Tesla Q2 2020 Earnings Report Released, Four Consecutive Quarters of Profit Expected to be Included in S&P 500 Index.

About Financial Data

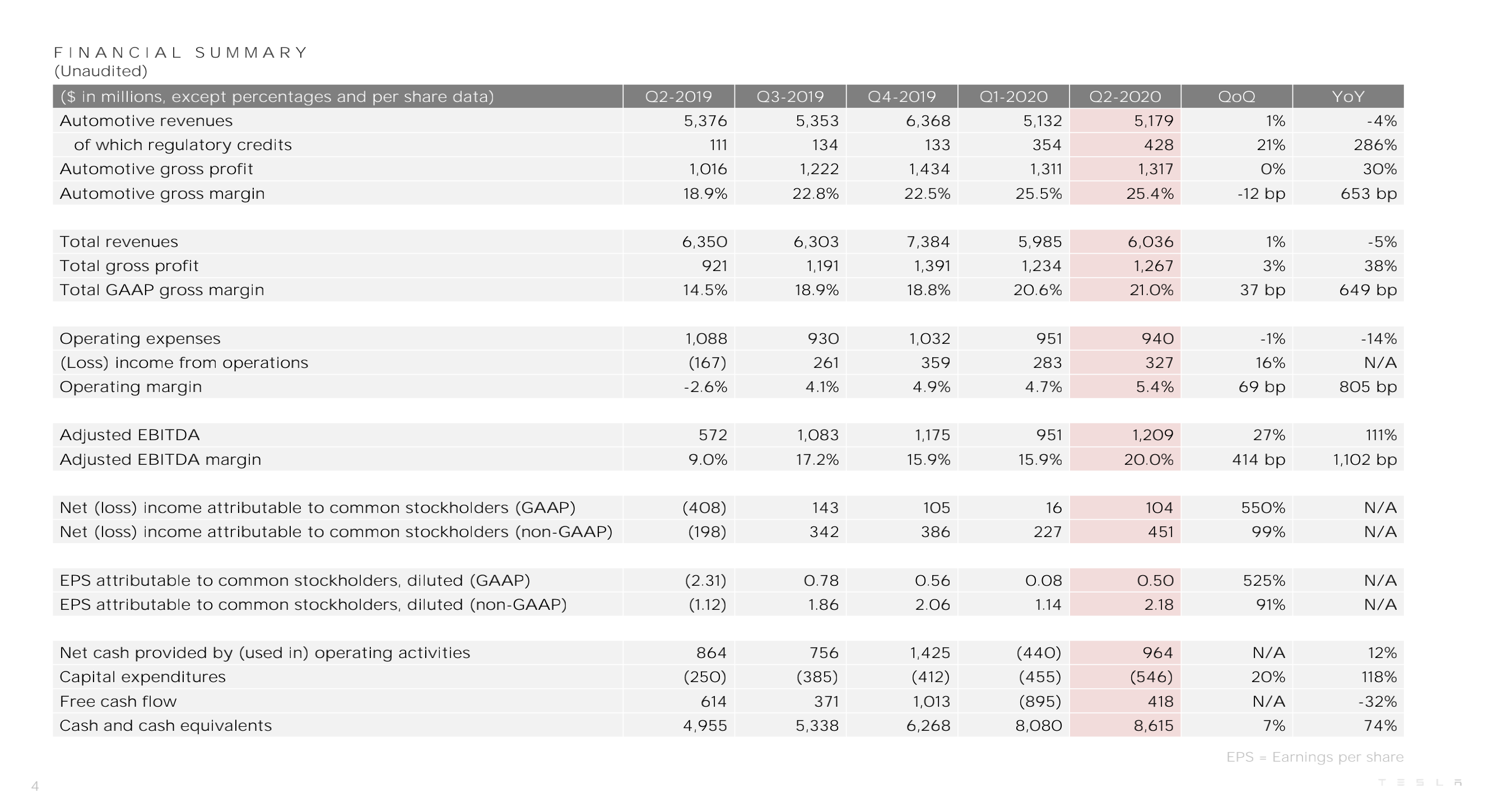

Total revenue was $6.036 billion, with a QoQ increase of 0.85% and a YoY decrease of 4.94%. Automotive sales revenue was $5.179 billion, with a QoQ increase of 0.92% and a YoY decrease of 3.66%.

Automotive sales profit was $1.317 billion, with a QoQ increase of 0.46% and a YoY increase of 29.63%.

Total gross profit was $1.267 billion, with an overall gross margin of 21.0% and a vehicle gross margin of 25.4%, a decrease of 0.1 percentage points compared to the previous quarter.

