Author: Zhu Yulong

As the chip bill was passed in the United States, Europe has also taken action yesterday:

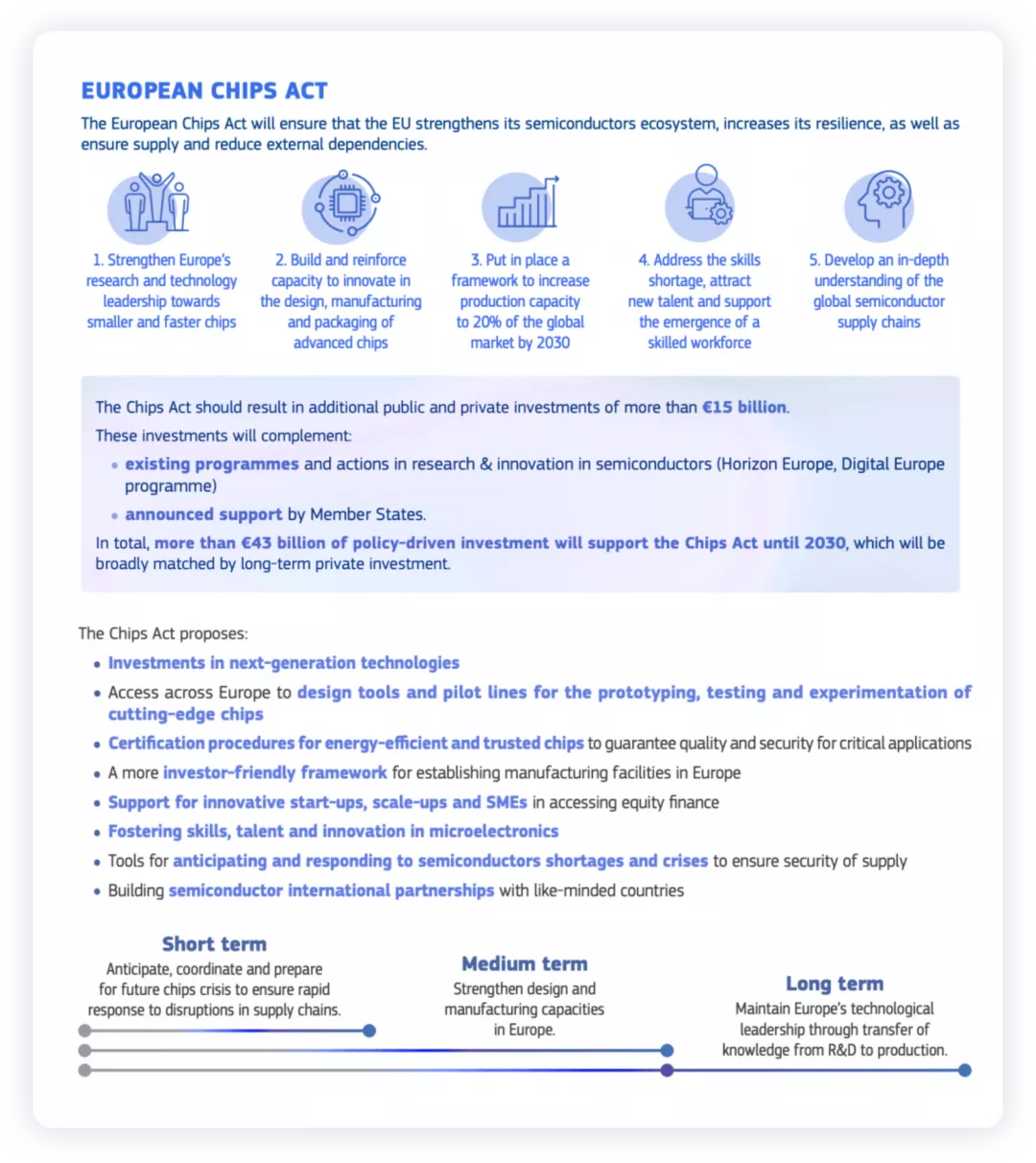

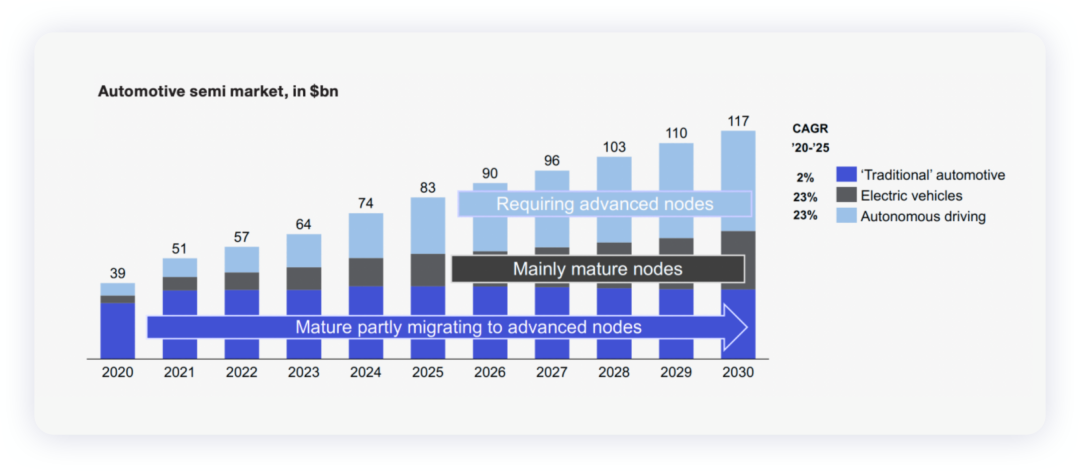

The European Chips Act has been officially released, with a similar logic to invest €43 billion to achieve the target that the EU’s chip production capacity will account for 20% of the world’s total by 2030.

Chips are the core of the modern digital economy, serving as the fundamental component for key applications and infrastructure in various fields such as smartphones, automobiles, healthcare, energy, communication and industrial automation. The impact of the pandemic has caused severe shortages of chips worldwide, and it’s necessary for Europe to enhance its semiconductor capability to ensure future competitiveness, maintain its technological leadership and supply security.

- The Advantages of Europe:

Europe has first-class research institutions and outstanding universities, some advanced semiconductor technologies, and is leading the supply of materials and equipment required to operate large-scale chip manufacturing plants, with European companies playing an important role in the supply chain.

- The Disadvantages of Europe:

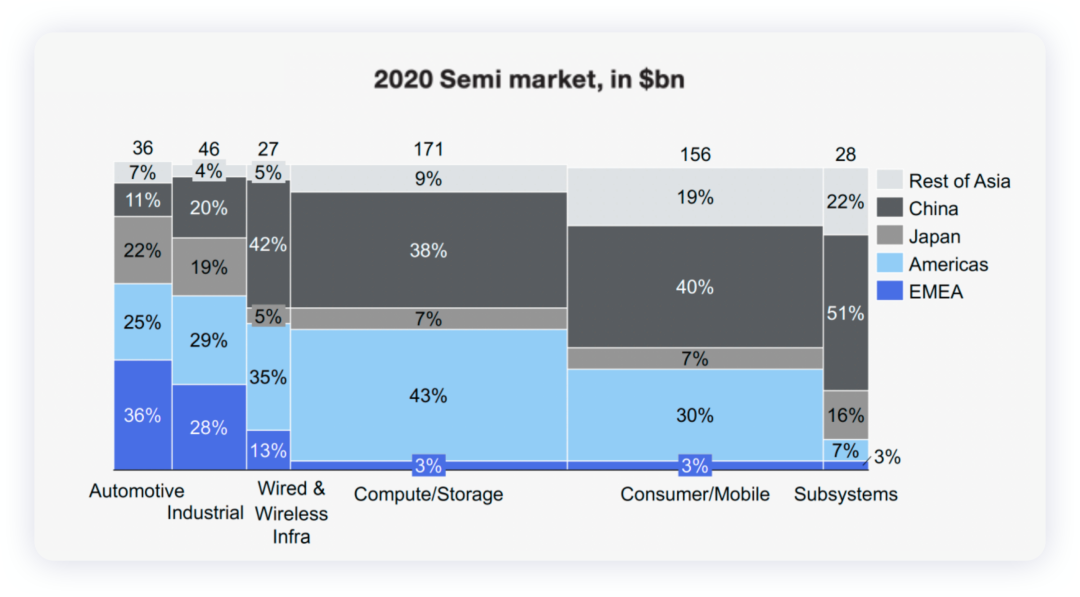

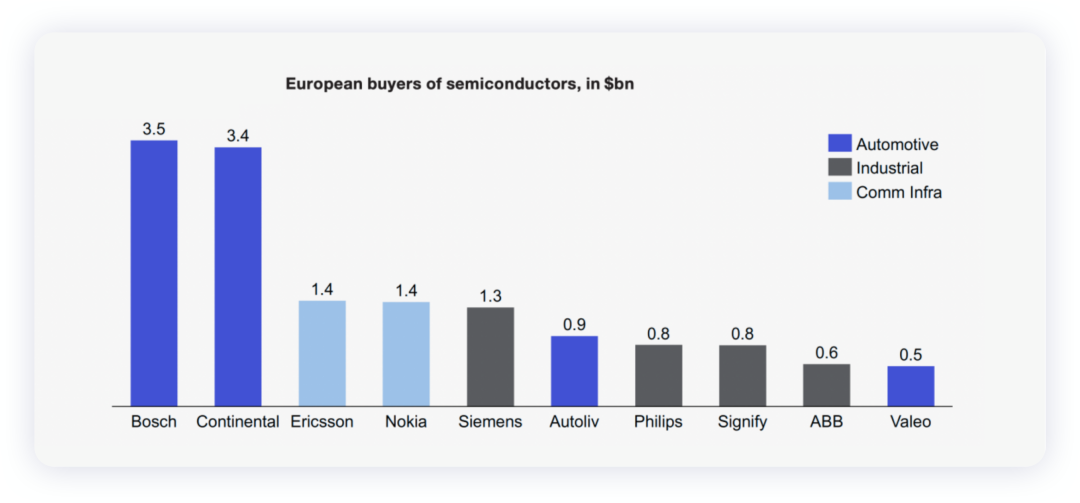

Europe’s share in the global semiconductor market is below 10%, and it heavily relies on third-country suppliers, with the supply chain severely interrupted. The chip reserves in the industrial field (automobiles or healthcare) may be exhausted within weeks, resulting in significant losses.

Europe Action Plan

The EU has cooperated with the industry under different programs and action frameworks in semiconductor research, development, and innovation to support startups and SMEs with market-creating innovation potential in the field of semiconductor and quantum technologies, and help them mature innovation and attract investors.

The EU plans to carry out joint financing with the public in the field of microelectronics and communication technology through the European Interest Commons for Strategic Importance (IPCEI), and launch processor and semiconductor industrial alliances to bring together companies, representatives of member states, academia, users, and research and technology organizations.

Of course, the most crucial thing is the money. The source of €43 billion is: each country contributes €30 billion, with €13 billion from public and private funds (€11 billion of public investment is dedicated to the “European Chips Plan,” of which €2 billion supports semiconductor startups through the EU Chips Fund).From a practical perspective, support is needed for chip production, pilot projects, and startups, from chip design to manufacturing and packaging testing. Manufacturing is a key focus, and efforts should be made to strengthen the ability to research and develop next-generation processors and semiconductor technology, aiming for cutting-edge manufacturing with a 5nm process and gradually moving towards the 2nm technology node.

