Time flies like an arrow and days and months pass swiftly. In the blink of an eye, the “balance” in 2021 is already insufficient.

Looking back at the past year of 2021, under the normalization of the epidemic, everyone’s life seems to be continuing in some kind of inertia, seemingly unchanged.

Meanwhile, it is precisely within the seemingly unchanged individual daily life that the tide of the times is rolling forward. If 2020 was still only the year of the “takeoff of new energy vehicles” in people’s discussions, then 2021 has already surged ahead at an astonishing pace, as if everything related to new energy vehicles has been pressed on the accelerator button.

As usual, at the end of the year, a review of the major events that occurred during the year should be conducted. However, in looking back, we find that it is already impossible to condense the exciting developments in the new energy vehicle industry in 2021 with just a few isolated events.

Therefore, the Super Charging Station editorial team has selected the top ten key words for the new energy vehicle industry of the year, and through the hot events behind these key words, we will jointly recall the development trend of the more heated new energy vehicle market this year with everyone.

The Battle for 1000 km Range: What Consumers Care About Most Currently

In 2020, the proportion of individual new energy vehicle consumption rose sharply to nearly 75%. And the most important thing that ordinary consumers focus on when choosing new energy vehicles is still the most realistic driving range.

Therefore, the first key word that ignited the industry at the beginning of this year was “1000 km range”.

On January 9th, 2020, NIO Day arrived as scheduled. The heavy model released at the press conference, NIO’s first pure electric sedan ET7, was undoubtedly most attractive to consumers in terms of driving range – based on NIO’s 150 kWh battery pack, this pure electric sedan’s NEDC driving range would reach 1000 km.

Unfortunately, similar to the ET7 planned for delivery in the first quarter of 2022, the NIO 150 kWh battery pack is a more distant “futures contract”. NIO models will have to wait until the end of next year to use this battery.

But this has not affected the heat and popularity of the topic and has also led other manufacturers to follow suit.On January 13th, IM Auto announced its cooperation with CATL to launch its first vehicle equipped with “silicon-doped lithium” batteries, achieving a maximum range of over 1000 kilometers.

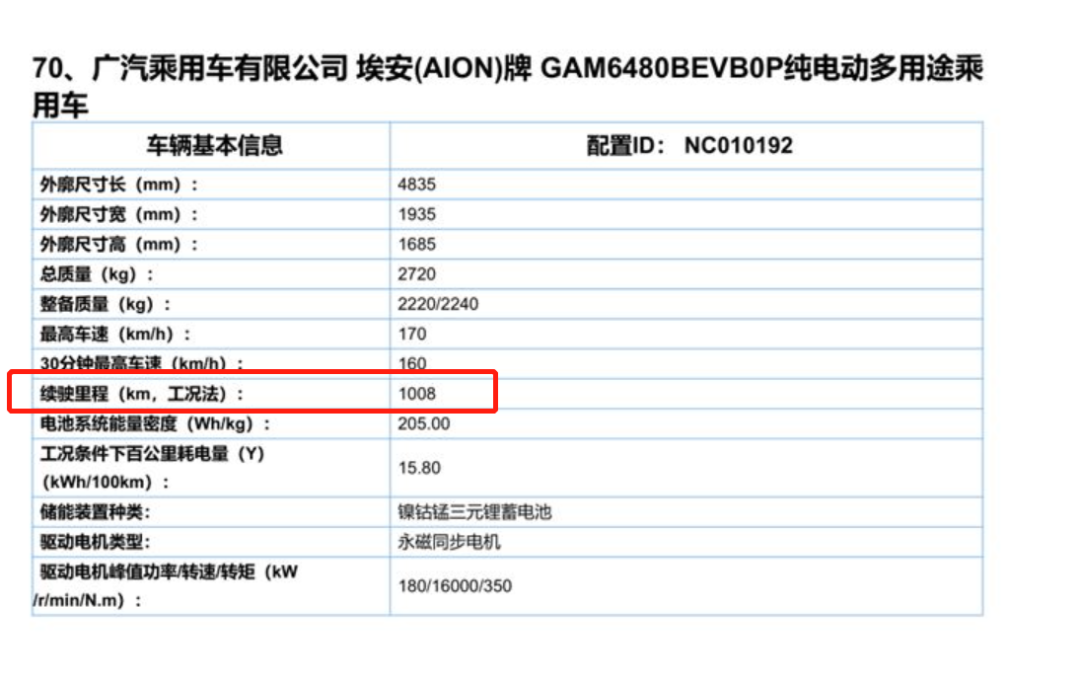

On January 15th, GAC Aion released a poster claiming that its vehicle equipped with graphene-based super fast-charging batteries can charge to 80% in 8 minutes, while its silicon-carbon anode battery technology can achieve a range of 1000 kilometers under NEDC standard.

The “1000-kilometer range battle” at the beginning of this year was ignited by a comment from Academician Ouyang Minggao, Vice Chairman of the China EV100 Forum and a member of the Chinese Academy of Sciences: “If someone says a pure electric vehicle can go 1000 kilometers, can be fully charged in just a few minutes, and is particularly safe and low-cost, then don’t believe it, because it is currently impossible.”

As for the subsequent public opinion war, due to length limit, it will not be discussed here. Beyond the dazzling “1000-kilometer range” numbers, we can once again clarify that:

Range is still the most appealing factor to consumers when it comes to electric vehicles. Or more specifically, compared to fossil fuel cars, electric cars are still weak in terms of charging conditions and energy replenishment experience.

Do you still remember the news during the National Day holiday this year, where electric car owners “spent one hour charging and half a day queuing up” on the highway?