Cash and cash equivalents increased by $0.535 billion, reaching $8.6 billion.

Operating cash flow minus capital expenditures (free cash flow) was -$0.418 billion.

In the past 12 months, the GAAP operating profit margin has reached about 5%.

About Delivery Data

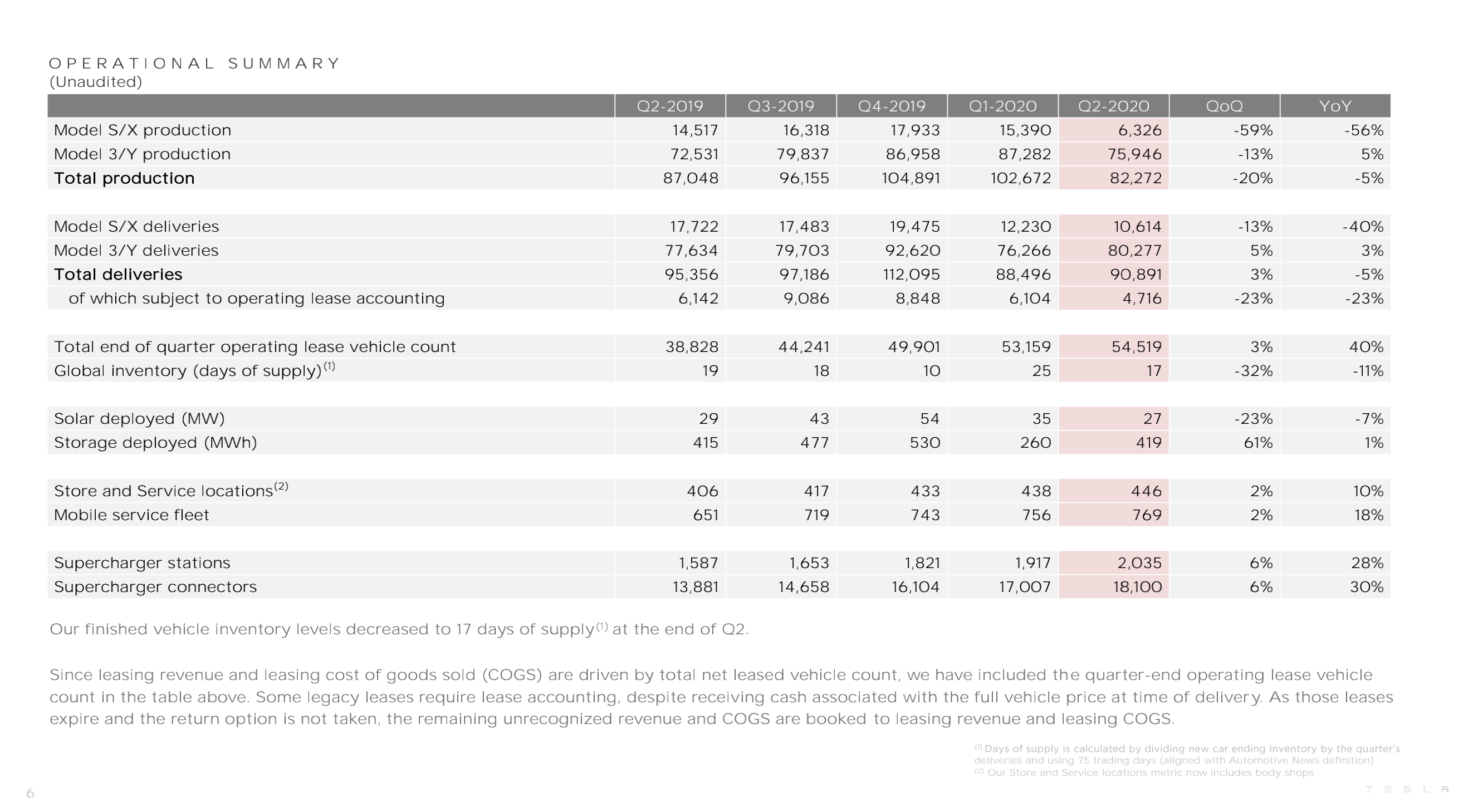

The total production of Q2 2020 was 82,272 vehicles, including 6,326 Model S&X and 75,946 Model 3&Y.

The total delivery of Q2 2020 was 90,891 vehicles, including 10,614 Model S&X and 80,277 Model 3&Y.

The inventory turnover was 17 days, compared to 25 days in the previous quarter.

