Wanbo, from the copilot temple.

Intelligent Car Reference | AI4Auto Official Account

The new energy vehicle battery swap track has welcomed a newcomer – the Contemporary Amperex Technology Co. Limited (CATL) stepping onto the stage.

Unlike existing battery swap solutions, CATL’s battery swap mode core is to turn batteries into chocolates – swap blocks. A single swap block can last for 200 kilometers, and multiple swap blocks can be rented for any desired range.

How to play with CATL’s battery swap as a newcomer? Let’s take a look.

How to play with CATL’s battery swap?

CATL has been transformed from a battery manufacturer to a battery operator. Though the release conference is short, the content is significant, announcing the launch of battery swap brand EVOGO.

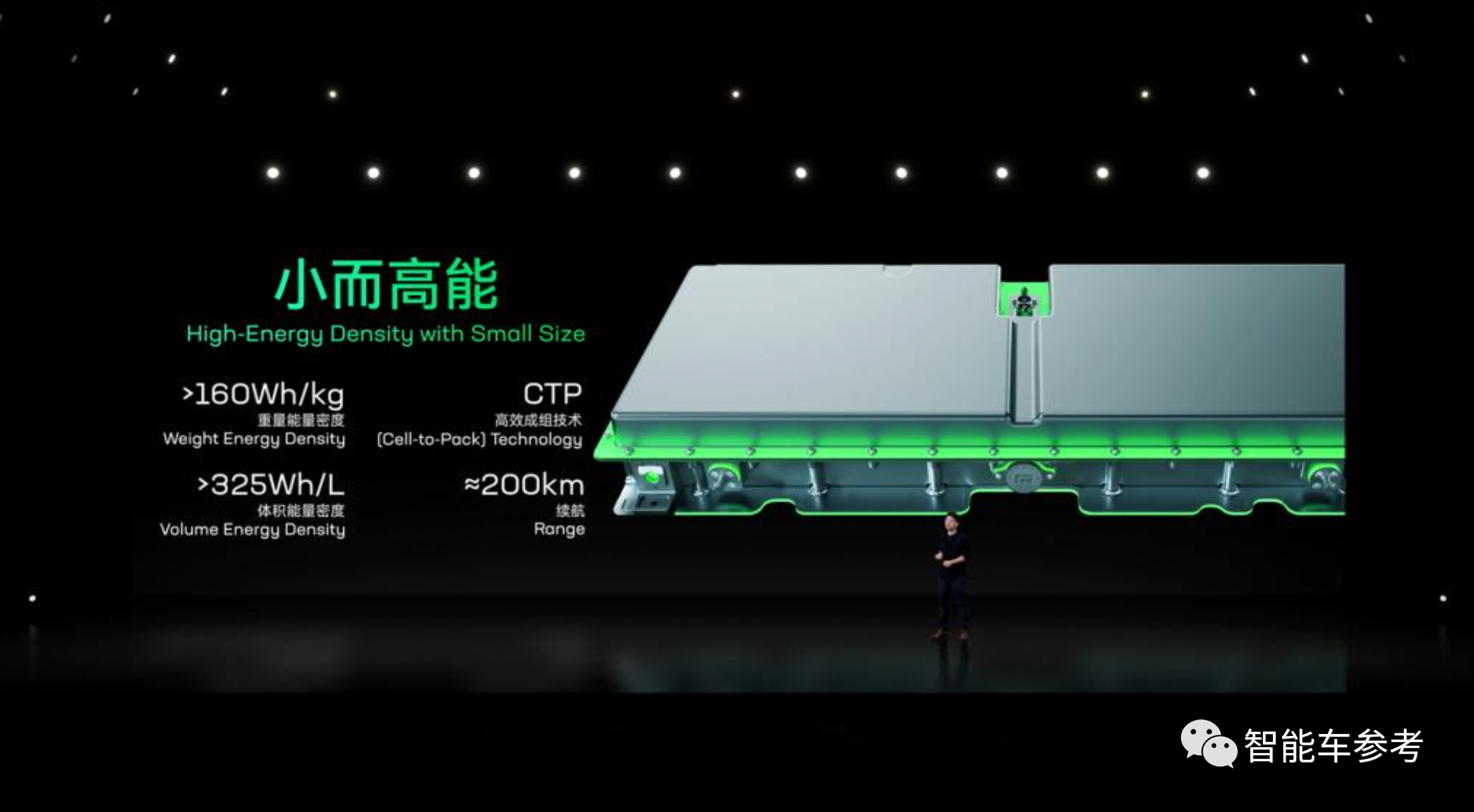

CATL also came up with an alternative battery swap and power supplement solution. The key difference is CATL’s self-developed battery module for battery swaps – the swap block. Officially named Choco, this swap block lives up to its name, looking like a chocolate while possessing many features of chocolate. For example, it is small in size but large in energy, with a weight energy density of over 160Wh/kg and volume energy density of over 320 Wh/L.