This also indicates that only when charging is as convenient as refueling, can electric vehicles be placed on an equal footing with fossil fuel cars in consumers’ purchasing decisions.

Fortunately, to achieve this goal, both car manufacturers and battery manufacturers are working hard to alleviate consumers’ “refueling anxiety” by increasing battery density, charging speed, and better layout of the charging network.

Also, on November 1st, GAC Aion officially announced that its AION LX with a range of 1000 kilometers using sponge silicon anode battery technology had been listed by China’s Ministry of Industry and Information Technology (MIIT).

Perhaps this also means that having an electric car with a range of 1000 kilometers in 2022 will no longer be a surprising thing.

Xiaomi’s Entry into the Car Manufacturing Industry: Technology Companies Rush In

This year, Xiaomi finally announced that it will officially enter the car manufacturing industry.

On the afternoon of March 30, Xiaomi Group issued a notice that the company’s board of directors officially approved the establishment of a fully-owned subsidiary for the intelligent electric vehicle business, with an initial investment of RMB 10 billion, and an expected total investment of USD 10 billion in the next 10 years.

At the Xiaomi Spring New Product Launch Event held that evening, Lei Jun, founder of Xiaomi and Chairman and CEO of Xiaomi Group, loudly announced: “I will bet all of my achievements and reputation to fight for Xiaomi’s entry to the automobile industry.”

Although the first “Xiaomi car” is planned to be in mass production in the first half of 2024, this does not hinder Xiaomi from gradually advancing its manufacturing pace according to its own rhythm.

First of all, Xiaomi needs to understand the industry: After the official announcement of entering into the manufacturing of cars, Xiaomi conducted a large amount of user research and industry chain investigations, with more than 2,000 research interviews and visits to more than 10 industry peers and dozens of industry partners. Pictures of Lei Jun’s visits to enterprises, such as BYD and SAIC-GM-Wuling, were widely circulated online.

Secondly, Xiaomi needs to recruit people and build a team: Lei Jun personally recruited engineers for core posts such as autonomous driving on Weibo. At the media meeting for the Q3 financial report in August, Xiaomi stated that it has received more than 20,000 resumes for car manufacturing since it started, and has now formed a team of about 300 people.

On September 1, Xiaomi’s car factory found its location: Xiaomi Automotive Co., Ltd. was officially registered in Beijing with a registered capital of RMB 10 billion. Lei Jun personally serves as the legal representative and CEO, and the first factory will be located in Yizhuang, Beijing.

There is a rumor that Xiaomi plans to “launch cars in 3 years and sell 100,000 units in the first year“. Additionally, after the launch of Xiaomi’s car in 2024, the company will introduce a new car each year for the following three years, with a goal of selling a total of 900,000 vehicles within three years.

There is a rumor that Xiaomi plans to “launch cars in 3 years and sell 100,000 units in the first year“. Additionally, after the launch of Xiaomi’s car in 2024, the company will introduce a new car each year for the following three years, with a goal of selling a total of 900,000 vehicles within three years.

Xiaomi’s car-making is just a microcosm of internet technology giants competing in the intelligent electric vehicle arena.

Alibaba invests in “IM Auto” and partners with SAIC, and Zhangjiang High-tech to build high-end intelligent electric vehicles. The first product, IM L7, was unveiled this year with a pre-sale price of 4.088 million yuan and will be officially delivered in the first half of 2022.

360, which started as an antivirus software, invested in NIO Auto with about 3 billion yuan, becoming the second-largest shareholder and providing intelligent cockpit technology support for NIO’s car models. In November this year, “NIO V Pro,” priced at about 80,000 yuan, went on sale, equipped with 360 car security guard.

Baidu has been deeply involved in autonomous driving technology over the past few years, launching the Baidu Apollo platform to provide relevant technical support to automakers.

This year, Baidu finally decided to personally make cars, and established a joint venture with Geely named “Jidu Auto”. The company will use Baidu’s autonomous driving technology and Geely’s SEA platform to create new cars. The first product is expected to debut at the Beijing Auto Show next year.

Of course, we cannot forget about Huawei, who has always claimed that they do not make cars.

During this year’s Shanghai Auto Show, a video of Huawei’s autonomous driving technology being debugged in real-world scenarios went viral on the internet. Behind the scenes, Huawei is attempting to unify the intelligent car-related technological norms, standards, interfaces, and talent training standards in order to possibly become the “next Bosch” in the field of intelligent cars.

Meanwhile, Huawei is even “substantially making cars”. First, the Seres SF5, which is equipped with the Huawei DriveONE electric drive system and has a “Huawei Select” emblem on the tail, was officially offered for sale this year at Huawei’s offline stores.

In December, Jinkang Saili announced the high-end brand “AITO”, but the release of its first product, the AITO M5, was scheduled for the winter new product launch. According to rumors, this new car will be fully handled by Huawei from initial planning, design, marketing to sales. It means that Huawei has bought the model and Jinkang Saili is only responsible for OEM production.

In addition, besides domestic internet technology companies rushing into the car-making industry, news about Apple making cars overseas has also become a frequent topic in media reports.

A few years ago, when mobile payment technology began to rise, there was a saying that internet companies would all make finance.

Today, as cars gradually evolve into “super mobile terminals with four wheels”, this statement may need to be changed to “technology companies are all laying out in the automobile industry”.

Shanghai Auto Show: Intense Competition for New Cars

Every year, the auto industry’s predicted grand events, there are no more than domestic and foreign auto shows of various sizes. In 2021, from Shanghai, Chengdu, Guangzhou in China to Munich and other overseas auto shows, almost all have become “new energy vehicle exhibitions”.

