Author: Leng Zelin

In the winter of 2015, Wang Jing, the then SVP of Baidu, confidently declared, in front of the first red self-driving car modified by Baidu, “Driverless taxis will be commercially available in three years and mass produced in five years”.

But as wide as the ambition, the reality is narrow. Six years have passed, and Baidu’s subsidiary RoboTaxi has just obtained qualifications to cautiously carry out commercial pilot services within an area of less than 60 square kilometers. Wang Jing himself had a hard time reaching a settlement with his own start-up company and started his second venture.

In 2016, DJI, which occupies nearly 80% of the global drone market, quietly began to develop its automotive business internally. Many people may think that a company whose main business is drones is somewhat neglecting its core business by doing automotive.

However, within DJI, whether to do a business or not is not determined by the growth space and commercial value of the business, but by the company’s ability boundary. The R&D capabilities accumulated in the process of drone development, such as image recognition, perception algorithms, navigation, and obstacle avoidance functions, are common to those needed for automotive, so it makes sense to do automotive.

According to media reports, DJI also considered doing Robotaxi at first, but eventually gave up due to various reasons.

Different from directly doing L4-level autonomous driving as a Robotaxi, DJI’s car business currently mainly provides R&D, production, and sales services for L2-level intelligent driving systems and their core components for automakers. That is to say, it provides both software and hardware. For example, in 2019, DJI incubated Livox Technology, which develops LiDAR sensors.

Survival Status of L2 and L4

Looking back now, L2 was probably a more conservative choice at that time, but due to cost control and other reasons, it has become easier to land.

An insider at DJI told Photon Planet that there have been quite a few orders since DJI announced its entry into the automotive business this year. Each automaker customer has different needs, requiring a lot of manpower and time to land projects. Recently, DJI has been fully committed to capacity delivery, so it has not made frequent public statements after its announcement.

On the other hand, in recent years, a group of autonomous driving algorithm companies have emerged in China, such as Baidu Apollo, Pony.ai, WeRide, and AutoX. These companies are characterized by their high profile, choosing to skip L2/L3 and directly achieve L4-level autonomous driving, by retrofitting vehicles to build their own robotaxi fleet, and then improving their autonomous driving functions through driving data.

However, the dilemma of not landing on a large scale and the high operating costs have forced some companies that focus on Robotaxi to lay low.

In the past few years, pure algorithm companies have been seeking more monetization models, and 2019 was a turning point.

In the past few years, pure algorithm companies have been seeking more monetization models, and 2019 was a turning point.

One group of companies started to do commercial trucking, last-mile delivery and other businesses, while another group aimed to provide automatic driving solutions for original equipment manufacturers (OEMs). For example, Baidu launched Apollo Lite, Momenta launched Mpilot, HoloPilot was launched by HEDY and Haomo Zhixin was established by the former smart driving prospecting department of Great Wall Motors.

Although L4 automatic driving technology is claimed to be a blow to L2, the number of vehicle models that have actually been put into operation is very limited. Currently, the perception systems self-built by Robotaxi companies mostly do not meet the vehicle standards and are also expensive.

Simply put, one of the major issues that suppliers and OEMs need to solve when cooperating is how to use cheaper sensors and lower computing power to achieve more diverse driving assistance functions, rather than “stacking materials” like L4 regardless of the cost.

At the same time, pure algorithm companies still need to use third-party hardware to access fourth-party vehicles.

In terms of implementation speed, enterprises that combine software and hardware are often more likely to win the favor of OEMs. Due to differences in hardware manufacturing and software development, a large amount of experience needs to be accumulated. Currently, only Huawei and DJI are involved in software and hardware integration in the market.

Two paths for software and hardware integration

The two hardware companies coincidentally took the same path.