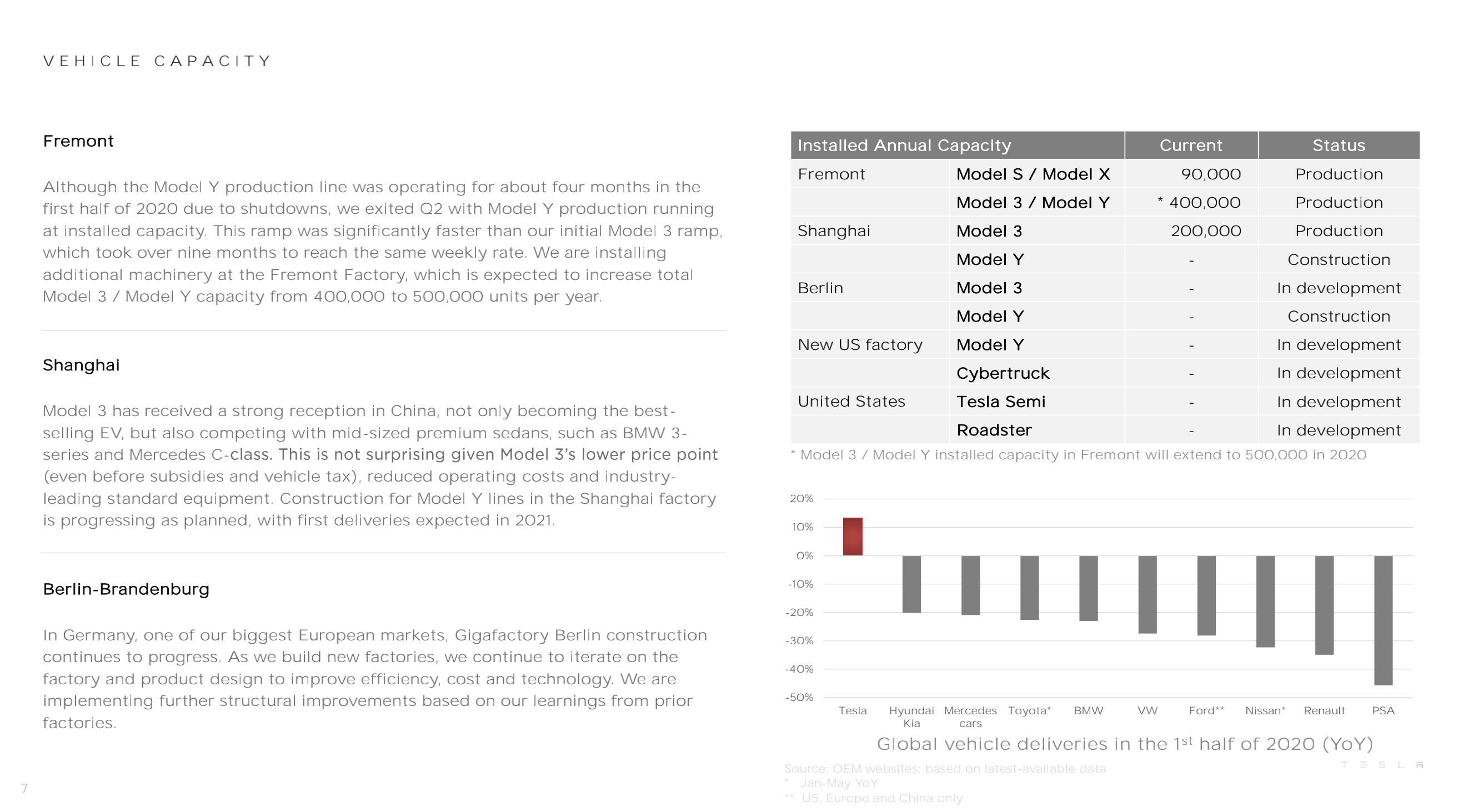

About Factory and Capacity

The location of the next American super factory has been determined, and preparations are underway. The construction of the Shanghai Model Y factory is proceeding as planned and is expected to deliver in 2021.

Due to the shutdown brought on by the pandemic, the Model Y production line only operated for about four months in the first half of this year, but in Q2, the Model Y production line was operating at full capacity. The production ramp-up is much faster than that of the Model 3, which took nine months to reach the same weekly production rate.Currently, Tesla is adding new production machines at its Fremont factory, expecting to increase the annual production capacity of Model 3/Y from 400,000 to 500,000 units.

