Revolution is Not a Dinner Party

Revolution is not a dinner party, not drawing or embroidery. It cannot be so delicate, so leisurely and gentle.

However, not all Wolfsburg locals have this kind of awareness. They resist this reality, and thus, Herbert Diess, the determined reformer and CEO of Volkswagen, is once again at the center of the storm.

According to Reuters, Daniela Cavallo, the head of Volkswagen’s labor union, representatives from the major shareholder Piech family, and the Porsche family, will discuss the issue of Diess’s departure at the supervisory board’s executive committee meeting on Tuesday and make a final decision before December 9th.

This crisis comes only four months after Diess secured a contract extension and ambitiously launched the 2030 “NEW AUTO” strategy, winning a milestone victory for reform.

For giants like Volkswagen, the turn in the face of a major transformation is bound to be painful and anything but peaceful.

The Most Unprecedented Situation in a Century

2021 is a year of continued rapid growth for intelligent electric vehicles. In the Chinese market, new energy vehicles penetrated more than 20% for the first time in September, only five months after the historic threshold of 10% penetration was broken.

Standing on this historic wave, the top three new forces in China’s auto industry, WM Motor, XPeng Motors and NIO, have each surpassed 100,000 units sold. Their transformation from 0 to 1 has been completed, and they are now extending their reach into Volkswagen’s European stronghold.

Tesla is leading the charge, with its Shanghai factory running at full capacity, delivering ammunition to the Chinese and European markets without pause. Its trillion-dollar market value exceeds the sum of over ten traditional automakers such as Toyota, Volkswagen, and GM.

Diess, taking the helm of the financially robust Volkswagen Group, cannot help but feel pangs of envy. “Tesla can endlessly raise funds and obtain resources due to its high valuation.”

Of course, Volkswagen is already the most proactive traditional automaker in transitioning to electrification. MEB, its pure electric platform, has launched ID. family products in the Chinese, European and American markets.

Diess can reassure Volkswagen employees in internal speeches. In China, their electric vehicle sales in the third quarter exceeded the total for the first half of the year by 60%. In October, the Volkswagen ID. family delivered 12,736 vehicles in China, continuing its record-breaking performance of exceeding 10,000 units per month.

The competitive situation remains fierce, and the alarm has sounded.

The competitive situation remains fierce, and the alarm has sounded.

The ID. family has always performed well in sales in Europe, giving Volkswagen a sense of achievement during its transformation phase. However, in September, the Tesla Model 3 rose to the top of Europe, leaving both the electric ID. family and the fuel-driven Golf behind, ruthlessly breaking this illusion.

Is there any more dazzling warning for Volkswagen than the fall of its European stronghold?

And even greater challenges lie ahead. Volkswagen currently faces only the distant firepower from Tesla’s Shanghai factory. Soon, Tesla’s Berlin factory will join the battlefield, and a head-on confrontation between Wolfsburg and Brandenburg (Berlin) on the European continent is imminent.

The power from China is also not to be underestimated. After testing these cars from China in Wolfsburg, Volkswagen Brand CEO Ralf Brandstätter and Diess had to admit that “they are really great.”

Diess is one of the few in Wolfsburg who is aware of the competitive situation. “We are the leader in the internal combustion engine world, but in the NEW AUTO world we call it, a previously unknown war awaits us Volkswagen,” he said.

Yes, this is a world of NEW AUTO, and the capabilities that Volkswagen has accumulated during the fuel era can no longer completely meet the needs of the times. To describe it in the words of well-known Zhihu answerer “Zhuge Jun”: perhaps Wolfsburg has not yet realized that the technology and brand premium of the German boutique era, represented by EA888+DSG+laser welding+hollow cavity wax injection+Bosch/Continental, is no longer applicable to the BEV market, especially the Chinese BEV market.

Actually, Diess knows that in the NEW AUTO era, “software will determine who can ensure how much market share,” but he must reluctantly admit that,”So far, we have almost no expertise in software.”

The best example is the intelligent electric products built by Volkswagen on the original pure-electric platform, such as the ID.3, which are considered the Golf of the electric era but are most remembered for their mechanical qualities, still representing the old capabilities of traditional automakers in the fuel era.An undeniable fact is that the Internet and intelligent capabilities from Silicon Valley, Beijing and Shenzhen are disrupting the automotive industry, transforming cars into the world’s most complex technology products.

The challenge faced by Volkswagen and Diess is how to maintain their dominant position in Wolfsburg from the old era to the new.

Remaking Wolfsburg!