Taking the Shanghai Auto Show, the most important A-class motor show in China this year, as an example, there were 1,000 well-known manufacturers participated in the exhibition, showcasing a total of 1,310 vehicles, including 128 vehicles making their global debut.

Among them, new energy vehicles have already accounted for more than half of all new cars. Described by conventional terms, the competition has become even more intense; using trendy words, the new car market has become increasingly crowded.

How crowded has it become? We can probably feel it by looking at two new car release conferences.

On the night of April 13th, the domestic launch of the Ford Mustang Mach-E.

As for this product that has already had a head-on confrontation with Tesla in the U.S. market, its performance parameters and product strengths are already well known.

What surprises people the most is the price: starting at RMB 265,000, breaking the inherent perception that the price of traditional international manufacturers’ new electric cars will not be lower than RMB 300,000. The new car has thus triggered a high traffic flow.

More dramatic, the publicity heat of Mustang Mach-E seems to have lasted only about 1 day. On April 15th, another newly-configured car that is exploding in popularity, the JiKe 001, was released.

This new car, based on the Geely SEA Haohan platform, has almost every parameter on every slide of the PPT at the press conference worthy of people taking out their phones to take a picture, such as the 100kWh battery, 360kW charging power, electric suction automatic doors, intelligent air suspension, etc., all belong to practical, hardcore and directly confrontational configurations and parameters compared to competitors.

In addition, JiKe announced its self-built charging network, called “JiChong”, and shouted the slogan “Charge for 5 minutes, continue driving for 120km”.

The popularity of JiKe 001 has also been converted into real-order numbers. After the press conference, rumors circulated that orders exceeded 70,000.

On June 15th this year, JiKe officially announced that it would stop accepting intention deposits, and the orders for JiKe deliveries in 2021 had been sold out.

Although JiKe 001 experienced a series of controversies such as price changes and configuration changes in the months after the press conference, it ultimately could not affect this car as the “annual explosion model” in people’s hearts.

Behind a series of events, we can also see a trend: in addition to producing a competitive new car, competition among manufacturers today has extended to comprehensive areas such as delivery speed, marketing services, and charging systems.

The “roll” of new energy vehicles is no longer just about vehicle models, but comprehensive and multi-field “rolls.” Consumers have become increasingly accepting of new energy vehicles, while becoming more and more picky.

Tesla’s “brake failure”

Since we have mentioned consumers, it is natural not to mention the following scene that also appeared at this year’s Shanghai Auto Show, which also brought up the most talked-about keyword in the first half of the year: Tesla’s brake failure.

The cause of the incident was a car accident on February 21st this year involving Ms. Zhang’s Tesla Model 3 in Henan. Ms. Zhang’s father was driving the vehicle at the time and traffic police determined that he bore full responsibility for the accident. Ms. Zhang believed that the Tesla’s “brake malfunction” was to blame and had gone to the Tesla Zhengzhou store multiple times to seek compensation.

The cause of the incident was a car accident on February 21st this year involving Ms. Zhang’s Tesla Model 3 in Henan. Ms. Zhang’s father was driving the vehicle at the time and traffic police determined that he bore full responsibility for the accident. Ms. Zhang believed that the Tesla’s “brake malfunction” was to blame and had gone to the Tesla Zhengzhou store multiple times to seek compensation.

On April 19th, at the Tesla booth of the Shanghai Auto Show, Ms. Zhang climbed onto the roof of a Tesla vehicle wearing a T-shirt with the words “brake malfunction” printed on it, and was arrested by Shanghai police for five days. The owner apologized for her “overly aggressive actions”.

As for Tesla’s response, we all remember it. First, Tesla’s senior executives and official Weibo account released a statement that they “cannot compromise on unreasonable demands,” which sparked a huge controversy.

Subsequently, CCTV, Xinhua News Agency, and other official media outlets took turns criticizing the company, and Tesla was forced to relent and issue statements for several consecutive days, ranging from “deeply apologetic” to finally “we will accept the accident regardless of the test results.”

At the same time, under pressure, Tesla provided the accident owner with detailed data from 30 minutes before the accident and released some of the data to the media on April 22nd.

According to this table, it can be basically proven that the braking system hardware of the accident vehicle was working properly and did not “completely fail”. However, due to the lack of relevant data such as braking pedal travel, brake assist system operating conditions, and road conditions, the blank spaces on the table raised suspicions that Tesla may have only released data that was favorable to themselves.

Whether or not Tesla falsified information, it is clear that if a Tesla vehicle has an accident, it can be traced back through its built-in EDR system.

EDR can be seen as the black box of a car, recording multiple key data before and after an accident, such as steering wheel angle, driving speed, seat belt tension, etc. After the accident, people can read the encrypted data by connecting the car’s EDR to a specially designed decoding computer to obtain complete original data.However, the EDR data of the accident vehicles for the rights protection car owners has not been disclosed to the public. The subsequent disputes have also faded out of people’s sight as time goes by.

The significance of this event lies in triggering a discussion on the problem of smart car driving data ownership and accelerating the introduction of related national regulatory policies.

On May 12th, the Office of the Central Leading Group for Cyberspace Affairs issued the “Regulations on the Management of Automotive Data Security (Draft for Soliciting Opinions)”, which controls the personal privacy and national security risks brought by the collection of smart car driving data from the legislative level.

In early December, the No.2 Amendment to the “Technical Conditions for Motor Vehicle Operation Safety” national standard was issued, requiring new domestically produced passenger cars to be equipped with “Automotive Black Box” EDR systems from January 1, 2022.

This may mean that in the future, when similar disputes occur, they will be clearly traced and judged for human reasons or product reasons.

On December 24th, the rights protection car owner sued Tesla executives for infringement of reputation, and the approval result has not yet been obtained. However, whether Tesla really has a “brake failure” problem is still doubtful.