As for the range, a single swap block can provide 200 kilometers of travel, and multiple swap blocks can be freely combined. For example, for short commutes, users only need to rent one swap block for daily use; for long-distance travels, users can rent multiple swap blocks as needed, and freely combine them according to the distance.

In other words, the biggest difference in CATL’s battery swap mode is the abandonment of the previous single-battery swap mode, and the switch to the free combination of battery module to provide targeted choices for users.

Furthermore, thanks to CATL’s basic battery manufacturing capabilities, the swap blocks have made many improvements in universality. The wireless BMS technology used in swap blocks only has a high voltage positive and negative interface externally. According to CATL, the battery swap solution can be adapted for passenger cars and logistics vehicles from A00 class to C level based on the Choco swap block.Translated English Markdown:

Regarding specific data, CATL’s answer is:

More than 80% of pure electric vehicles already on the market, or those that will be launched within the next three years, can be adapted to CATL’s battery swap technology.

Adaptation of battery swap stations to support electric vehicle batteries is a key part of this announcement.

From the information released, there are two main features of CATL battery swap stations.

The first is high capacity.

Official information shows that a single battery swap station can store 48 battery modules.

Assuming each battery module is capable of traveling 200 kilometers, its battery capacity is roughly equivalent to that of the second-generation battery swap station of NIO.

The second feature is fast battery swaps.

A single battery swap takes one minute, and multiple swaps can be stacked.

In addition, to adapt to different climates in the North and South of China, CATL’s battery swap stations have also been adapted to different versions.

As for how to layout the network of battery swap stations, CATL said that the first batch of battery stations will be deployed in 10 cities across China.

However, the specific cities have not been disclosed.

The first partner for CATL’s battery swap solution is FAW, one of China’s leading auto groups.

The first FAW battery-swapping vehicle will be the Bestune NAT battery-swapping model, which is designed for ride-hailing and online mobility service use.

At present, CATL’s battery swap model still has two parts.

The first is to focus on the B2B market, serving ride-hailing and online mobility services, among others.

This is to take advantage of the benefits of having all vehicles use a unified battery module.

This is not very different from mainstream third-party battery swap operators in China.

The second is to leverage the battery swap technology to offer more choices in the private vehicle market where consumer demand is more diverse.

As the saying goes, “grasp both hands and work hard with both of them.”

After years of preparation, CATL started its foray into the battery swapping market in 2020.

First, they partnered with KES and State Grid’s energy storage businesses, in an attempt to get ahead of the curve and integrate energy storage and charging systems.

This move was seen by analysts as a preparation for CATL’s entry into the vehicle-electrification market.

Starting in the second half of 2021, CATL’s efforts in the battery swap field have accelerated significantly.

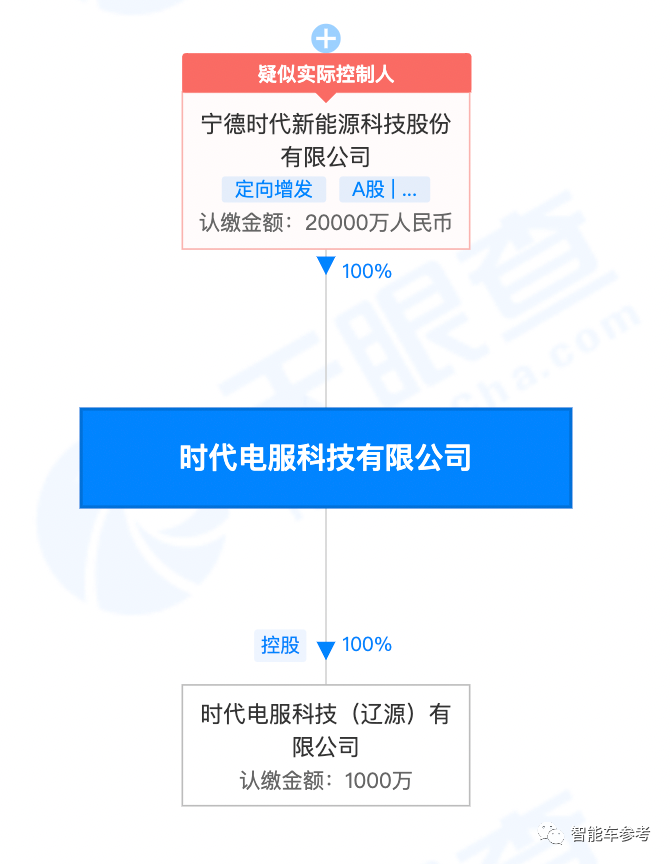

In August 2021, CATL (Contemporary Amperex Technology Co., Ltd.) established a wholly-owned subsidiary called EVOGO, which is the behind-the-scenes operator of CATL’s battery swapping brand.

EVOGO is headquartered in Xiamen.

At the end of last year, EVOGO established a regional battery swapping business company in Geelyn, where the headquarters of FAW Group is located.

Therefore, it can be inferred that the cooperation between the two parties in the battery swapping field was probably confirmed in the second half of last year.

