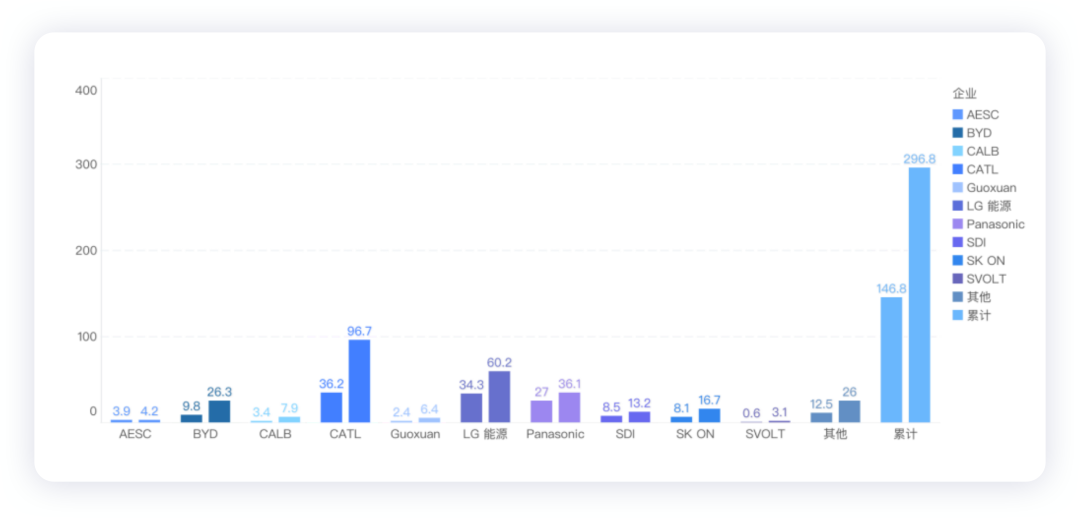

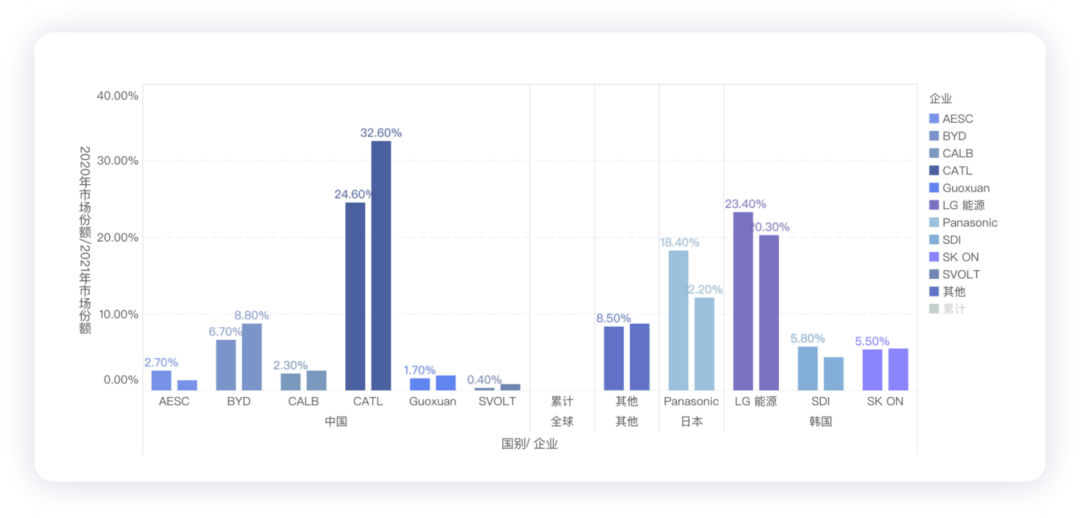

Let’s take a look at SNE’s review of the global power battery market first. In 2021, the total amount of new energy vehicle battery capacity in various countries around the world was 296.8 GWh, and the installed capacity of power batteries in 2020 was 146.8 GWh. The increase in power battery usage has had a significant impact on global resource prices.

Looking at it from a corporate perspective, CATL remains the leader, with LG Energy Solution in second place and Panasonic in third. However, BYD is closing in on Panasonic. SK Innovation finally achieved fifth place this year.

Here are some of SNE’s battery predictions for KABC.