Of course, this has ultimately failed to stop Tesla products from selling well in the Chinese and even global markets.

Tesla’s Market Value Reaches Trillions

On October 26th, Tesla’s market value surpassed one trillion U.S. dollars.

What is the concept of trillions in market value?

Previously, there were only six companies in the world with a market value of over one trillion, namely: Apple, Microsoft, Saudi Aramco, Google’s parent company Alphabet, Amazon, and Facebook.

Why did Tesla’s market value surpass one trillion?

Firstly, of course, it is selling more and earning more.

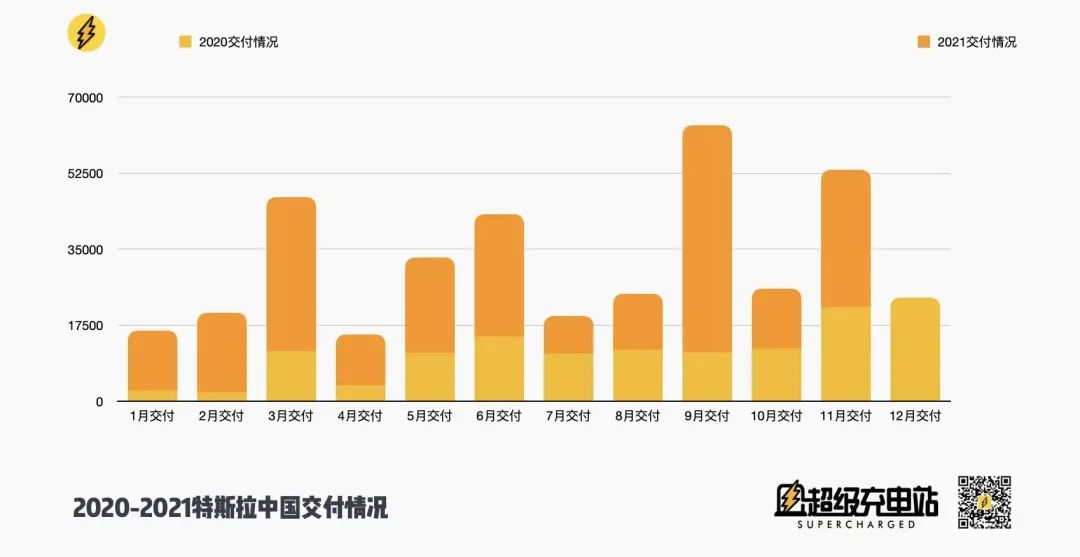

In the Chinese market alone, Tesla’s cumulative sales from January to November this year have reached 248,500 units. Last year, Tesla’s China sales were only 137,400 for the whole year.

The biggest factor driving the increase in sales is undoubtedly the launch of the new car Model Y. In September this year, the Model 3 once surpassed the long-term SUV market leader Haval H6 with a monthly sales volume of 33,000, making people exclaim that electric cars defeating gasoline cars is no longer a dream.

According to Tesla’s Q3 2021 financial report, the quarter’s revenue was $13.757 billion (approximately RMB 87.957 billion), a year-on-year increase of 57%, and net profit reached $1.618 billion, an increase of 389% compared to the same period last year, surpassing $1 billion in net profit for the second consecutive quarter.

According to Tesla’s Q3 2021 financial report, the quarter’s revenue was $13.757 billion (approximately RMB 87.957 billion), a year-on-year increase of 57%, and net profit reached $1.618 billion, an increase of 389% compared to the same period last year, surpassing $1 billion in net profit for the second consecutive quarter.

This is Tesla’s third consecutive quarter with revenue exceeding $10 billion and also the third consecutive quarter of record profits, with net profit surpassing $1 billion for two consecutive quarters.

Secondly, Tesla’s global factory construction is progressing rapidly.

In October, Tesla’s Berlin factory was finally completed. The maximum annual production capacity of the factory will reach about 500,000 units, and the vehicle production can be started within two hours as long as the final government approval is obtained.

In China, Tesla’s Shanghai factory has reached an annual production capacity of about 450,000 units. At the end of the year, Tesla announced an investment of RMB 1.2 billion in a new expansion project for this factory, which will further increase production capacity next year.

In addition, Tesla’s new factory in Texas, USA is also being built intensively.