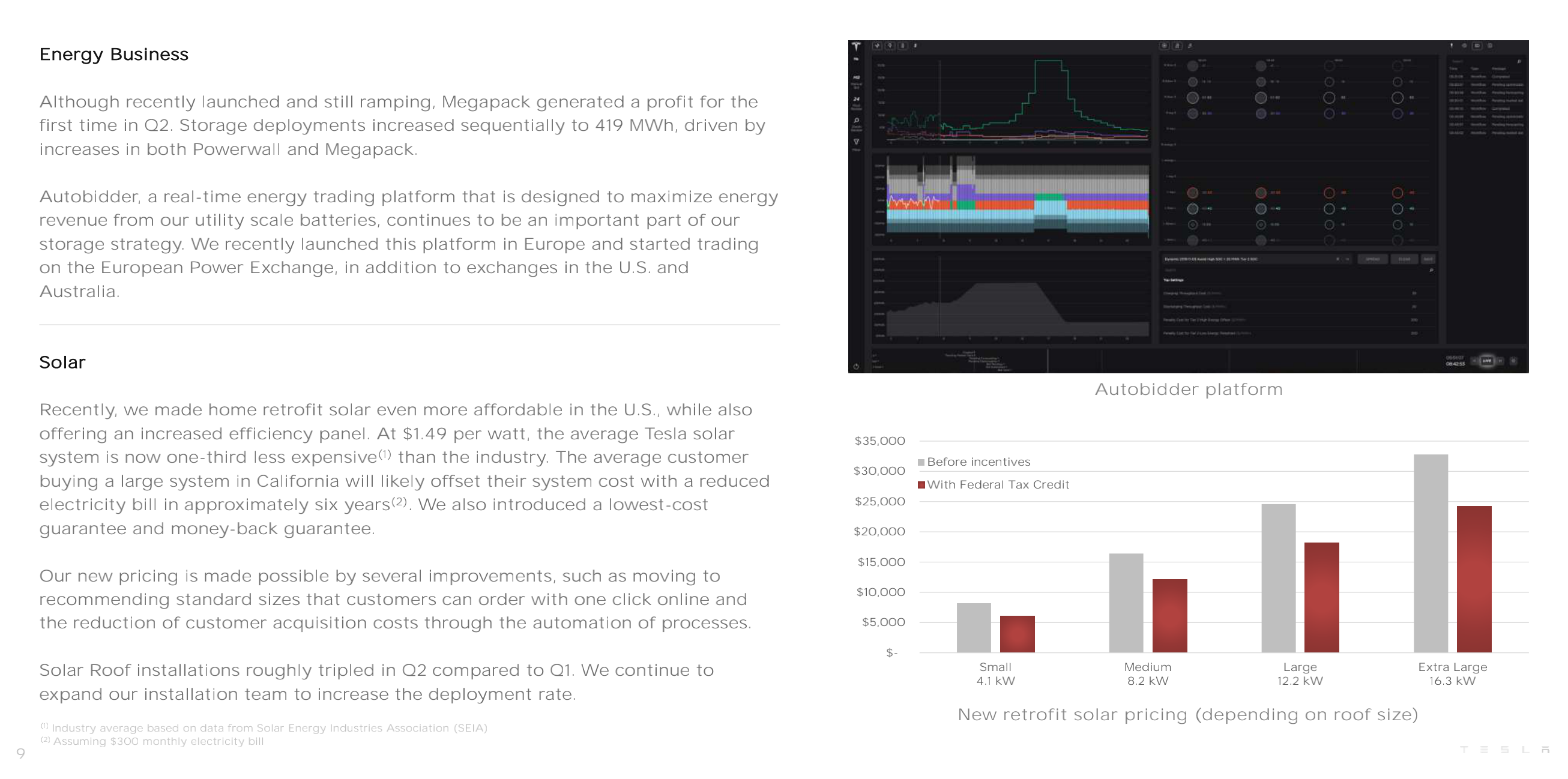

Energy Business

Megapack turned a profit for the first time in Q2, with energy storage deployments reaching 419 MWh, driven by the growth of Powerwall and Megapack.

Compared to Q1, the installation of solar roofs roughly doubled in Q2.