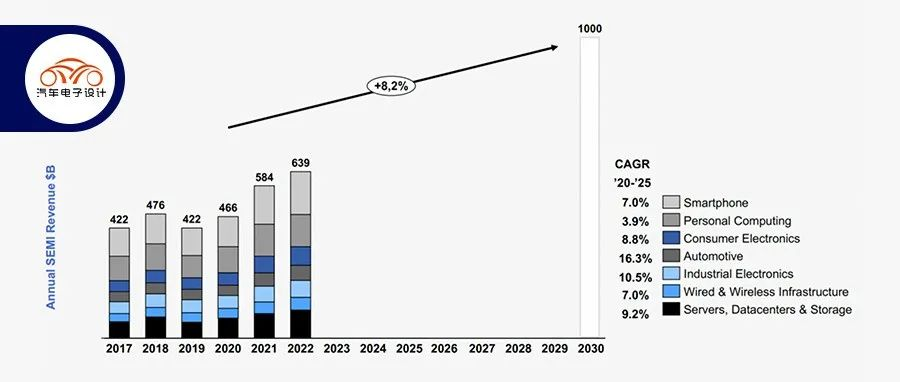

ASML responded immediately with a very interesting document titled “A Chips Act to secure Europe’s relevance in the global semiconductor industry.” With the continued popularity of the Internet of Things, the number of devices connected to the Internet of Things is expected to increase from today’s 4 billion to 35 billion by the end of the century, which will have a profound impact on computing and data. There will be an exponential increase in demand for data centers and cloud storage, which will significantly increase the demand for all chips. The economic losses caused by the global chip shortage are similar to the 1973 oil crisis, and just as we discovered in 1973 that oil could run out, we have discovered in 2021 that the chip shortage will not disappear.

Note: Assuming that the semiconductor industry will reach approximately USD 10 trillion by 2030, if nothing is done, Europe’s semiconductor manufacturing capabilities will only account for 4%, which is insignificant.

The global semiconductor industry is based on a collaborative system of “interdependence.” No region has end-to-end semiconductor design and manufacturing capabilities (E2E). Currently, the semiconductor value chain depends on the specialized capabilities of different regions, and there is interdependent value chain across the globe. In other words, collaboration is the key to success, provided you can provide what others need.

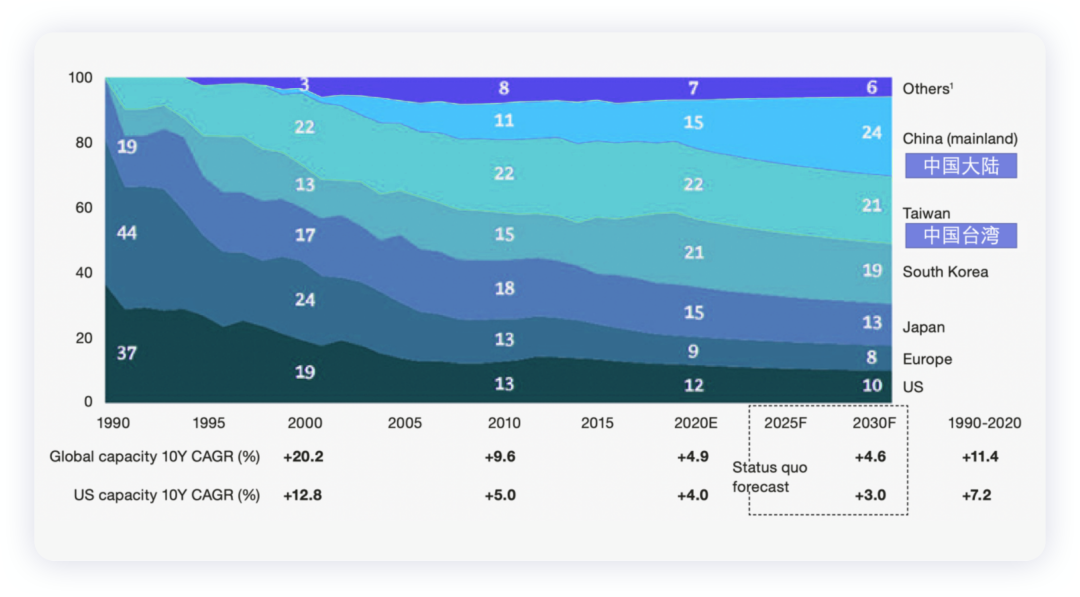

Europe has gradually fallen behind in semiconductor manufacturing, from 24% of global production capacity in 2000 to today’s 8%. The European semiconductor industry mainly focuses on mature microchip technology, and has limited presence in advanced manufacturing processes. As the only place in the world with advanced process semiconductor factories is in East Asia, Europe’s industry does indeed depend on Asian semiconductor manufacturers. From a risk management perspective, policymakers can seek to rebalance production capacity throughout the entire production process (by investing in European manufacturing capacities and then outsourcing chip production back to Europe).