If Diess can continue to lead Volkswagen’s reform, his next mission is remaking Wolfsburg. For a long time, Tesla has been praised for its software, mileage, and acceleration while being criticized for quality control, giving the impression that Tesla’s engineering capabilities fall behind traditional automakers. But as production quality continues to improve, Tesla’s engineering capabilities have impressed Wolfsburg.

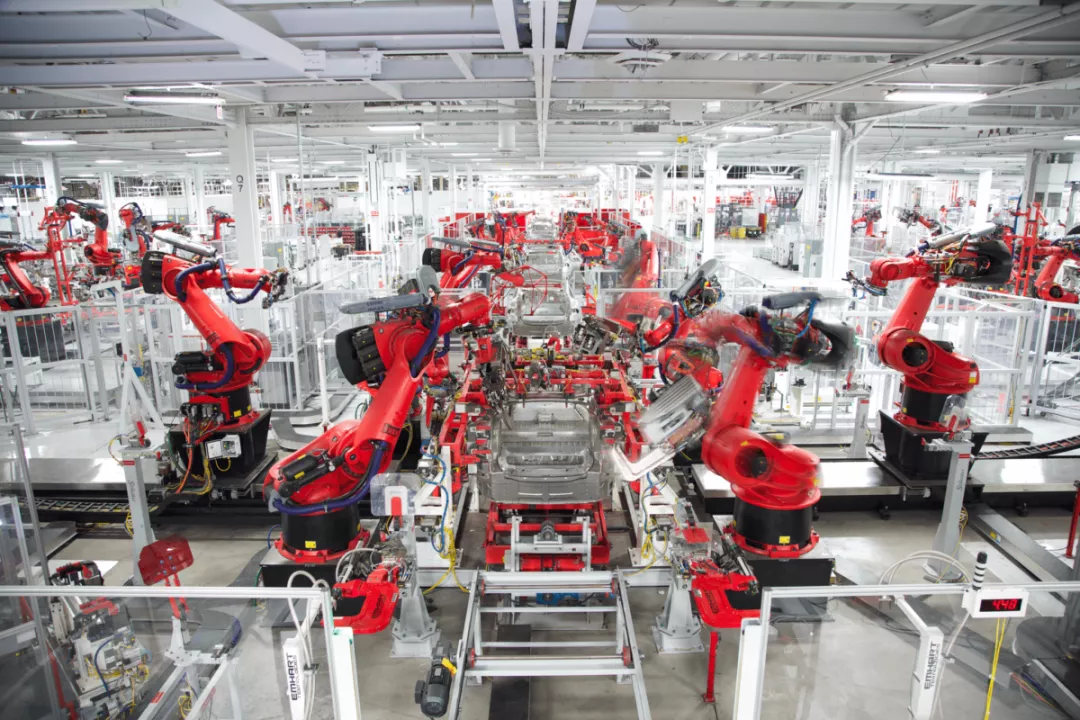

In an internal speech, Diess pointed out that at the Berlin plant, Tesla plans to produce 500,000 cars with 7,000 people (directly and indirectly). One production line at the Berlin plant can produce 90 cars per hour, and the production time for each car can be compressed to 10 hours. In comparison, Volkswagen’s production efficiency is 700,000 cars produced by 25,000 workers. It takes more than 30 hours to produce each car at Volkswagen’s Zwickau factory.

