Translated English Markdown text (preserving HTML tags inside Markdown):

This article is authorized by Chuxingyike (出行一客) (WeChat public account ID: carcaijing), created by the transportation industry group of [Caijing (《财经》)] magazine, Author: Li Yang, Li Xiyin, Zhao Cheng; Editor: Wang Jingyi.

Adapting to over 80% of existing models, CATL tries to standardize the “Measurement Unit” of the battery swapping field.

Batteries can be rented on demand, long-term rentals for daily commutes using one battery, and extra two block batteries for temporary long-distance trips. In the eyes of CATL (300750.SZ), the future new energy vehicle battery can be standardized, installed on demand, plug and play, and replaceable when out of power like a No. 5 battery.

On January 18, CATL launched the battery swapping service brand EVOGO and a complete set of combination battery swapping solutions through an online press conference.

At present, the battery swapping industry lacks industry standards, and each automaker has its own approach. As a supplier with a market share of over 50% in the battery field, CATL is trying to standardize the “Measurement Unit” of the battery swapping field.

CATL proposes a “three-pronged approach”: the “Chocolate Swapping Block”, which takes only 1 minute to change, can be adapted to models of pure electric platforms that have already been launched globally and those that are to be launched in the next three years, at a single-standard station of three parking spaces, one battery swapping unit takes about 1 minute to install, and the station can store 48 swapping blocks. Users, vehicles, swapping stations, and swapping blocks are connected to each other through an app.

“It is inevitable that CATL expands downstream.” XU Yanhua, Secretary-General of the China Electric Vehicle Charging Infrastructure Promotion Alliance, analyzed to Chuxingyike (ID: carcaijing) that, first, with the increasing number of electric vehicles, the market size of energy supplies has considerable growth potential; second, based on battery swapping, it can allow CATL to operate battery assets in practice and understand the specific situation of the batteries; third, battery swapping helps recycling and reutilization of batteries to form a commercial closed loop.

China International Capital Corporation calculated in its related research report that the number of battery swapping stations would reach 12,500 to 51,900 by 2025. In the long run, China will need 550,000 passenger car battery swapping stations and 60,000 electric logistics vehicle battery swapping stations, corresponding to a total investment of CNY 1.8 trillion in swapping station equipment and power grid-side equipment.

Battery swapping is also the current direction advocated by national policy. In November 2020, the State Council issued the “New Energy Vehicles Industry Development Plan (2021-2035)”, which requires the acceleration of the construction of charging and battery swapping infrastructure, and coordinated promotion of the construction of intelligent road network facilities. Scientific layout of charging and battery-swapping etc., should be supported with fiscal investment as a public facility for charging piles.

—## CATL’s Three Moves to Swap Batteries

CATL’s subsidiary, TIME EV Service, announced at its press conference that it will launch battery swapping services in the first batch of 10 cities. TIME EV Service was established in August 2021 with a registered capital of CNY 200 million, and its legal representative and general manager are both Chen Weifeng.

According to CAR News, Chen Weifeng has been working with Dongguan New Energy Technology Co., Ltd. since he graduated from college. He joined CATL in 2012 and was part of the early team that founded the company. At CATL, he has successively served as the head of the power battery cell development department, the former director of public affairs department, and the assistant to the chairman. Currently, he also serves as the head of the marketing department for CATL.

As a combination of battery swapping solutions, TIME EV Service has three tool systems: First, the chocolate-shaped battery swapping block. As a battery that has been converted to open mass production for swapping batteries, its weight energy density exceeds 160 Wh/kg, and a single battery can provide a range of 200 kilometers. Secondly, the fast swapping station with a small footprint. The standard swapping station is the size of three parking spaces, and it takes about 1 minute to swap a single battery, and the station can store 48 battery swapping blocks. Thirdly, the App connects users, vehicles, swapping stations, and battery swapping blocks.

The battery swapping mode of TIME EV Service attempts to solve two major pain points for users: the high cost of purchasing batteries and the embarrassment of using less than 20% of the capacity of their big batteries in daily commuting.

The chocolate-shaped battery swapping block is its core product, which can reportedly be adapted to 80% of new models of the pure electric platform that have already been launched or will be launched within the next 3 years, ranging from A00 to B, C-grade passenger cars, and logistics vehicles. The swapping station is compatible with various branded models that use the battery blocks mentioned above. At the same time, the existing battery blocks support home charging and fast charging.

An informed source from CATL told CAR News that different prices will be offered according to different times and locations.

The name of the battery swapping mode, Evogo, shows CATL’s ambitions: combining “evolution” and “go” emphasizes CATL’s hope to use the battery swapping mode as a lever to comprehensively improve the company’s transformation.

From research and development, manufacturing, recycling, energy storage utilization, to operation, CATL gradually completes the puzzle of the entire battery application field. More importantly, battery swapping allows CATL to have a direct scenario facing consumers, and it can also directly connect with consumers through the App.