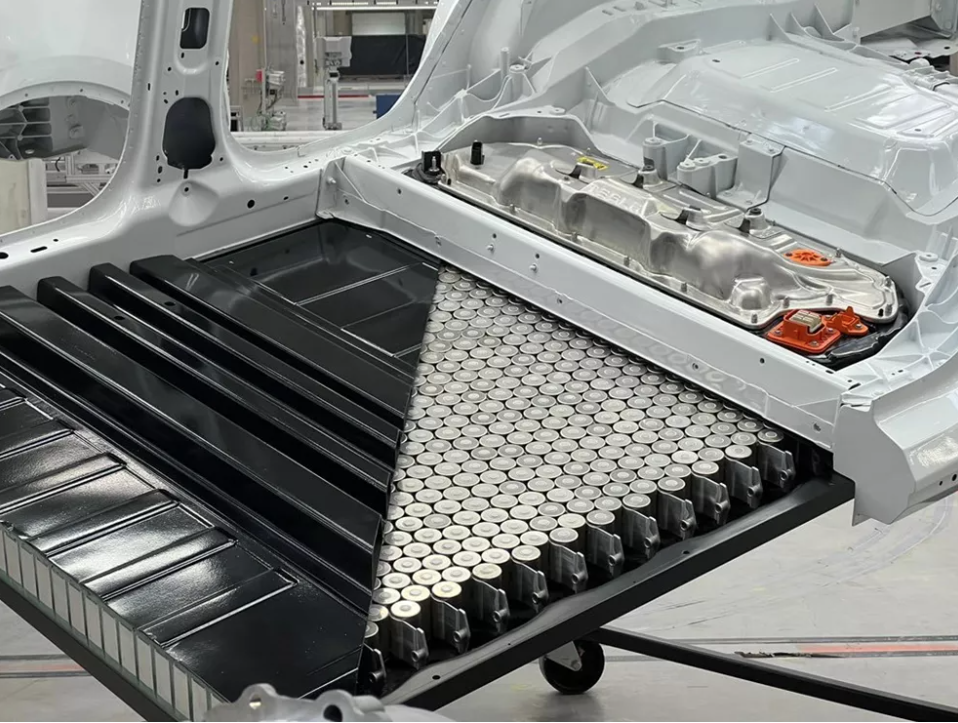

Finally, Tesla is pushing the development of new batteries and new technologies at its own pace.

The brand-new 4680 battery pack appeared at the Berlin factory completion ceremony. The production of this battery pack will be crucial for the mass production of new vehicle models such as the Cybertruck in the future.

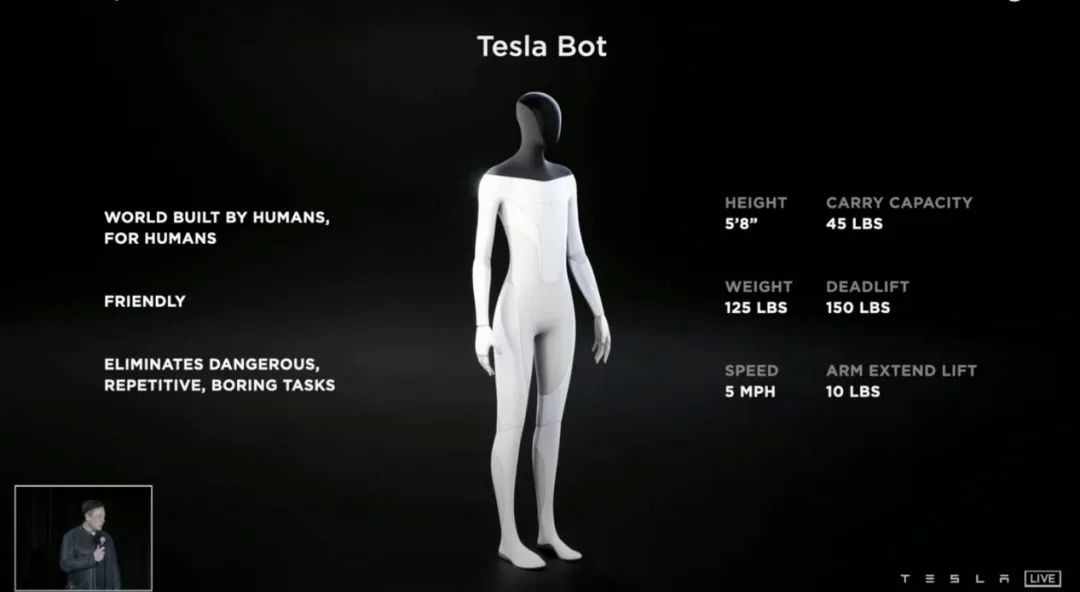

At the same time, Tesla held a grand AI Day event this year, showcasing the supercomputer Dojo, the D1 chip, and even bringing the humanoid robot Tesla Bot to the public.

From smart cars to robots, Tesla’s story is bigger and more exciting.

Selling cars is for the present, and autonomous driving and artificial intelligence are for the future. All of this has driven Tesla’s valuation to an insane level.

The transformation of giantsTesla continues to surge, while traditional carmakers accelerate their transformation. This year, we have seen a series of traditional international giants such as Volkswagen, Mercedes-Benz, and Toyota launch their plans for electric vehicles.

Of these, we need to pay attention to the two giants in the East and West: Volkswagen and Toyota.

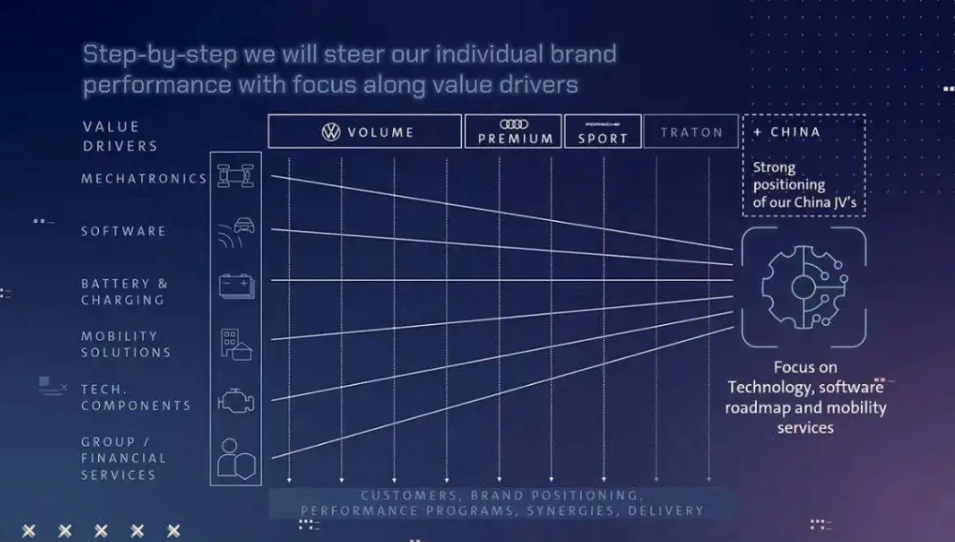

On July 13th, Volkswagen released its 2030 NEW AUTO Strategy to accelerate its transformation into a software-driven mobile travel service provider.