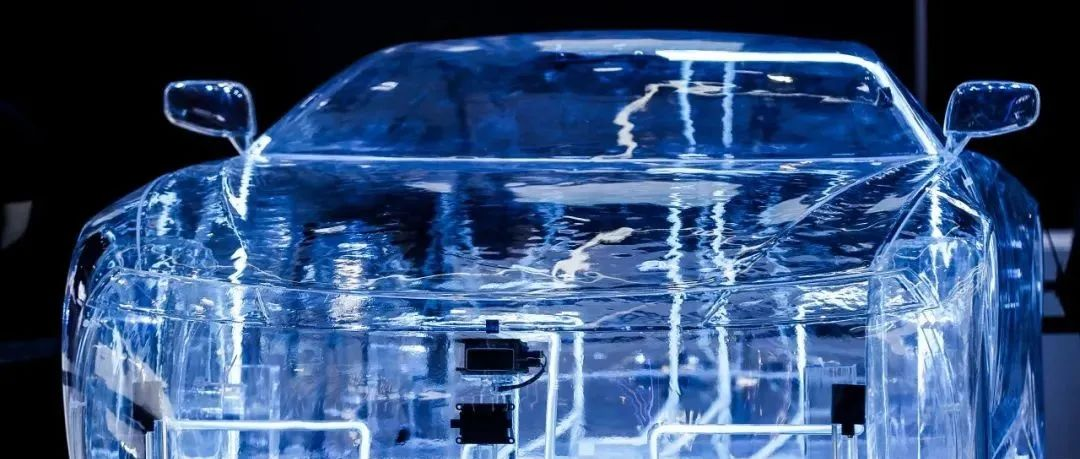

During this year’s Shanghai Auto Show, DJI launched its smart driving business brand “DJI Automotive” and announced that it would become a Tier 1 supplier of automatic driving solutions. On the other hand, Huawei cooperated with GeometryAuto Auto in a Alpha S Hi automatic driving test ride activity, demonstrating its determination to become a Tier 1 supplier.

DJI Automotive and Huawei Hi Smart Car Solutions are similar, both focusing on providing automatic driving solutions for vehicle manufacturers. Therefore, the visual perception sensor, lidar, smart driving domain controller, driving behavior recognition warning system and other products provided by DJI’s smart driving solutions are also possessed by Huawei.

However, there are still significant differences between the two.

Huawei entered the game earlier and started researching automotive-related topics in 2012 from the perspective of vehicle interconnection; subsequently with the development of the new energy market, it expanded into intelligent cockpits, automatic driving, car clouds and other fields. DJI started its team in 2016 and only gradually emerged this year. At present, it mainly focuses on a complete set of smart driving systems that includes both software and hardware.

The first-mover advantage enables Huawei to be involved in a wider range of areas and have richer products, but it also poses a major challenge: the emergence of “Huawei Inside” actually breaks the balance between original Tier 1 suppliers and OEMs.Huawei Intelligent Car Solutions BU President Wang Jun previously stated in an interview that the Huawei Inside mode is essentially starting from the definition of the entire vehicle, integrating Huawei and automotive companies’ teams through joint design and development. If the HI brand is to be established, Huawei’s full-stack autonomous driving solution must be used.

This is also the reason why the SF5 of the leading automobile brand Sitech is equipped with a series of components, such as the Huawei Hi Car and HUAWEI DriveONE electric drive system, but still can only be called Huawei Smart Choice. Currently, Huawei HI has only three partners: Changan, GAC, and BAIC. Wang Jun has previously stated that due to large investment, Huawei HI partners have reached saturation and the list will not increase in the short term.

Previously, Huawei and Chongqing Jinkang Sitech jointly released a high-end brand named AITO. Recently, they launched a new model-AITO M5. Although the vehicle has not been included in the HI mode, Huawei is still deeply involved in the development work of this car.

What’s more interesting is that this new model was not released by Sitech, which is a “car-making” company, but by Huawei, which is a “non-car-making” company, at its winter new product launch event, which is somewhat of a meaning of stealing the show.

We know that perception, computing power, algorithms, and data are the four key points for the growth of autonomous driving. Looking closely at the brands cooperating with Huawei, Avita, Sitech, and Kaira are all facing the situation of low sales and poor brand awareness, forcing Huawei to take on the responsibility of B2C.

On the contrary, DJI’s orientation is more towards B2B. In the past six months, DJI has announced two partners to the public: Volkswagen and Wuling, one is the “tyrant” in domestic fuel vehicles, and the other is the “sales champion” in new energy. This provides a bottom for the upgrade of autonomous driving.

Here, let’s briefly describe DJI’s business layout. There are currently three major solutions: Intelligent Driving D80/D80+ (0-80km/h), D130/D130+ (0-130km/h), and DJI Intelligent Parking (P5, P100, P1000), divided according to speed range, perception hardware, and different functions, respectively corresponding to three major vehicle usage scenarios: urban expressways, highways, and parking lots.

These three solutions are not fixed. The small print in the lower left corner of the picture distinguishes the role differences between DJI and Huawei when working with automakers.Traditional suppliers bundle “software + parts” to sell to the OEM, resulting in deep integration of software and hardware. However, DJI provides software, hardware, and integrated solutions. According to a representative from DJI’s automotive division, in an interview with Photon Planet, if the OEM has specific requirements for suppliers, DJI can also use hardware specified by the customer.

One particularly important point is that DJI’s solution is also applicable to gasoline-powered vehicles. As early as 2017, QbitAI captured footage of what was suspected to be a Ford Edge SUV modified by DJI in a location in Shenzhen.