The Market and Order Status of Power Batteries

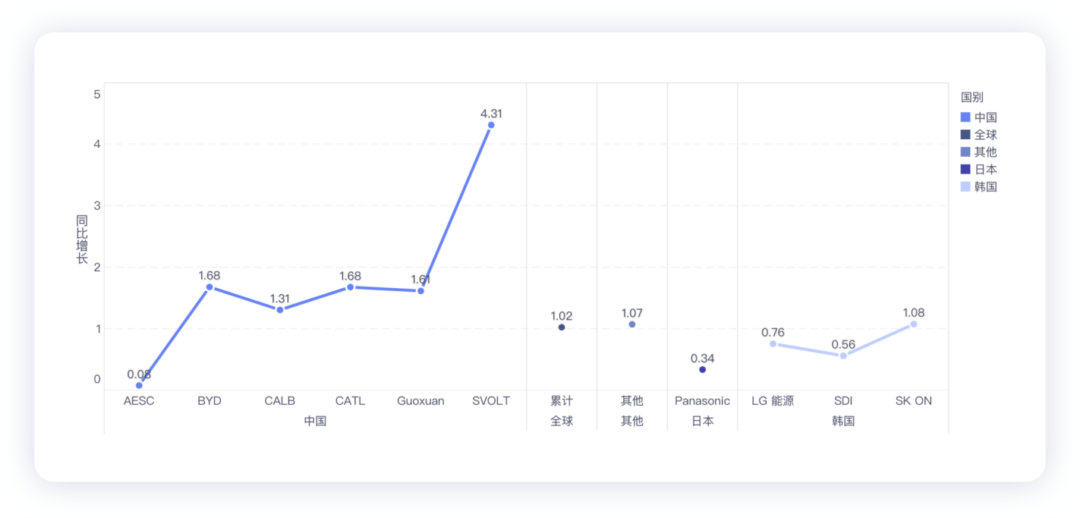

From the perspective of the automotive industry, despite the impact of semiconductor shortages and the pandemic, the rebound that started in Q3 2020 has been steadily continuing in 2021. A group of Chinese companies, including CATL and BYD, have boosted the overall market, and China’s power battery companies have gained market share mainly due to the rapid growth of the Chinese market. In contrast, the growth rates of most Japanese companies, including Panasonic, have been lower than the market average, and their market share has declined. The growth rates of the three South Korean battery companies are mixed; their total market share is 30.4%, slightly lower than the previous year.

SK Innovation increased by 107.5% to 16.7GWh, and Samsung SDI saw a 56.0% increase.

LG Energy Solution’s growth was mainly due to the surge in shipments of Tesla Model Y (made in China), Volkswagen ID.4, and Ford Mustang Mach-E. SK Innovation relied on strong sales of Hyundai Ioniq 5 and Kia Niro EV and EV6 to achieve high growth. Samsung SDI’s growth was mainly driven by increased sales of Fiat 500, Jeep Wrangler PHEV, and BMW iX, but the sharp decline in Volkswagen e-Golf sales has clearly eroded overall growth.