Also at the end of last year, CATL signed a cooperation agreement with the government of Guizhou Province to build a battery swapping network. This was also the first time that CATL entered the public’s sight as a battery swapping identity.

It can be speculated that Guiyang is included in the list of the first ten battery swapping stations that CATL has not yet announced.

Is it too late to enter the battery swapping market at this point?

According to Orient Securities’ forecast, China’s new energy vehicle sales are expected to reach 7.8 million units in 2025, and the proportion of vehicles that support battery swapping is expected to reach 30%. This means that battery swapping vehicle sales are forecasted to reach 2.34 million units in 2025.

Based on the calculation of the battery swapping volume and swapping time of the swapping station, the demand for battery swapping stations in China at that time will reach 22,000.

This gap cannot be ignored.

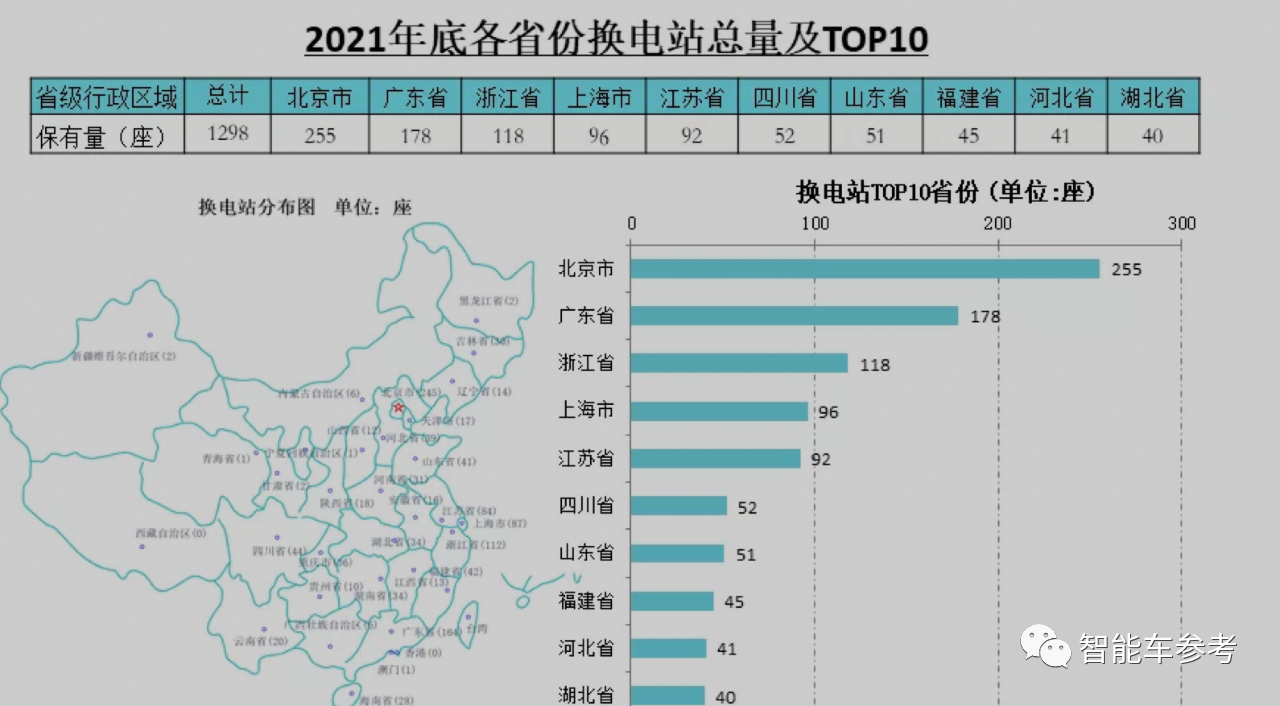

China Charging Alliance data shows that the domestic battery swapping market is currently dominated by three players, NIO Inc., ODRIVE Inc., and Hangzhou Botan.

As of the end of 2021, the number of domestic battery swapping stations was only 1,298.

NIO’s battery swapping network mainly serves its own models.

ODRIVE and Hangzhou Botan currently serve mainly B-end models.

Therefore, the battery swapping market still has potential for development.

There are two advantages:

The first is that there is a large gap in the number of battery swapping stations.

The second is that the cake of C-end models has basically not been developed.

Therefore, entering the battery swapping market at this time is indeed an opportune time in this “blue ocean.”

However, there is still one question that all battery swapping players face:

Can the swapping mode be implemented successfully for vehicular power assistance? There is no template to follow at the moment.

Therefore, the relationship between the battery swapping players is more like a cooperative effort to open the road rather than a competition for territory.

This is also why NIO, which is an experienced player in the battery swapping field, responded positively to CATL’s entry into the battery swapping field:

“We welcome innovative and business models that are beneficial to the convenience of electric vehicle owners for use and travel.”It is very clear that CATL is not satisfied with being just a “petrol” supplier in the battery energy era.

Why not make a business of “refueling stations”?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.