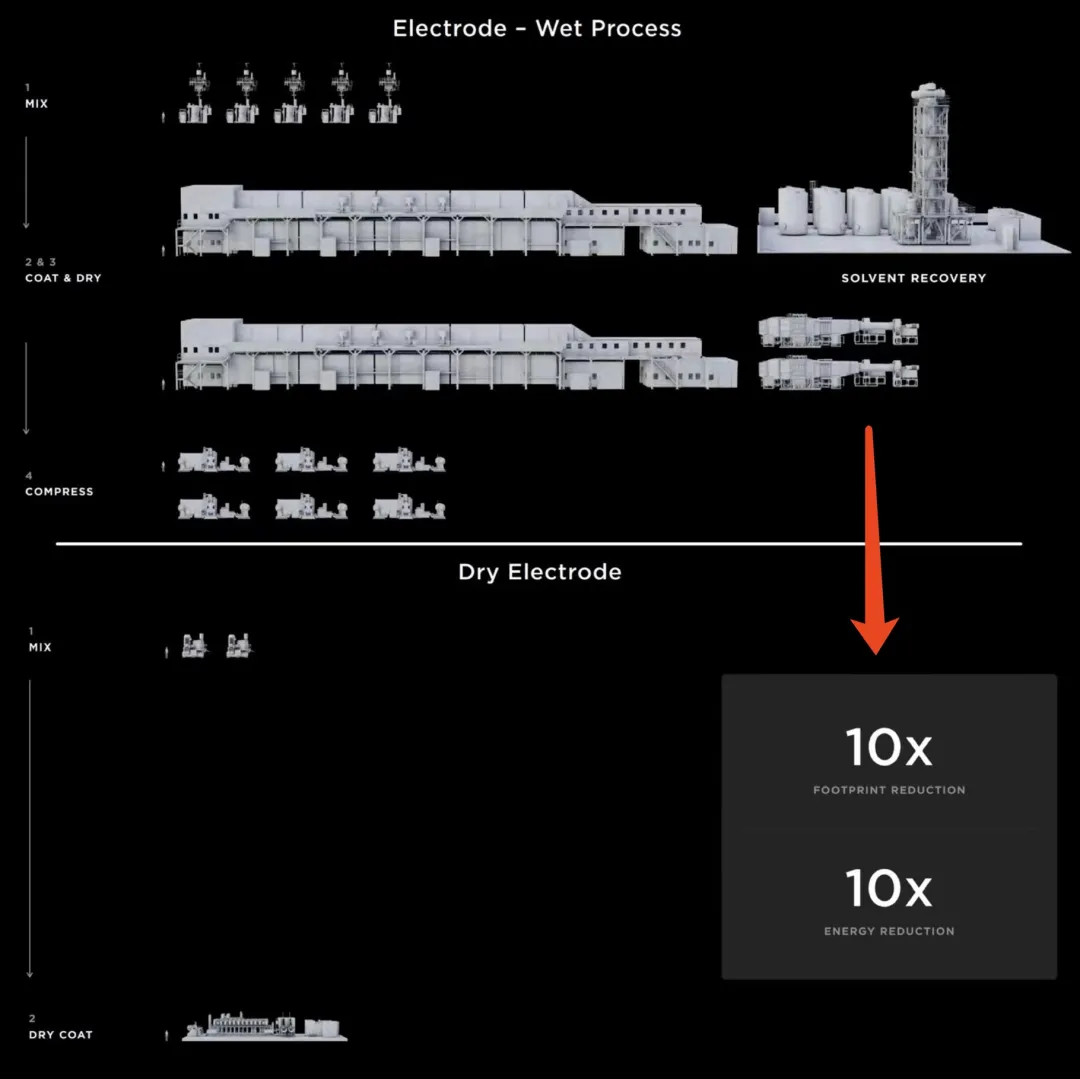

It is worth noting that at Tesla’s Shanghai factory, the production time for each Model 3 is also 10 hours. However, in Volkswagen’s statistics, advanced technologies such as Tesla’s integral die-casting front body and dry electrode process that will be deployed in Tesla’s Berlin factory may not be included. The efficiency improvement effect of integral die-casting front body has been verified in Model 3/Y production. As for the dry electrode process, it can reduce 90% of production steps and energy consumption compared to current wet electrode process.

Brandenburg is coming aggressively. If Wolfsburg does not take action, the gap will only widen further.

This engineering and manufacturing competition actually reflects the attitude towards exploring technological boundaries between new forces and old giants. Under the given constraints, manufacturing is actually a balance issue. Automakers are dancing with shackles under the impossible triangle of speed, quality, and cost in engineering and manufacturing.-

But the significance of new technologies lies in breaking limiting conditions and providing greater space for car companies to develop, although this process also comes with risks, testing the courage of the decision-makers.

Take the example of die-casting technology. When Tesla just adopted die-casting for car bodies, it was naturally questioned whether it was a behavior that sacrificed quality for speed and cost. But ideal, Smart, Ford, GAC and other new forces and traditional car companies have followed suit with reports of relevant news about die-casting technology, indicating that the die-casting technology guided by Tesla has been recognized by the industry, and Folmont and Shanghai are set to become new benchmarks of automobile manufacturing.

Wolfsburg cannot sit idly by as such a situation occurs, so Diess called for making Wolfsburg a new benchmark of competition at the employee meeting.

Wolfsburg hopes to become the flag bearer of car production once again. From the perspective of this city, this region and Germany as a country with a manufacturing base, Wolfsburg must also be great again.

Difficult Reform

Wolfsburg’s opportunity lies in the SSP superplatform and the Trinity project. Through these two projects, Volkswagen will completely rethink the production of cars, seeking faster production times and more efficient forms of cooperation, provided that Diess can sort out Volkswagen’s complex internal relationships.

Diess has praised Musk for changing the current situation of electric cars in public more than once, and leading the development of electric cars worldwide. Union chairman Cavallo dislikes Diess’s attitude and said, “If your (Diess) enthusiasm for Musk can also be applied to dealing with the current challenges of the company (due to the chip shortage causing reduced production), then we would welcome it.”