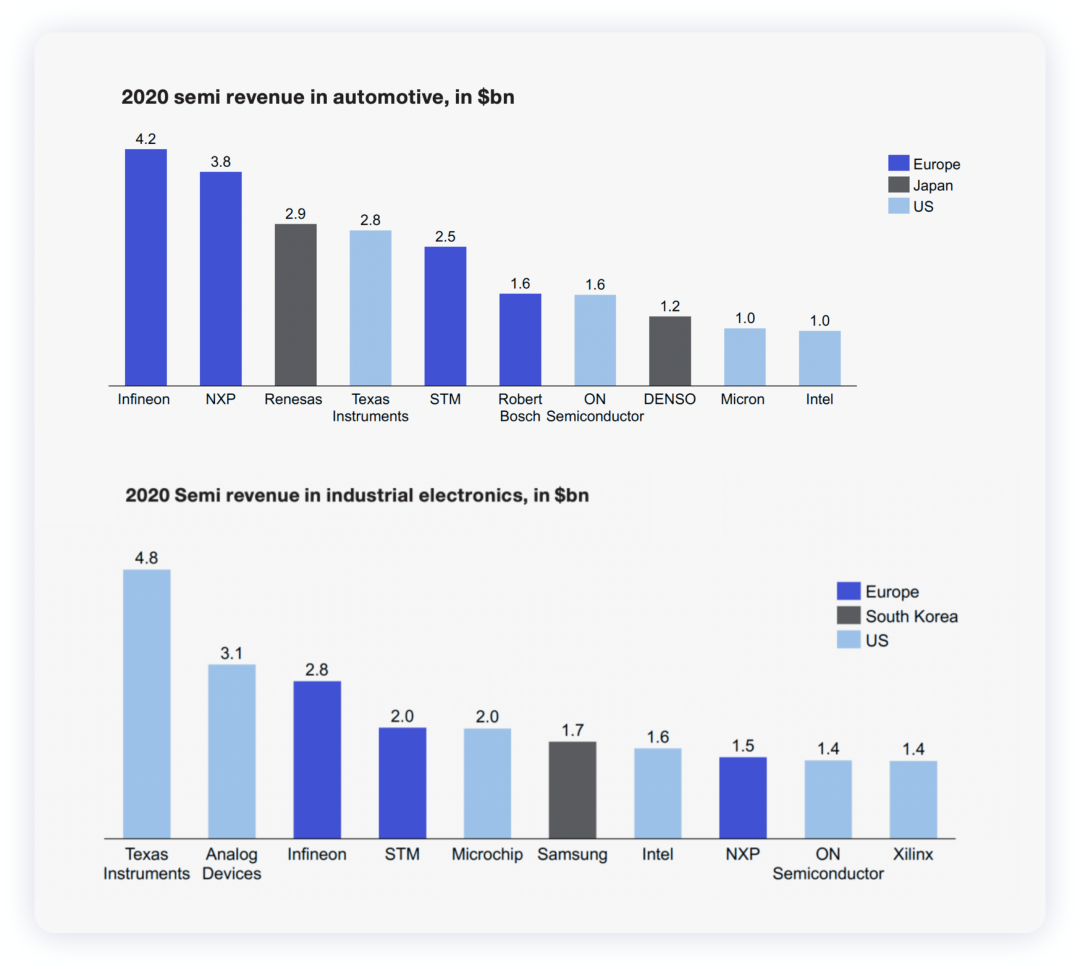

Although European chip manufacturers such as NXP, Infineon, STMicroelectronics and Bosch have strong capabilities in the industrial and automotive fields, European semiconductor capital expenditure (CapEx) only accounts for 3% to 4% of the global total, ranking the top five in the world in 2019.

Chip capital expenditure investors are all outside the European Union, accounting for 69% (71.2 billion U.S. dollars) of the total expenditure.

Conclusion: The development path of industrialization is highly valued around the world, and the chip industry has reached a strategic height. Ultimately, to have the ability to compete, there must be something that others need!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.