Translation

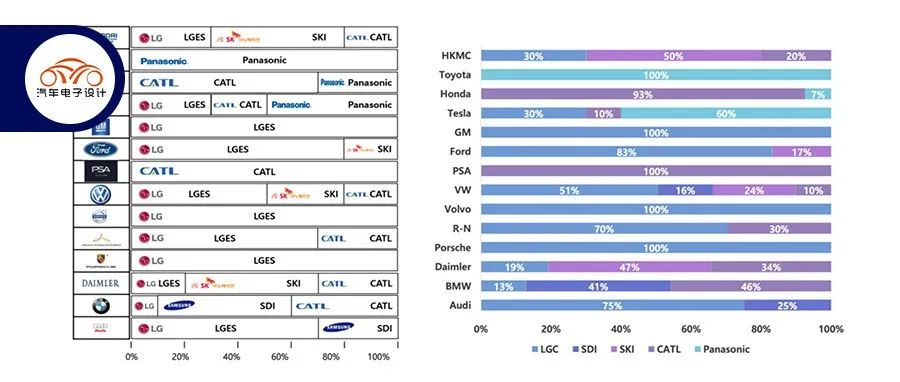

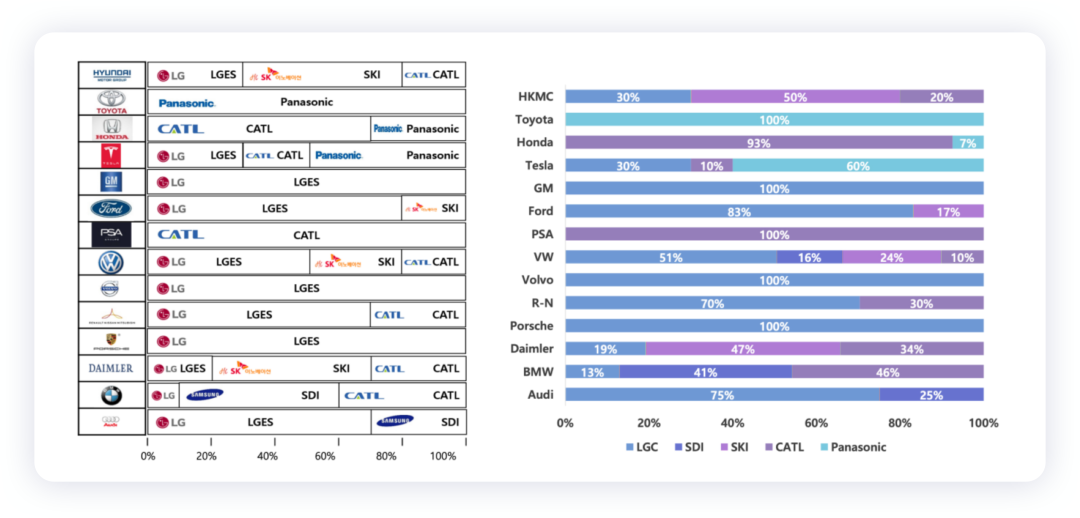

Under the evaluation of order allocation by SNE, as shown in the figure below, it can be understood that Tesla has undergone significant changes. CATL’s order volume has increased from 10% to 30-40%+. LG and Panasonic have been surpassed. Due to the promotion of PHEV by many car companies worldwide, the demand for power batteries in the BEV strategy around China before 2021 has increased.

Note: The figure below is a general distribution of orders for car companies estimated by SNE from 2021 to 2030.

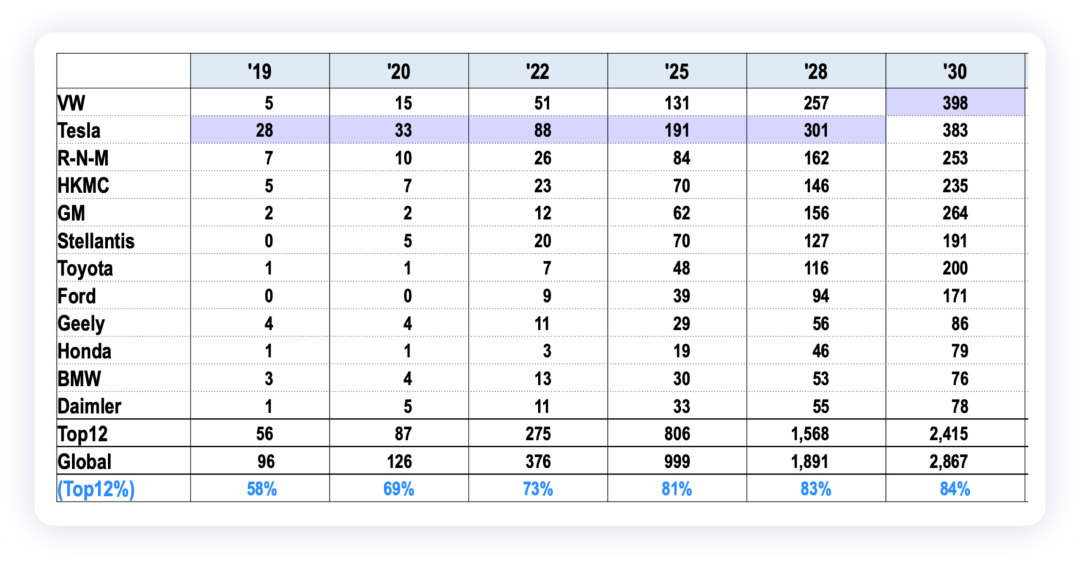

SNE estimates the demand for power batteries by car companies from 2022 to 2030 in terms of GWh.