The representative explained to Photon Planet that, with years of experience in drones, DJI can achieve intelligent driving with lower power consumption. As long as the platform supports a 48V voltage, DJI can assist the OEM in R&D through their existing manufacturing base and ultimately help the OEM achieve mass production.

At the same time, the low energy consumption can also ease some of the range anxiety for electric vehicles, making it possible for some models with smaller battery capacities to adopt this intelligent driving system. This means that several popular micro-cars under Wuling will also have the chance to incorporate this intelligent driving solution.

Due to the differences in their delivery targets to Huawei, their roles and positioning are somewhat different. DJI’s delivery is to the OEM, adjusting service items according to the actual needs of the OEM, strictly speaking, they are the second party. They are not willing to overshadow the host when it comes to how to sell to the OEM as the first party.

On the other hand, Huawei is more focused on consumers. With its increasing involvement in various aspects, it has become less like the second party and more like half of the first and second parties. They have a say in many areas, offering more than just intelligent driving solutions, but also deeply involved in the R&D and design of intelligent cabins and many other areas.

Direct Approach or Step-by-Step Approach?

Even though many OEMs are working on autonomous driving/advanced driver assistance systems, according to data from HIS Markit, the penetration rate of level 2 and above autonomous driving among China’s passenger car market only increased from 3% to 13% from 2018 to 2020. Another set of data shows that the actual new car adoption rate of level 2 autonomous driving in Q1 of this year is only about 10%.

According to the “Energy-Saving and New Energy Vehicle Technology Roadmap 2.0” published earlier, the goal of autonomous driving is that by 2025, partially autonomous driving and conditionally autonomous driving levels of intelligent connected vehicles will account for more than 50% of annual sales, and by 2030, this number should reach 70%.

We need to aspire to the stars and the sea, but it is also easy to see that there is currently greater demand for level 2 autonomous driving, and the market is broader.

According to DJI’s Director of Public Relations, Xie Kandi, “DJI hopes to convey an idea that creating a better L2 experience is the key to achieving higher levels of autonomous driving.”

In short, DJI’s focus on their current automotive offering is on level 2 autonomous driving.Currently, there are many mass-produced car models that provide L2 functions. However, most of them use a distributed architecture for system integration, which requires an independent set of sensors and controllers to add a certain auxiliary driving function. As the functions increase, the system becomes more complex.

At the same time, the same function can have different advantages and disadvantages, and is not always coherent, such as in scene switching.

Currently, DJI adopts a centralized architecture for its car model, using a central domain controller and a set of sensors to implement multiple functions in different scenarios. It also attempts to make these singular functions continuous, such as the continuous driving between city expressways and highways.

However, during actual experimentation, DJI’s car system may not always be continuous in some scenarios. For example, manual takeover may still be required for turns or intersections on city roads. Of course, this system only has one binocular camera, one monocular camera, four fisheye cameras, and five millimeter wave radars, and has yet to include a LIDAR or high-precision map.

This is also the problem we mentioned earlier – how can autonomous driving suppliers and automakers control costs through cooperation?

Currently, new energy car models are all competing to improve their computing power and include more perception devices, such as the ET7 with four built-in NVIDIA DRIVE Orin chips, achieving a total computing power of 1016 TOPS, seven times higher than that of Tesla’s FSD. For example, at least 12 LIDAR models are planned to be mass-produced by 2022, with Salon Jijiaolong under Great Wall Motor having four LIDARs installed.

Of course, these car models tend to be expensive. The price difference between the standard and HI versions of the Huawei HiPhi Alpha S is as high as 190,000 yuan.

Is it worth it for consumers to spend more on a car model with a basic L4 when it is known that L4 level autonomous driving will not be available in the short term? The hype behind it may be even greater than the reality.

There is no exact conclusion on whether autonomous driving should make the leap to L4 or refine L2. DJI believes that each company has a different route, but the ultimate goal is the same, which is to achieve unmanned driving. DJI is also working towards L4, but its current goal is to improve the L2 experience.

In this regard, everyone’s ultimate goal is the same, but the process and methodology are very different. Like going up stairs, some people choose to practice their leg strength and try to jump straight up, but they find that the floor is too high and they keep hitting a wall. Others choose to use a few steps in the middle and climb up step by step.

For every increase in autonomous driving level, the conditions for implementation become more demanding. Under conditions where legal regulations, vehicle-road coordination, communication networks, and technology itself have not been well resolved, choosing a more realistic path may be the way to end the persistent losses and burning of money, and to survive until the next level of implementation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.