Ideal car has submitted an IPO prospectus to the SEC with the stock code LI.

The funds raised will mainly be used for:

- New product development

- Capital expenditure, including further development of production equipment.

- General corporate purposes and operating capital.

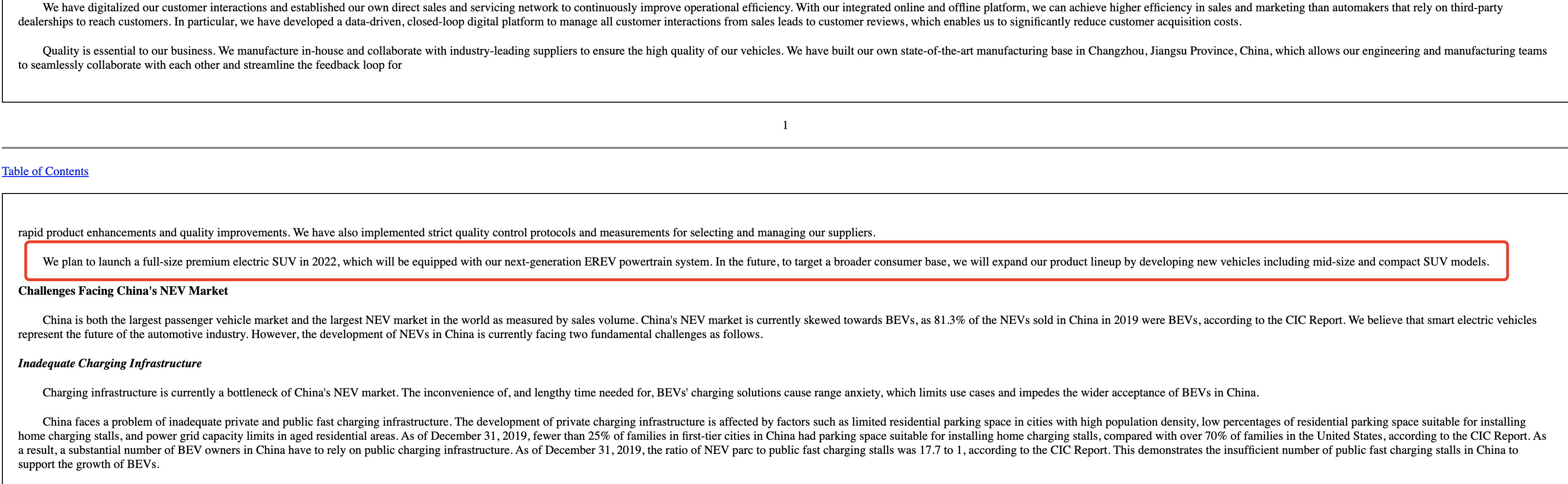

In the prospectus, Ideal car revealed plans to launch a full-size SUV with a new generation of range-extender system in 2022. In the future, mid-size and compact SUVs will also be launched to meet the needs of more consumers.

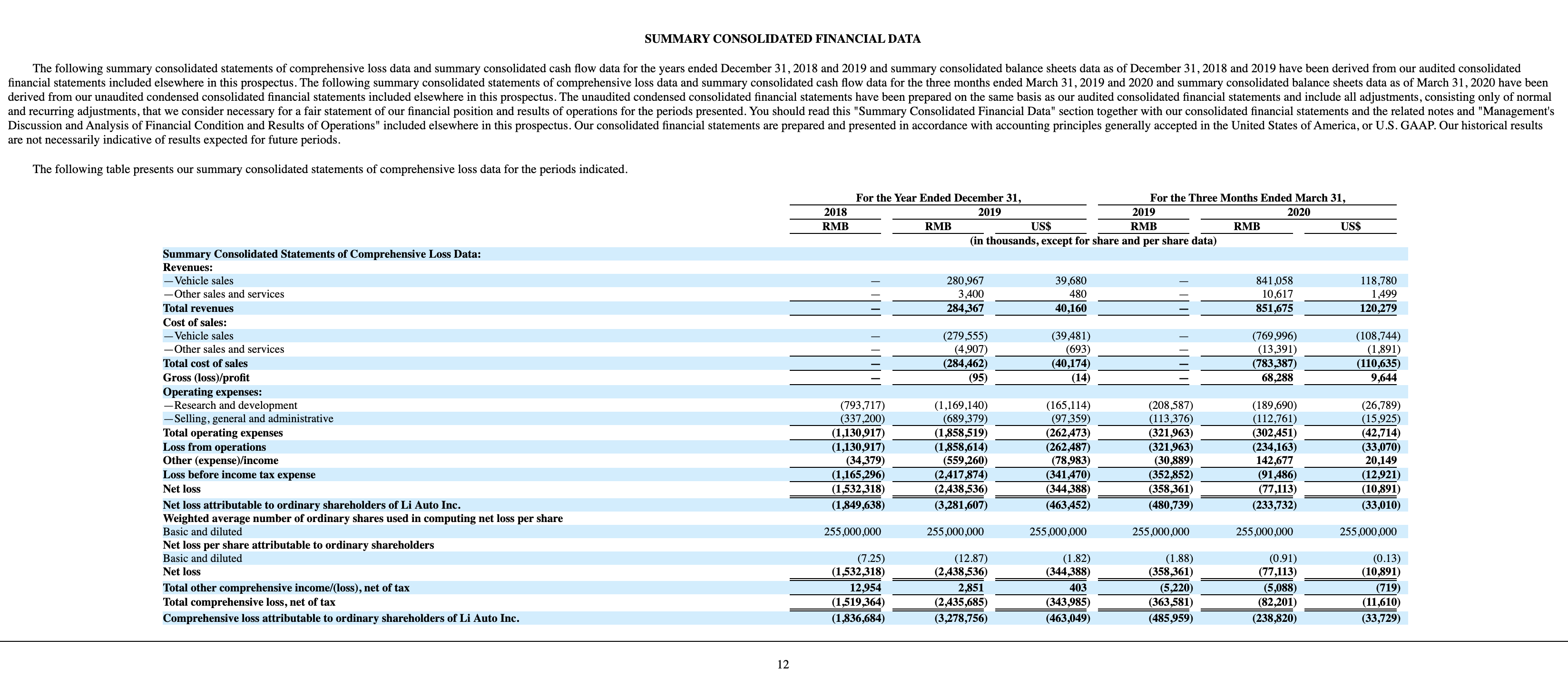

In 2019, Ideal car had a net loss of $344 million. For the three months ending March 31, 2020, the net loss was $10.89 million, and Ideal car held $149 million in cash and cash equivalents.

It is worth mentioning that “Ideal car delivered a total of 2,869 vehicles in Q1 2020, achieving revenue of RMB 850 million, gross profit of RMB 68.3 million, and gross margin of 8%”.

The company’s shares are divided into two classes, class A shares and class B shares. Class A shares have one vote per share, while class B shares have 10 votes per share. Class A shares cannot be converted into class B shares but class B shares can be converted into class A shares.

Ideal car’s founder and CEO, Li Xiang, is the largest shareholder, holding 115,812,080 Class A shares and 240,000,000 Class B shares, accounting for 25.1% of the shares and 70.3% of the voting rights. Wang Xing and Meituan hold a total of 332,664,073 Class A shares, accounting for 23.5% of the shares and 9.3% of the voting rights.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.