Other Highlights

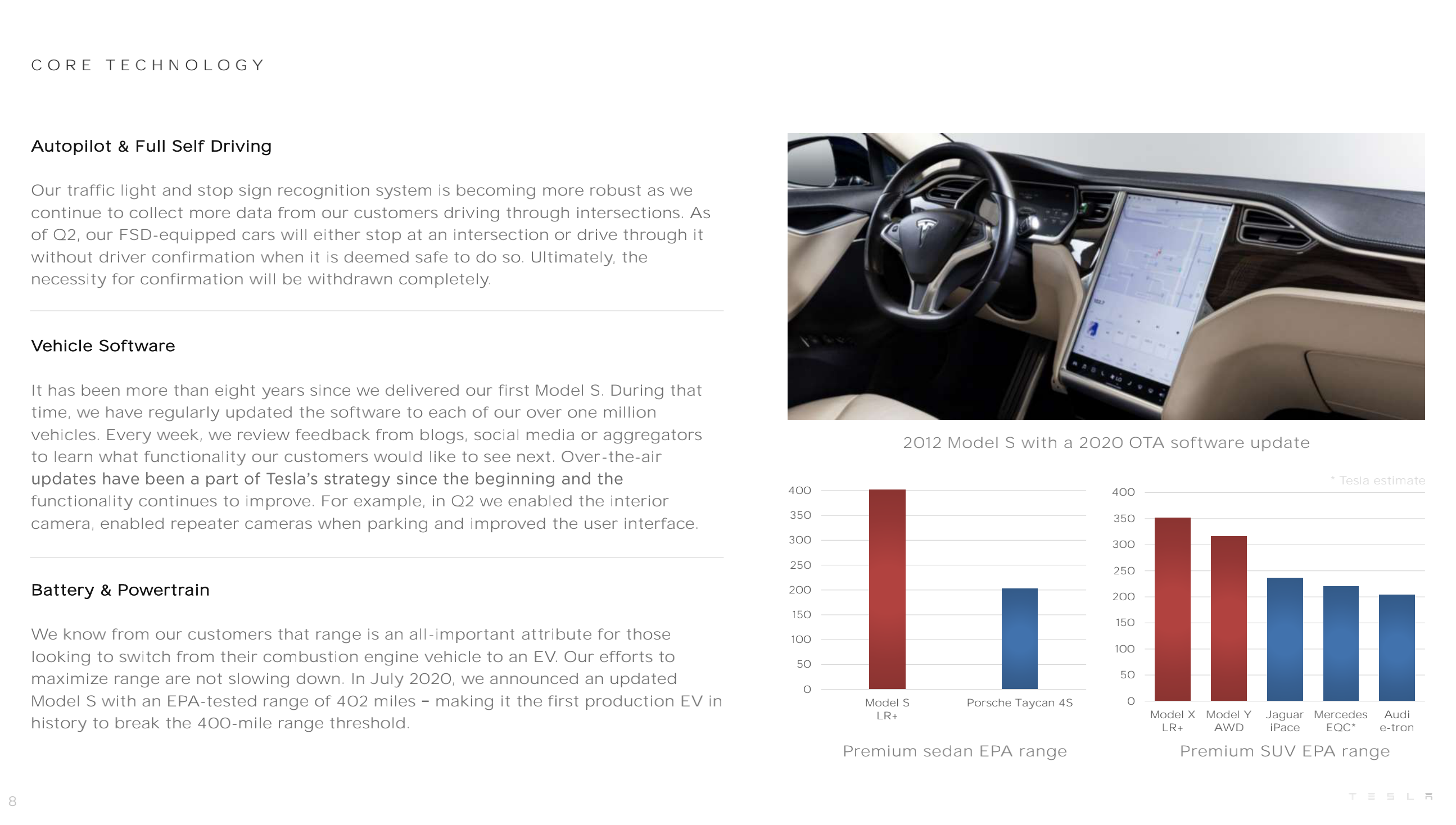

Starting in Q2, vehicles equipped with FSD will be able to make it through intersections without the need for driver confirmation, and this “user confirmation” process will be completely eliminated in the future.

In July 2020, the new Model S achieved a range of 402 miles in EPA testing, becoming the first production electric car to break the 400-mile range barrier in history.

Reasons for maintaining Q2 operating profit

- Temporary reduction in labor costs resulting in reduced operating costs;

- Continued growth in regulatory credit revenue (selling carbon credits to other automakers);

- $48 million in deferred revenue related to fully autonomous driving (FSD).

However, these positive contributions were offset by the losses caused by the factory shutdown and a $101 million stock option award given to Elon…

Key Information in the Conference Call

During the conference call following Tesla’s 2020 Q2 earnings report, Elon announced the construction of the next Gigafactory in Austin, Texas.

The Fremont factory will produce Model S&X and Model 3&Y for the Western North American market, while the Austin Gigafactory will produce Cybertruck, Semi, and Model 3&Y for the Eastern North American market.

Tesla will introduce more compact models and models with higher range in the future, but there is still a long way to go.

The Shanghai factory expects to achieve 80% localization of parts by the end of 2020.

“`markdown

“`markdown

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.