Currently, the first vehicle model equipped with this technology is the FAW-Besturn NAT combination battery swapping edition. “We have done adaptions for many automakers, and this is our advantage,” Chen Weifeng told CAR News.Another industry insider told carcaijing that car companies have limited difficulty in switching from charging to swapping, mainly requiring corresponding chassis space and power interfaces, and the redesign time can be controlled within 6 to 8 months.

Xu Yanhua said to carcaijing that she hopes to promote the standardization of battery packs starting from the swapping model, to avoid the embarrassment of consumers being unable to use the swapping station due to different standards. Contemporary Amperex Technology (CATL) has good technological strength and industrial relations. It is hoped that it can help promote the industry’s orderly development.

Xu Yanhua added that as a company that sells products globally, CATL naturally needs to adapt to the dual carbon targets of different countries around the world. Swapping batteries can help manage the carbon footprint of the entire battery life cycle.

In December 2021, the People’s Government of Guizhou Province announced its cooperation with CATL to build a swapping network, aiming to make Guizhou a demonstration area for provincial swapping networks in China.

What are the advantages of swapping mode?

According to a survey by carcaijing, the theoretical average charging rate of DC fast charging for hot-selling pure electric models is about 1C (C is a unit of charging rate, 1C represents a complete charge that requires 1 hour). It takes at least 30 minutes to charge from 30% to 80% SOC (state of charge, also known as remaining battery capacity). Considering factors such as charging efficiency and temperature, it takes more than 90 minutes to charge from 0% to 100% SOC. Once long-distance travel is required, such charging efficiency is unacceptable to consumers.

For new energy vehicles to completely replace fuel vehicles, it is necessary to eliminate range anxiety. From the perspective of consumers, swapping batteries takes less than 5 minutes, which is similar to refueling experience, and is considered a very good technological solution.

In the short term, the promotion of swapping mode solves the problem of new energy vehicle range anxiety, and it also means that the charging and maintenance of batteries will be handed over to swapping stations, which means that power batteries will be regularly monitored, cared for, and managed by professionals, which is conducive to extending battery life. More importantly, car owners can directly avoid the most dangerous period of electric vehicles – charging (currently most battery fires occur during charging).

Swapping batteries not only benefits the batteries, but also reduces the cost of buying a car for consumers. On the one hand, the popularity of swapping mode is conducive to the development of the ladder use of power batteries, reducing the cost of the entire battery life cycle; on the other hand, the separation of car and power can provide richer commercial models, such as buying a car and renting a battery, greatly reducing the threshold for buying a car.In the long run, the battery swapping model has effectively solved the problem of power battery recycling. According to industry statistics, the total retired amount of power batteries in China in 2020 was about 200,000 tons, and this number is expected to increase to around 780,000 tons by 2025, but there is a lack of effective recycling methods.

Battery cascade utilization is the most ideal way of recycling, but it is extremely difficult. Gao Weiqiao, deputy general manager of Huayou Circulating Technology Co., Ltd. said in an interview with “Car Caijing” (ID: carcaijing) that, “the uneven quality of recycled batteries and the poor continuity and small scale of battery materials are the two major difficulties currently encountered.”

The chaos in the battery recycling industry is a microcosm of the scarcity of recycling and utilization in the entire automotive industry, while the battery swapping model skips the “recycling” stage. By monitoring the performance indicators of batteries used in the process, battery swapping stations can clearly determine the health status of the batteries. Once the battery does not meet the safety standards for servicing electric vehicles, the battery swapping station can carry out deep, scientific evaluations, repairs, screenings, pairings, to make full use of the battery or dispose of it.

From a longer-term perspective, battery swapping stations are endowed with energy storage functions. The global trend of replacing fossil energy with renewable energy is irreversible, and the significance of energy storage is self-evident.

The popularity of the battery swapping model has allowed the energy storage properties of electric vehicles to be fully released. Battery swapping stations can fully utilize the grid demand for “peak shaving and valley filling”, reduce the burden on urban power grids, and even V2X (vehicle to everything), to serve as an important hub for the energy internet.

An industry consensus is that electric vehicles emitting no CO2 only during the use stage cannot be considered as green. Only when production, use, and recycling can meet the needs of sustainable development, can electric vehicles be called green mobility. There is no doubt that the battery swapping model is more conducive to professional teams providing professional services for the full life cycle of power batteries, allowing new energy vehicles to return to their green essence.