According to the plan, Volkswagen plans to allocate 73 billion euros for investment in future technologies from 2021 to 2025, accounting for 50% of the total investment.

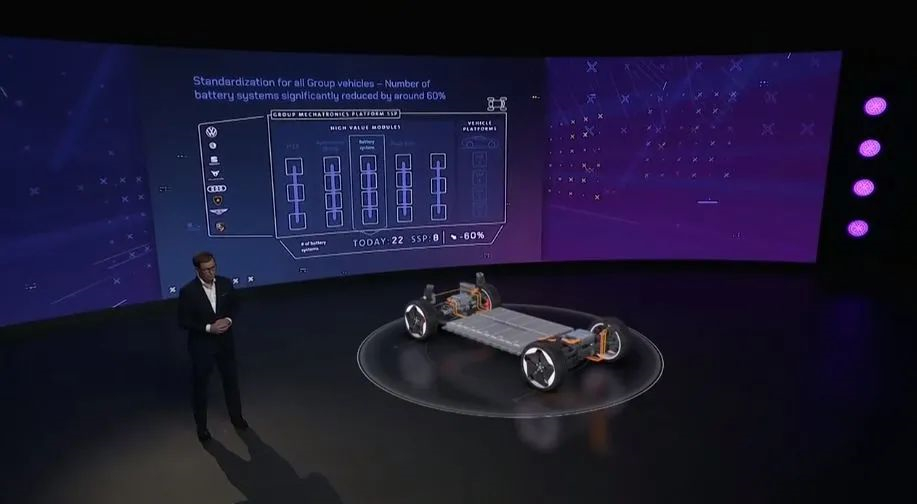

At the vehicle level, Volkswagen will develop the next-generation electric-mechanical integrated platform expandable system platform (SSP platform). This will be a brand new car platform that integrates pure electric, comprehensive interconnection, and high scalability. During its life cycle, it is expected to produce more than 40 million cars.

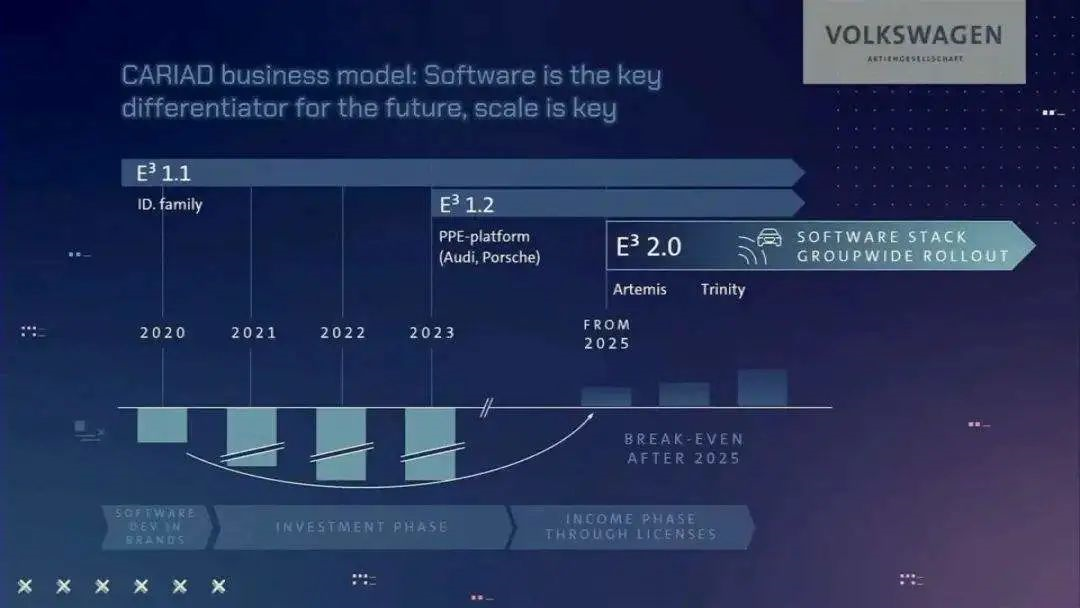

Apart from manufacturing cars, Volkswagen’s software company CARIAD aims to develop a leading software platform for all Volkswagen vehicle products by 2025.

In the field of batteries, Volkswagen plans to build six battery factories in Europe with a total annual production capacity of up to 240 GWh, and will develop standardized battery cells to provide uniform batteries for 80% of the entire Volkswagen Group’s electric vehicles.

In the more distant field of autonomous driving, Volkswagen aims to build a fleet of self-driving cars by 2030. The “Mobility-as-a-Service” and “Transport-as-a-Service” that integrate fully autonomous driving technology will become new growth points for Volkswagen’s new businesses, and the related value chain will include four parts: autonomous driving systems, the integration of autonomous driving technology in vehicles, shared cars, and travel service platforms.

In addition to Volkswagen, Toyota, who has always had an ambiguous attitude towards electric vehicles, finally showcased 15 brand new pure electric concept cars to the world at the end of the year.

On December 14, Toyota CEO Akio Toyoda announced a shocking electrification strategy in the industry:

By 2030, Toyota will cumulatively launch 30 pure electric vehicles, with a goal of achieving a global sales volume of 3.5 million electric vehicles that year.

Lexus will transform into a pure electric vehicle brand: starting in 2030, it will only develop pure electric vehicles and achieve annual sales of 1 million electric vehicles in China, North America, and Europe. By 2035, 100% of new Lexus vehicles will be electric vehicles.