Future Battery Trends

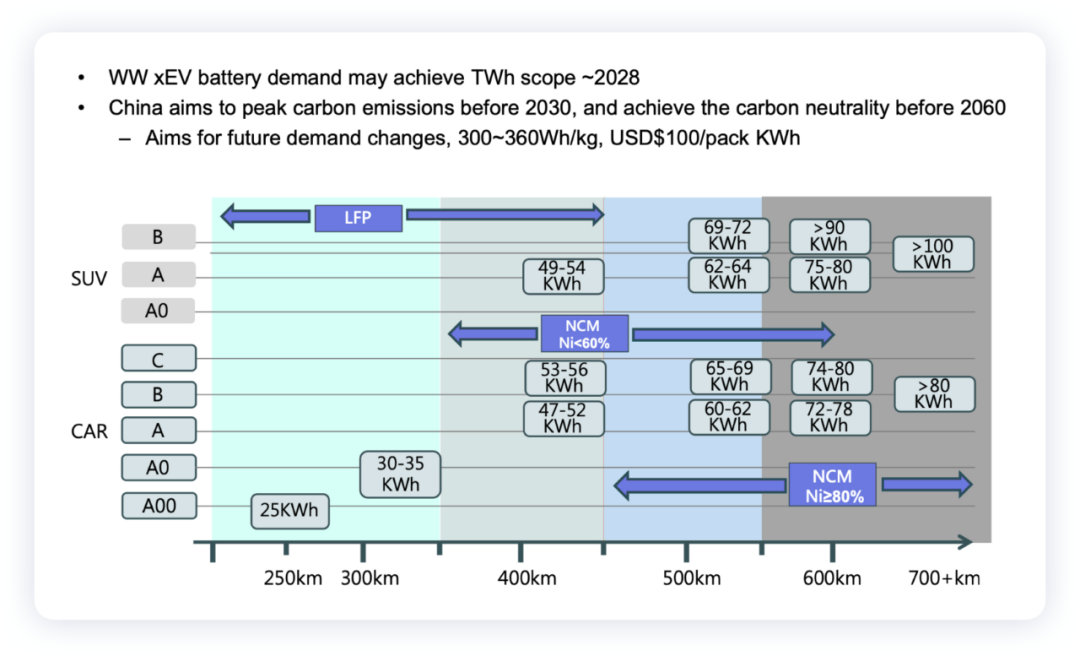

Regarding the future trends of batteries, my overall view is similar to Mr. Lyu Xuelong’s estimation shown on this page: from current data, LFP batteries can easily cover 60-70 kWh, so Ni 60 is indeed quite embarrassing.

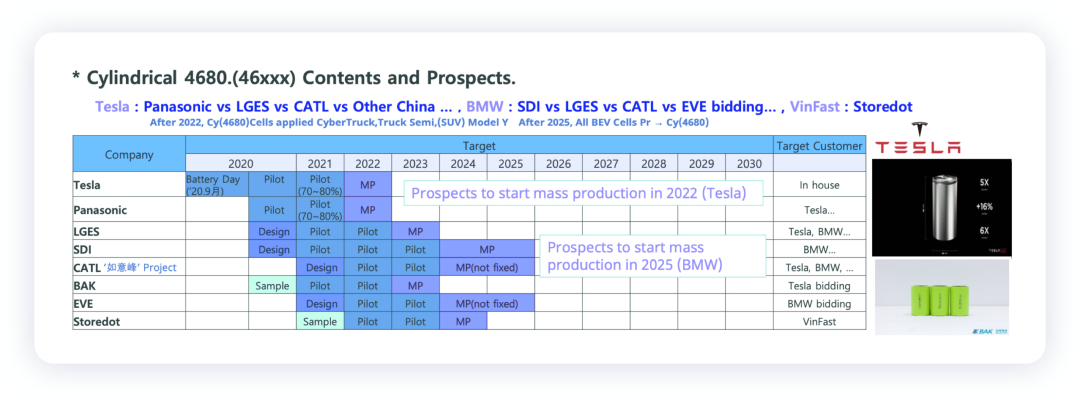

I think the most important thing is the estimation of the main progress of 4680 on this page, which may have a relatively high similarity to the actual situation. Everyone can also pay attention to the progress of Yifeng project.

Summary: With the systematic progress of battery technology coming to an end, the voice of semi-solid-state batteries is becoming louder from 2022. Let us continue to see if we can try to install a 360 Wh/kg semi-solid-state battery on the car to see if the 1000-kilometer vehicle can run as expected, which is quite interesting.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.