Market share determines the bargaining power

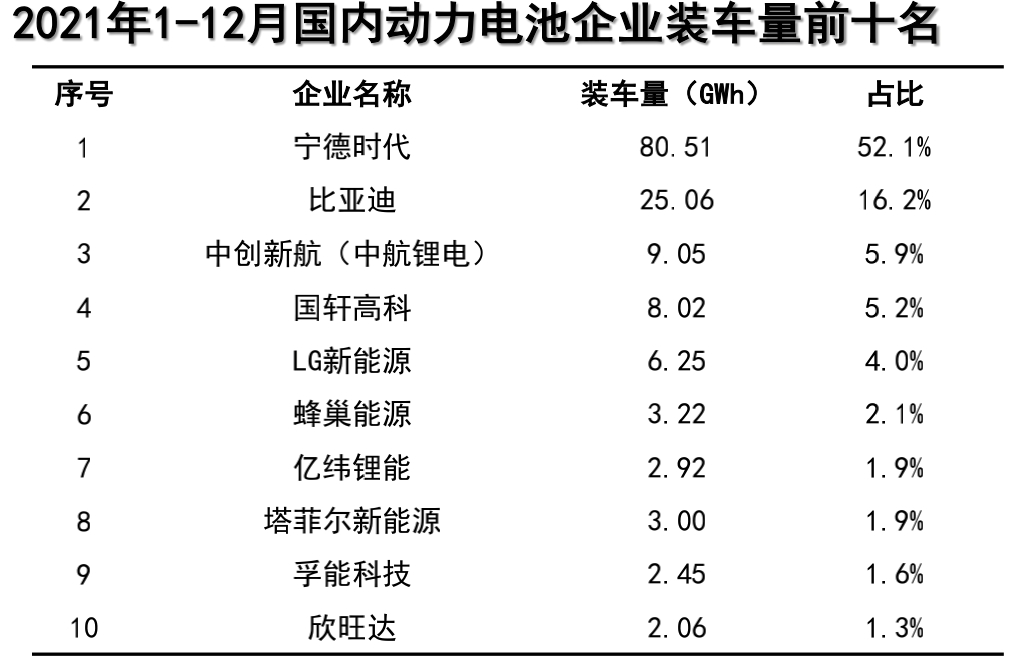

CATL has always locked in a market share of around 50% in China’s new energy vehicle industry. According to data from the China Automotive Power Battery Innovation Alliance, the cumulative installed capacity of power batteries in China in 2021 was 154.5 GWh, a year-on-year increase of 142.8%. Among them, the installed capacity of CATL is 80.51 GWh, with a market share of 52.1%.

Meanwhile, CATL is also growing into an international company, with Volkswagen, Daimler, BMW, and other well-known automakers as its solid partners. In overseas markets, CATL signed investment agreements with the Thuringian government in Germany to build a battery factory with an annual capacity of 14 GWh, which is expected to expand to 100 GWh in the future. By the end of 2021, there was news that CATL will build power battery production bases in the United States and Poland.

Covering the global power battery market, CATL is a strong supporter of the battery swapping service, which means that it is easier to achieve a unified standard for battery specifications, and battery swapping operations, maintenance, and recycling can also operate more efficiently under a unified standard.

CATL told Carcaijing that it had designed and manufactured batteries that are long-lasting, easy to dismantle, and easy to detect. It monitors the battery health status by tracking the battery performance indicators during use. Relying on its subsidiary, Guangdong Bangpu, CATL has created a “battery production – use – cascaded utilization – recycling and resource regeneration” ecological closed loop, with a core metal total recovery rate of 99.3%.

At present, the battery pack specifications of the entire vehicle enterprises are diverse and distinctive, and cannot be universally used in the entire industry like charging piles. However, from the user’s perspective, there has always been a call for standardization of power batteries in the industry, and CATL, with the highest market share, has a strong voice.

Secondary market researchers also told Carcaijing that the mentality of automakers is changing, and they are willing to accept standardized battery packs to reduce the cost of car development and adaptation, and focus more on areas that consumers can perceive and reflect their own value.

At the same time, the battery swapping model has also spurred a heavier asset operation model. As a big charging treasure, batteries have become the property of battery asset companies from private ownership, and can be used as collateral assets to issue ABS to obtain funds, helping to expand the scale of charging piles and improve charging station services. At the same time, the behavior data, payment habits and other scenarios derived from user battery swapping allow CATL to no longer be a simple 2B company, and its future business models and scenarios are more imaginative.

Chen Weifeng told Carcaijing that the battery swapping project is indeed a heavy asset, but once this project is integrated with the real economy, the capital market can be channeled here, stimulating the real economy and manufacturing industry while serving as a bridge to reach end consumers.“`

“There are some infrastructural characteristics of high costs, low income, and long return on investment period in battery swap stations. Battery swap stations themselves are not a profitable business. Automakers such as BAIC New Energy and NIO adopt battery swapping models to sell cars rather than to earn money through battery swapping,” said an industry insider to Carcaijing (ID: carcaijing). Ningde Times can both do battery swapping and production, management, recycling, hierarchical utilization, and energy storage, with great value throughout the entire industry chain.

”

”

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.