By 2030, Toyota plans to invest 2 trillion yen (17.6 billion US dollars) in battery technology research and development.

In mid-2022, Toyota’s new pure electric vehicle brand, bZ, will launch its first new vehicle, the bZ4X, for sale worldwide. At the same time, Toyota plans to launch 7 bZ series electric vehicles by 2025, including sedans, MPVs, crossovers, and other models.

It is worth mentioning that the sales of the Volkswagen ID. pure electric vehicle family in the Chinese market gradually increased this year: since September, monthly sales have exceeded 10,000 units; and in November, deliveries exceeded 14,000 units.

When the production lines of traditional automotive giants roar to life, the battle for new energy vehicles gradually heats up.

Sales of New Forces Exceeded 10,000

Of course, the hottest new energy vehicle market in the world is China, and the most talked about in the Chinese market is new automakers, represented by “NIO.”

Apart from new cars, what can generate the most buzz for new automakers? It’s still sales.Since I don’t know when, it has become the practice for domestic new forces to announce last month’s sales on the first day of each month.

The hot topic sparked by sales saw many new energy vehicle manufacturers surpassing 10,000 units in November.

Among them, XPeng Motors was the most eye-catching, breaking the 15,000-unit mark in monthly sales and achieving a cumulative sales volume of 82,000 units, ranking first among new energy vehicle manufacturers.

In addition, this year, Ideal Automobile, which has not lost its popularity thanks to the outstanding product strength of the new Ideal ONE, sold 13,000 units in a single month. What is most proud of Ideal is that while its competitors offered multiple models for sale, Ideal achieved such outstanding results with only one model.

Although NIO launched the ET7 at the beginning of the year, in fact, only the ES8/ES6/EC6 “old models” were on sale this year. Moreover, since June, NIO has been embroiled in negative public opinion due to issues such as seat design, high-speed NOP accidents, and supply chain turmoil.

Achieving sales of over 10,000 units in November may be a perfect time for NIO to end its “retrograde”. At the just-concluded 2021 NIO DAY, the stunning ET5 had so many orders that the NIO APP was once down.

In addition to the mighty “Three Musketeers,” the second-tier new energy vehicle manufacturers who have been quietly pursuing them have also proven themselves with their achievements.

Li Auto, using its sales of more than 10,000 units, declared that it had found its niche in the market and stood firm in the competition. FOLLOWING them, leading manufacturers LI and WM Motors released highlights such as the LI C11 and WM Motors M7 this year, and are expected to achieve even better sales results in the future.

From controversy to steadily increasing monthly sales, the new energy vehicle manufacturers who have persisted are forging their own paths in the booming new energy market.

The Pain of Chip ShortageAfter reading some positive keywords, it is not without hidden worries in the field of new energy vehicles this year, and the most widely affecting “black swan” is inevitably the “chip shortage.”

In fact, the problem of shortage of car-grade chips has been exposed on a large scale since the end of 2020. This trend has not been fundamentally resolved until the end of this year.

The causes of chip shortages are complex and diverse. On the one hand, the level of vehicle intelligence is getting higher and higher, and the demand for chips naturally increases. In addition, a series of unstable factors such as the Texas snow disaster in the United States and the Malaysian COVID-19 pandemic have also made the chip supply chain continuously turbulent.

The chips that are missing here are not the high-precision and cutting-edge automatic driving-related chips that people imagine, but a variety of complex components.

According to their functions, automotive chips can be roughly divided into three categories:

-

Responsible for computing and processing, such as AI chips used for automatic driving perception and fusion, and traditional MCU (electronic control unit) used for engine/chassis/body control;

-

Responsible for power conversion, such as IGBT (insulated gate bipolar transistor) and other power devices;

-

Sensing chips used for various radars, such as automatic driving, as well as airbags, tire pressure detection, and so on.

Data from the China Association of Automobile Manufacturers showed that the demand for chips in traditional fuel vehicles in China is about 934 chips per vehicle, while the demand for chips in new energy vehicles is about 1459 chips per vehicle.

These chips involve specific functions ranging from tire pressure monitoring and wiper control to automatic driving and in-vehicle systems. The frightening thing is that it is not a specific shortage of a particular chip, but no one can predict which chip supply will have problems next.

In this regard, William Li, the CEO of NIO, once had a vivid metaphor: “In fact, the automotive industry has been plagued by chip shortages every quarter this year. But the chips that are lacking every week are different, and we don’t even know which chip is next. It’s like cooking in a restaurant. Now less oil, next less vinegar. This is a local impact, but different local impacts continue to exist.”

Just like what he said, we can imagine manufacturers as chefs and different models as different recipes. The chip is like seasoning, even the most talented chef cannot make dishes without oil, salt, soy sauce and vinegar missing.

Just like what he said, we can imagine manufacturers as chefs and different models as different recipes. The chip is like seasoning, even the most talented chef cannot make dishes without oil, salt, soy sauce and vinegar missing.

As for the impact of chip shortages, we can analyze it from both manufacturer and consumer ends.

From the manufacturer’s end, it naturally affects vehicle production, “no car to sell”. For example, Ideal Automobile announced delivery delays in September due to the impact of the Malaysian epidemic and the shortage of millimeter-wave radar chips.

From the consumer’s end, chip shortages have turned the market into “supply-determines-demand”. To put it more bluntly, even with money, some popular cars may not be available.

In addition, to cope with the impact of chip shortages, many manufacturers have also resorted to various measures. Ideal and XPeng have introduced emergency delivery plans of “deliver the car first and then install the millimeter-wave radar chip”.

According to forecasts by relevant agencies, the global auto production will decrease by approximately 7 million to 8 million vehicles due to chip shortages this year, and the Chinese market will decrease by around 2 million vehicles.

