the EV market is growing irreversibly, the margin of EV is gradually receiving attention.Consider adopting the four-step EV design recommendations discussed in this article to help OEMs reduce the high manufacturing costs of EVs (including materials, production, and final assembly). We believe that by focusing on simplified and more flexible platforms, combined with innovative technologies and design methods, there is still a positive opportunity for EV to achieve commercial success at scale.

In fact, based on our analysis, the total manufacturing costs of mid-level EV products and the price of fully equipped configurations (including software and hardware options such as non-standard colors, extended mileage, and different software settings) can differ by up to 40%-50%. Even in the case where the cost structure of non-powertrain components and final assembly is similar to that of traditional internal combustion engines, the main cost influencing factors are still the powertrain costs of EVs themselves and the related uncertainty of future battery costs.

All of this also presents an overall attractive business opportunity, but other measurement factors, such as sales logic and channel strategy, are still necessary.

Finally, overall, we have seen the emergence of a profitable EV scale market, driven by the trend of flexibility, integration, and simplified design to maximize user value, and enabled by cost-effectiveness targeting mass production.

- McKinsey: We dismantled ten popular electric vehicles and identified the five most important factors for car manufacturing* McKinsey: How Auto Manufacturers Can Seize the New Opportunities of Shared Mobility

→Click to read the original article by McKinsey.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.