Clearly, Cavallo is more concerned about the current interests of the employees than the future of Wolfsburg.

Diess is clear that “even if I stop talking about Musk, he will still be there, thoroughly changing our industry and constantly improving competitiveness.” If Volkswagen wants to keep up with the pace of its competitors, it needs to change.# Volkswagen’s Elephant Turning Point: Embracing Intelligence

The emphasis of Volkswagen’s recent turning point remains on intelligence. As vehicles enter the age of software-defined technology, the pace of software iteration dominates the rhythm of automotive evolution. If automakers cannot establish an organizational structure dominated by software capabilities, their R&D progress and product pace will inevitably be limited.

Therefore, Diess pointed out succinctly on Twitter that “efficiency is the key to our (automotive) industry and Germany’s transformation. Tesla has a shorter development process, works more closely with the best in the industry, and can take on more risk.”

For example, Tesla can rewrite software in just two to three weeks to switch from one out-of-stock microchip to another.

Although CARIAD, a software company, has been established to collaborate with various brands to promote Volkswagen’s digital products, what Volkswagen really needs is a systematic intelligence capability that includes electronic and electrical architecture, human-machine interaction, and artificial intelligence.

This capability cannot be achieved by just setting up one department. A group-level organizational structure change is inevitable for Volkswagen.

For Volkswagen, product definition, development processes, supply chain management, and sales models that were built on hardware integration capabilities in the past must be overturned and rebuilt. This process will inevitably be accompanied by the rise and fall of departmental status, the withdrawal of power from the top echelon, and even employee layoffs.

Diess, known as a cost killer during his time at BMW, is a true reformer and a grave digger of vested interests. He faces a massive interest group with 100 production bases and 660,000 employees in 27 countries around the world. As a result, he cannot avoid strong opposition from conservatives.

Last year, Diess had a fierce argument with the then union chairman, Bernd Osterloh, over cost-cutting and layoffs. In the last confrontation, Diess was almost fired and had to apologize to the Supervisory Board to calm the situation. He also lost his position as CEO of the Volkswagen brand, and his request for a contract extension was shelved by the Supervisory Board.

Diess has no choice but to be obsessed with Musk because, without a free territory, he still needs competitors like Musk to attack the stubborn factions in Wolfsburg through side remarks.At a recent management meeting held by Volkswagen, Diess introduced Musk as a “surprise guest” and had him “lecture” 200 senior executives at Volkswagen Group via video conference. Diess later candidly explained on LinkedIn that he brought in Musk to make Volkswagen understand that they need faster decision-making and less bureaucracy to achieve the biggest transformation in Volkswagen’s history.

But once the reforms touch on the interests of vested interests, fierce backlash will follow. Reuters reported in October that Diess warned at a supervisory board meeting that if Volkswagen’s electrification transformation is too slow, it may lose 30,000 job opportunities.

Subsequently, due to the need to meet with investors and political figures in the United States, Diess was scheduled to miss the Volkswagen Group’s employee meeting, and the union leader Cavallo took the opportunity to publicly accuse Diess of preferring Wall Street investors and lacking empathy for employees.

During this period, Volkswagen Group set up a mediation committee to discuss Diess’s future, which is rare in Volkswagen’s history. Under pressure, Diess cancelled his meeting with American investors and instead participated in the employee meeting on November 4.

Although Diess emphasized at the employee meeting, “I hope your children and grandchildren will still have a stable job in Wolfsburg in 2030. This is my purpose for being here today, and it is also the reason I am here at Volkswagen”, the same plot repeated itself. In Volkswagen’s latest official news photo, Volkswagen Group CEO Herbert Diess did not appear, but was replaced by union leader Daniela Cavallo and Volkswagen brand CEO Ralf Brandstätter. This is not accidental, as on Tuesday afternoon German time, the Volkswagen Supervisory Board is deciding on Diess’s future.

Even if he survives this hurdle, there will be more difficult obstacles waiting for Diess ahead. No one can guarantee that he will not miss the opportunity to lead Volkswagen towards the era of “NEW AUTO” in the next confrontation with the conservatives.

In a moment, they may be shouting, “The next Golf must never be a Tesla! The next Golf cannot come from China! The next benchmark must once again come from Wolfsburg! It must be Trinity!” But the next moment, they may be packing up and leaving.

For Diess, once Volkswagen’s reform enters the deep water area, situations like this will continue. Perhaps, this is the fate of a reformer. For giants like Volkswagen, the pains of change will also accompany the reform throughout.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.