At the same time, this trend will not improve in the short term, and a 10% to 20% shortage rate will continue to be the norm next year.

As always, besides developing new cars, ensuring supply chain stability will be a long-term issue facing all automakers.

Quagmire and Bankruptcy

While the market is booming and top new forces are on the rise, others are bogged down in the quagmire or even leaving the market quietly.

The one stuck in the quagmire is Evergrande Auto.

At the Shanghai Auto Show in April, Evergrande even rented the largest exhibition area, showcased 9 new models of the Evergrande family, and organized thousands of media visits to the Shanghai factory, conducting driving tests of the Evergrande 5 model.

Regarding the small delivery target and the large expectation for future development, the chairman of Evergrande Group, Xu Jiayin, also confidently stated at the time that the first mass-produced car of Evergrande Auto will start trial production in the fourth quarter of this year and will be delivered next year. In 2025, the annual sales will exceed 1 million vehicles, and in 2035, it will expand to 5 million vehicles.

When the time moved to August, Evergrande Group suddenly announced that they were in contact with a third party to discuss the sale of part of the equity of Evergrande New Energy Automotive Group, and Evergrande’s car-making plan seemed to be in trouble.

When the time moved to August, Evergrande Group suddenly announced that they were in contact with a third party to discuss the sale of part of the equity of Evergrande New Energy Automotive Group, and Evergrande’s car-making plan seemed to be in trouble.

Subsequently, Evergrande’s car-making plan continued to move forward in a fog.

In October or so, Evergrande Auto held a partner conference. The most well-known part was the slogan “Work hard for three months, and Hengchi’s first car is offline in Tianjin factory” in the photo below.

In addition, as an independent brand, Evergrande Auto also announced on November 19 the public offering of shares for raising 3.2 billion yuan for the research and development and production of new energy vehicles.

However, shortly afterwards, the situation reversed again, and two models of Evergrande were exposed by the media recently, and disappeared from the new product announcement of the Ministry of Industry and Information Technology.

In summary, the difficulties of the Hengchi model are basically due to the financial difficulties faced by its parent company, Evergrande Group. As for whether we can really see the Hengchi 5 next year, it is currently uncertain.

But what can be asserted is that we can no longer see the once-superior BYTON M-Byte.

On November 1, the bankruptcy and liquidation case of Nanjing Zhihang New Energy Automobile Technology Development Co., Ltd., a related company of Byton Automotive, was officially heard in court. This may mean the end of Byton’s car-making ambition.

What can people recall about Byton now?

Once upon a time, the massive central control screen on the Byton M-Byte concept car attracted much media attention. However, in today’s highly homogenized era of electric vehicle interiors, it seems that the feature has lost its novelty.

Once upon a time, the story of “two foreigners making cars in China” was heavily reported on by the media, but the ending was quite absurd: one went to Faraday Future as CEO, and the other went to Evergrande Auto as Vice President.

Perhaps many years later, people’s impression of Byton may only be limited to “300 people eating snacks worth 50 million in a year” and “burning out 8.4 billion but unable to produce cars in large quantities” and other tabloid news.

When the tide recedes, it reveals those swimming naked. It remains to be seen what lessons the sudden retreat of BYD, which left the stage in disgrace, can teach us all.

Carbon Neutrality

For the final keyword, we have chosen “Carbon Neutrality“. This is a concept that no major automaker can avoid when announcing their strategies for transitioning to electric vehicles.

China first set its target for peak carbon dioxide emissions and carbon neutrality in September 2020, during the general debate of the 75th session of the United Nations General Assembly. The Chinese President promised the world that China would adopt stronger policies and measures to achieve peak emissions before 2030 and to lower carbon dioxide emissions per unit of GDP by 60% to 65% by 2030, using 2005 as the baseline year. China also aims to achieve carbon neutrality before 2060.

In addition, China’s “Government Work Report 2021” emphasizes the need to develop an action plan for peaking carbon emissions by 2030 and to optimize industrial and energy structure.

Low-emission hybrid cars and zero-emission electric vehicles are the entry point for the automobile industry to participate in this grand plan.

This trend can be seen from the increasing penetration rate of new energy vehicles in China this year:

According to the China Association of Automobile Manufacturers, sales of new energy vehicles in China reached 450,000 units in November, up 120% year on year, and the penetration rate of new energy vehicles in the market reached 17.8% that month. Among them, the retail penetration rate of new energy passenger vehicles exceeded 20%, reaching 20.8%.

From January to November this year, cumulative sales of new energy vehicles reached 2.99 million units, an increase of 170% year on year, and the market penetration rate reached 12.7%.

For the overall sales, the China Association of Automobile Manufacturers predicts that sales of new energy vehicles in China will reach 3.4 million units this year and 5 million units next year.

If the forecast can be realized, China’s goal in its “Plan for the Development of New Energy Vehicles (2021-2035)” of achieving a new energy vehicle sales ratio of 20% by 2025 may be achieved ahead of schedule.

Apart from the whole automotive industry responding to the global issue of “carbon neutrality,” choosing a new energy vehicle is also the best way for every individual consumer to participate in the critical cause that concerns the fate of the entire human future.

Apart from the whole automotive industry responding to the global issue of “carbon neutrality,” choosing a new energy vehicle is also the best way for every individual consumer to participate in the critical cause that concerns the fate of the entire human future.

Once upon a time, when Tesla was just born, it was only a toy for the rich in Silicon Valley who showed their “love for the environment” with an electric car.

Today, the popularity of electric cars is destined to be another major turning point in history, which our generation will have the privilege to witness, and the world will once again change.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.